Indiana Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction

Description

How to fill out Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction?

US Legal Forms - one of several most significant libraries of authorized varieties in the States - offers a variety of authorized document layouts you can acquire or printing. Making use of the web site, you can find a huge number of varieties for business and person uses, categorized by groups, states, or key phrases.You will discover the latest types of varieties much like the Indiana Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction in seconds.

If you already have a monthly subscription, log in and acquire Indiana Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction in the US Legal Forms catalogue. The Acquire switch will appear on every single kind you view. You get access to all previously downloaded varieties in the My Forms tab of your own profile.

If you wish to use US Legal Forms for the first time, listed here are straightforward directions to obtain started:

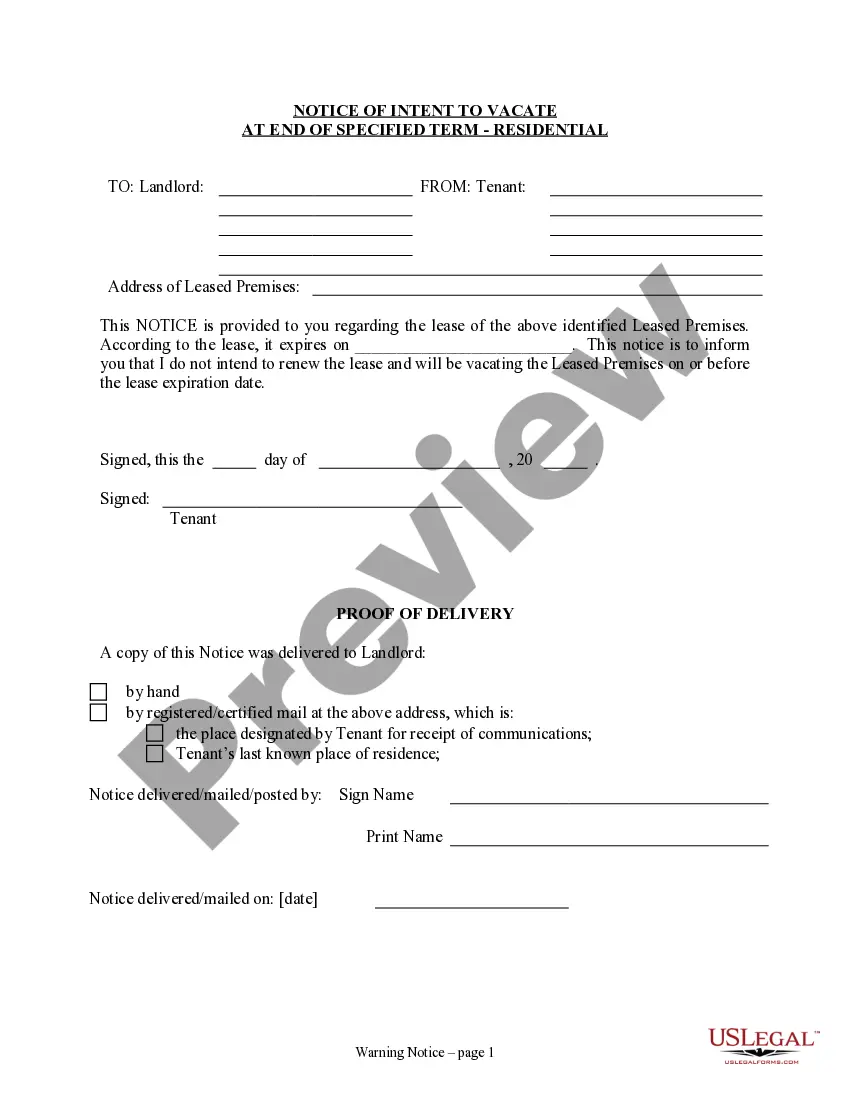

- Ensure you have picked out the right kind for your personal area/area. Click on the Review switch to review the form`s content. See the kind explanation to actually have selected the correct kind.

- If the kind does not suit your specifications, take advantage of the Research discipline at the top of the screen to obtain the one who does.

- If you are satisfied with the form, validate your choice by simply clicking the Acquire now switch. Then, choose the costs strategy you like and offer your credentials to register for the profile.

- Process the financial transaction. Make use of your bank card or PayPal profile to perform the financial transaction.

- Find the formatting and acquire the form on your own product.

- Make modifications. Fill out, change and printing and indication the downloaded Indiana Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction.

Every format you put into your account lacks an expiry particular date and it is your own property for a long time. So, if you would like acquire or printing yet another copy, just visit the My Forms area and click on the kind you need.

Get access to the Indiana Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction with US Legal Forms, one of the most extensive catalogue of authorized document layouts. Use a huge number of specialist and status-distinct layouts that satisfy your organization or person needs and specifications.

Form popularity

FAQ

Illegally "structuring" a transaction means setting up (structuring) a large cash transaction so that it doesn't trigger the reporting requirements. The most common method for doing this is called ?smurfing,? breaking up a large cash deposit into a series of smaller deposits to avoid bank detection.

Federal law requires financial institutions to report currency (cash or coin) transactions over $10,000 conducted by, or on behalf of, one person, as well as multiple currency transactions that aggregate to be over $10,000 in a single day. These transactions are reported on Currency Transaction Reports (CTRs).

A "structured transaction" is a series of related transactions that could have been conducted as one transaction, but the financial institution and/or the transactor intentionally broke it into several transactions for the purpose of circumventing the reporting requirements of the Bank Secrecy Act (BSA).

Typical structuring schemes involve taxpayers making multiple deposits below the $10,000 threshold in order to avoid having to fill out Form 8300 and report said receipts to the IRS. Structuring is a felony offense and the punishments can be severe.

Having an IRS Currency Transaction Report on your file increases your likelihood of being audited, which is one of the reasons even people who have nothing to hide try to avoid the CTR.

A structured transaction is a series of transactions broken up from a larger sum in order to avoid reporting requirements under the Bank Secrecy Act (BSA), which requires financial institutions to report all transactions of $10,000 or more.

Let's say that someone has $90,000 in cash. If they want to avoid reporting requirements, they can split this into 10 transactions of $9,000. This is an example of structuring. Remember, structuring transactions in this way is illegal.

Given below are some examples of transactions that a banker should report by filing CTRs. A person deposits $11,000 in currency to his savings account and withdraws $3,000 in currency from his checking account. The CTR should be completed as ? cash In $11,000 and no entry for Cash Out.