Indiana Personal Financial Information Organizer

Description

How to fill out Personal Financial Information Organizer?

If you need to finalize, acquire, or produce genuine document templates, utilize US Legal Forms, the largest repository of authentic forms available online.

Employ the site’s straightforward and efficient search feature to locate the documents you require.

A selection of templates for business and personal purposes are categorized by groups and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and provide your credentials to register for the account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.Step 6. Select the format of the legal document and download it onto your device.Step 7. Complete, modify, and print or sign the Indiana Personal Financial Information Organizer.

- Utilize US Legal Forms to discover the Indiana Personal Financial Information Organizer with just a few clicks.

- If you are already a user of US Legal Forms, Log In to your account and click on the Acquire button to find the Indiana Personal Financial Information Organizer.

- You can also access forms you previously obtained from the My documents tab in your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

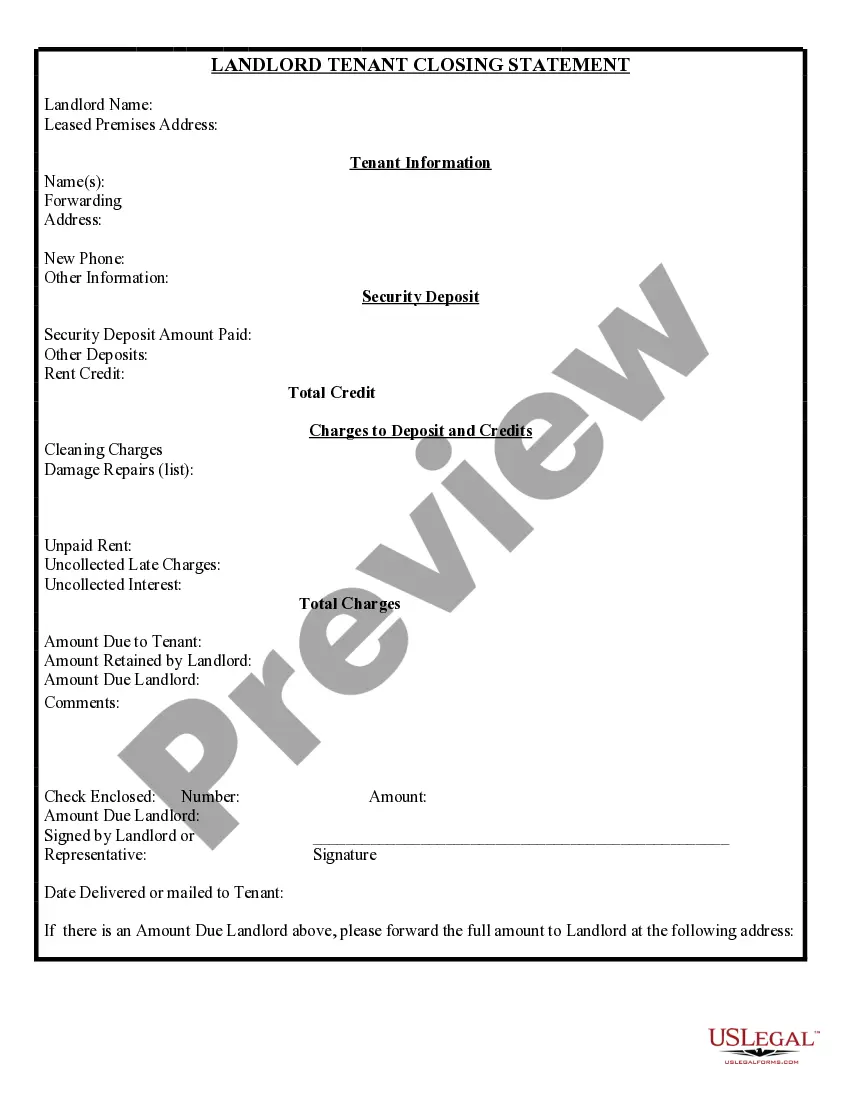

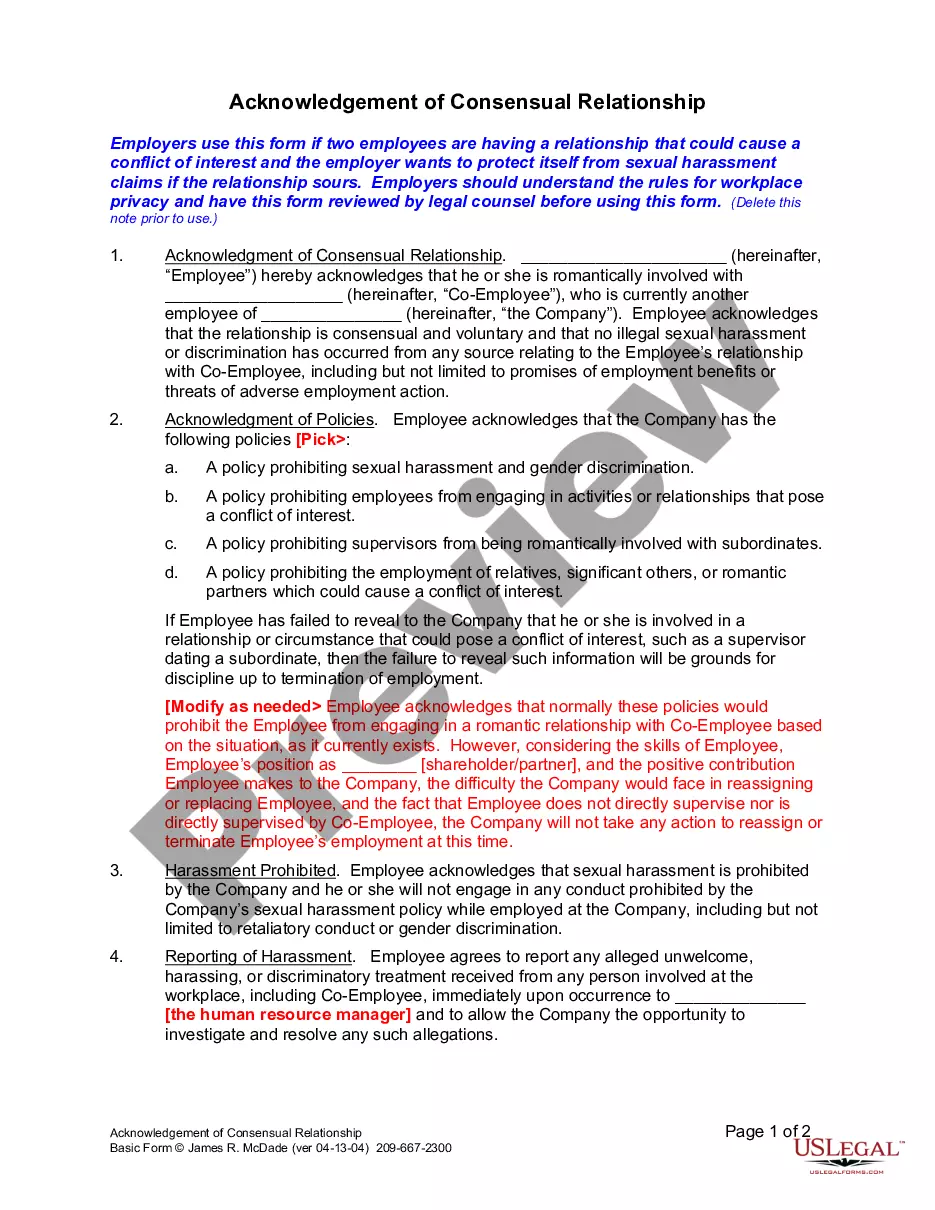

- Step 2. Use the Review option to check the form's content. Remember to read the directions.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other types of the legal form template.

Form popularity

FAQ

"Anyone can pretty much call themselves a financial advisor, but they don't have the same requirements as someone who's calling themself a certified financial planner," says Frank Pare, a certified financial planner and national president of the Financial Planning Association.

The certification process is complete after having passed a rigorous, 10-hour exam (52% pass rate) given over two days. The test measures your ability to apply financial planning concepts and principles to real client scenarios.

What is the Chartered Retirement Planning Counselor2122 (CRPC®) Designation? The CRPCA®helps financial advisors by guiding them through specialized tax and estate objectives and strategies for a retiree and presents the unique financial and emotional aspects of financial planning that are unique to the retirement process.

Becoming a financial planner requires a bachelor's degree, along with courses in investments, taxes, estate planning, and risk management. If you're comfortable with sales, are great with people, have excellent analytical and communication skills, and can work independently, financial planning may be right for you.

A financial planner is a professional who helps individuals and organizations create a strategy to meet long-term financial goals. "Financial advisor" is a broader category that can also include brokers, money managers, insurance agents, or bankers. There is no single body in charge of regulating financial planners.

CRPCs are different from Certified Financial Planners (CFP). The latter provides financial planning across all aspects of an individual's life. CRPCs are focused on retirement planning. The CRPC program is developed with a focus on client-centered problem-solving.

The daily schedule of a financial advisor includes prospecting, servicing current clients, administrative tasks, financial planning, and continuing education. In addition to providing financial guidance, a large part of a financial advisor's career is managing relationships.

Financial planners: what they do A financial planner guides you in meeting your current financial needs and long-term goals. That typically means assessing your financial situation, understanding what you want your money to do for you (both now and in the future) and helping create a plan to get you there.

Malcolm Ethridge, CFP®, CRPCA® is an Executive Vice President and fiduciary Financial Advisor with CIC Wealth, based in the Washington, DC area.