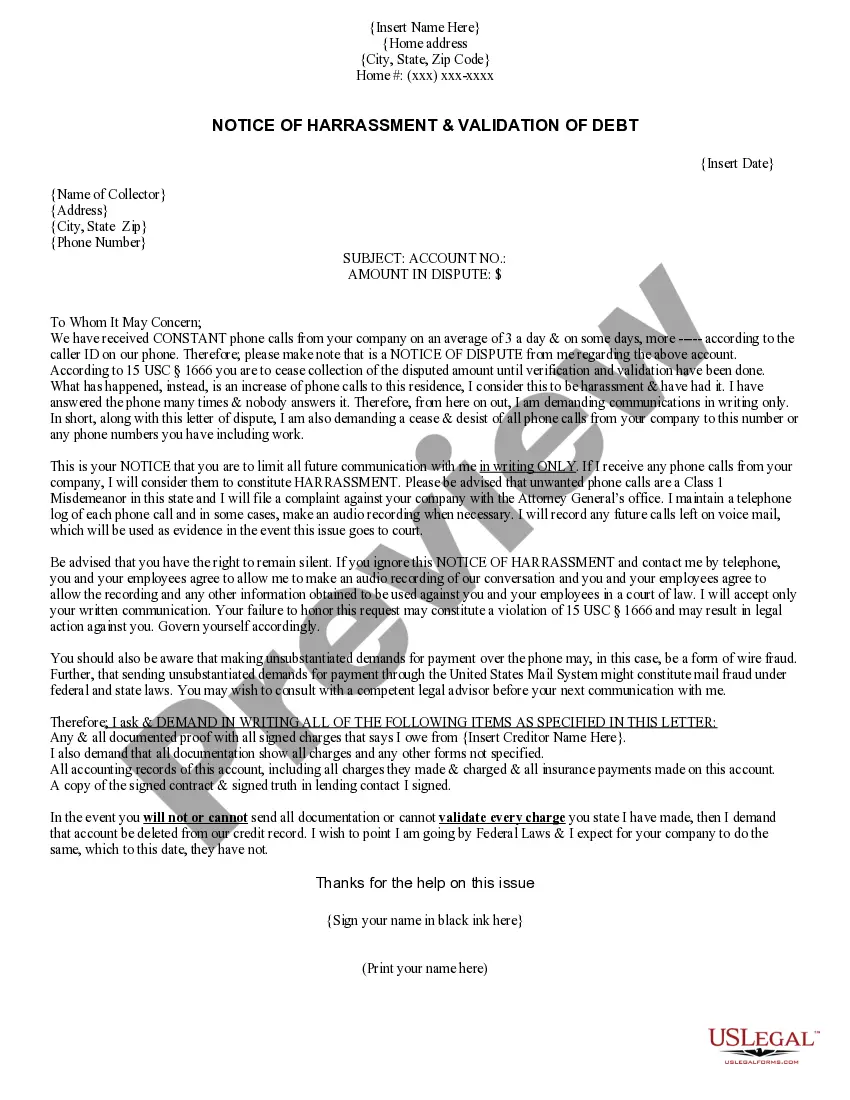

This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

Indiana Notice of Harassment and Validation of Debt

Description

How to fill out Notice Of Harassment And Validation Of Debt?

You can allocate time on the internet trying to locate the valid document template that fulfills the local and national requirements you need. US Legal Forms offers numerous legal templates that are reviewed by experts.

It is easy to download or print the Indiana Notice of Harassment and Validation of Debt from the platform. If you possess a US Legal Forms account, you can Log In and click the Download button. After that, you can complete, modify, print, or sign the Indiana Notice of Harassment and Validation of Debt. Every legal document template you acquire is yours permanently. To obtain another copy of the purchased form, visit the My documents tab and click the corresponding button.

If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for the area/city of your choice. Review the form description to confirm that you have chosen the correct template. If available, use the Review button to check through the document template as well. To find another version of the form, use the Search box to locate the template that suits your needs and requirements. Once you have found the template you want, click Get now to proceed. Select the pricing plan you wish, enter your information, and create your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make edits to your document if necessary. You can complete, modify, sign, and print the Indiana Notice of Harassment and Validation of Debt. Download and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to manage your business or personal requirements.

Form popularity

FAQ

To get a debt lawsuit dismissed in Indiana, you will need to respond to the lawsuit with a motion to dismiss, stating your reasons clearly. Gather evidence that supports your case, such as proof that the debt is invalid or that proper procedures were not followed. Consulting with an attorney can provide you with the best strategy for your situation. The Indiana Notice of Harassment and Validation of Debt can also offer guidance on your rights in these circumstances.

You can report harassment from debt collectors to several agencies, including the Consumer Financial Protection Bureau and your state's attorney general's office. Collect all evidence of the harassment, such as recordings or written correspondence. This information will strengthen your case. Utilizing the Indiana Notice of Harassment and Validation of Debt can help you identify the appropriate reporting channels.

If you experience harassment from a debt collector, you can file a complaint with the Consumer Financial Protection Bureau or the Federal Trade Commission. Document each instance of harassment, including dates, times, and what was said. You may also consider consulting with a legal professional to explore further actions. The Indiana Notice of Harassment and Validation of Debt provides information on the protections available to you.

Disputing the validity of a debt involves sending a dispute letter to the debt collector. In your letter, clearly state why you believe the debt is incorrect or invalid. It's important to send this letter within 30 days of receiving the initial notice from the collector. Referencing the Indiana Notice of Harassment and Validation of Debt will guide you through your rights and the necessary steps.

To file a debt validation claim, start by sending a written request to the debt collector. This request should ask for verification of the debt, including the amount owed and the original creditor's details. It's crucial to keep a copy of your request for your records. Utilizing the Indiana Notice of Harassment and Validation of Debt can help you understand your rights and ensure the proper process is followed.

An example of a debt validation letter includes your personal information, a request for validation, and details about the debt. You might write, 'I request validation of the debt as outlined in the Indiana Notice of Harassment and Validation of Debt.' Platforms like USLegalForms offer examples that you can customize for your specific situation, ensuring you follow the proper format.

The 11-word phrase to stop debt collectors is, 'I do not acknowledge this debt; please contact my attorney.' When you communicate this phrase, refer to the Indiana Notice of Harassment and Validation of Debt for added support. This phrase can effectively halt collection actions. Always remember to document your interactions with collectors.

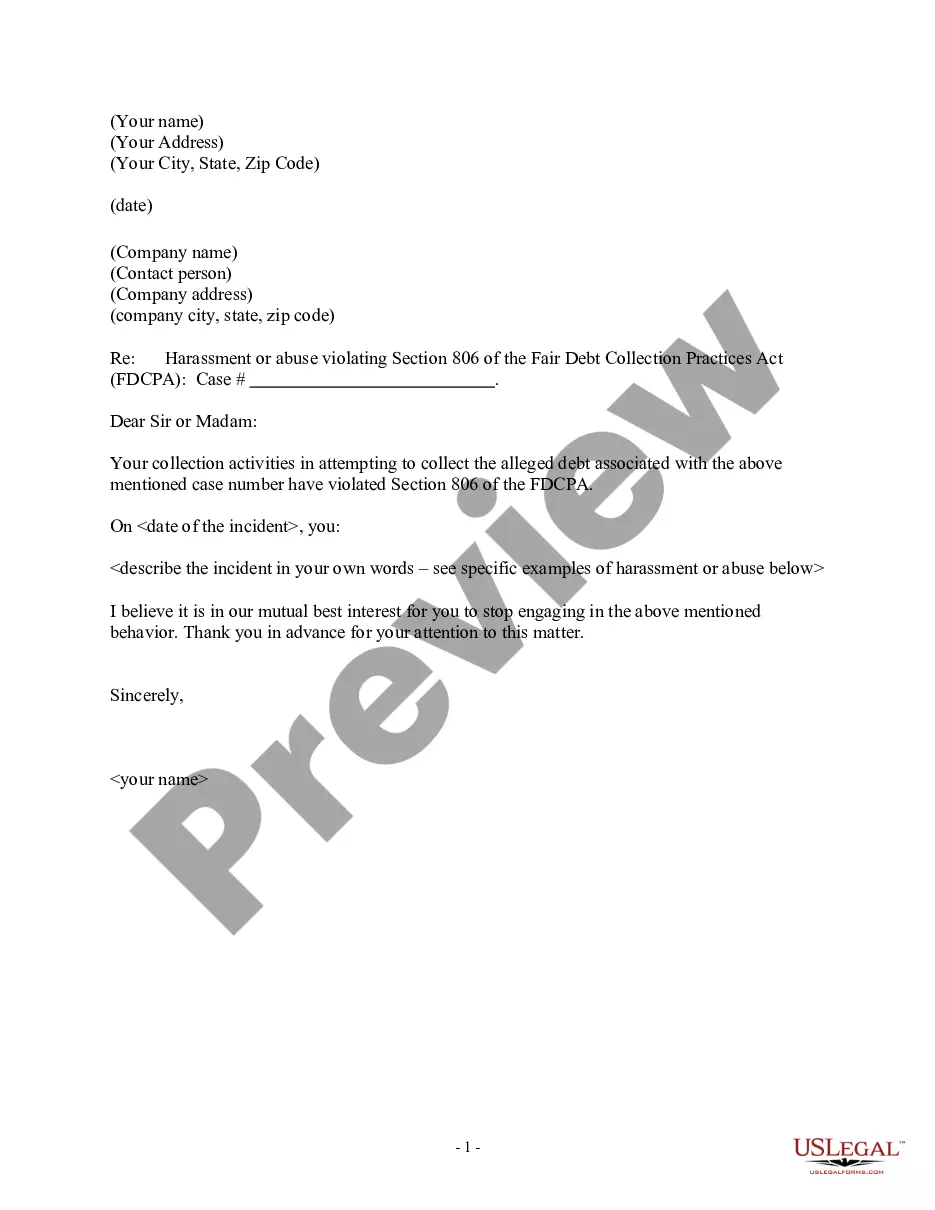

Filling out a debt validation letter involves several key steps. Start by entering your name, address, and the date at the top. Next, clearly state your request for validation, referencing the Indiana Notice of Harassment and Validation of Debt. Be sure to include the debt amount and the creditor's name, and finish by signing the letter and including your contact information.

The best sample for a debt validation letter includes essential elements such as your personal details, the date, and a clear request for debt validation. Refer to the Indiana Notice of Harassment and Validation of Debt to strengthen your case. You can find templates on platforms like USLegalForms, which provide reliable and legally compliant samples to guide you.

When you receive a summons for debt collection in Indiana, respond promptly by filing an answer with the court. Include your defense, such as lack of validation of the debt under the Indiana Notice of Harassment and Validation of Debt. It's crucial to meet the deadlines outlined in the summons to avoid a default judgment. Consider seeking legal advice if you feel overwhelmed.