Indiana Account Executive Agreement - Self-Employed Independent Contractor

Description

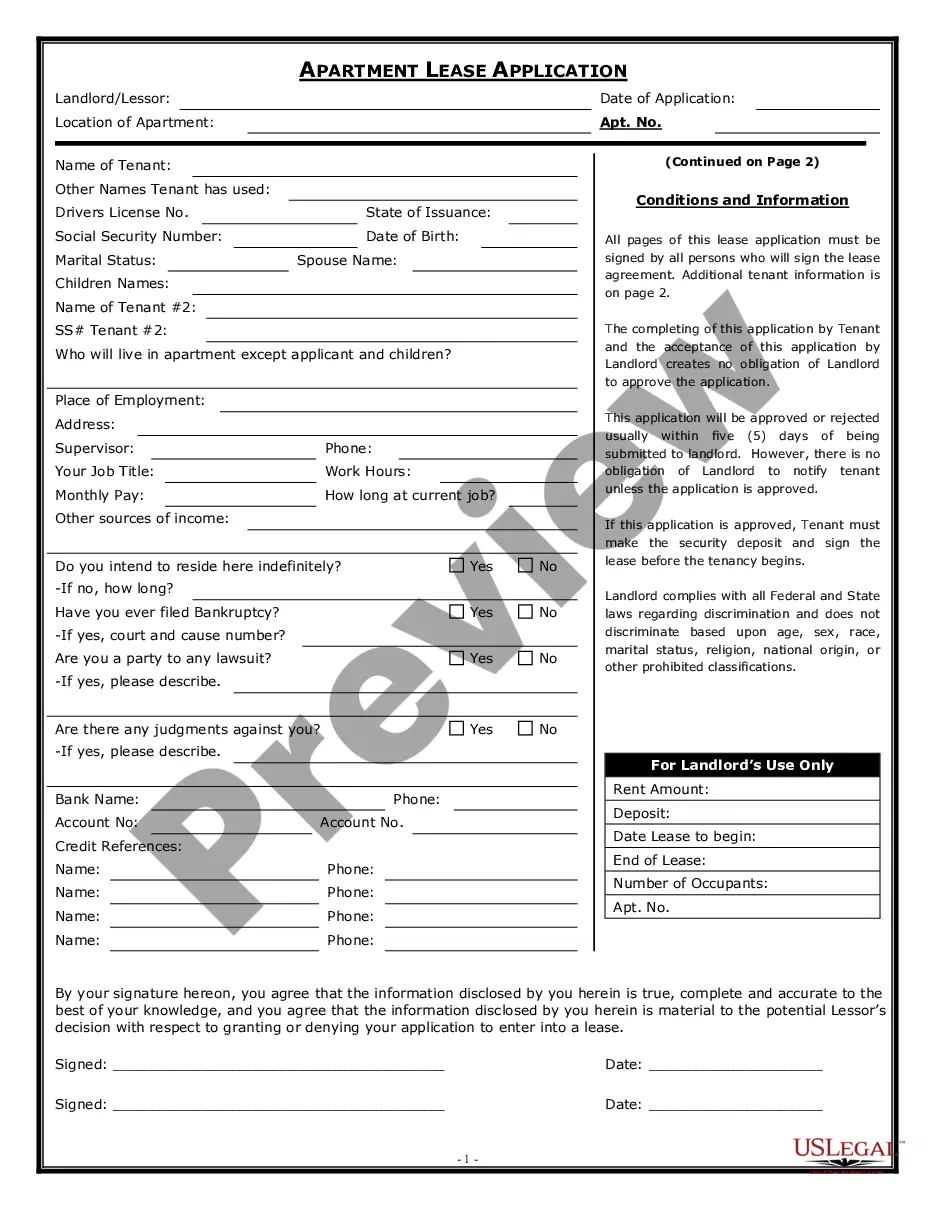

How to fill out Account Executive Agreement - Self-Employed Independent Contractor?

Locating the appropriate legitimate document template can be a challenge. Naturally, there are numerous online templates accessible, but how will you acquire the legitimate document you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the Indiana Account Executive Agreement - Self-Employed Independent Contractor, that can be utilized for business and personal purposes. All the forms are validated by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Indiana Account Executive Agreement - Self-Employed Independent Contractor. Use your account to browse through the legitimate forms you may have previously purchased. Visit the My documents section of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure that you have chosen the correct form for your city/region. You can examine the form using the Preview button and review the form summary to confirm this is indeed the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. When you are sure that the form works, select the Buy now button to purchase the form. Choose the pricing plan you prefer and provide the necessary details. Create your account and make a purchase using your PayPal account or credit card. Select the document format and download the legitimate document template to your device. Finally, complete, review, print, and sign the acquired Indiana Account Executive Agreement - Self-Employed Independent Contractor.

Make use of US Legal Forms to efficiently obtain the legitimate documents you need.

- US Legal Forms is the largest collection of legitimate documents available.

- You will find various document templates.

- Utilize the service to obtain professionally crafted documents that comply with state regulations.

- All templates are reviewed by professionals.

- The documents can be used for both business and personal needs.

- Access your previous orders easily through your account.

Form popularity

FAQ

Generally, independent contractors do not qualify for workers' compensation, as they are not considered employees. However, some exceptions may exist depending on the nature of the work and the agreement in place. By implementing an Indiana Account Executive Agreement - Self-Employed Independent Contractor, you can specify the terms under which you operate, including any liabilities regarding workers' compensation.

Certain independent contractors, including sole proprietors and some agricultural workers, may be exempt from workers' compensation in Indiana. It's crucial to research specific exemptions that apply to your situation. Using an Indiana Account Executive Agreement - Self-Employed Independent Contractor can help clarify the responsibilities and exemptions related to your business.

Independent contractors should consider liability insurance, professional indemnity insurance, and possibly health insurance. These types of coverage can protect you against accidents, lawsuits, and loss of income. By utilizing an Indiana Account Executive Agreement - Self-Employed Independent Contractor, you can better understand your insurance needs based on your specific services.

In Indiana, independent contractors classified as 1099 employees typically do not require workers' compensation coverage. However, it is essential to understand your specific obligations and exceptions. A properly constructed Indiana Account Executive Agreement - Self-Employed Independent Contractor can clarify the relationship and liability between the contractor and the hiring party.

Yes, an accountant can be an independent contractor if they provide services on a contract basis rather than being an employee. This arrangement can offer flexibility and control over work schedules and business operations. By drafting an Indiana Account Executive Agreement - Self-Employed Independent Contractor, accountants can establish clear terms for their services.

The new federal rule on independent contractors affects the classification of workers for wage and hour laws. This rule intends to clarify when a worker is considered an independent contractor or an employee. Adhering to the Indiana Account Executive Agreement - Self-Employed Independent Contractor can help you navigate these changes and maintain proper classification.

Independent contractors in Indiana may need a business license depending on the type of services they provide and local regulations. It's advisable to check with your city or county to ensure compliance. Moreover, using an Indiana Account Executive Agreement - Self-Employed Independent Contractor can help clarify your business structure and responsibilities.

In Indiana, independent contractors do not automatically require workers' compensation insurance, but it is highly advisable. As a self-employed independent contractor under the Indiana Account Executive Agreement, you face unique risks and responsibilities. Obtaining this insurance can protect you against workplace injuries and related medical expenses. Remember, while it's not mandatory for all independent contractors, having coverage provides peace of mind as you operate your business.

Filling out the AW-9 form is straightforward but essential for your work as an independent contractor. You’ll need to provide your name, business name if applicable, and your taxpayer identification number. Ensure that the information matches your records to avoid any tax issues. If you need assistance, USLegalForms offers resources to help you complete the AW-9 correctly.

Writing an independent contractor agreement requires clarity and precision. Begin by outlining the scope of work, responsibilities, and payment terms to avoid future misunderstandings. Include clauses about contract termination and confidentiality to protect both parties. The Indiana Account Executive Agreement - Self-Employed Independent Contractor template available on USLegalForms can help you create a thorough agreement.