Indiana Instructions for Completing IRS Form 4506-EZ

Description

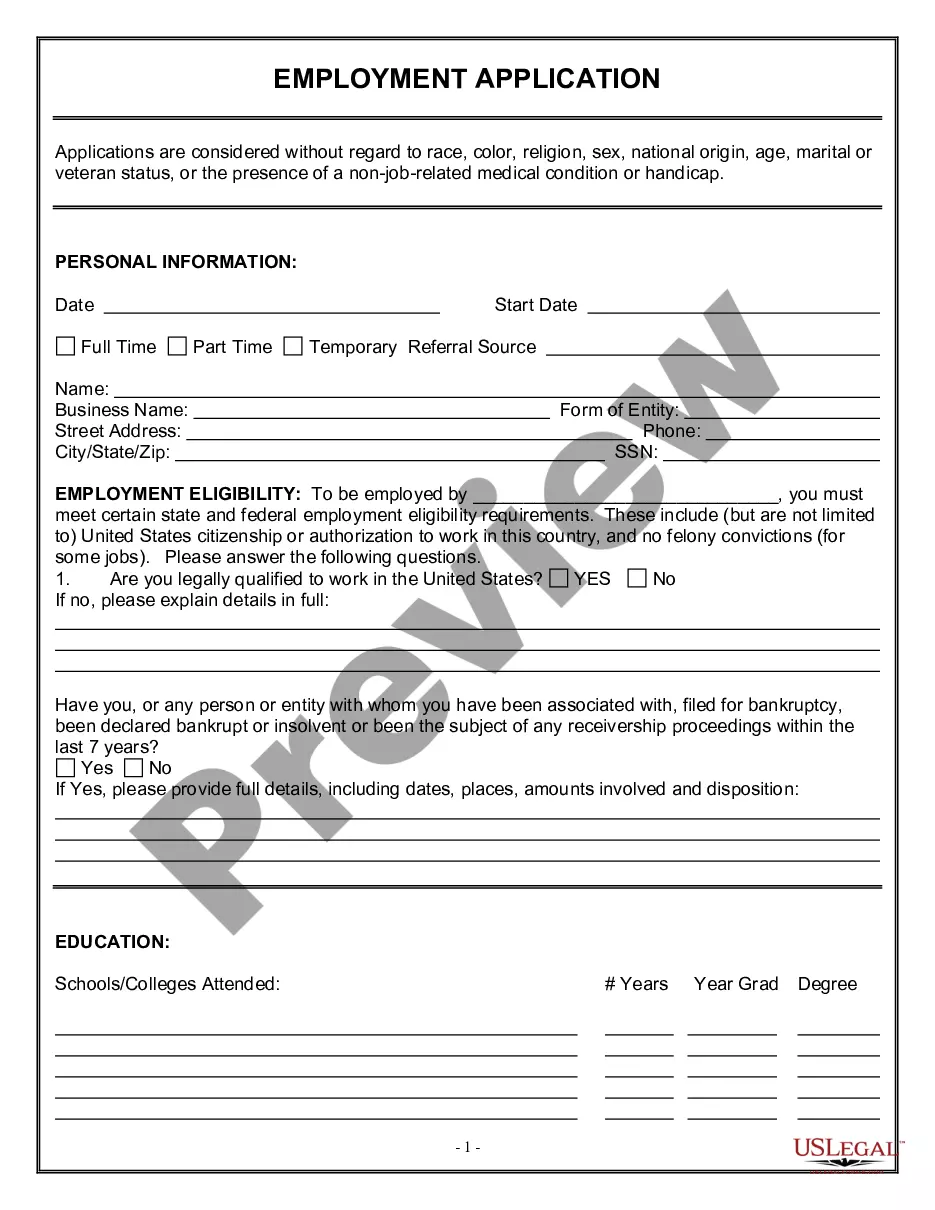

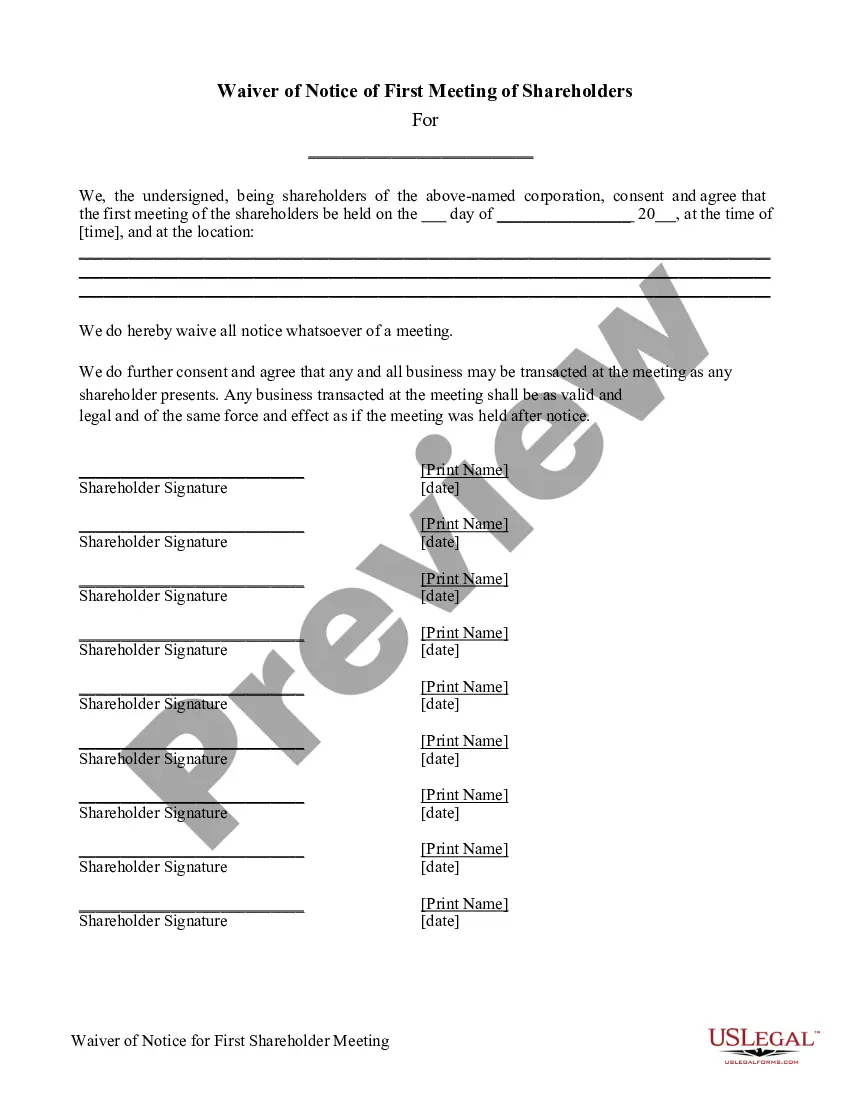

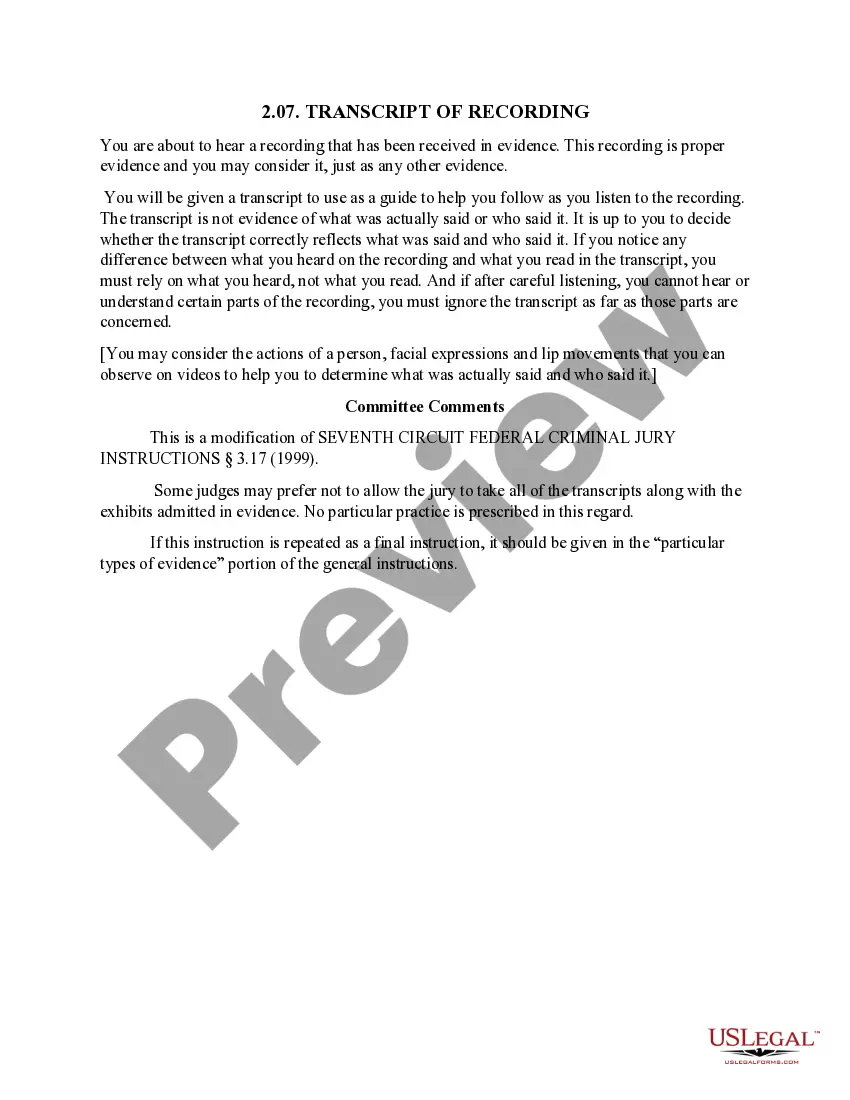

How to fill out Instructions For Completing IRS Form 4506-EZ?

Have you been within a place where you need to have papers for both organization or personal uses virtually every day time? There are a lot of authorized file layouts available online, but locating types you can depend on isn`t easy. US Legal Forms gives a huge number of kind layouts, such as the Indiana Instructions for Completing IRS Form 4506-EZ, that are composed to fulfill federal and state requirements.

In case you are currently knowledgeable about US Legal Forms internet site and possess an account, just log in. Next, you may down load the Indiana Instructions for Completing IRS Form 4506-EZ web template.

Should you not come with an bank account and want to begin using US Legal Forms, follow these steps:

- Find the kind you want and make sure it is for the appropriate city/county.

- Make use of the Preview switch to check the form.

- Read the description to ensure that you have chosen the proper kind.

- In case the kind isn`t what you are trying to find, use the Research field to obtain the kind that meets your requirements and requirements.

- Whenever you discover the appropriate kind, just click Acquire now.

- Opt for the prices strategy you desire, complete the necessary information and facts to generate your money, and pay money for an order with your PayPal or Visa or Mastercard.

- Decide on a hassle-free document structure and down load your duplicate.

Locate each of the file layouts you possess purchased in the My Forms food list. You can get a further duplicate of Indiana Instructions for Completing IRS Form 4506-EZ any time, if possible. Just select the needed kind to down load or print out the file web template.

Use US Legal Forms, one of the most extensive variety of authorized varieties, to save some time and steer clear of faults. The assistance gives expertly manufactured authorized file layouts that can be used for a range of uses. Generate an account on US Legal Forms and commence producing your life a little easier.

Form popularity

FAQ

The IVES Request for Transcript of Tax Return (IRS Form 4506-C) provides the borrower's permission for the lender to request the borrower's tax return information directly from the IRS using the IRS Income Verification Express Service (IVES).

Individuals can use Form 4506T-EZ to request a tax return transcript for the current and the prior three years that includes most lines of the original tax return. The tax return transcript will not show payments, penalty assessments, or adjustments made to the originally filed return.

Signature and date. Form 4506-T must be signed and dated by the taxpayer listed on line 1a or 2a. The IRS must receive Form 4506-T within 120 days of the date signed by the taxpayer or it will be rejected. Ensure that all applicable lines are completed before signing.

Form 4506, Request for Copy of Tax Return is filed by taxpayers to request exact copies of one or more previously filed tax returns and tax information from the Internal Revenue Service (IRS).

Paper Request Form ? IRS Form 4506-T Complete lines 1 ? 4, following the instructions on page 2 of the form. Line 3: enter the non-filer's street address and zip or postal code. ... Line 5 provides non-filers with the option to have their IRS Verification of Non-filing Letter mailed directly to a third party by the IRS.

1. Complete the form. Line 1a: Enter your name as it's shown on your tax returns. Line 1b: Enter your Social Security number. Line 2a: Enter your spouse's name if you filed a joint return. Line 2b: Enter your spouse's Social Security number, if you filed a joint return. Line 3: Enter your current address.

Complete these lines on the form: Line 1a: Enter your name as it's shown on your tax returns. Line 1b: Enter your Social Security number. Line 2a: Enter your spouse's name if you filed a joint return. Line 2b: Enter your spouse's Social Security number, if you filed a joint return. Line 3: Enter your current address.