Indiana Term Sheet for LLC Unit Offering

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth."

How to fill out Term Sheet For LLC Unit Offering?

If you have to total, acquire, or print lawful papers themes, use US Legal Forms, the largest selection of lawful types, which can be found on-line. Utilize the site`s easy and hassle-free look for to get the documents you want. Numerous themes for enterprise and individual reasons are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to get the Indiana Term Sheet for LLC Unit Offering in a number of clicks.

In case you are currently a US Legal Forms consumer, log in for your bank account and click on the Download switch to have the Indiana Term Sheet for LLC Unit Offering. You may also gain access to types you in the past downloaded within the My Forms tab of the bank account.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Make sure you have selected the form for that appropriate city/land.

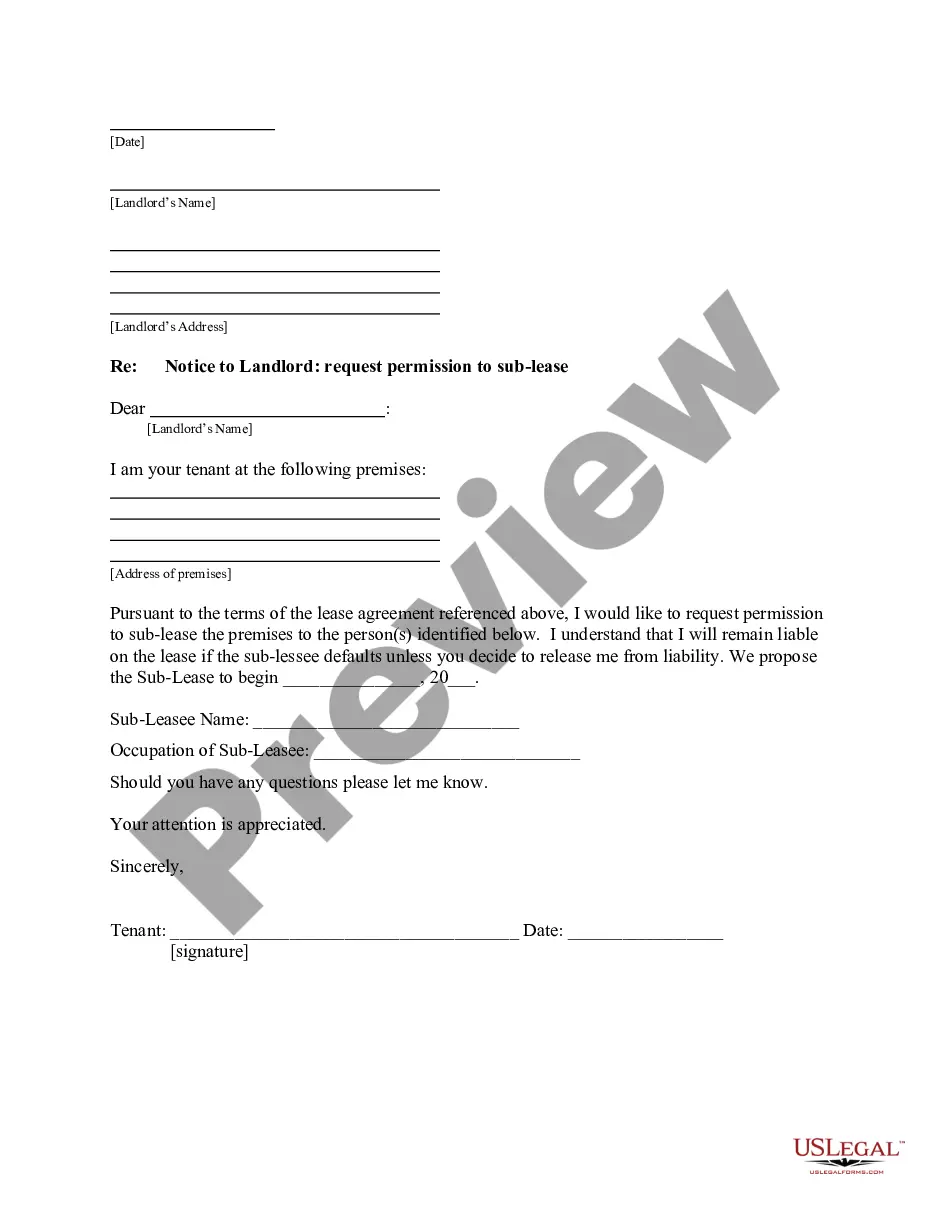

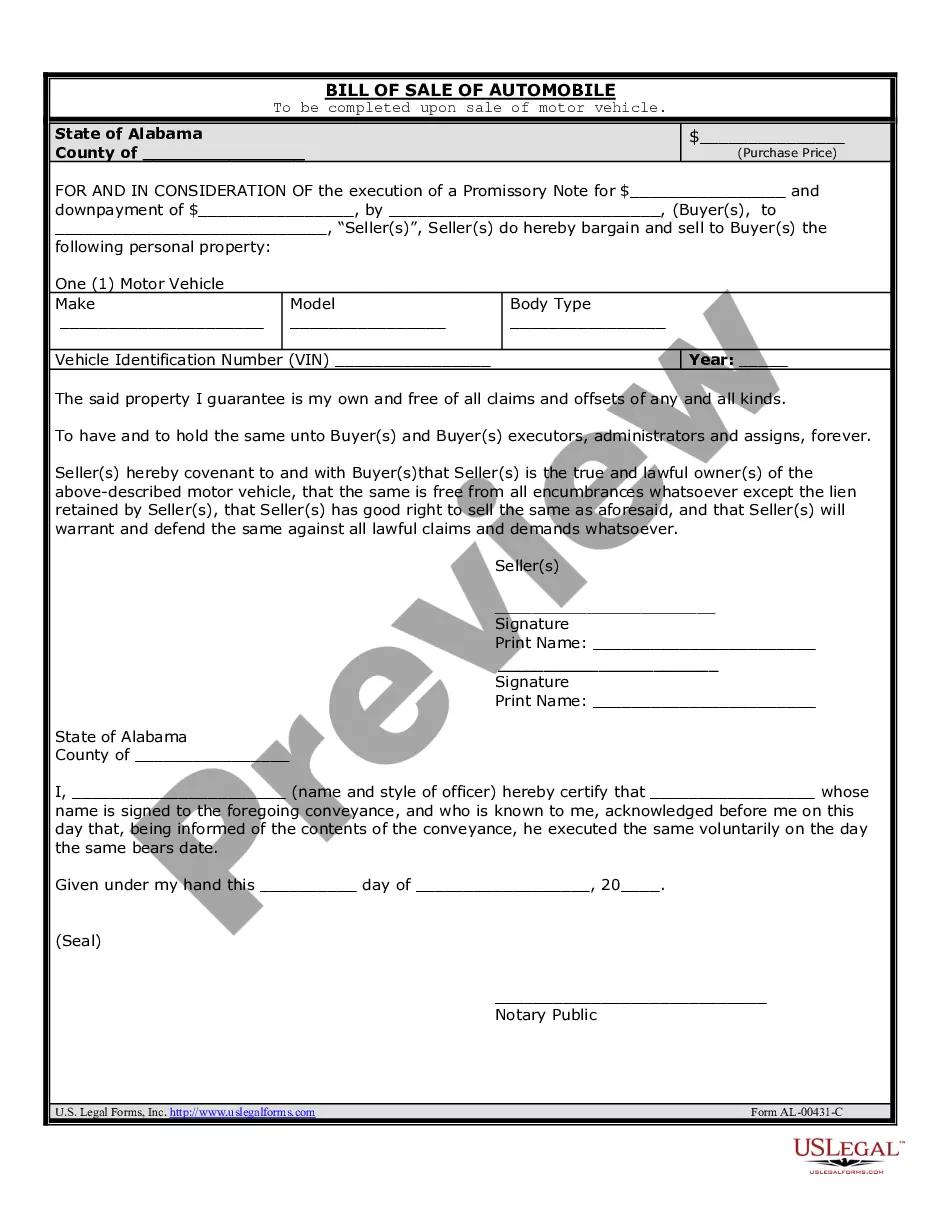

- Step 2. Make use of the Preview option to look through the form`s content material. Never overlook to read through the outline.

- Step 3. In case you are not happy together with the type, make use of the Look for area towards the top of the display screen to discover other models from the lawful type web template.

- Step 4. Upon having identified the form you want, click the Purchase now switch. Pick the costs program you like and add your credentials to sign up for an bank account.

- Step 5. Approach the purchase. You can utilize your Мisa or Ьastercard or PayPal bank account to finish the purchase.

- Step 6. Select the format from the lawful type and acquire it in your system.

- Step 7. Full, revise and print or indication the Indiana Term Sheet for LLC Unit Offering.

Each lawful papers web template you purchase is your own permanently. You might have acces to every type you downloaded within your acccount. Click the My Forms section and choose a type to print or acquire yet again.

Contend and acquire, and print the Indiana Term Sheet for LLC Unit Offering with US Legal Forms. There are thousands of professional and state-certain types you can use for your enterprise or individual requires.

Form popularity

FAQ

A unit is a record and indication of ownership in a limited liability company (LLC). In that sense, it's like the more familiar terms ?stock? or ?shares? (the two terms are synonymous), each of which indicate ownership in a corporation. Units give their owners certain rights in LLCs.

Shareholders have an investment interest in the company, while members have a legal interest in the company's management and operation. All members and shareholders are recorded in the company's register of members. In a company limited by shares, the register of members and register of shareholders are synonymous.

An LLC differs from a corporation in that it has the freedom to assign its ownership interests any which way it chooses, without regard for the amount of money, asset, or property a member has contributed to the company.

Membership units/interests consist of both financial and governance rights, although a particular member may have financial rights but no governance rights or vice versa. Membership units/interests may be evidenced by a membership certificate but, most frequently, are uncertificated.

Indiana state law does not mandate that LLCs adopt an operating agreement. Indiana state code § 23-18-4-5 states that LLCs may enter into an operating agreement but does not require them to do so. Even so, it is in your company's best interest to have a written operating agreement.

A unit is a record and indication of ownership in a limited liability company (LLC). In that sense, it's like the more familiar terms ?stock? or ?shares? (the two terms are synonymous), each of which indicate ownership in a corporation. Units give their owners certain rights in LLCs.

The LLC membership units are not dependent on the amount of capital, assets, or property contributed by each member. On the other hand, stocks or shares of corporations are typically based on the amount invested. Moreover, typical LLCs can't go public to sell their membership units.

In an LLC, the units of ownership are not known as shares of 'stock'. The majority of the LLC's agreement delegates a particular number of ?membership interests? or ?membership units?. These LLC shares or units may also be further broken down into two types: the voting units and the non-voting units.