Indiana Medical Representative Agreement - Self-Employed Independent Contractor

Description

How to fill out Medical Representative Agreement - Self-Employed Independent Contractor?

If you need to finalize, obtain, or create legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the site’s straightforward and user-friendly search feature to find the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the Indiana Medical Representative Contract - Self-Employed Independent Contractor within just a few clicks.

Every legal document template you purchase is yours forever. You will have access to each form you downloaded within your account.

Go to the My documents section and select a form to print or download again. Stay competitive and download, as well as print the Indiana Medical Representative Contract - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to retrieve the Indiana Medical Representative Contract - Self-Employed Independent Contractor.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/region.

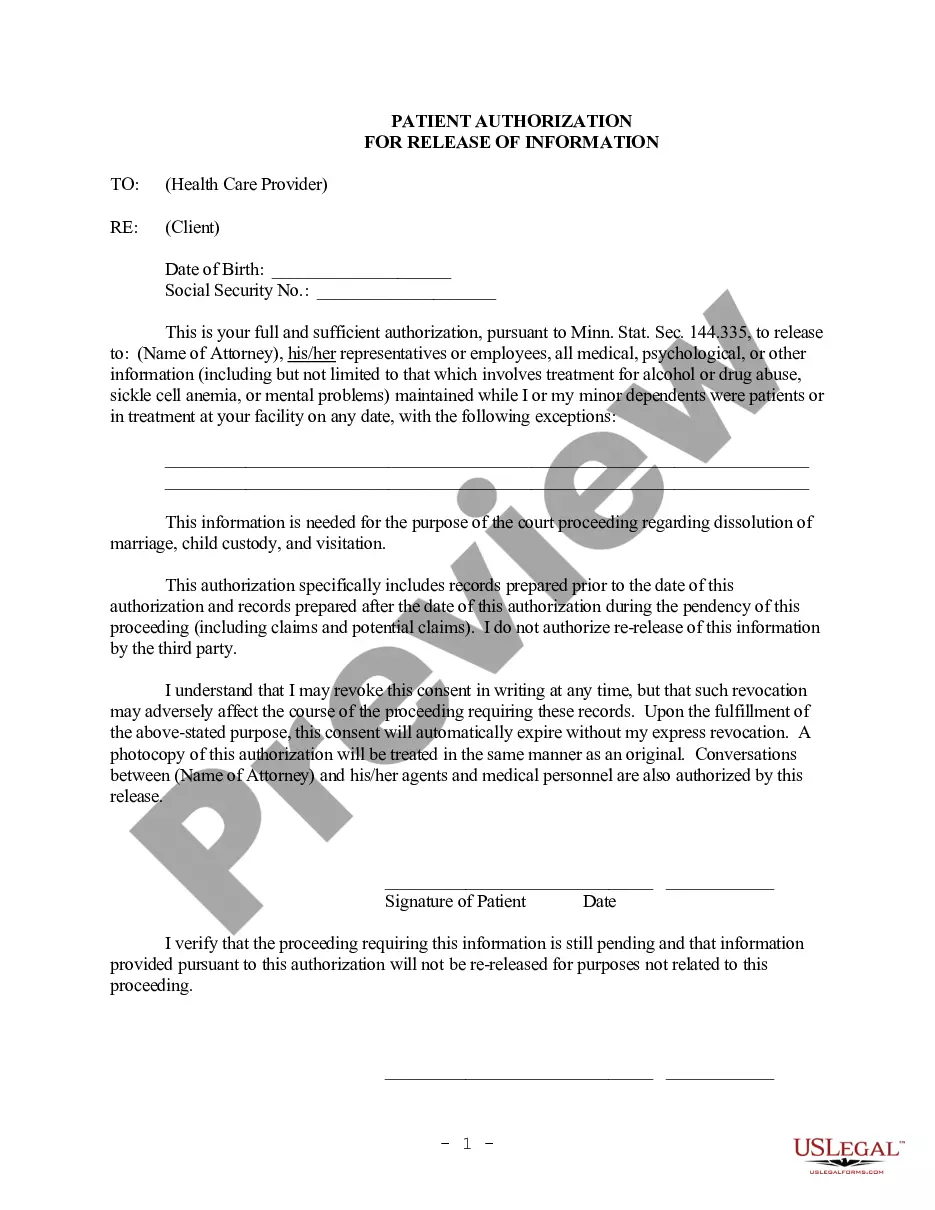

- Step 2. Utilize the Review feature to inspect the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Indiana Medical Representative Contract - Self-Employed Independent Contractor.

Form popularity

FAQ

In Indiana, independent contractors typically do not require workers' compensation insurance. However, the specific situation may vary based on the nature of the work and the contract terms. It is wise to check with legal advisors or your insurance provider to understand your obligations. Utilizing the Indiana Medical Representative Agreement - Self-Employed Independent Contractor can help clarify responsibilities related to insurance needs.

Filling out an independent contractor agreement involves detailing the scope of work, payment structure, and any privacy or confidentiality clauses. Be sure to accurately list both parties' information, such as names and addresses. Each party should read the agreement carefully to ensure mutual understanding. You can access streamlined templates for the Indiana Medical Representative Agreement - Self-Employed Independent Contractor on platforms like uslegalforms to assist you.

To write an independent contractor agreement, start by clearly stating the terms of the relationship. Include details such as the services provided, payment terms, and project timelines. You should also specify the rights and obligations of both parties. Using a template, like the Indiana Medical Representative Agreement - Self-Employed Independent Contractor, can simplify the process and ensure that you cover all necessary aspects.

Receiving a 1099 form usually indicates that you are considered self-employed. This form reports non-employee compensation and signals that you are running your own business. Therefore, if you're working under an Indiana Medical Representative Agreement - Self-Employed Independent Contractor, you are indeed classified as self-employed.

Writing an independent contractor agreement involves outlining specific terms such as services, payment, and project deadlines. Make sure to include responsibilities and any relevant legal obligations. Utilizing templates from platforms like USLegalForms can help ensure that your Indiana Medical Representative Agreement - Self-Employed Independent Contractor is comprehensive and legally binding.

The terms self-employed and independent contractor can often be used interchangeably, but context matters. If you want to emphasize the autonomy and responsibilities associated with your work, saying self-employed may be more beneficial. However, referencing your Indiana Medical Representative Agreement - Self-Employed Independent Contractor provides clearer legal context to your business status.

In Indiana, independent contractors might need a business license depending on the nature of their work. While not all independent contractors are required to have a license, specific professions may necessitate one. It’s advisable to consult local regulations and the terms laid out in your Indiana Medical Representative Agreement - Self-Employed Independent Contractor for clarity.

Yes, an independent contractor is indeed considered self-employed. This classification means that they manage their own business affairs, including taxes and business expenses. The Indiana Medical Representative Agreement - Self-Employed Independent Contractor serves to clearly define this status and the expectations such as payment terms and responsibilities.

To be classified as self-employed, an individual must work for themselves rather than being an employee of another person or company. This includes generating income from your services or business activities, which is essential in an Indiana Medical Representative Agreement - Self-Employed Independent Contractor. Additionally, self-employed individuals manage their own tax obligations and can define their work conditions.

Yes, independent contractors are typically considered self-employed. They operate their own business and are responsible for their own taxes. An Indiana Medical Representative Agreement - Self-Employed Independent Contractor outlines the specifics of this relationship, making it clear that you are not an employee of any company but rather running your own operation.