Indiana Termination and Severance Pay Policy

Description

How to fill out Termination And Severance Pay Policy?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a vast selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent updates of forms such as the Indiana Termination and Severance Pay Policy in moments.

If you have a subscription, Log In to download the Indiana Termination and Severance Pay Policy from the US Legal Forms library. The Download button will appear on each form you review. You can access all previously saved forms in the My documents section of your account.

Make adjustments. Complete, modify, print, and sign the downloaded Indiana Termination and Severance Pay Policy.

Each document saved to your account does not expire and is yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Gain access to the Indiana Termination and Severance Pay Policy with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you're using US Legal Forms for the first time, here are some simple instructions to help you get started.

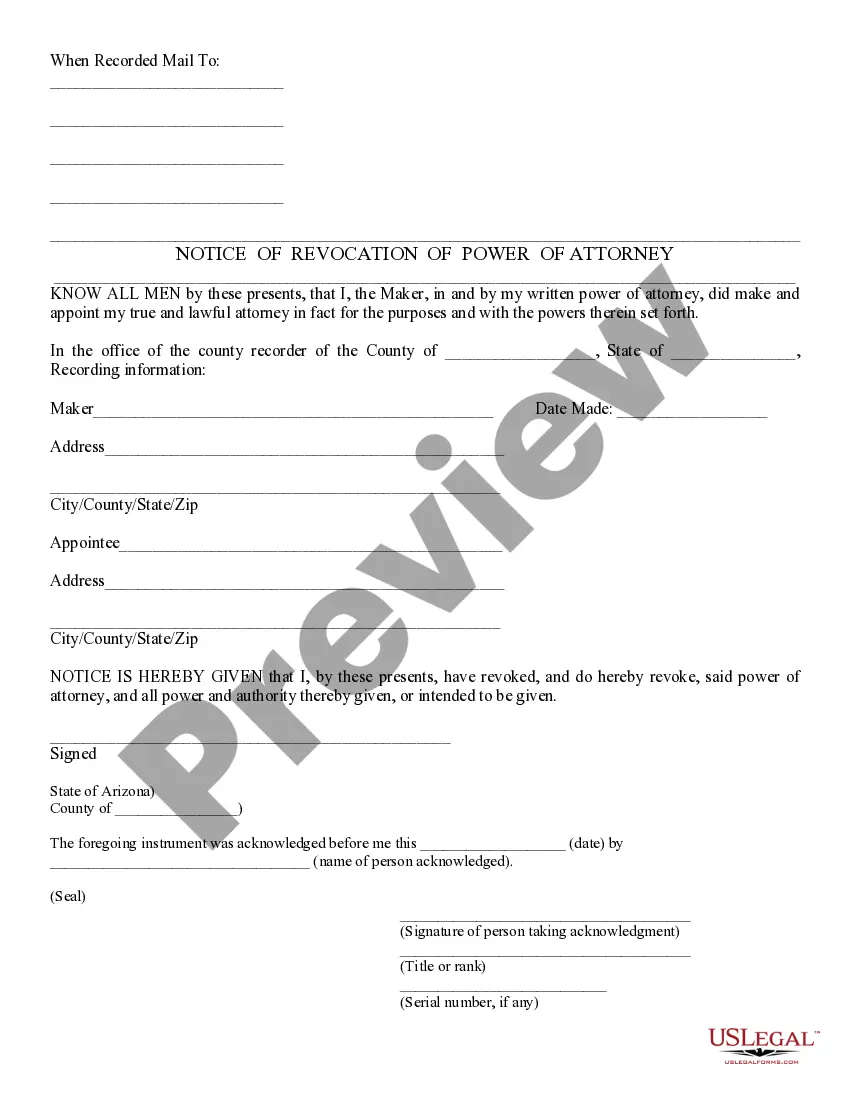

- Ensure you have selected the correct form for your location/state. Click the Preview button to view the content of the form. Read the form description to confirm you have chosen the right document.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the pricing plan you want and enter your details to register for an account.

- Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the purchase.

- Access the format and download the form to your device.

Form popularity

FAQ

In Indiana, receiving severance pay does not automatically disqualify you from unemployment benefits. However, any severance received may affect the amount and duration of your unemployment compensation. It's crucial to understand how the Indiana Termination and Severance Pay Policy interacts with unemployment benefits, as this knowledge can help you make informed decisions during your transition.

In Indiana, there is no legal requirement for employers to provide a termination letter. However, it is considered a best practice to document termination discussions in writing. This can help clarify the reasons for the termination and provide a record for both parties. Following the Indiana Termination and Severance Pay Policy can make the process smoother and more transparent.

Termination laws in Indiana are primarily governed by at-will employment principles. This means an employer can terminate an employee at any time, for any lawful reason, with or without notice. However, the Indiana Termination and Severance Pay Policy provides guidelines for severance pay that employees might be entitled to after termination. For clarity and proper documentation, employers should consider utilizing tools offered by UsLegalForms.

Yes, Indiana requires employers to provide a separation notice to employees who are terminated or laid off. This notice is important as it outlines the reason for the separation and can impact unemployment benefits. Understanding the Indiana Termination and Severance Pay Policy is essential for both employers and employees to ensure compliance. Employers can use resources like UsLegalForms to streamline the process and avoid potential issues.

Though sometimes used interchangeably, termination pay and severance pay are not the same thing. While all employees of three months or longer with a company are entitled to termination pay (in place of notice) upon dismissal, not everyone is entitled to severance pay.

Indiana labor laws do not require employers to provide employees with severance pay. If an employer chooses to provide severance benefits, it must comply with the terms of its established policy or employment contract.

Though sometimes used interchangeably, termination pay and severance pay are not the same thing. While all employees of three months or longer with a company are entitled to termination pay (in place of notice) upon dismissal, not everyone is entitled to severance pay.

In INDIA there is a law which compel to pay gratuity to terminated employee. Not in the name of severance pay, unlike United States and other countries, There are certain labour laws in India compel for payment of certain an amount for retrenched or terminated employee from the employment by his employer.

While termination pay is the minimum amount a person can receive when their employer fires them, severance pay is the full amount. As with termination pay, the longer the employment relationship, the greater the severance pay. But severance pay in Ontario also takes into account factors specific to each employee.

According to the employment standards in Alberta: After serving three months, an employer must give you one week's notice. After twelve consecutive months of employment, an employer must give you two week's notice. After three consecutive years of employment, an employer must give you three week's notice.