Indiana Declaration of Trust

Description

How to fill out Declaration Of Trust?

Choosing the best legitimate record web template can be a battle. Obviously, there are a variety of templates available on the net, but how would you find the legitimate type you want? Use the US Legal Forms internet site. The assistance provides a large number of templates, including the Indiana Declaration of Trust, which you can use for enterprise and personal needs. All of the varieties are examined by pros and satisfy federal and state requirements.

If you are currently authorized, log in for your profile and click on the Obtain button to get the Indiana Declaration of Trust. Use your profile to appear with the legitimate varieties you possess acquired earlier. Go to the My Forms tab of your respective profile and get another backup of your record you want.

If you are a whole new end user of US Legal Forms, listed below are basic guidelines so that you can comply with:

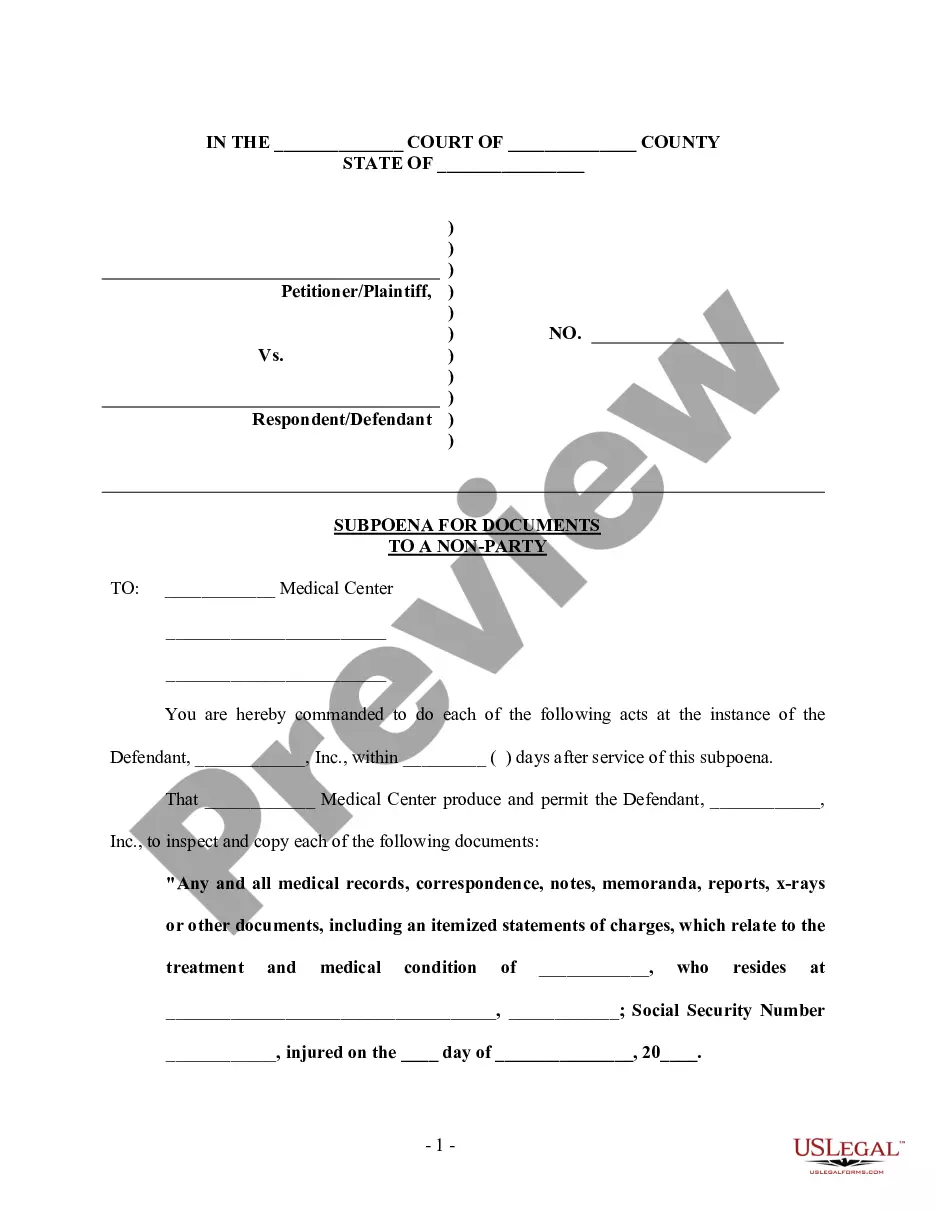

- First, make certain you have selected the right type for your city/area. You may look over the shape utilizing the Preview button and look at the shape description to make sure it is the right one for you.

- In case the type is not going to satisfy your expectations, utilize the Seach discipline to get the appropriate type.

- When you are positive that the shape is suitable, click the Purchase now button to get the type.

- Choose the pricing program you desire and enter in the necessary information and facts. Build your profile and buy an order making use of your PayPal profile or Visa or Mastercard.

- Pick the data file structure and acquire the legitimate record web template for your product.

- Complete, edit and produce and sign the attained Indiana Declaration of Trust.

US Legal Forms is definitely the greatest collection of legitimate varieties where you can see various record templates. Use the company to acquire skillfully-made files that comply with condition requirements.

Form popularity

FAQ

Estate planning in Indiana involves creating legal documents to manage assets, taxes, and burial arrangements, including wills, durable power of attorney, and healthcare power of attorney. The costs vary based on complexity, with wills typically around $500 and trusts approximately $2,000.

A living trust may be better than a will if: You want to maintain privacy over your property or assets. You have several real estate properties. You have significant financial assets.

Creating a living trust in Indiana is simple. There is no specific form required and your trust document must simply be clear in its terms. You sign the document in front of a notary and then fund the trust by placing ownership of assets in its name. A living trust provides many benefits that can be very appealing.

Whether you're single or married, how sophisticated the trust needs to be, and the state you live in, you'll probably pay an attorney between $1,500 and $2,500 to create your trust.

A living trust Indiana is a private contract that is not filed with a court or made part of the public record. This is often considered one of the most important benefits of a trust. The assets in the trust, terms of the trust, and beneficiaries remain secret.

How much money do you need to have trust? You can start a trust fund for as little as $100 in initial deposit and a few hundred dollars in fees, but if you have $100,000 or more and own real estate, then a trust might be beneficial to protect your assets.

A will is a simple legal document that provides instructions on how to distribute property to beneficiaries after death, while a trust is a complex legal arrangement that allows you to transfer ownership of property, is managed by a third party, and is distributed to beneficiaries at any time determined by the creator ...

In order to establish a trust, Indiana law requires that a person be over the age of 18 and be of sound mind. A person must describe the trust in writing.