Indiana Self-Employed Surveyor Services Contract

Description

How to fill out Self-Employed Surveyor Services Contract?

If you need to thoroughly, download, or print official document templates, utilize US Legal Forms, the largest collection of official forms available online.

Take advantage of the site's simple and user-friendly search to find the documents you require. Various templates for corporate and personal purposes are organized by categories and keywords.

Use US Legal Forms to acquire the Indiana Self-Employed Surveyor Services Contract in just a few clicks.

Every legal document template you obtain is yours forever. You have access to each form you saved in your account. Click the My documents section and select a form to print or download again.

Compete and download, and print the Indiana Self-Employed Surveyor Services Contract with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Indiana Self-Employed Surveyor Services Contract.

- You can also retrieve forms you previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

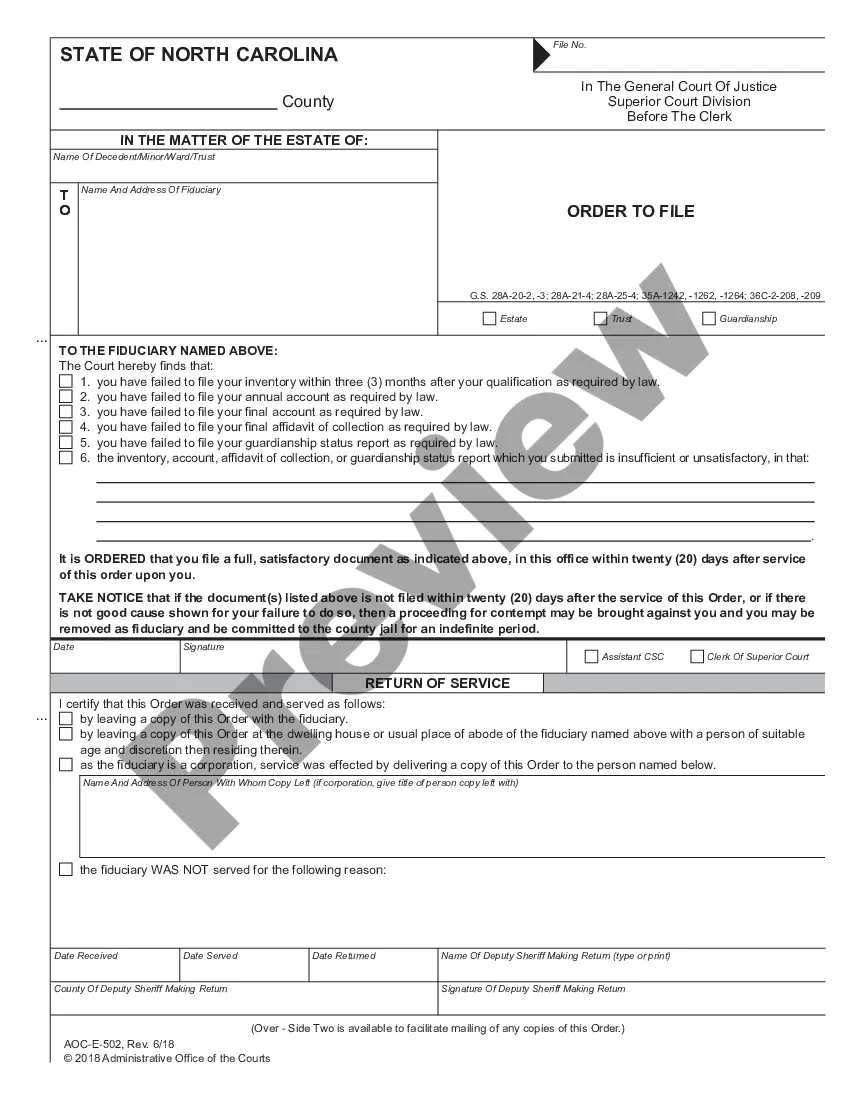

- Step 2. Use the Preview option to review the form's content. Remember to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other forms in the legal format.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Indiana Self-Employed Surveyor Services Contract.

Form popularity

FAQ

Writing a self-employed contract requires you to detail the services offered, payment terms, and deadlines. It's vital to include any necessary disclaimers or legal obligations to protect both parties. This contract should clearly outline the nature of your self-employment to avoid future disputes. For guidance, consider using the Indiana Self-Employed Surveyor Services Contract available on US Legal Forms.

When writing a contract for a 1099 employee, detail the services they will perform and the payment structure. It is important to clarify that they are an independent contractor, not an employee, to avoid any confusion regarding tax obligations. Additionally, specify the duration of the contract and any deliverables. Templates like the Indiana Self-Employed Surveyor Services Contract from US Legal Forms can help you draft an effective agreement.

To write a simple employment contract, start by identifying the employer and employee, then outline job responsibilities and compensation. Include the duration of the contract and any termination conditions. Keeping the language straightforward will help both parties understand their commitments. For a streamlined experience, you might want to check the Indiana Self-Employed Surveyor Services Contract on US Legal Forms.

Yes, you can write your own legally binding contract as long as it includes essential elements such as offer, acceptance, consideration, and mutual consent. Ensure that the terms are clear and unambiguous to protect both parties. While DIY contracts are possible, utilizing a template like the Indiana Self-Employed Surveyor Services Contract from US Legal Forms can provide peace of mind and legal assurance.

Writing a self-employment contract involves outlining the services you will provide as an independent contractor. Specify payment details, timelines, and any relevant legal obligations. Clearly state the expectations for both parties to avoid misunderstandings. For a comprehensive approach, consider using the Indiana Self-Employed Surveyor Services Contract template from US Legal Forms.

To fill out an independent contractor agreement, begin by clearly identifying the parties involved. Include the scope of work, payment terms, and deadlines to ensure both parties understand their responsibilities. Be sure to also outline any confidentiality clauses or termination conditions. Using a template, like the one available on US Legal Forms, can simplify this process.

In Indiana, independent contractors are generally not required to carry workers' compensation insurance. However, if you are working under an Indiana Self-Employed Surveyor Services Contract, it is prudent to consider the potential risks involved in your work. Having workers' comp can provide you with financial protection in case of an injury. To navigate this effectively, consult with legal professionals or platforms like USLegalForms to ensure you comply with local laws.

In Indiana, a breach of contract occurs when one party fails to perform their obligations under a legally binding agreement. To establish a breach, you must show that a valid contract existed, the other party did not fulfill their duties, and you suffered damages as a result. If you are involved in an Indiana Self-Employed Surveyor Services Contract, understanding these elements is crucial to protecting your rights. You can use legal resources to ensure your contract is clear and enforceable.

It is not illegal to be employed without a contract, but it can lead to complications. Without an Indiana Self-Employed Surveyor Services Contract, you may struggle to enforce your rights regarding payment and work conditions. A contract fosters trust and clarity between you and your employer. Hence, it is prudent to establish a formal agreement whenever possible.

Yes, having a contract as an independent contractor is highly recommended. An Indiana Self-Employed Surveyor Services Contract helps clarify the expectations and obligations of both parties. It can mitigate misunderstandings and provide legal protection if disputes arise. Therefore, securing a contract is a smart choice for any independent contractor.