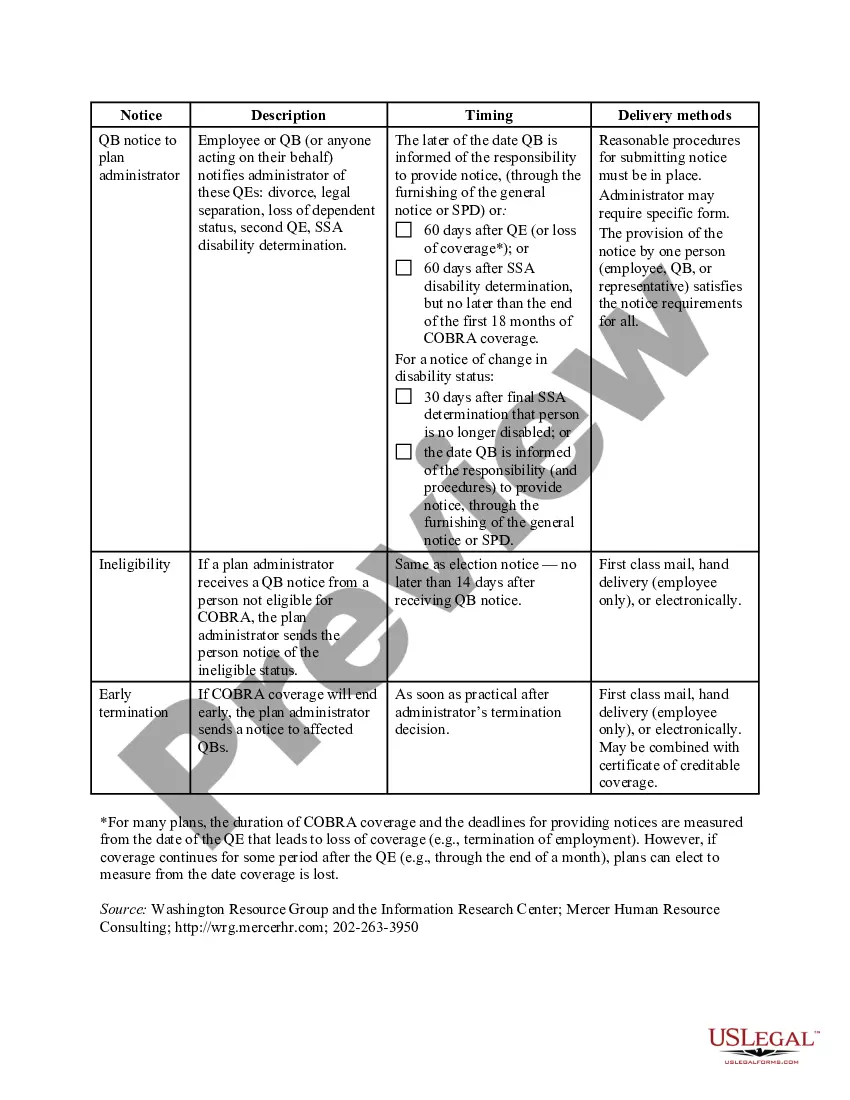

Indiana COBRA Notice Timing Delivery Chart

Description

How to fill out COBRA Notice Timing Delivery Chart?

You can spend numerous hours online trying to locate the legal document template that meets the federal and state requirements you seek. US Legal Forms offers a multitude of legal templates that are vetted by experts.

It is possible to obtain or print the Indiana COBRA Notice Timing Delivery Chart from their services.

If you have a US Legal Forms account, you can Log In and click the Download button. After that, you can fill out, modify, print, or sign the Indiana COBRA Notice Timing Delivery Chart. Each legal document you acquire is yours indefinitely.

Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make modifications to your document if possible. You can fill out, edit, sign, and print the Indiana COBRA Notice Timing Delivery Chart. Download and print countless document templates using the US Legal Forms website, which provides the largest collection of legal templates. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another copy of a purchased document, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct template for your desired county or city. Review the document description to confirm you have chosen the right one.

- If available, use the Preview button to review the template as well.

- To find another version of the document, utilize the Search feature to locate the template that suits your needs and requirements.

- Once you have identified the template you wish to obtain, click Get now to proceed.

- Select the pricing plan you prefer, enter your credentials, and create an account on US Legal Forms.

Form popularity

FAQ

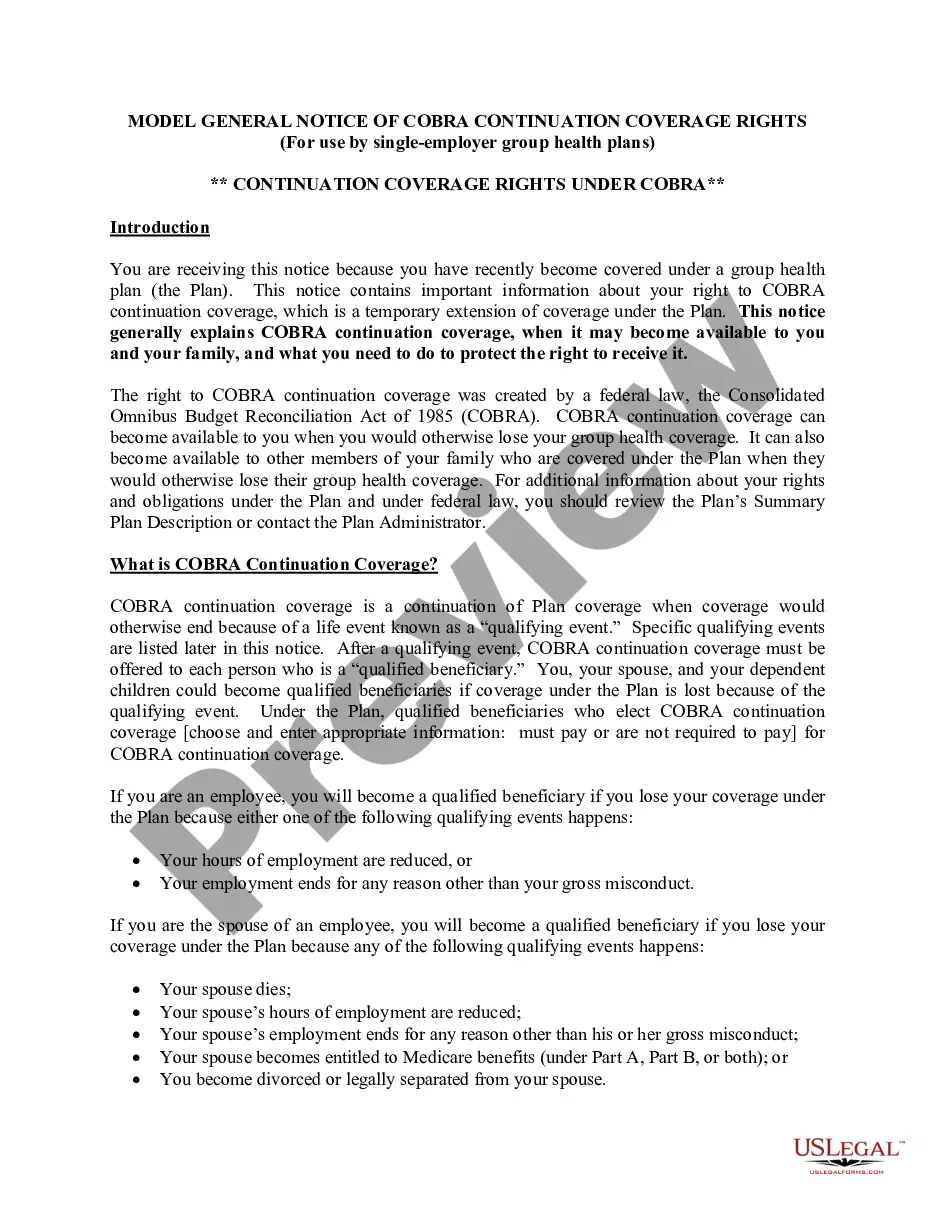

Q11: How long does COBRA coverage last? COBRA requires that continuation coverage extend from the date of the qualifying event for a limited period of 18 or 36 months.

Employers who fail to comply with the COBRA requirements can be required to pay a steep price. Failure to provide the COBRA election notice within this time period can subject employers to a penalty of up to $110 per day, as well as the cost of medical expenses incurred by the qualified beneficiary.

Meet the Deadlines You should get a notice in the mail about your COBRA and Cal-COBRA rights. You have 60 days after being notified to sign up. If you are eligible for Federal COBRA and did not get a notice, contact your employer. If you are eligible for Cal-COBRA and did not get a notice, contact your health plan.

COBRA Notice of Early Termination of Continuation Coverage Continuation coverage must generally be made available for a maximum period (18, 29, or 36 months).

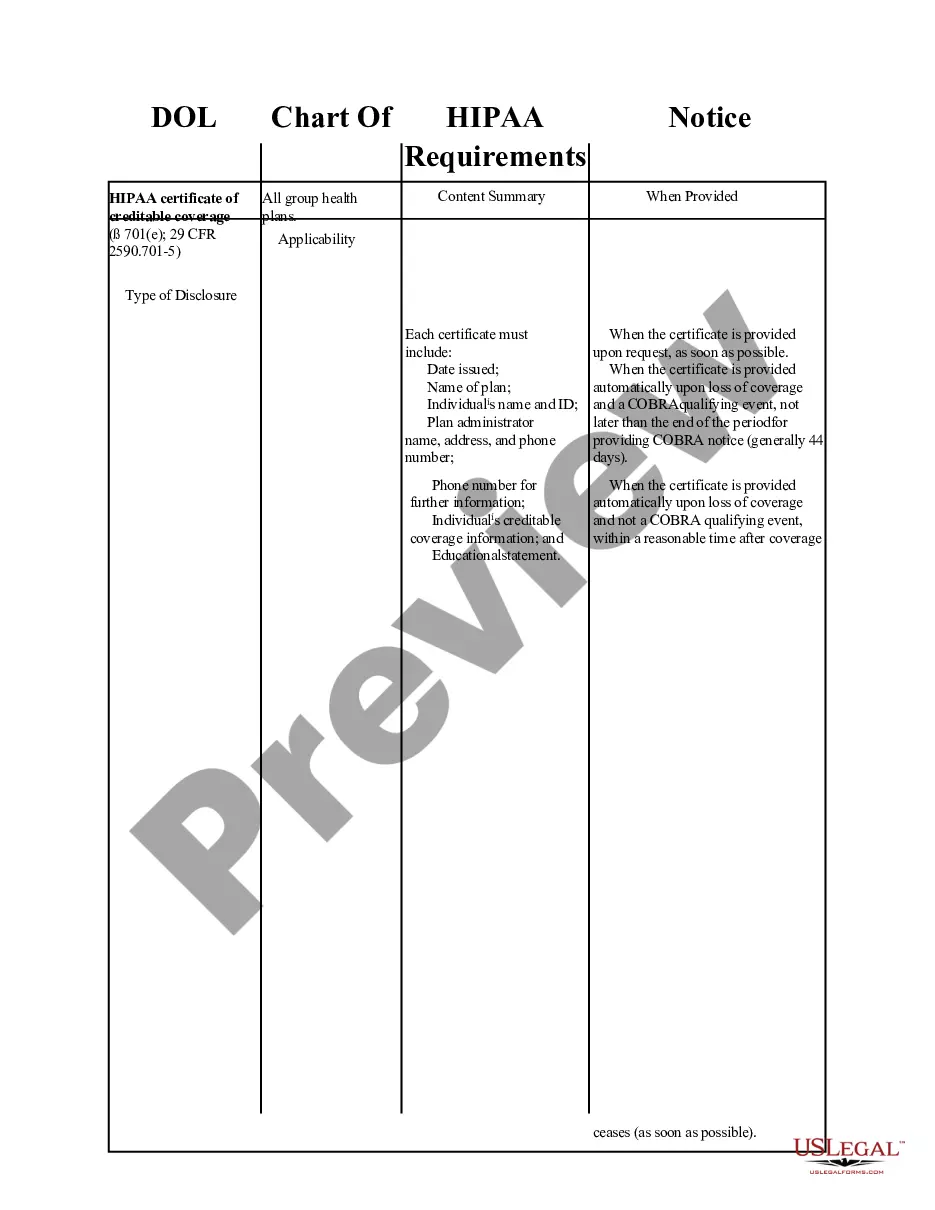

In addition, employers can provide COBRA notices electronically (via email, text message, or through a website) during the Outbreak Period, if they reasonably believe that plan participants and beneficiaries have access to these electronic mediums.

Are there penalties for failing to provide a COBRA notice? Yes, and the penalties can be substantial. Under the Employment Retirement Income Security Act of 1974 (ERISA), a penalty of up to $110 per day may be imposed for failing to provide a COBRA notice.

If You Do Not Receive Your COBRA PaperworkReach out to the Human Resources Department and ask for the COBRA Administrator. They may use a third-party administrator to handle your enrollment. If the employer still does not comply you can call the Department of Labor at 1-866-487-2365.

COBRA continuation coverage may be terminated if we don't receive timely payment of the premium. What is the grace period for monthly COBRA premiums? After election and initial payment, qualified beneficiaries have a 30-day grace period to make monthly payments (that is, 30 days from the due date).

COBRA allows a 30-day grace period. If your premium payment is not received within the 30-day grace period, your coverage will automatically be terminated without advance warning. You will receive a termination letter at that time to notify you of a lapse in your coverage due to non-payment of premiums.

Your employer must mail you the COBRA information and forms within 14 days after receiving notification of the qualifying event. You are responsible for making sure your COBRA coverage goes into and stays in effect - if you do not ask for COBRA coverage before the deadline, you may lose your right to COBRA coverage.