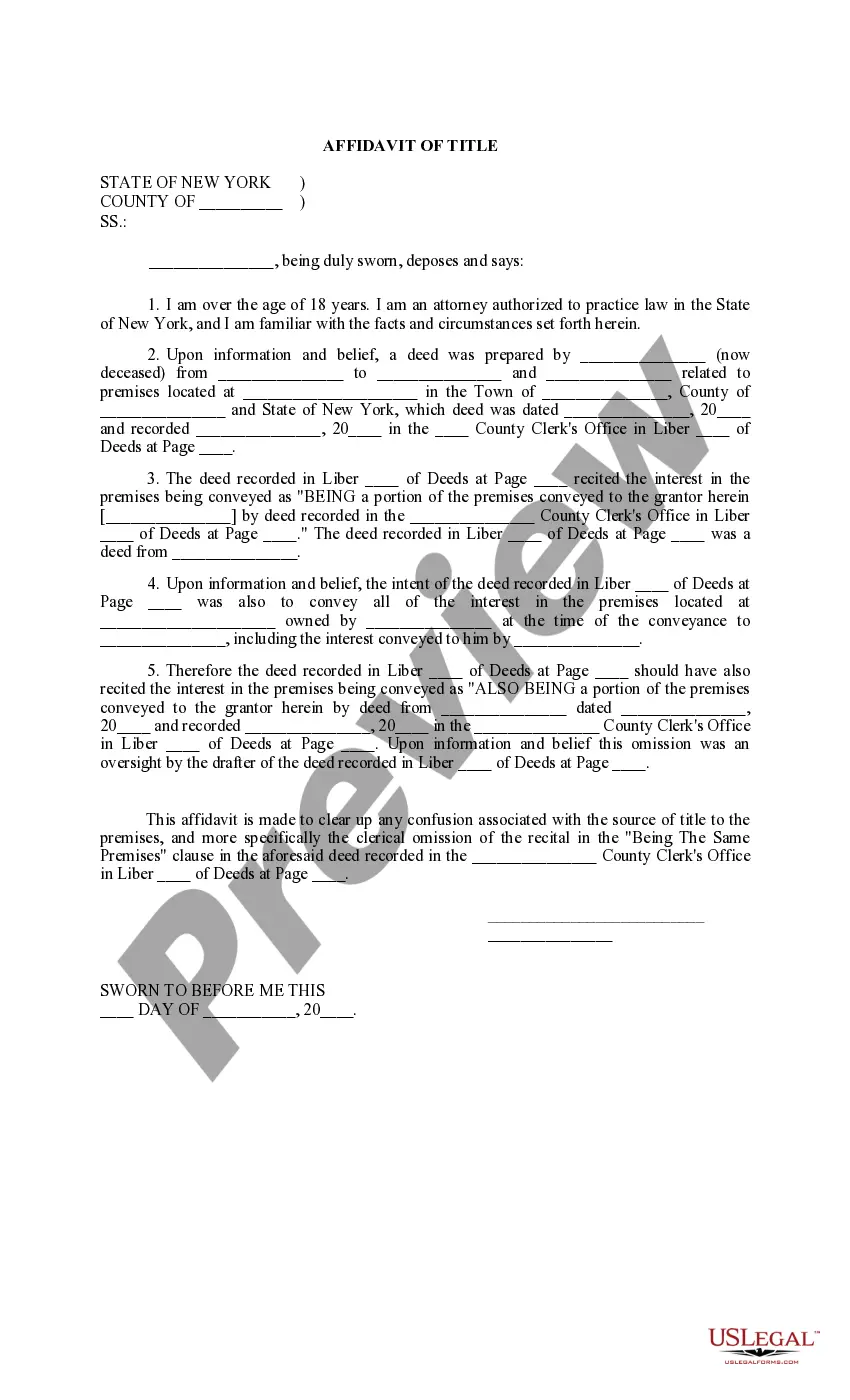

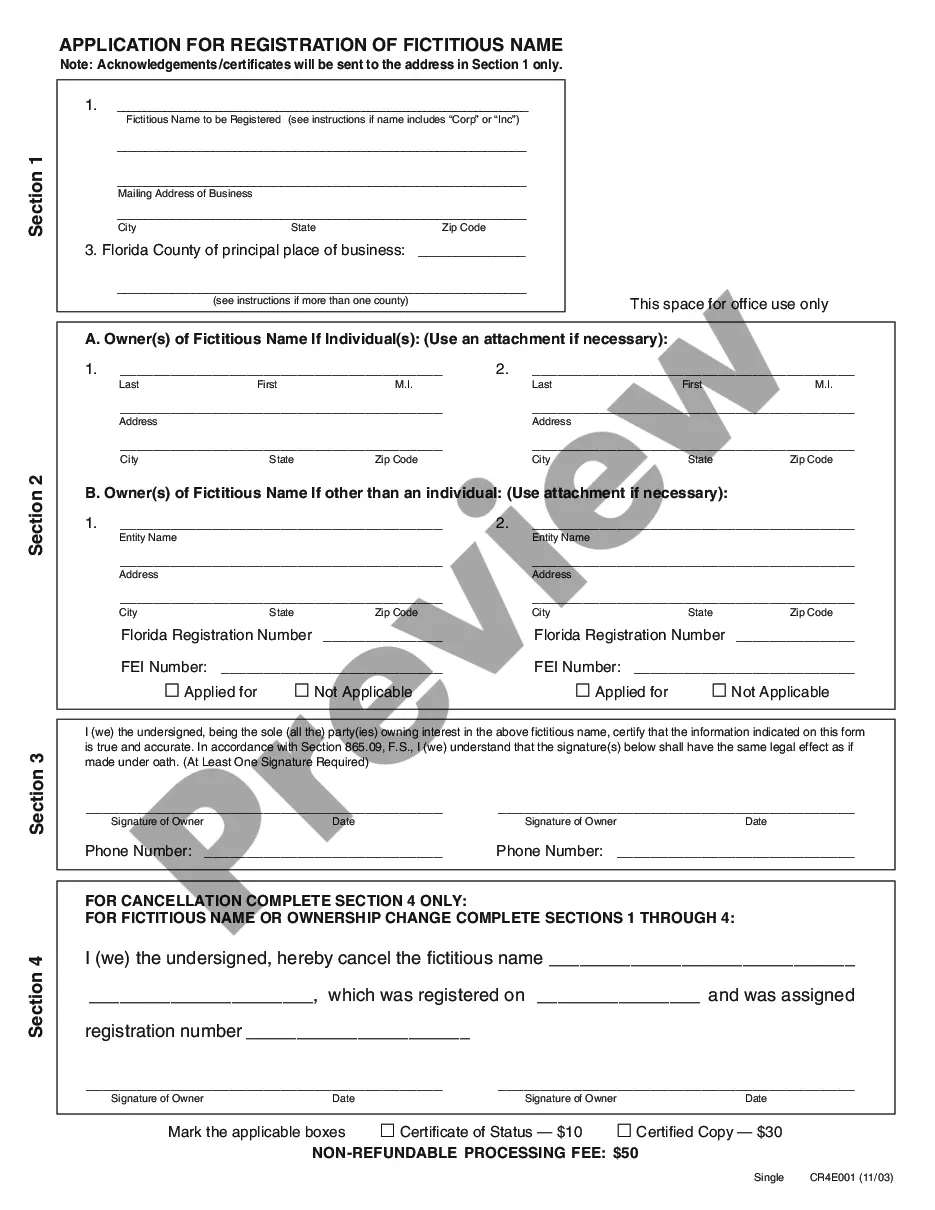

This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

Indiana Application for Certificate of Discharge of IRS Lien

Description

How to fill out Application For Certificate Of Discharge Of IRS Lien?

If you wish to full, download, or printing legal papers templates, use US Legal Forms, the most important variety of legal types, which can be found on the web. Use the site`s simple and convenient search to get the documents you need. Various templates for enterprise and individual reasons are categorized by categories and suggests, or keywords. Use US Legal Forms to get the Indiana Application for Certificate of Discharge of IRS Lien with a few clicks.

When you are previously a US Legal Forms client, log in in your account and then click the Down load switch to find the Indiana Application for Certificate of Discharge of IRS Lien. You can also accessibility types you earlier saved in the My Forms tab of the account.

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have selected the shape for the appropriate city/land.

- Step 2. Use the Review choice to look over the form`s articles. Don`t forget to learn the description.

- Step 3. When you are unhappy using the develop, make use of the Search discipline towards the top of the screen to find other versions from the legal develop design.

- Step 4. Once you have discovered the shape you need, click the Get now switch. Choose the rates strategy you choose and put your references to register to have an account.

- Step 5. Procedure the deal. You can utilize your bank card or PayPal account to accomplish the deal.

- Step 6. Find the format from the legal develop and download it on your own device.

- Step 7. Comprehensive, change and printing or indicator the Indiana Application for Certificate of Discharge of IRS Lien.

Each and every legal papers design you get is the one you have forever. You have acces to every single develop you saved inside your acccount. Click the My Forms area and decide on a develop to printing or download yet again.

Remain competitive and download, and printing the Indiana Application for Certificate of Discharge of IRS Lien with US Legal Forms. There are thousands of specialist and state-specific types you can utilize for your personal enterprise or individual demands.

Form popularity

FAQ

The IRS form for lien withdrawal is Form 12277, Application for the Withdrawal of Filed Form 668. This form allows you to request the IRS to withdraw a previously filed lien. Completing the Indiana Application for Certificate of Discharge of IRS Lien can also help you understand the process and ensure you provide all necessary details for a successful withdrawal.

You can obtain a lien release form, known as Form 668(Z), directly from the IRS website or through authorized tax professionals. This form is essential for formally requesting the release of a federal tax lien. Using the Indiana Application for Certificate of Discharge of IRS Lien can simplify the process and help you gather the necessary information for your request.

To request a lien discharge from the IRS, you typically need to submit Form 12277, Application for the Withdrawal of Filed Form 668. This process allows you to remove the lien from your property. Additionally, the Indiana Application for Certificate of Discharge of IRS Lien can provide guidance and support to ensure your request is correctly processed.

You can obtain an IRS lien payoff letter by contacting the IRS directly. This letter provides the exact amount you owe to satisfy the lien. To facilitate the process, consider using the Indiana Application for Certificate of Discharge of IRS Lien, which can help clarify your situation and expedite your request.

To request a certificate of release of a federal tax lien, you need to file IRS Form 668(Z). This form notifies the IRS of your request and includes information about the lien. You can also use the Indiana Application for Certificate of Discharge of IRS Lien to streamline the process. Make sure you provide all required documentation to avoid delays.

To obtain a federal tax lien payoff, you can contact the IRS directly or check their website for the latest payoff amounts. The payoff amount includes the principal tax owed, interest, and penalties. You can also request a payoff statement, which provides a detailed breakdown. For clarity and guidance, consider the Indiana Application for Certificate of Discharge of IRS Lien as a useful resource.

To apply for a federal tax lien discharge, you need to fill out IRS Form 14135. This form allows you to request that the IRS discharge the lien from specific properties. You will also need to include documentation supporting your request. The Indiana Application for Certificate of Discharge of IRS Lien can assist you in completing this application correctly and effectively.

To obtain a copy of a federal tax lien, you can request it from the IRS. You may need to provide your identifying information and the details of the lien in question. Once you submit your request, the IRS will process it and send you the information. For assistance, consider using the Indiana Application for Certificate of Discharge of IRS Lien, which can guide you through the necessary steps.

To apply for a certificate of discharge from a federal tax lien, you must complete IRS Form 14135. This form allows you to request the IRS to discharge the lien on your property. After completing the form, submit it along with any required documentation to the IRS. Utilizing the Indiana Application for Certificate of Discharge of IRS Lien can streamline this process and ensure accuracy.

Yes, you can process a lien release on an Indiana title, but it typically requires specific documentation from the IRS. Once the IRS has released the lien, you must file the appropriate paperwork with the Indiana Bureau of Motor Vehicles to update the title. This ensures that the lien is officially removed from public records. Leveraging the Indiana Application for Certificate of Discharge of IRS Lien can help you manage this process effectively.