Indiana Auditor Agreement - Self-Employed Independent Contractor

Description

How to fill out Auditor Agreement - Self-Employed Independent Contractor?

Are you presently in a location where you require documents for both professional or personal reasons every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms provides a vast selection of template forms, such as the Indiana Auditor Agreement - Self-Employed Independent Contractor, which are crafted to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes.

The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms site and possess an account, just Log In.

- After that, you can download the Indiana Auditor Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require and confirm it is for the correct city/state.

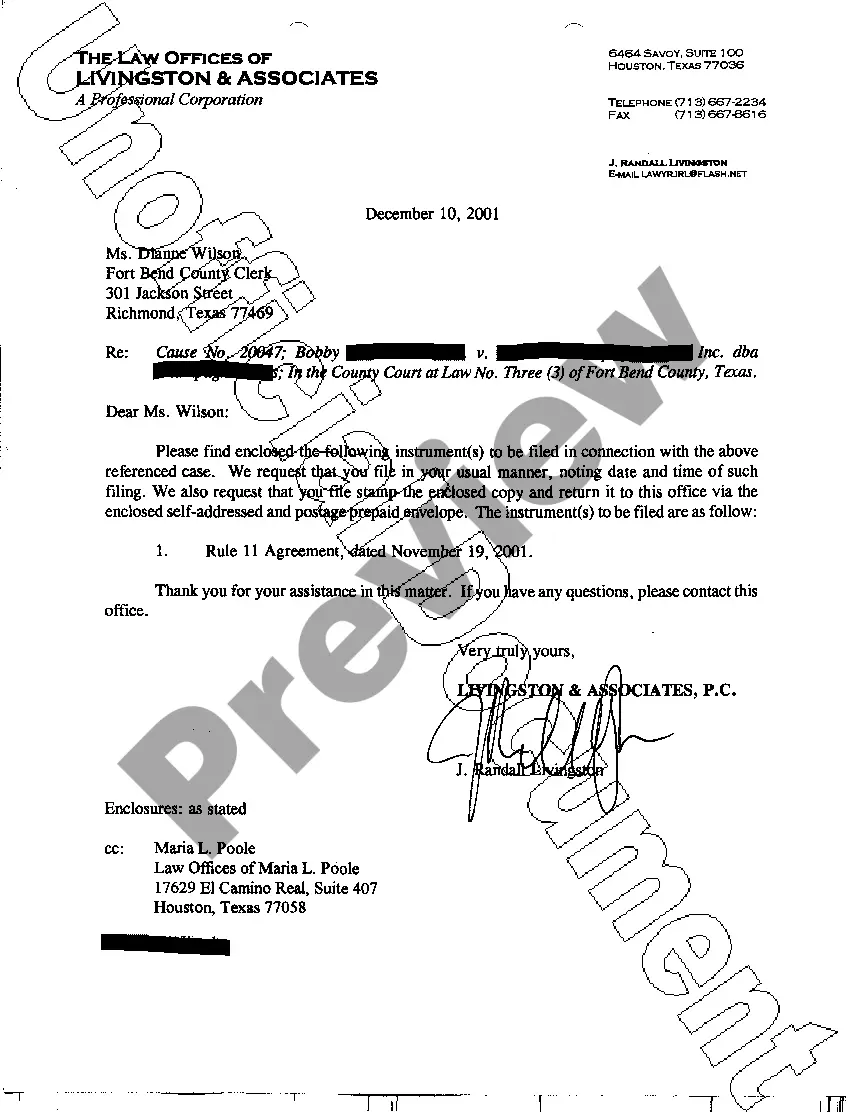

- Use the Preview button to review the document.

- Check the details to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search section to find a form that meets your needs and criteria.

- Once you find the right form, click Acquire now.

- Select the payment plan you want, provide the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can download an additional copy of the Indiana Auditor Agreement - Self-Employed Independent Contractor whenever needed. Just click the required form to download or print the document template.

Form popularity

FAQ

Filling out an independent contractor form requires attention to important information. Enter your name, business details, and the type of services you will provide. Additionally, make sure to clarify your payment arrangement and terms of service. By accurately completing this form, you align with the integrity of the Indiana Auditor Agreement - Self-Employed Independent Contractor.

To fill out a declaration of independent contractor status form, begin by stating your name and address. Provide a description of the services you offer and detail your business operations. This form helps establish your status as an independent contractor, particularly in the context of the Indiana Auditor Agreement - Self-Employed Independent Contractor, ensuring you comply with legal standards.

To write an independent contractor agreement, start by specifying the parties involved along with their contact information. Then, define the work to be performed, deadlines, and compensation details. Incorporating essential clauses related to termination, confidentiality, and liability can enhance the clarity of the agreement, making it an effective tool under the Indiana Auditor Agreement - Self-Employed Independent Contractor.

An independent contractor typically needs to fill out several documents to ensure compliance. First, they should complete a W-9 form to provide tax information. Additionally, depending on the state and specific agreement, various contracts, like the Indiana Auditor Agreement - Self-Employed Independent Contractor, may be required to formalize the relationship with clients.

Filling out an independent contractor agreement involves several key steps. Start by entering your details, including your name and contact information. Next, clearly outline the scope of work, payment terms, and any other important conditions. This careful documentation can help you establish a solid relationship under the Indiana Auditor Agreement - Self-Employed Independent Contractor.

Typically, the hiring party drafts the independent contractor agreement to ensure their interests are covered. However, both parties should review and agree on all terms before signing. Using the Indiana Auditor Agreement - Self-Employed Independent Contractor as a reference can guide you in writing a fair agreement. For more support, uslegalforms offers various templates and resources to assist in the drafting process.

Creating an independent contractor agreement involves outlining the responsibilities and expectations of both parties. Start by detailing the services to be provided, payment terms, and the duration of the agreement. The Indiana Auditor Agreement - Self-Employed Independent Contractor can be a helpful model for your agreement. You can also utilize uslegalforms to access templates that simplify this process.

In Indiana, independent contractors typically do not need a specific business license to operate, but local regulations may require one. It is essential to check with your city or county for any licensing requirements. The Indiana Auditor Agreement - Self-Employed Independent Contractor may help clarify your status. For comprehensive resources and guidance, consider using uslegalforms for templates and legal insights.