Indiana Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

US Legal Forms - among the greatest libraries of legitimate varieties in the USA - gives an array of legitimate document web templates you may down load or produce. Making use of the website, you can get a large number of varieties for company and individual reasons, categorized by categories, claims, or keywords.You can find the most up-to-date variations of varieties much like the Indiana Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights within minutes.

If you have a monthly subscription, log in and down load Indiana Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights in the US Legal Forms local library. The Acquire button can look on each and every type you perspective. You get access to all formerly downloaded varieties in the My Forms tab of your respective bank account.

In order to use US Legal Forms for the first time, listed here are basic recommendations to obtain started off:

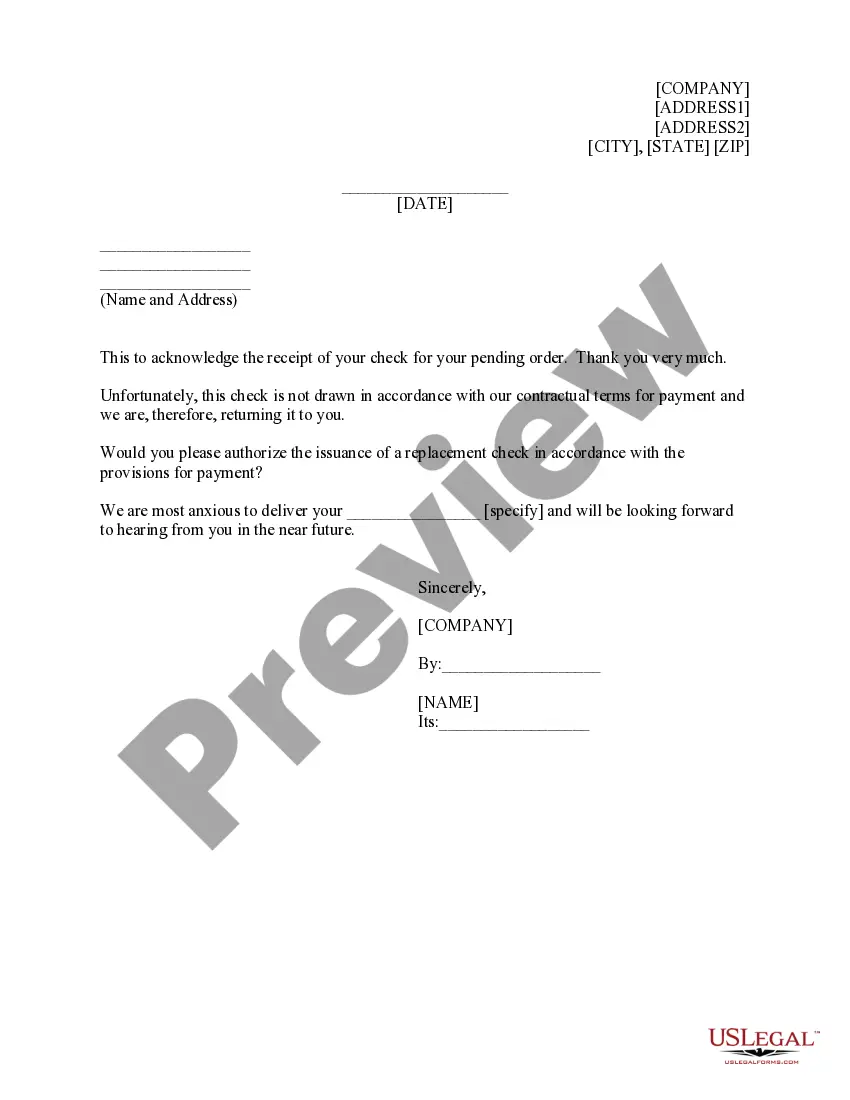

- Be sure to have selected the best type for your personal city/region. Click the Review button to analyze the form`s articles. Browse the type description to actually have selected the correct type.

- When the type doesn`t fit your needs, take advantage of the Research discipline towards the top of the display to get the one that does.

- If you are happy with the form, validate your decision by clicking on the Get now button. Then, pick the costs prepare you want and supply your accreditations to register for the bank account.

- Approach the transaction. Make use of Visa or Mastercard or PayPal bank account to finish the transaction.

- Choose the structure and down load the form on the product.

- Make adjustments. Load, change and produce and signal the downloaded Indiana Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights.

Each and every design you put into your account does not have an expiration time which is your own property eternally. So, if you want to down load or produce an additional version, just proceed to the My Forms area and then click on the type you will need.

Gain access to the Indiana Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights with US Legal Forms, probably the most considerable local library of legitimate document web templates. Use a large number of professional and express-certain web templates that meet your small business or individual requires and needs.

Form popularity

FAQ

For example, if you're based in the US, you can offer ISOs to your domestic employees. However, as you cannot use an EOR to offer ISOs to foreign employees, you would need to offer an alternative, such as NSOs, RSUs, or VSOs.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

qualified stock option (NSO) is a type of ESO that is taxed as ordinary income when exercised. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. 5 With ISOs, on the other hand, no reporting is necessary until the profit is realized.

ESOPs are designed for prolonged, sustained growth by a business, and for a business that intends to operate for 10, 20, or more years into the future. An Equity Incentive Plan, in contrast, is geared more toward a change of control and exit from the business by service provider employees in 3-5 years (or less).

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

Employee stock purchase plans tend to be viewed as a benefit while stock options are a form of compensation. From an employee perspective, there are some differences in operations, eligibility, and design.

All transactions or qualified plans involving ESOPs are simply variations on one of these three types. Nonleveraged ESOP. This first type of ESOP (Diagram 1) does not involve borrowed funds to acquire the sponsoring employer's stock. ... Leveraged Buyout ESOP. ... Issuance ESOP.

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.