Indiana Engineering Agreement - Self-Employed Independent Contractor

Description

How to fill out Engineering Agreement - Self-Employed Independent Contractor?

Have you visited a location where you need documentation for potential business or specific reasons almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms offers thousands of template forms, including the Indiana Engineering Agreement - Self-Employed Independent Contractor, designed to comply with federal and state regulations.

Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life simpler.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Indiana Engineering Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for your specific city/county.

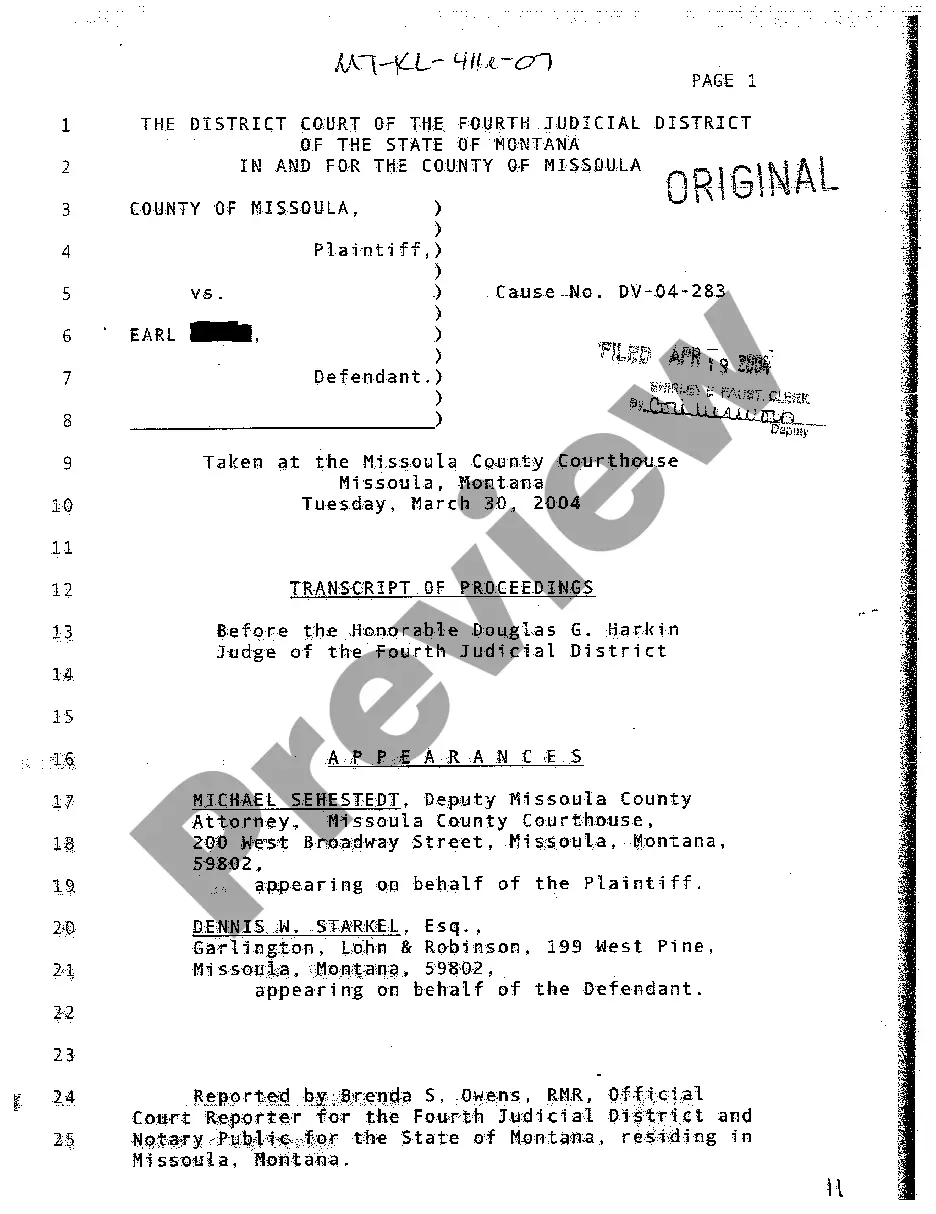

- Use the Preview button to review the document.

- Read the description to ensure you have selected the correct form.

- If the form is not what you are looking for, utilize the Search bar to find the form that meets your needs and specifications.

- When you find the correct form, click Get now.

- Choose the pricing plan you prefer, fill in the required details to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a convenient document format and download your copy.

- Find all the document templates you have purchased in the My documents section.

- You can obtain another copy of the Indiana Engineering Agreement - Self-Employed Independent Contractor at any time if necessary.

- Simply access the required form to download or print the document template.

Form popularity

FAQ

Writing an independent contractor agreement begins with outlining the key components of the contract. Start by stating the names and addresses of both the contractor and client, followed by a description of the services the contractor will provide. Ensure to include payment details, timelines, and conditions for terminating the agreement. For a solid foundation, consider utilizing templates from US Legal Forms that cater to the Indiana Engineering Agreement - Self-Employed Independent Contractor, making the writing process easier and more effective.

To fill out an independent contractor agreement effectively, start by identifying the parties involved. Provide clear details such as the project scope, payment terms, and deadlines. It’s crucial to include any applicable clauses related to confidentiality and termination. Using a reliable template, like those from US Legal Forms, can streamline this process and ensure you do not miss any essential elements of the Indiana Engineering Agreement - Self-Employed Independent Contractor.

Creating an independent contractor agreement involves outlining the terms of the work arrangement. Start by detailing the scope of work, payment terms, and deadlines. Using resources like the Indiana Engineering Agreement - Self-Employed Independent Contractor can simplify this process, providing clear sections to fill out. Applications such as uslegalforms can also assist you in generating a legal document that meets your specific needs.

Typically, either the hiring party or the independent contractor drafts the independent contractor agreement. However, for the smoothest process, it is advisable to use a template specifically designed for this purpose. Utilizing a standard template ensures that all necessary elements are included. The Indiana Engineering Agreement - Self-Employed Independent Contractor serves as a helpful guide for drafting a comprehensive agreement.

Yes, engineers can absolutely be self-employed. This option allows them to take control of their careers, choose projects that interest them, and set their own rates. Being self-employed offers the potential to grow a successful engineering practice. An Indiana Engineering Agreement - Self-Employed Independent Contractor can provide the necessary framework to establish and thrive in this venture.

Certainly, an engineer can also take on the role of a contractor. This dual role allows engineers to manage projects while providing technical expertise. It can lead to more efficient project execution and better quality control. Utilizing an Indiana Engineering Agreement - Self-Employed Independent Contractor can streamline your responsibilities and client expectations.

Yes, having a contract is critical for independent contractors. A clear agreement, such as an Indiana Engineering Agreement - Self-Employed Independent Contractor, helps define the scope of work, payment terms, and responsibilities involved. A written contract protects you and your client, ensuring all parties are on the same page. It reduces misunderstandings and establishes a professional relationship.

In Indiana, independent contractors do not typically need workers' compensation insurance. However, it is advisable to verify your specific situation and requirements. Coverage might be necessary if you have employees working for you or if your client requires it. An Indiana Engineering Agreement - Self-Employed Independent Contractor can include terms regarding insurance and liability.

Indeed, independent contractors are considered self-employed individuals. They operate their own businesses and are not subject to employee benefits. This status offers greater autonomy, but it also comes with the responsibility of managing taxes and expenses. An Indiana Engineering Agreement - Self-Employed Independent Contractor can serve as a helpful guide in navigating these requirements.

Absolutely, an engineer can be an independent contractor. This setup allows engineers to provide services to various clients without being tied to a single employer. It fosters entrepreneurship and can lead to higher earning potential. Using an Indiana Engineering Agreement - Self-Employed Independent Contractor clarifies the working relationship and protects both parties.