Indiana Separation Notice for 1099 Employee

Description

How to fill out Separation Notice For 1099 Employee?

Are you presently in a role that requires you to have paperwork for both business or personal reasons almost all the time.

There are numerous legal document templates accessible online, but locating forms you can trust is not simple.

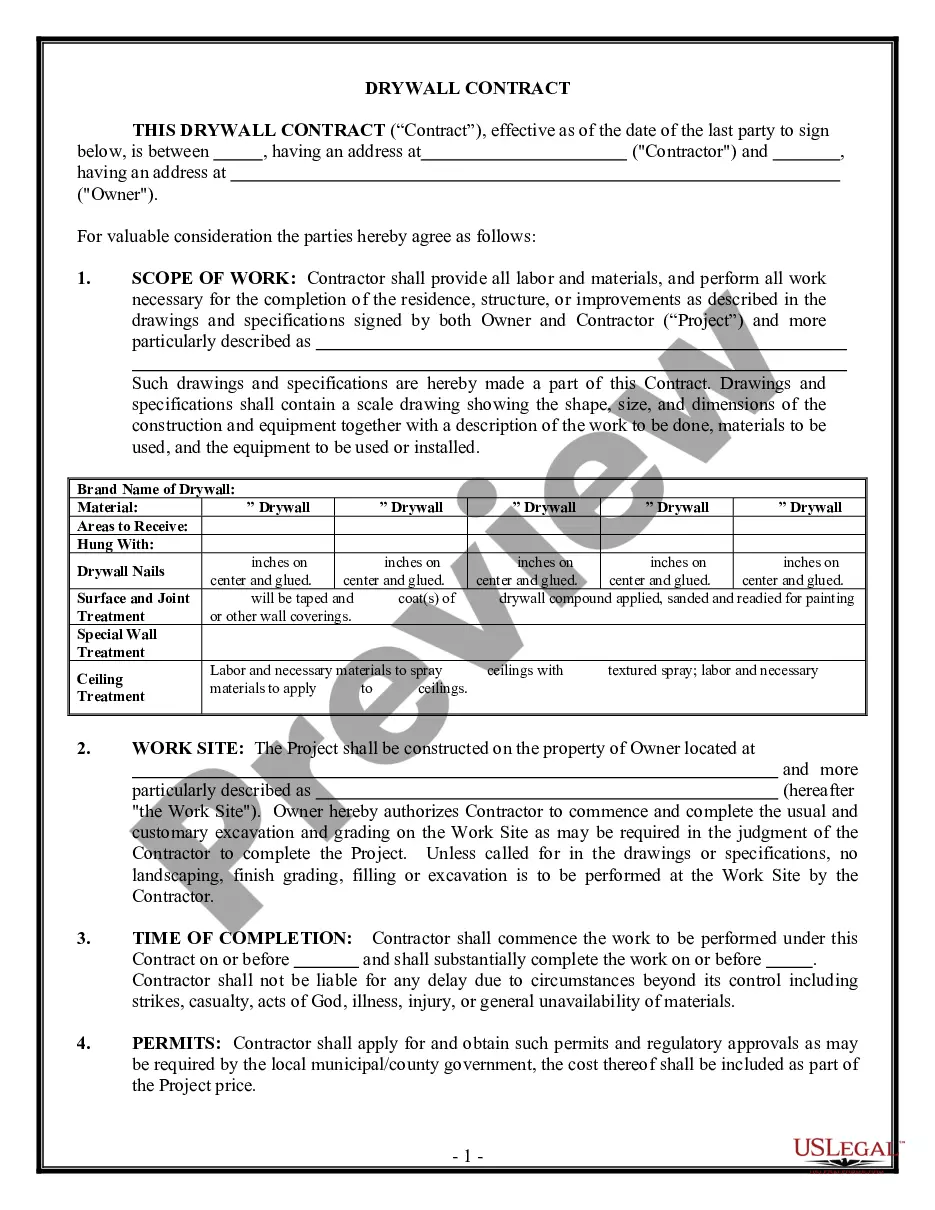

US Legal Forms offers thousands of template options, including the Indiana Separation Notice for 1099 Employee, which are crafted to satisfy state and federal regulations.

If you find the correct form, click Acquire now.

Select a preferred payment plan, fill in the necessary details to create your account, and complete the purchase using your PayPal or credit card.

- If you're already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can access the Indiana Separation Notice for 1099 Employee template.

- If you do not have an account and would like to start using US Legal Forms, follow these instructions.

- Find the form you need and verify it is for the correct location/state.

- Utilize the Review option to examine the document.

- Check the description to confirm that you have selected the right form.

- If the form isn't what you're looking for, use the Lookup field to locate the form that suits your needs.

Form popularity

FAQ

Because independent contractors pay self-employment tax, employers typically do not have to withhold taxes from their wages. There is, however, an exception known as backup withholding.

Short answer: No. Longer answer: You can get rid of an independent contractor if they're not holding up their end of the contract. But it's not firing because independent contractors don't work for you, they work for themselves.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

The only problem is that it is often illegal. There is no such thing as a 1099 employee. The 1099 part of the name refers to the fact that independent contractors receive a form 1099 at the end of the year, which reports to the IRS how much money was paid to the contractor.

Yes, you should apply for unemployment benefits! Pandemic Unemployment Assistance (PUA) is the best relief option available for self-employed creatives. Don't snooze on this! To receive PUA, you must apply for regular Unemployment Insurance (UI) and be denied.

How To Resign From a Contract Position With GraceCommunicate with your recruiting partner. There are a lot of reasons why you might want to move on, most of which are perfectly understandable.Give proper notice.Keep the stakes in mind.Leave the job better than you found it.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

Independent contractors, gig workers and residents who would otherwise not typically qualify for state unemployment insurance can begin applying for new federal unemployment benefits by Friday, the Department of Workforce Development announced on Thursday.

Indiana is an employment-at-will state. This means that an employer may generally terminate an employee at any time and for any reason, unless a law or contract provides otherwise.