Indiana FLSA Exempt / Nonexempt Compliance Form

Description

How to fill out FLSA Exempt / Nonexempt Compliance Form?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates you can purchase or create.

By using the platform, you can locate a multitude of forms for corporate and personal purposes, categorized by types, states, or keywords.

You can find the most recent versions of forms such as the Indiana FLSA Exempt / Nonexempt Compliance Form in just a few moments.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking on the Download Now button. Then, select your preferred payment plan and provide your details to register for an account.

- If you have an account, Log In and obtain the Indiana FLSA Exempt / Nonexempt Compliance Form from the US Legal Forms library.

- The Download button will be visible on each form you view.

- You have access to all previously downloaded forms in the My documents section of your profile.

- If you are new to US Legal Forms, here are straightforward instructions to get you started.

- Ensure you have selected the appropriate form for your city/state.

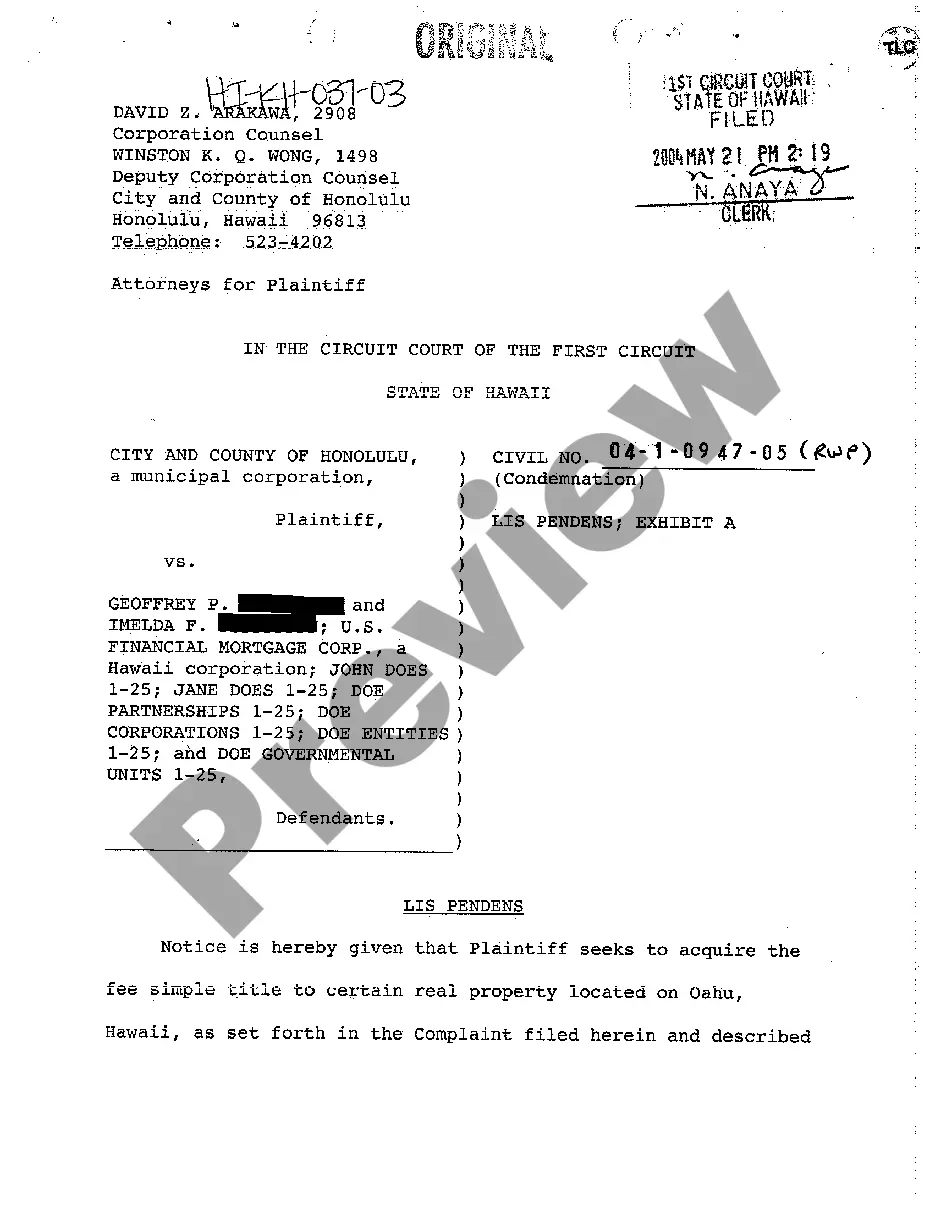

- Click the Preview button to review the form's details and confirm you have chosen the right one.

Form popularity

FAQ

To transition from nonexempt to exempt status, employers must evaluate current job duties alongside FLSA guidelines. Employees must primarily perform executive, administrative, or professional duties and earn a salary above the minimum threshold. Using the Indiana FLSA Exempt / Nonexempt Compliance Form provides clarity and documentation for these classification changes.

How to Communicate a Change in FLSA Exemption Status to EmployeesStep 1: Explain Why the Change Is Occurring.Step 2: Discuss the Meaning of a Change in Status.Step 3: Apprise the Employee of Changes in Compensation.Step 4: Inform the Employee of Changes in Position.More items...

Tips For Drafting Job Descriptions for Exempt EmployeesAccuracy is King. The job description must be accurate.Accuracy Does Not Mean Exhaustion.Strong Verbs, Clear Impact.Focus on Exempt Functions.Don't Shy Away From Degree Requirements.Assist With Can Diminish a Role.Consider Requiring Acknowledgement.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

From time to time, employers may need to reclassify employees due to changes in job duties and responsibilities....Non-Exempt to Exempt:Apply federal and state tests first. Ensure the employee qualifies as exempt under federal and applicable state laws.Communicate the change in advance.Avoid improper deductions.

Executive, administrative, professional and outside sales employees: (as defined in Department of Labor regulations) and who are paid on a salary basis are exempt from both the minimum wage and overtime provisions of the FLSA.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

Standards Act (FLSA) However, Section 13(a)(1) of the FLSA provides an exemption from both minimum wage and overtime pay for employees employed as bona fide executive, administrative, professional and outside sales employees.