Indiana Educator Agreement - Self-Employed Independent Contractor

Description

How to fill out Educator Agreement - Self-Employed Independent Contractor?

Are you currently in a situation where you require documents for either business or personal purposes almost every day? There are numerous legal document templates available online, but finding ones you can rely on is not easy. US Legal Forms offers thousands of form templates, such as the Indiana Educator Agreement - Self-Employed Independent Contractor, that are designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the Indiana Educator Agreement - Self-Employed Independent Contractor template.

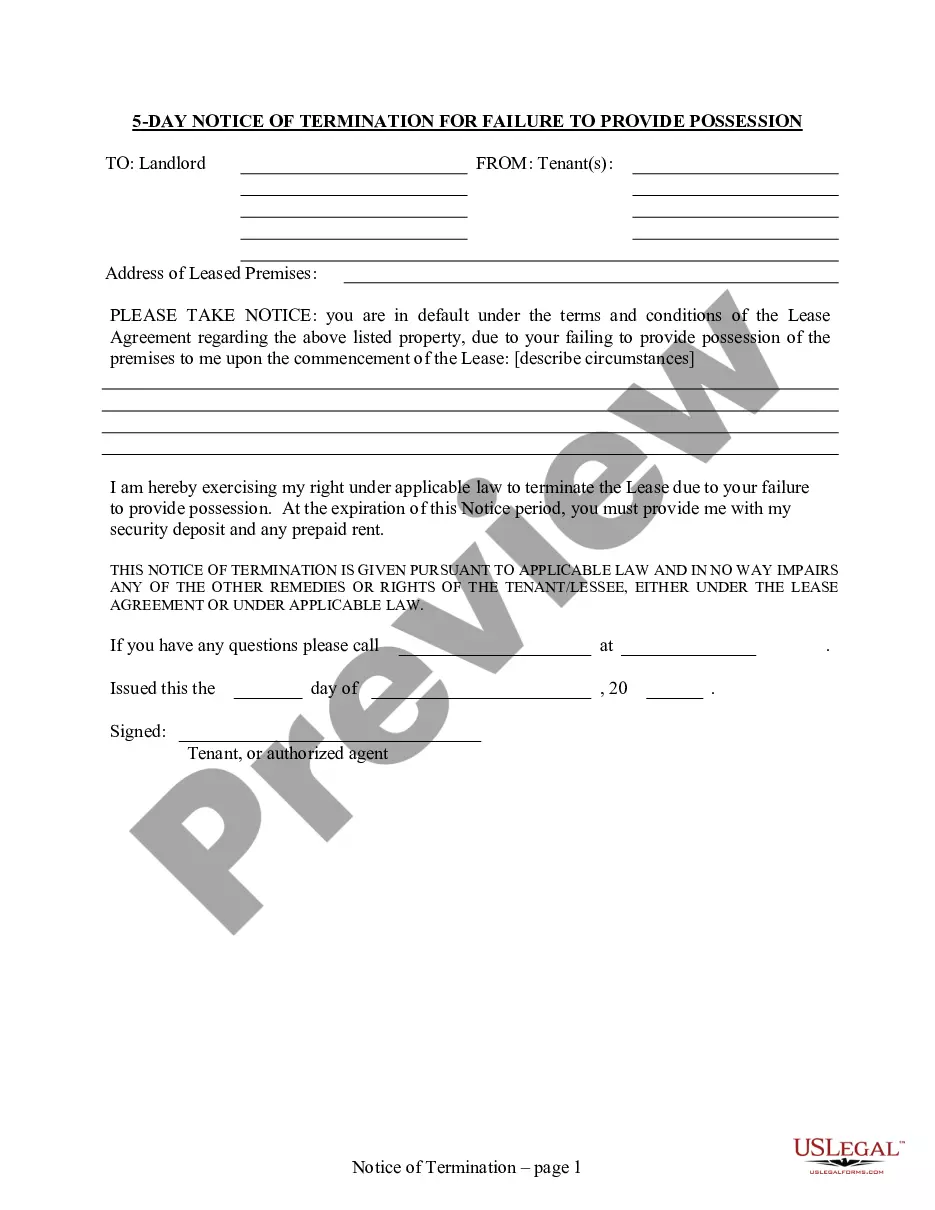

If you do not have an account and wish to start using US Legal Forms, follow these steps: Obtain the form you need and ensure it is for your correct city/county. Utilize the Preview button to review the document. Read the description to ensure you have selected the appropriate form. If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and requirements. Once you locate the correct form, click Purchase now. Choose the pricing plan you prefer, fill out the necessary information to create your account, and pay for your order using PayPal or Visa or Mastercard. Select a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents list.

- You can download an additional copy of the Indiana Educator Agreement - Self-Employed Independent Contractor at any time, if needed.

- Simply click the required form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

- The service offers professionally crafted legal document templates that can be used for various purposes.

- Create your account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

Yes, teachers can be classified as 1099 independent contractors if they are providing services outside of a traditional employment relationship. This arrangement often occurs with private tutoring or educational consulting. When operating as a 1099 contractor, it's essential to understand the implications for taxes and benefits. An Indiana Educator Agreement - Self-Employed Independent Contractor can effectively outline the terms of your engagement and help manage your responsibilities.

In Indiana, independent contractors generally do not need workers' compensation insurance, as they are not employees. However, it can be beneficial to have coverage, especially if you are working in high-risk environments. This insurance protects you against potential claims resulting from work-related injuries. Use the Indiana Educator Agreement - Self-Employed Independent Contractor to outline any necessary insurance requirements for your specific situation.

Both terms, 'self-employed' and 'independent contractor,' have specific implications, but they are often used interchangeably. However, using 'independent contractor' may offer more clarity regarding the nature of your work arrangements. Depending on your situation, you might prefer one term over the other. Utilizing an Indiana Educator Agreement - Self-Employed Independent Contractor can provide context and clarity in professional communications.

Yes, if you receive a 1099 form, it typically indicates that you are self-employed. This form is issued for payments made to independent contractors, verifying the income earned outside of traditional employment. Understanding your status as self-employed also highlights the need for diligent tax preparation. To simplify this process, consider using an Indiana Educator Agreement - Self-Employed Independent Contractor for clear guidelines.

An independent contractor is indeed considered self-employed. They operate their own business and invoice clients directly, rather than receiving a regular paycheck from an employer. This status impacts tax obligations, as independent contractors must manage their own taxes. Utilizing an Indiana Educator Agreement - Self-Employed Independent Contractor helps outline the specifics of this professional arrangement.

Yes, an independent contractor counts as self-employed because they provide services to clients on a contractual basis, rather than through traditional employment. This classification allows them the flexibility to set their own hours and potentially work for multiple clients. The Indiana Educator Agreement - Self-Employed Independent Contractor is a perfect example of an agreement that clarifies this relationship. Understanding this designation is vital for tax purposes and legal compliance.

A person qualifies as self-employed if they operate their own business and perform services for clients without an employer-employee relationship. This includes individuals offering their services under an agreement, like the Indiana Educator Agreement - Self-Employed Independent Contractor. Additionally, self-employed individuals carry the responsibility for managing their taxes, expenses, and benefits. Understanding this distinction is crucial for compliance and financial planning.

To write an independent contractor agreement, start by clearly defining the scope of work, payment terms, and deadlines. It's important to outline each party's responsibilities and rights to avoid misunderstandings. Ensure you include terms related to confidentiality and dispute resolution. Consider using templates like the Indiana Educator Agreement - Self-Employed Independent Contractor available on USLegalForms to create a legally binding document.

To show proof of income as a 1099 contractor, collect your 1099 forms, which report the payments received from each client. Additionally, maintain comprehensive records of invoices and bank statements that reflect these earnings. The Indiana Educator Agreement - Self-Employed Independent Contractor should also be included as it outlines your payment agreements. This collection of documents provides a clear financial picture.

An independent contractor typically shows proof of employment through contracts, invoices, and client references. The Indiana Educator Agreement - Self-Employed Independent Contractor is a crucial document to include. It establishes the terms of your work and relationship and can be presented alongside other documentation. Always keep a clear and organized record of your engagements.