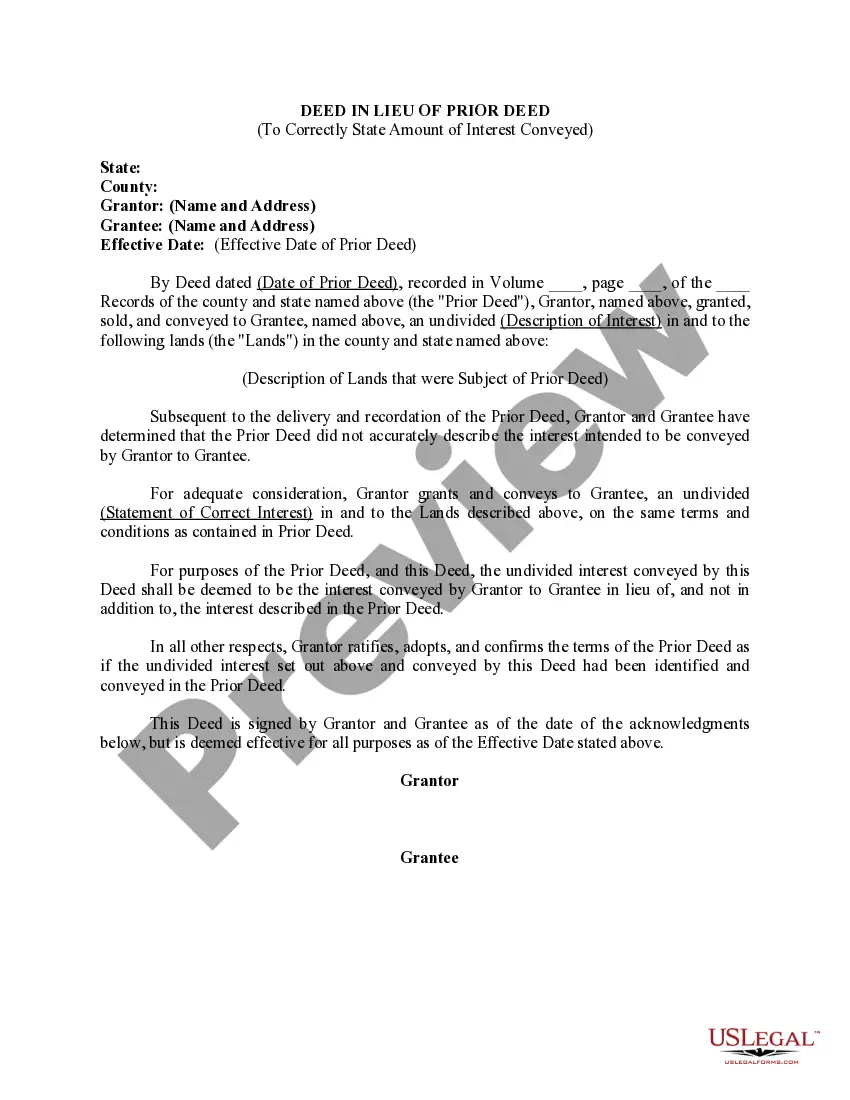

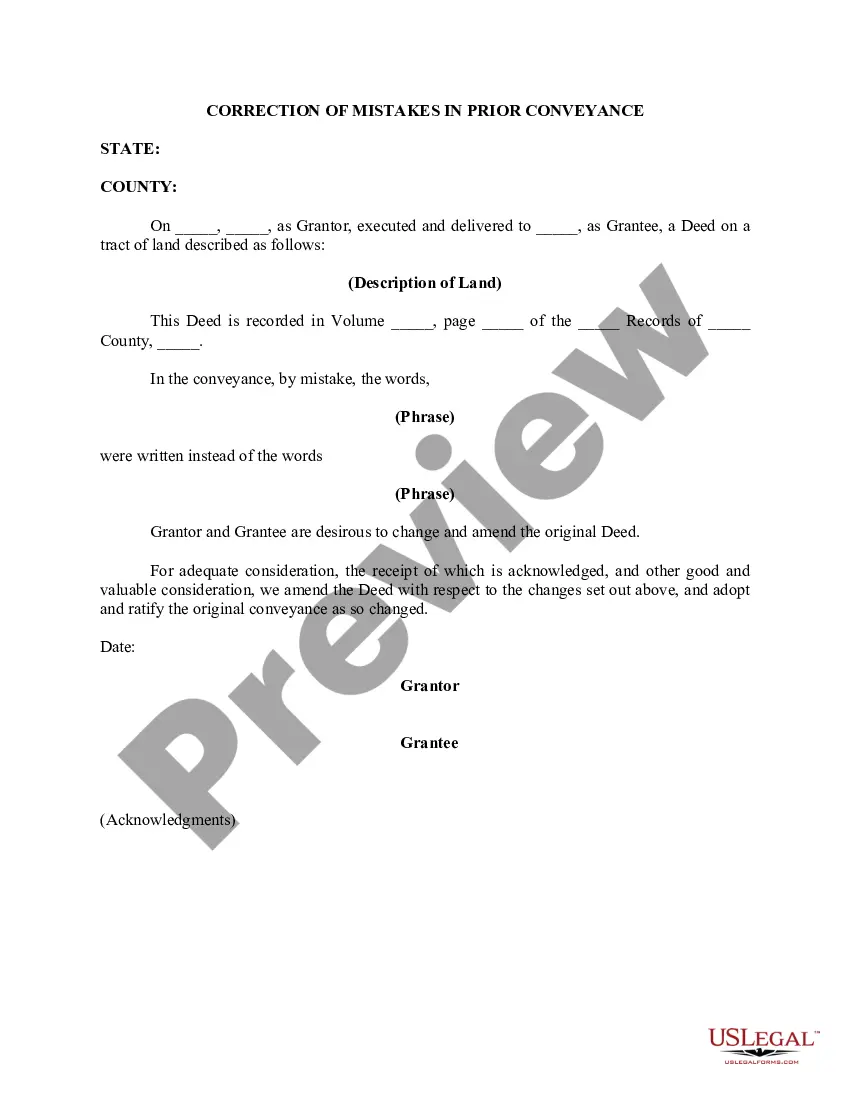

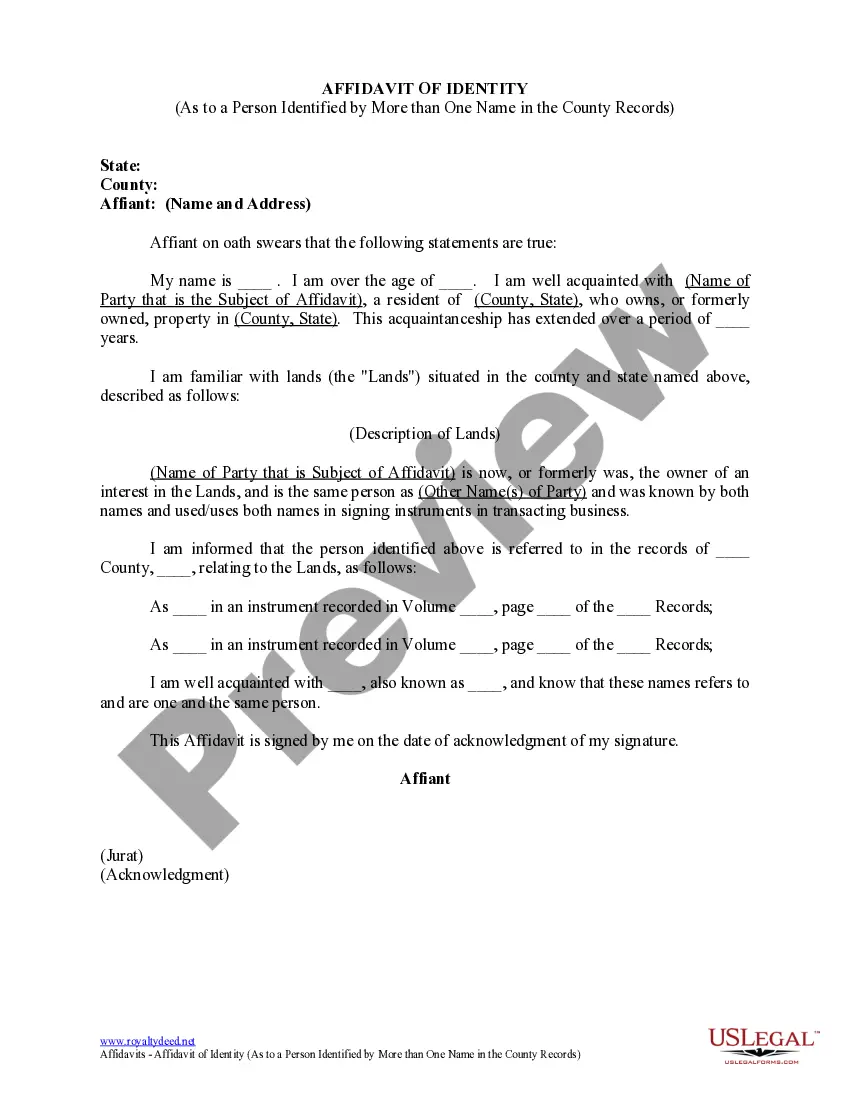

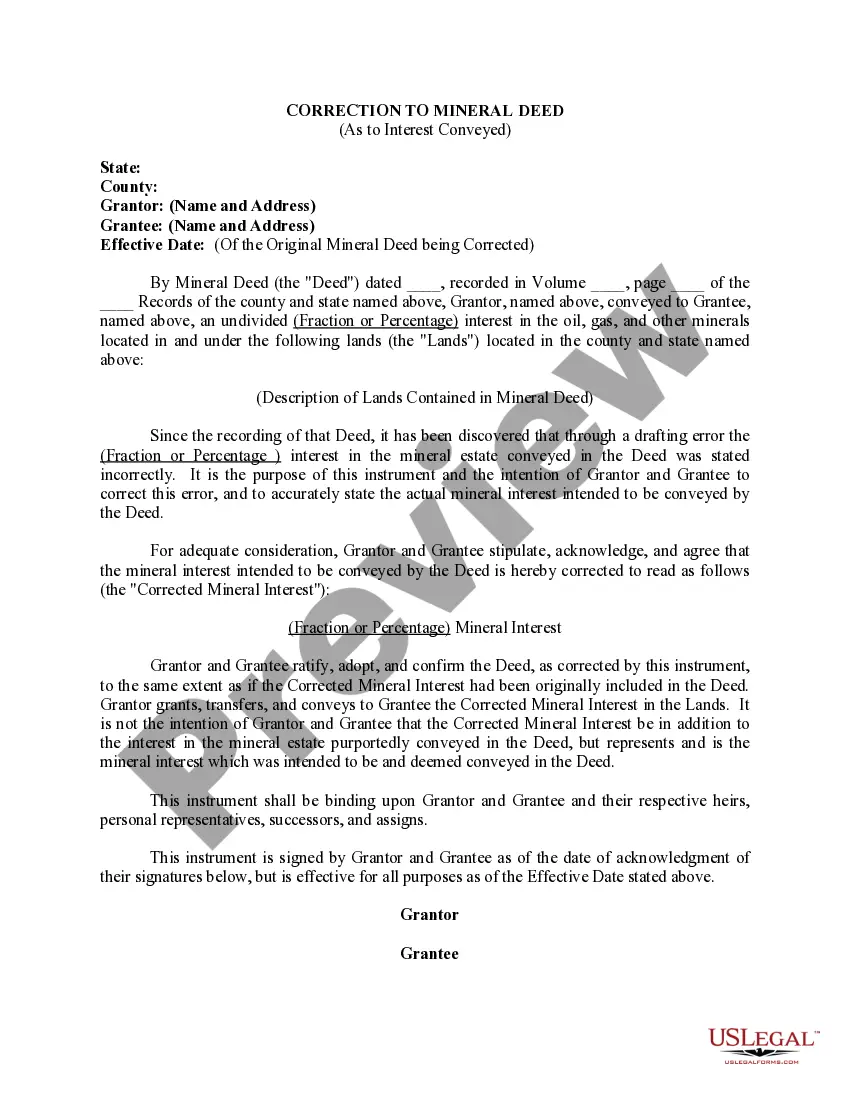

This form is used to when it has been discovered that through a drafting error the (Fraction or Percentage ) interest in the mineral estate conveyed in a Deed was stated incorrectly. It is the purpose of this instrument and the intention of Grantor and Grantee to correct this error, and to accurately state the actual mineral interest intended to be conveyed by the Deed.

Indiana Correction to Mineral Deed As to Interest Conveyed

Description

How to fill out Correction To Mineral Deed As To Interest Conveyed?

You can commit hrs on the Internet looking for the lawful document template which fits the state and federal demands you want. US Legal Forms offers 1000s of lawful varieties which can be evaluated by professionals. It is simple to download or printing the Indiana Correction to Mineral Deed As to Interest Conveyed from your assistance.

If you currently have a US Legal Forms account, you may log in and then click the Obtain switch. After that, you may full, revise, printing, or signal the Indiana Correction to Mineral Deed As to Interest Conveyed. Every lawful document template you get is your own forever. To obtain yet another duplicate for any purchased type, check out the My Forms tab and then click the related switch.

If you work with the US Legal Forms web site the very first time, adhere to the basic instructions beneath:

- Initially, be sure that you have selected the best document template for your region/metropolis that you pick. Browse the type description to ensure you have chosen the correct type. If available, make use of the Preview switch to search through the document template also.

- If you wish to discover yet another version of your type, make use of the Search field to discover the template that fits your needs and demands.

- Once you have located the template you desire, simply click Get now to proceed.

- Select the prices prepare you desire, type in your credentials, and register for a merchant account on US Legal Forms.

- Full the deal. You should use your charge card or PayPal account to fund the lawful type.

- Select the formatting of your document and download it in your product.

- Make modifications in your document if necessary. You can full, revise and signal and printing Indiana Correction to Mineral Deed As to Interest Conveyed.

Obtain and printing 1000s of document templates making use of the US Legal Forms Internet site, that offers the largest collection of lawful varieties. Use expert and condition-specific templates to handle your business or personal requires.

Form popularity

FAQ

Indiana mineral rights reach back to the late 1870's. The Trenton Field of Indiana was the first large oil-field discovered in 1876. From that point until the first decade of the twentieth century a major boom in oil and gas development occurred in east-central Indiana. Indiana Mineral Rights | Learn Basics of Mineral Rights in IN MineralWise ? mineral-rights-by-state ? ind... MineralWise ? mineral-rights-by-state ? ind...

The Indiana Dormant Mineral Interest Act" was passed by the Indiana Legislature in 1971. The Act provides that severed mineral interests would automatically revert to the current surface owner of the land unless one of the following conditions was met: 1. Sufficient "use" of the mineral interest by the owner.

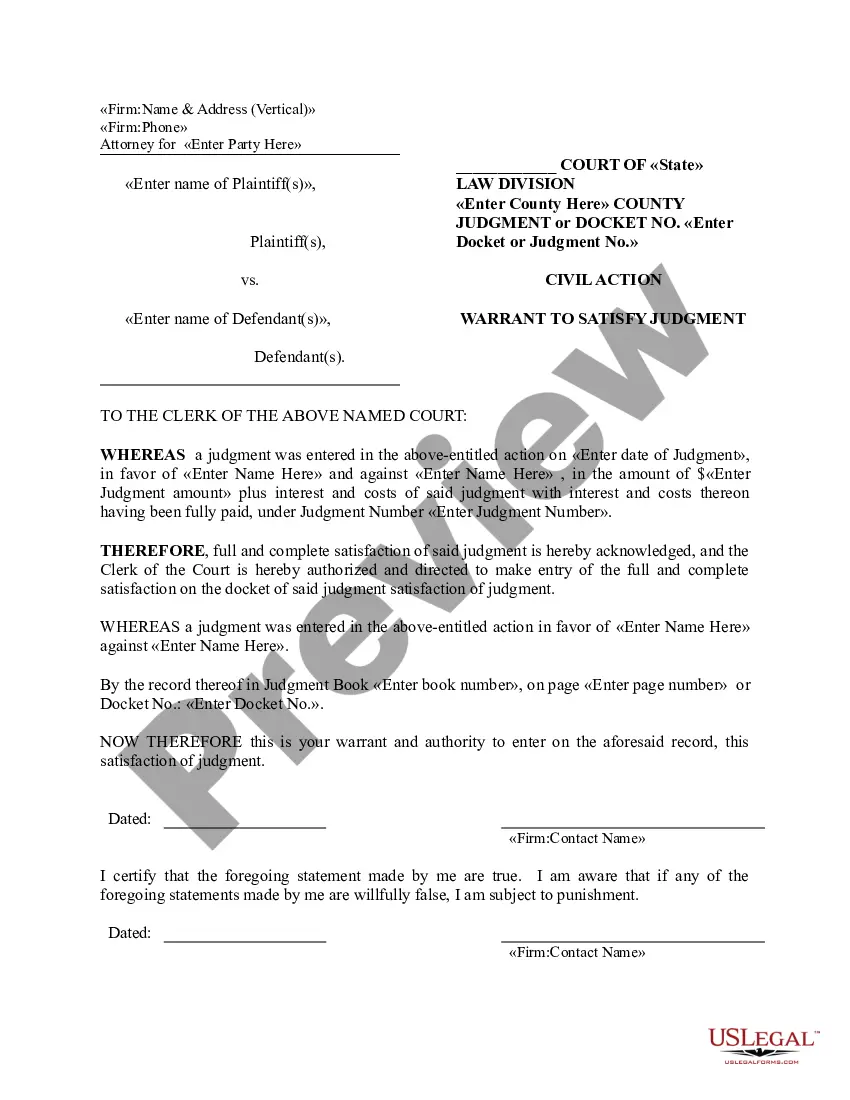

Transferring Indiana real estate usually involves four steps: Locate the prior deed to the property. ... Create the new deed. ... Sign the new deed. ... Record the original deed.

Deeds, power of attorneys, and other legal documents that involve legal consequences of actions must be prepared by an attorney.

Surface rights are what you own on the surface of the property. These include the space, the buildings and the landscaping. Mineral rights, on the other hand, cover the specific resources beneath the surface. In areas designated for mining, it's common for surface rights and mineral rights to be separate. How To Understand Your Mineral Rights | Rocket Mortgage rocketmortgage.com ? learn ? mineral-rights rocketmortgage.com ? learn ? mineral-rights

The most common way is through a will or estate plan. When the mineral rights owner dies, their heirs will become the new owners. Another way to transfer mineral rights is through a lease. If the mineral rights are leased to a third party, the new owner will need approval from the current lessee to claim them.

The Indiana Dormant Mineral Interest Act" was passed by the Indiana Legislature in 1971. The Act provides that severed mineral interests would automatically revert to the current surface owner of the land unless one of the following conditions was met: 1. Sufficient "use" of the mineral interest by the owner. United States Supreme Court Upholds Indiana Mineral Lapse ... UNM Digital Repository ? viewcontent UNM Digital Repository ? viewcontent PDF

Mineral rights generally include the right to sell all or part of the interest, the right to enter the land to produce and carry on production activities, the right to lease the mineral rights to others, and the right to create fractional shares of the mineral interest. mineral rights | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? mineral_rights cornell.edu ? wex ? mineral_rights