Indiana Investment Management Agreement for Separate Account Clients

Description

How to fill out Investment Management Agreement For Separate Account Clients?

Are you presently in a position where you will require documents for occasional business or personal reasons online every day.

There is a range of authentic document templates accessible on the web, but finding ones you can rely on can be challenging.

US Legal Forms provides thousands of template forms, such as the Indiana Investment Management Agreement for Separate Account Clients, which can be customized to fulfill federal and state regulations.

If you find the correct form, click Buy now.

Select the pricing plan required, input the necessary details to set up your account, and purchase the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the Indiana Investment Management Agreement for Separate Account Clients template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/region.

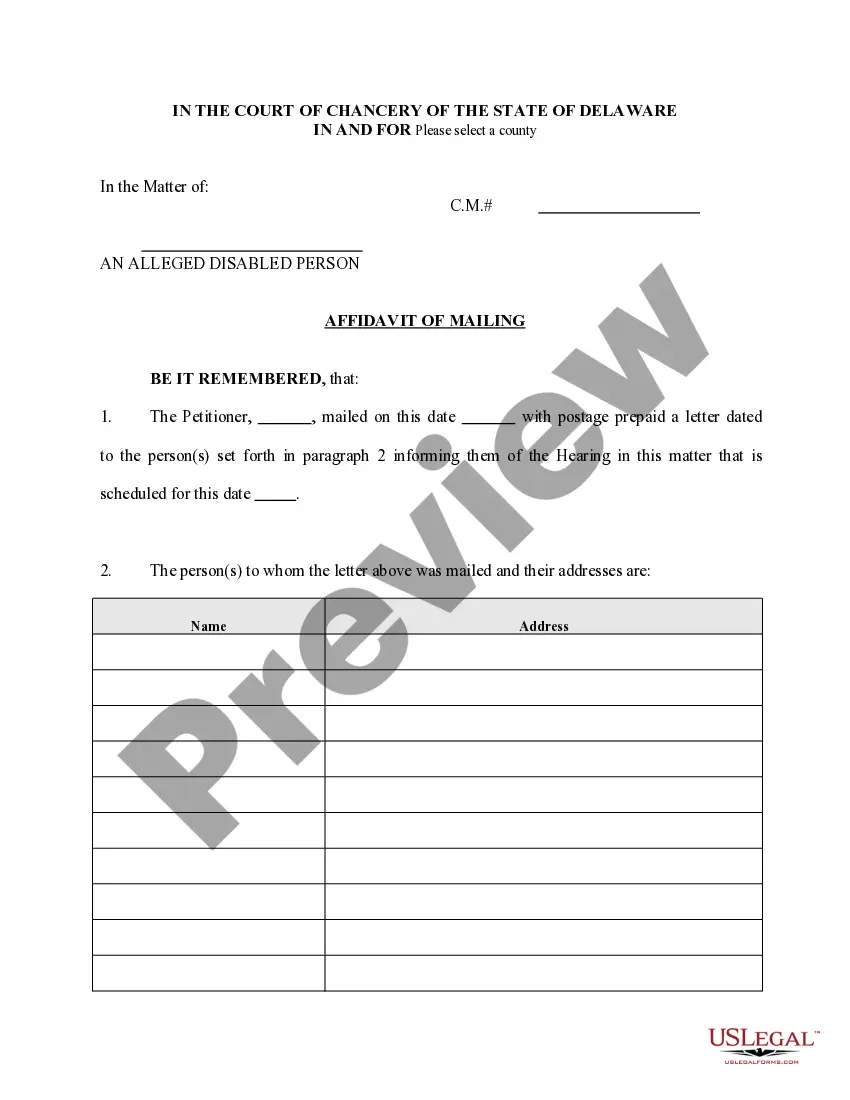

- Use the Preview button to review the form.

- Read the description to make sure you have selected the right form.

- If the form does not match what you are looking for, utilize the Search field to locate the form that meets your needs.

Form popularity

FAQ

Cons of SMAsYou may need to be rich to invest in some SMAs. Many SMA managers require high minimum account values.SMA fees can be unpredictable.A single SMA manager may not be an expert on every investment strategy and every asset class.

SMAs and EMAs are used in similar ways: to identify trends and find potential areas of support or resistance. An advantage of the SMA is that is smooth, but a disadvantage is that it might not accurately reflect the most recent trends.

SMAs are not right for every adviser or every client. For advisers who typically take a hands-on approach to managing their client's investment portfolios, SMAs are probably not a good fit. Additionally, SMAs typically will have a higher minimum investment than mutual funds.

A separately managed account, or SMA, is a portfolio of securities managed (for you) by a professional asset management firm. It's like having your own private mutual fundinstead of managing a portfolio of securities for a group of investors, the portfolio is being managed for you alone.

An investment management agreement to be used in connection with a private equity fund's appointment of an investment manager. This agreement sets out the terms and conditions by which a fund vehicle agrees to pay advisory and management services fees and out-of-pocket expenses to an investment manager entity.

A separate account is a segregated accounting and reporting account held by an insurance company not in, but rather "separate" from its general account. A separate account allows an investor to choose an investment category according to his individual risk tolerance, and desire for performance.

D)The primary disadvantage with single manager programs is that there is no independent professional approach to evaluating the ongoing performance and risk of the respective portfolios. This is as opposed to, for example, ETF wraps and multi-manager programs which have an additional layer of oversight.

A separate account is a separate set of financial statements held by a life insurance company, maintained to report assets and liabilities for particular products that are separated from the insurer's general account.

Low fees: SMAs typically have relatively low fees. The average fee on an SMA is 0.35%. That's lower than the average fee for a mutual fund, which is 0.68%. There may also be a management fee, however, which is typically 1% of the account's assets.

A separate account is an investment portfolio owned by an investor and managed by a professional investment firmtypically registered investment advisors (RIA). Although separate accounts are usually opened through a brokerage or financial advisor, they may also be held at a bank or opened with an insurance company.