Indiana Self-Employed Tailor Services Contract

Description

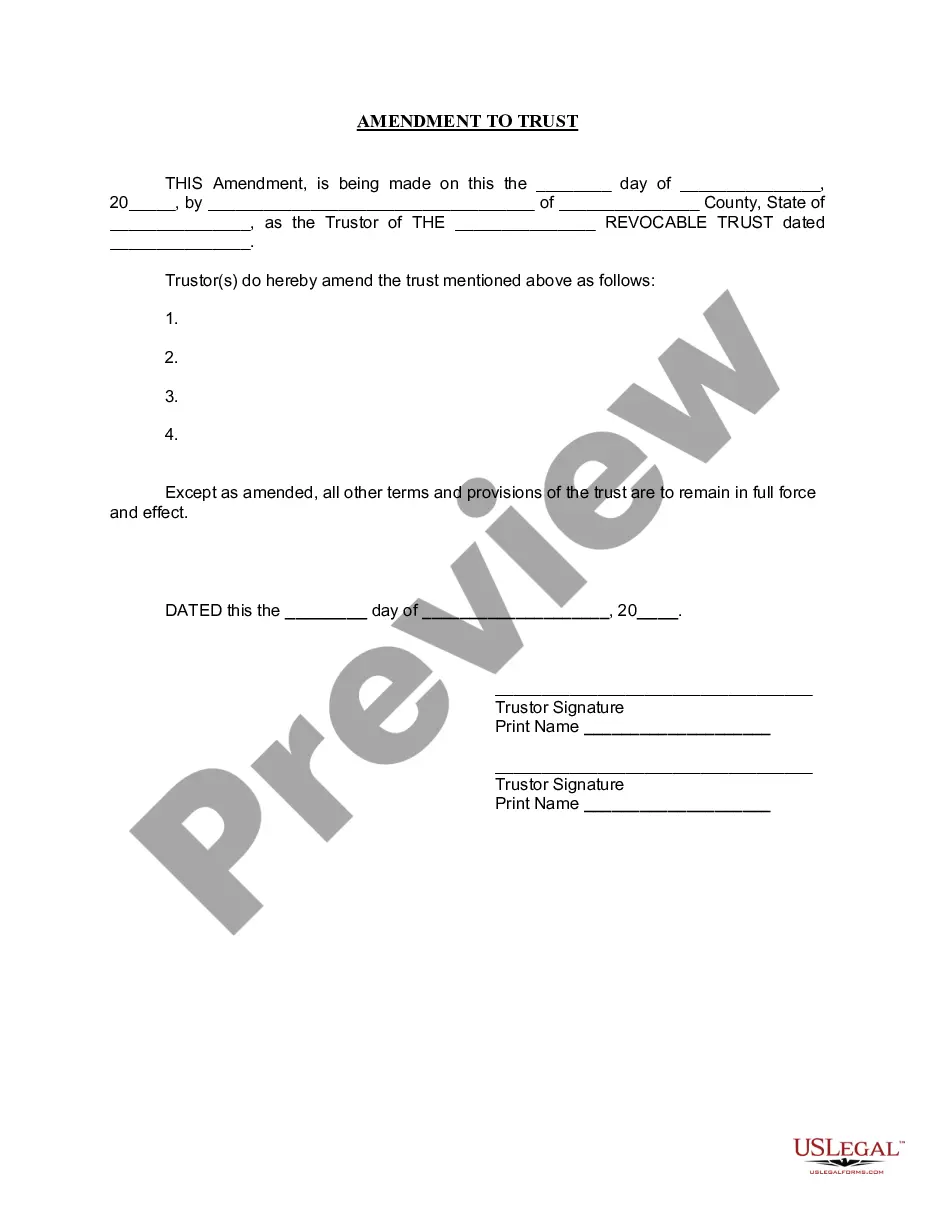

How to fill out Self-Employed Tailor Services Contract?

You can dedicate multiple hours online seeking the legal document template that meets the state and federal criteria you require. US Legal Forms provides thousands of legal forms that have been reviewed by experts.

You can conveniently download or print the Indiana Self-Employed Tailor Services Contract from my assistance. If you already possess a US Legal Forms account, you can sign in and click on the Obtain button. After that, you can fill out, edit, print, or sign the Indiana Self-Employed Tailor Services Contract. Every legal document template you purchase is yours indefinitely.

To obtain another copy of the purchased form, navigate to the My documents section and click on the appropriate option. If you are using the US Legal Forms site for the first time, follow the simple instructions outlined below: First, ensure that you have selected the correct document template for the county/city of your choice. Review the form description to confirm you have selected the right template. If available, utilize the Preview option to view the document template as well.

- If you wish to find another version of the form, use the Search field to locate the template that meets your needs and requirements.

- Once you have found the template you desire, click Purchase now to proceed.

- Select the pricing plan you prefer, enter your information, and register for an account on US Legal Forms.

- Complete the transaction. You can utilize your Visa, Mastercard, or PayPal account to pay for the legal form.

- Choose the format of the document and download it to your device.

- Make adjustments to your document if possible. You can fill out, edit, and sign and print the Indiana Self-Employed Tailor Services Contract.

- Access and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Use professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

While an operating agreement is not legally required for an LLC in Indiana, it is highly recommended. This document outlines the management structure and operating procedures of your business. For those offering Indiana Self-Employed Tailor Services, having an operating agreement can enhance credibility and help avoid potential disputes.

Establishing yourself as an independent contractor involves several steps. Start by defining your services and target market, then develop a professional portfolio. Creating an Indiana Self-Employed Tailor Services Contract can help you outline your offerings and terms clearly, setting a strong foundation for your business relationships.

The choice between being a 1099 contractor or forming an LLC largely depends on your business goals. A 1099 status means you are an independent contractor, but an LLC offers limited liability and potential tax benefits. For those providing Indiana Self-Employed Tailor Services, an LLC can provide a more secure structure as you grow your business.

To set up as an independent contractor, start by choosing a business name and structure. You should also register your business and obtain any necessary licenses. Additionally, consider using an Indiana Self-Employed Tailor Services Contract to formalize agreements with clients, ensuring clarity and professionalism from the outset.

Yes, independent contractors in Indiana typically need a business license to operate legally. This requirement can vary based on your location within the state, so it's wise to check with local authorities. For those offering Indiana Self-Employed Tailor Services, obtaining the appropriate license ensures compliance and builds trust with clients.

To write a contract for a 1099 employee, clearly outline the nature of the work, payment terms, and any deadlines. Specify that the individual is an independent contractor, not an employee, to avoid misclassification. An Indiana Self-Employed Tailor Services Contract can provide a solid framework for this type of agreement, ensuring it meets legal standards.

Writing a self-employment contract involves detailing the services you will provide and the payment structure. Include terms related to termination, confidentiality, and any other specific conditions. Consider using an Indiana Self-Employed Tailor Services Contract to ensure your agreement covers all critical aspects and protects your interests.

Yes, you can create your own legally binding contract as long as it meets certain legal requirements. Ensure that both parties agree to the terms and that you include necessary elements such as signatures, dates, and consideration. For guidance, explore the Indiana Self-Employed Tailor Services Contract to ensure your document is comprehensive and enforceable.

To write a contract agreement for services, begin by outlining the services you will provide and the compensation terms. Be specific about timelines, deliverables, and any other relevant details. Utilizing an Indiana Self-Employed Tailor Services Contract template can streamline this process and offer a solid foundation for your agreement.

Yes, you can write your own service agreement. Ensure it includes the scope of services, payment details, and any deadlines or milestones. Using an Indiana Self-Employed Tailor Services Contract can help you structure your agreement effectively and legally validate your terms.