Indiana Term Sheet - Series Seed Preferred Share for Company

Description

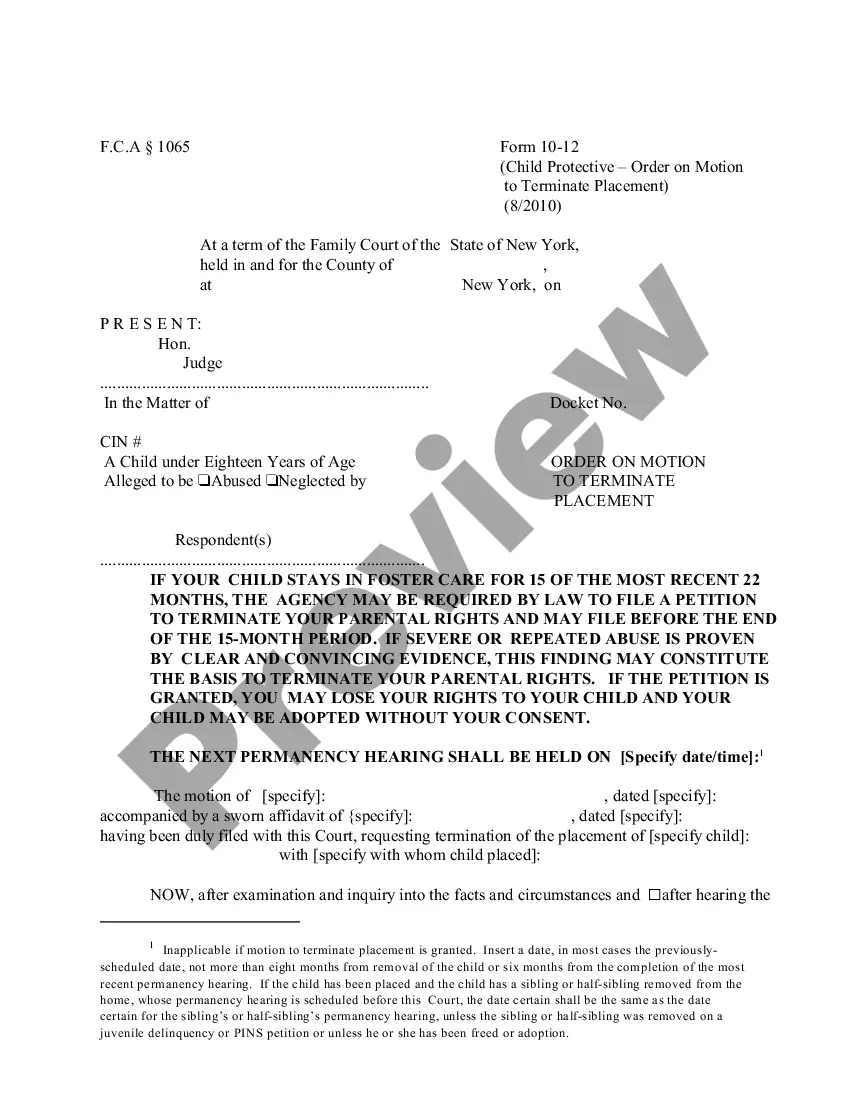

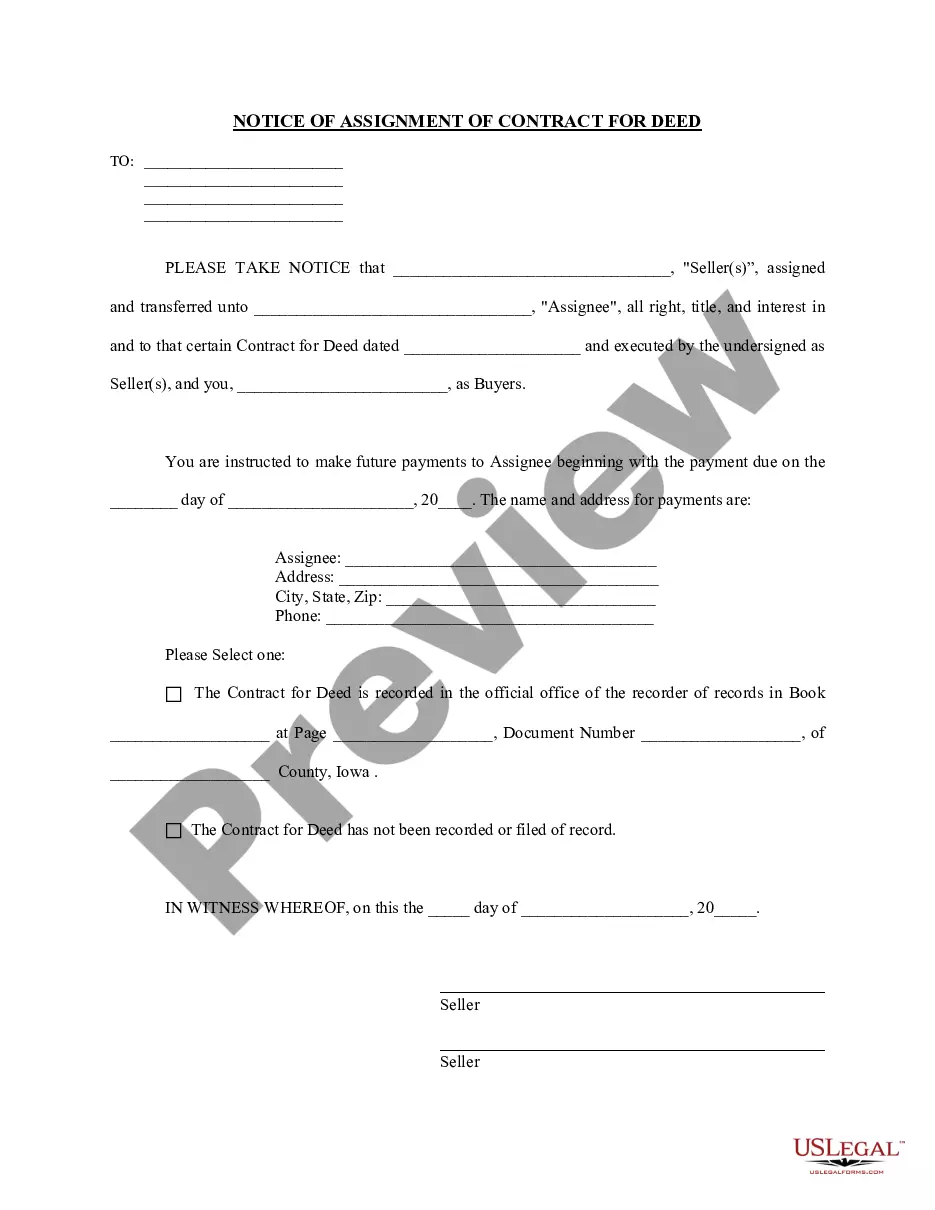

How to fill out Term Sheet - Series Seed Preferred Share For Company?

US Legal Forms - one of the most significant libraries of authorized forms in the States - gives a variety of authorized record themes you can obtain or print. While using web site, you may get a huge number of forms for business and personal reasons, sorted by categories, states, or keywords and phrases.You will discover the newest variations of forms like the Indiana Term Sheet - Series Seed Preferred Share for Company in seconds.

If you already possess a subscription, log in and obtain Indiana Term Sheet - Series Seed Preferred Share for Company in the US Legal Forms library. The Down load button can look on every type you view. You get access to all in the past downloaded forms within the My Forms tab of your respective profile.

In order to use US Legal Forms the first time, listed below are basic guidelines to help you get started out:

- Make sure you have selected the best type for your area/county. Click the Preview button to analyze the form`s articles. Browse the type outline to ensure that you have chosen the right type.

- In the event the type does not suit your demands, use the Research area on top of the display screen to get the one that does.

- If you are content with the form, affirm your option by clicking on the Get now button. Then, choose the pricing strategy you prefer and supply your qualifications to sign up to have an profile.

- Approach the transaction. Use your credit card or PayPal profile to finish the transaction.

- Select the format and obtain the form in your system.

- Make adjustments. Fill up, edit and print and indication the downloaded Indiana Term Sheet - Series Seed Preferred Share for Company.

Every design you put into your money does not have an expiration time and is also yours permanently. So, if you would like obtain or print yet another duplicate, just visit the My Forms segment and click on the type you want.

Obtain access to the Indiana Term Sheet - Series Seed Preferred Share for Company with US Legal Forms, probably the most substantial library of authorized record themes. Use a huge number of skilled and status-distinct themes that meet up with your small business or personal requires and demands.

Form popularity

FAQ

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

A seed round is the first formal round of venture capital financing for a startup. A typical seed round includes convertible debt, equity, and options, with the vast majority being equity. The size of a seed round can vary greatly, but is typically between $1 million and $5 million.

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

A seed round is a financing round that raises initial capital to start a business. Seed capital often comes from the company founders' personal assets, friends and family, angel investors, and VCs.

Series Seed will generally be issued as preferred stock. This is the order of payments made to various classes of stockholders in the event that the business is liquidated and there is cash available for distribution to the stockholders.

If you can manage to give up as little as 10% of your company in your seed round, that is wonderful, but most rounds will require up to 20% dilution and you should try to avoid more than 25%. In any event, the amount you are asking for must be tied to a believable plan.

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).