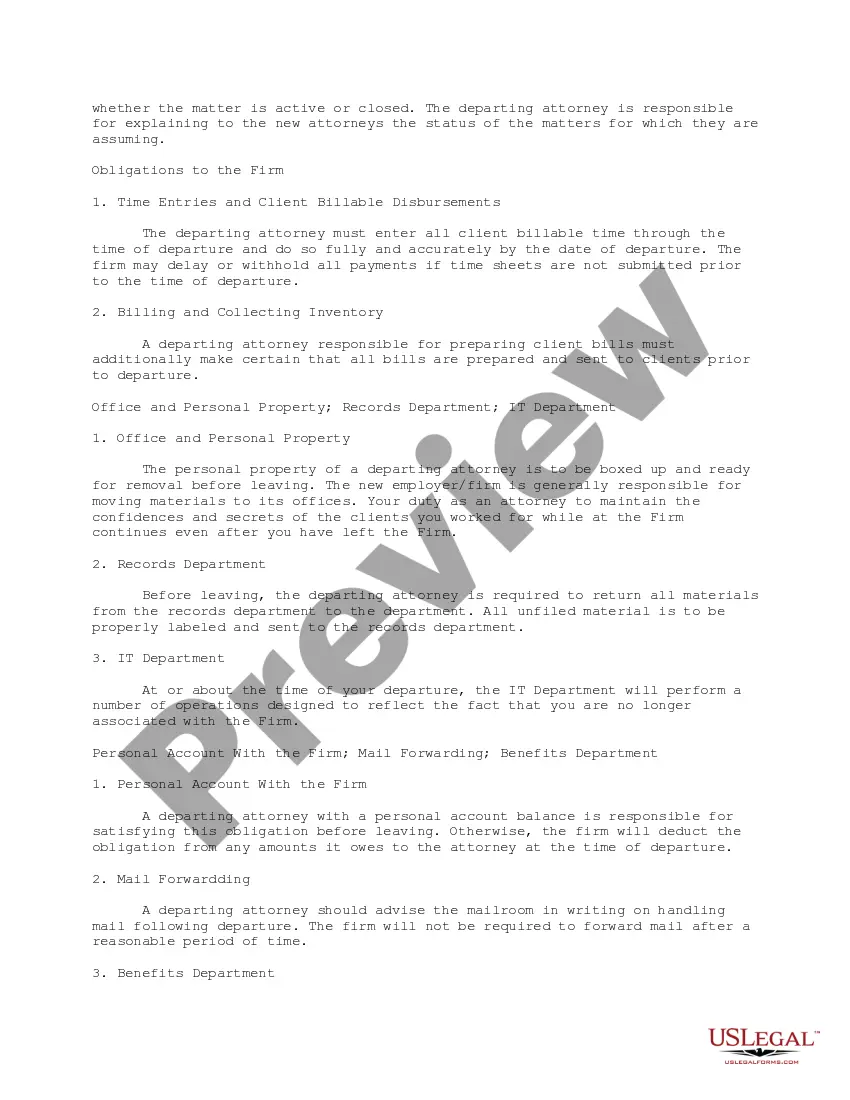

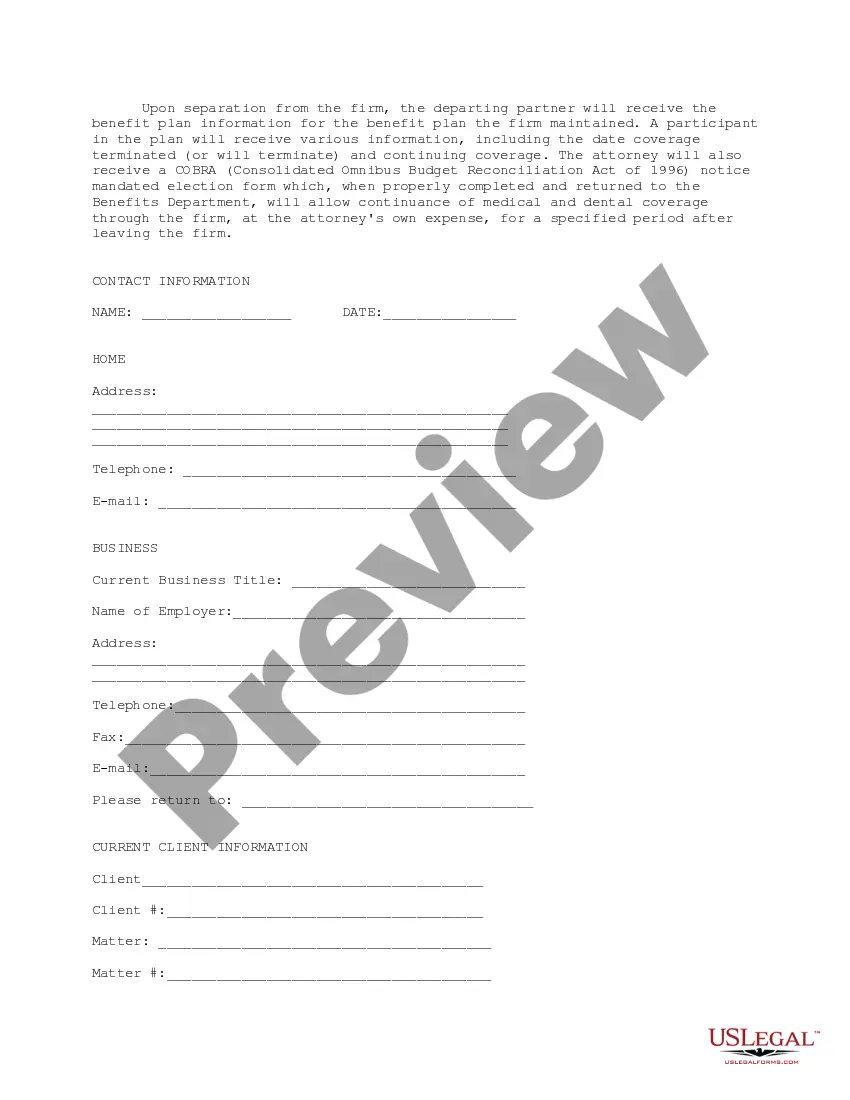

This is a memorandum setting out the policy and procedure when a partner withdraws from a law firm. Topics covered include: Informing the firm, informing clients, confidentiality, obligations to the firm regarding time entries and billing, office and personal property, personal account with the firm, and benefits.

Indiana Developing a Policy Anticipating the Voluntary Withdrawal of Partners

Description

How to fill out Developing A Policy Anticipating The Voluntary Withdrawal Of Partners?

Are you within a placement where you require papers for sometimes company or person uses almost every day? There are a lot of lawful file layouts available on the net, but finding versions you can trust is not easy. US Legal Forms gives 1000s of type layouts, such as the Indiana Developing a Policy Anticipating the Voluntary Withdrawal of Partners, that are published to meet state and federal needs.

If you are currently informed about US Legal Forms website and have your account, just log in. Following that, you are able to acquire the Indiana Developing a Policy Anticipating the Voluntary Withdrawal of Partners template.

Should you not provide an accounts and wish to start using US Legal Forms, follow these steps:

- Get the type you want and make sure it is to the appropriate city/state.

- Use the Preview switch to check the shape.

- Look at the outline to actually have selected the appropriate type.

- When the type is not what you are trying to find, use the Look for industry to discover the type that fits your needs and needs.

- Once you discover the appropriate type, simply click Purchase now.

- Opt for the pricing prepare you want, fill out the specified details to create your account, and buy the order making use of your PayPal or credit card.

- Decide on a handy paper file format and acquire your version.

Locate all the file layouts you may have bought in the My Forms menus. You may get a additional version of Indiana Developing a Policy Anticipating the Voluntary Withdrawal of Partners any time, if possible. Just click the necessary type to acquire or print the file template.

Use US Legal Forms, one of the most considerable variety of lawful types, to conserve some time and steer clear of errors. The services gives appropriately manufactured lawful file layouts that can be used for a variety of uses. Create your account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

However, this partnership can be dissolved only when some predefined provisions, ing to the Partnership Act of 1932 are matched, such as: Dissolution by Agreement. Dissolution by Notice. Dissolution by the Court.

A general partner may withdraw from a limited partnership at any time by giving written notice to the other partners.

Types of Withdrawal from a Partnership Firm The partner is guilty of a breach of trust or is in breach of the partnership agreement. The partner has been declared as a person of unsound mind by a competent court. The partner is permanently incapacitated.

A partner might leave a partnership involuntarily when: they're expelled (or forced out) by the other partners?usually when they breach the partnership agreement or engage in wrongful conduct that hurts the business. they die or become incapacitated. they file for bankruptcy, or. a court orders their expulsion.

Partners may withdraw by selling their equity in the business, through retirement, or upon death.

Dissolving the Partnership If a partner's departure triggers an end to the partnership, the partners will need to follow a dissolution procedure. In this case, the partnership will settle its debts and distribute any remaining assets to the partners?including the withdrawing partner?ing to their capital accounts.