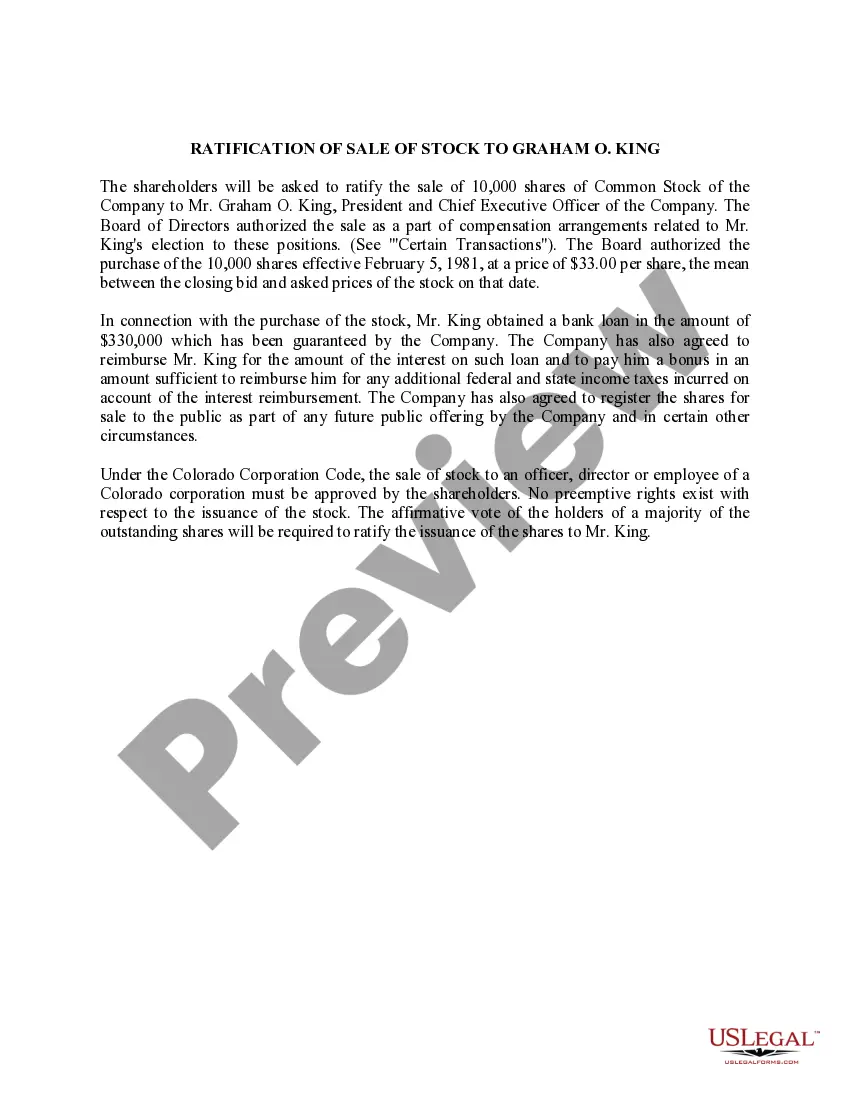

Indiana Ratification of Sale of Stock

Description

How to fill out Ratification Of Sale Of Stock?

Are you within a situation where you require files for both organization or individual uses almost every day? There are plenty of authorized document themes available on the Internet, but locating ones you can rely on isn`t simple. US Legal Forms offers 1000s of kind themes, such as the Indiana Ratification of Sale of Stock, which are written to fulfill federal and state demands.

If you are already knowledgeable about US Legal Forms internet site and also have an account, simply log in. Following that, it is possible to down load the Indiana Ratification of Sale of Stock design.

Should you not have an bank account and need to begin using US Legal Forms, follow these steps:

- Find the kind you want and ensure it is to the proper city/region.

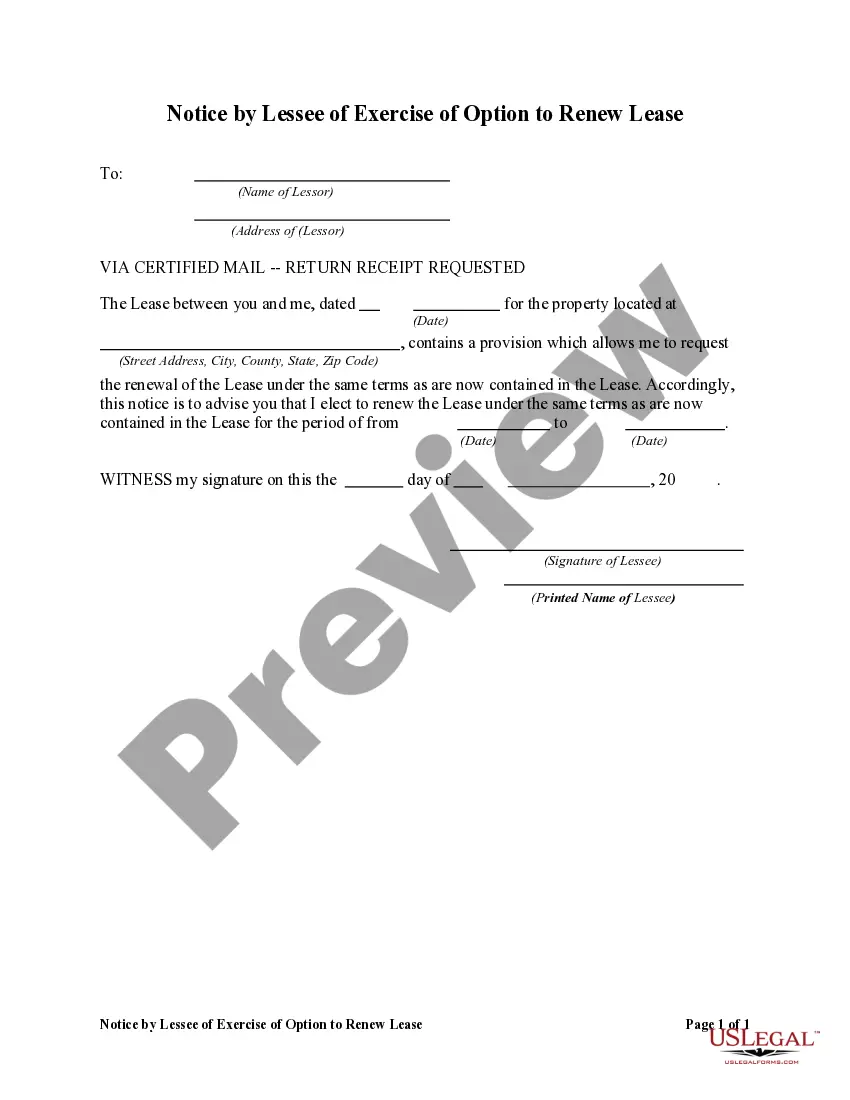

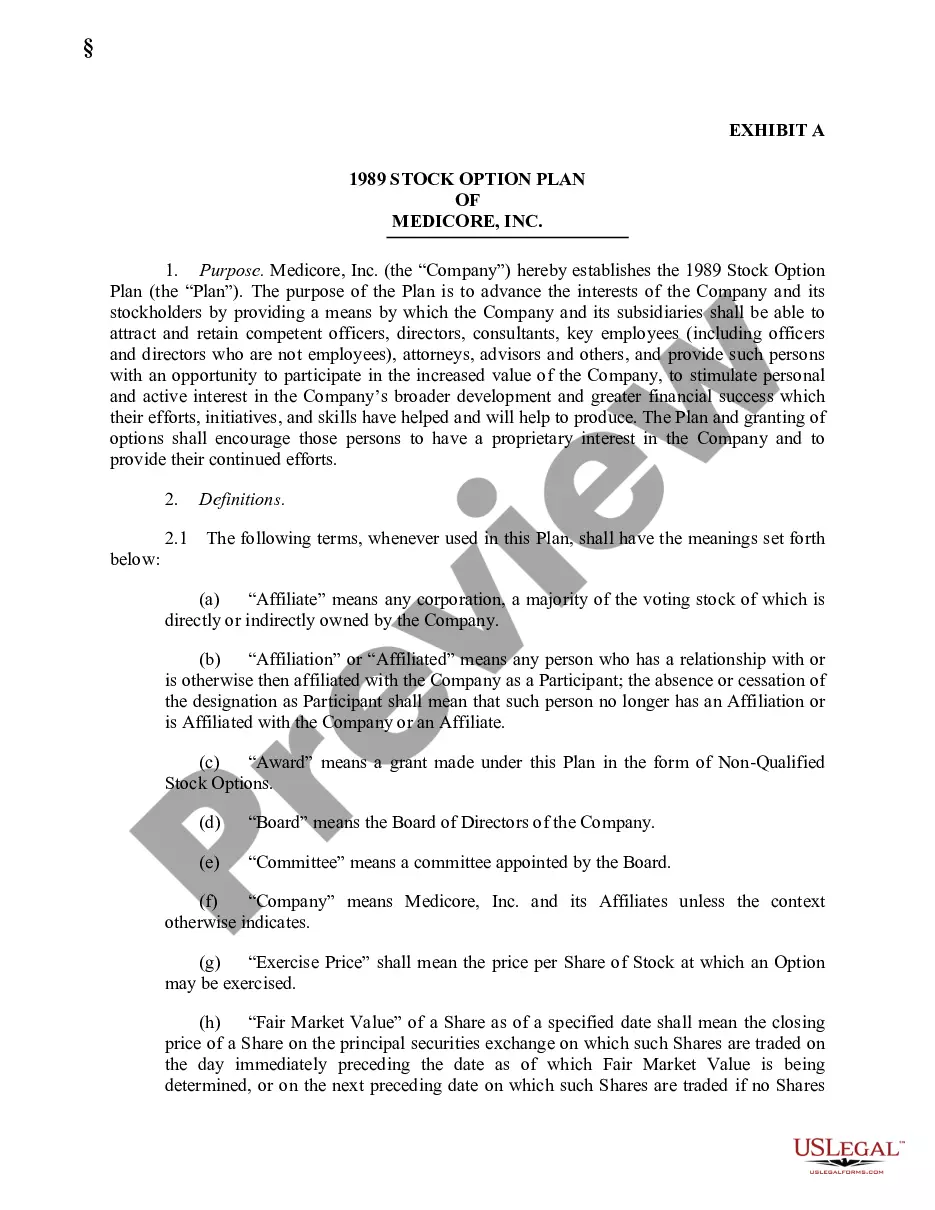

- Take advantage of the Preview switch to check the form.

- Look at the information to ensure that you have chosen the appropriate kind.

- In the event the kind isn`t what you`re seeking, take advantage of the Look for area to find the kind that meets your requirements and demands.

- When you obtain the proper kind, just click Buy now.

- Opt for the pricing plan you desire, fill out the necessary information and facts to make your bank account, and pay for the order with your PayPal or Visa or Mastercard.

- Choose a handy paper structure and down load your version.

Find every one of the document themes you possess purchased in the My Forms menu. You may get a more version of Indiana Ratification of Sale of Stock anytime, if necessary. Just click on the needed kind to down load or printing the document design.

Use US Legal Forms, probably the most comprehensive variety of authorized varieties, in order to save time as well as stay away from errors. The support offers professionally produced authorized document themes which can be used for a selection of uses. Create an account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

Transfer-On-Death (TOD) assets. Indiana residents can use a transfer-on-death form to name beneficiaries for vehicles, securities, and real estate to bypass probate. Cars, small boats, stocks, bonds, brokerage accounts, land, and houses all qualify.

(a) When a person dies, the person's real and personal property passes to persons to whom it is devised by the person's last will or, in the absence of such disposition, to the persons who succeed to the person's estate as the person's heirs; but it shall be subject to the possession of the personal representative and ...

Indiana Code § 23-0.5-3-1. Permitted Names; Falsely Implying Government Agency Status or Connection :: 2022 Indiana Code :: US Codes and Statutes :: US Law :: Justia.

Survived by spouse and at least one descendant from a previous spouse ? spouse inherits one-half of your intestate personal property and 1/4 of the fair market value of your real estate, minus the value of any liens or encumbrances on that real estate. Descendants inherit everything else.

Unless an alleged incapacitated person is already represented by counsel, the court may appoint an attorney to represent the incapacitated person.

Trial Rule 11 of the Indiana Rules of Trial Procedure tracks Federal Rule 11 in stating that an attorney's signature on a pleading or motion "constitutes a certificate by him that he has read the pleadings; that to the best of his knowledge, information, and belief, there is good ground to support it; and that it is ...

Rule 5.5 - Unauthorized Practice of Law; Multijurisdictional Practice of Law (a) A lawyer shall not practice law in a jurisdiction in violation of the regulation of the legal profession in that jurisdiction, or assist another in doing so.

Code § 29-1-2-1. Adultery or abandonment. If you are separated from your spouse and "living in adultery" at the time of your spouse's death, or if you have abandoned your spouse without just cause, you will not receive a share of your spouse's estate. Ind.