Indiana Subcontract for Construction of Portion of or Materials to go into Building

Description

How to fill out Subcontract For Construction Of Portion Of Or Materials To Go Into Building?

If you want to finalize, obtain, or generate official document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take benefit of the website's straightforward and convenient search functionality to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you desire, click the Get Now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to discover the Indiana Subcontract for Construction of Part of or Materials to be used in Building within a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Indiana Subcontract for Construction of Part of or Materials to be used in Building.

- You can also find forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct area/state.

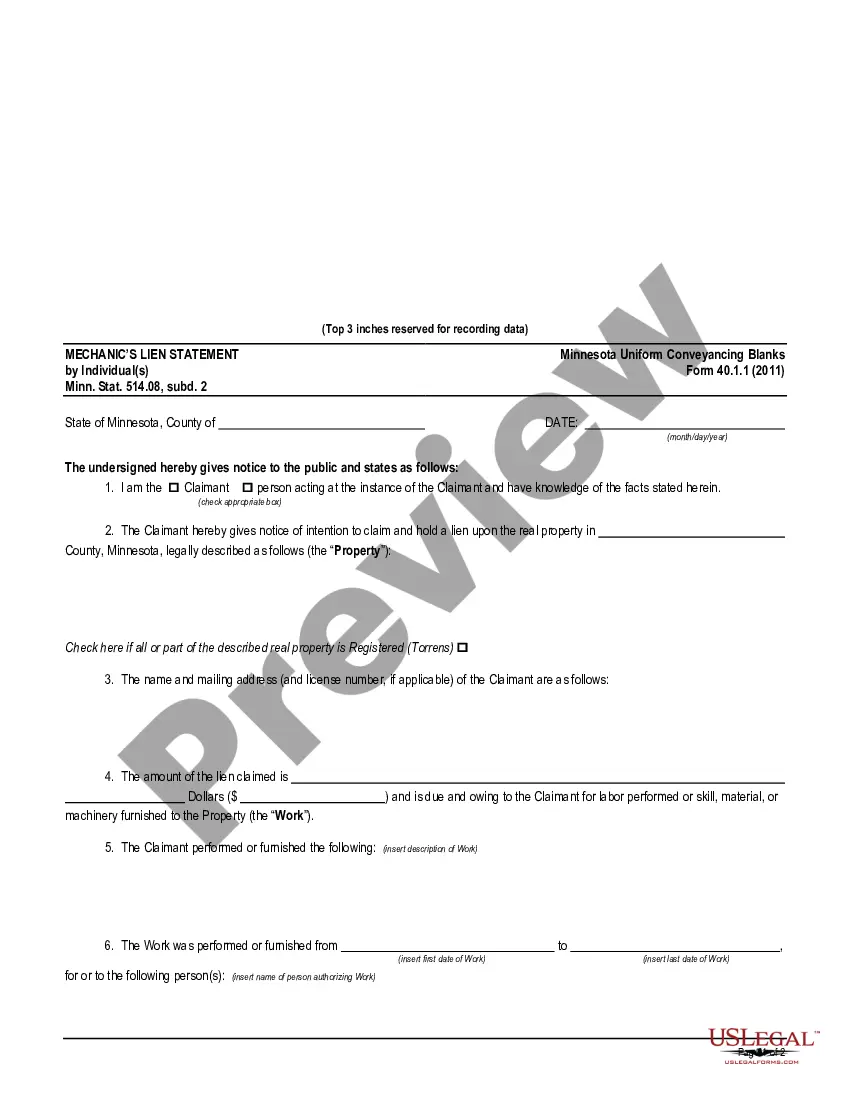

- Step 2. Use the Preview option to review the contents of the form. Don't forget to review the details.

- Step 3. If you are unsatisfied with the form, use the Search feature at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

Material Contractor means any contractor (including General Contractor) or subcontractor who executes a Material Contract.

Are services subject to sales tax in Indiana? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In Indiana, services are generally not taxable.

Installation charges that are not separately stated from the selling price of an item or the delivery charge for an item are subject to sales tax.

How do I write a subcontractor agreement?Negotiate and finalise all terms and conditions of the agreement.Draft the agreement in writing and send it to the subcontractor for review.Review the agreement, sign and execute.23-Aug-2021

Rules To write tight subcontractsStart with successful procurement standards.Execute all subcontracts PRIOR to starting your projects.Help those who help you.Always award to the lowest and complete responsible qualified bidder.Use Contract Scope Checklists to write complete subcontracts.Make sure you have tight clauses.More items...?

A subcontractor agreement is a contract between a contractor and a subcontractor to perform a portion of work that is part of a larger construction project. A subcontractor doesn't have an agreement with the property owner directly.

Goods that are subject to sales tax in Indiana include physical property, like furniture, home appliances, and motor vehicles. The purchase of groceries and prescription medicine are tax-exempt.

The installation charge is exempt from sales tax. If contractor did not separate the charge for manufacture, but instead wrapped it into a general labor charge with the installation charge, it would subject the entire labor charge to sales tax.

In general, all sales of tangible personal property, including construction material, are subject to tax. Thus, absent an exemption, all purchases of construction material by contractors are taxable at the time the material is purchased, or, if acquired exempt, upon disposition.