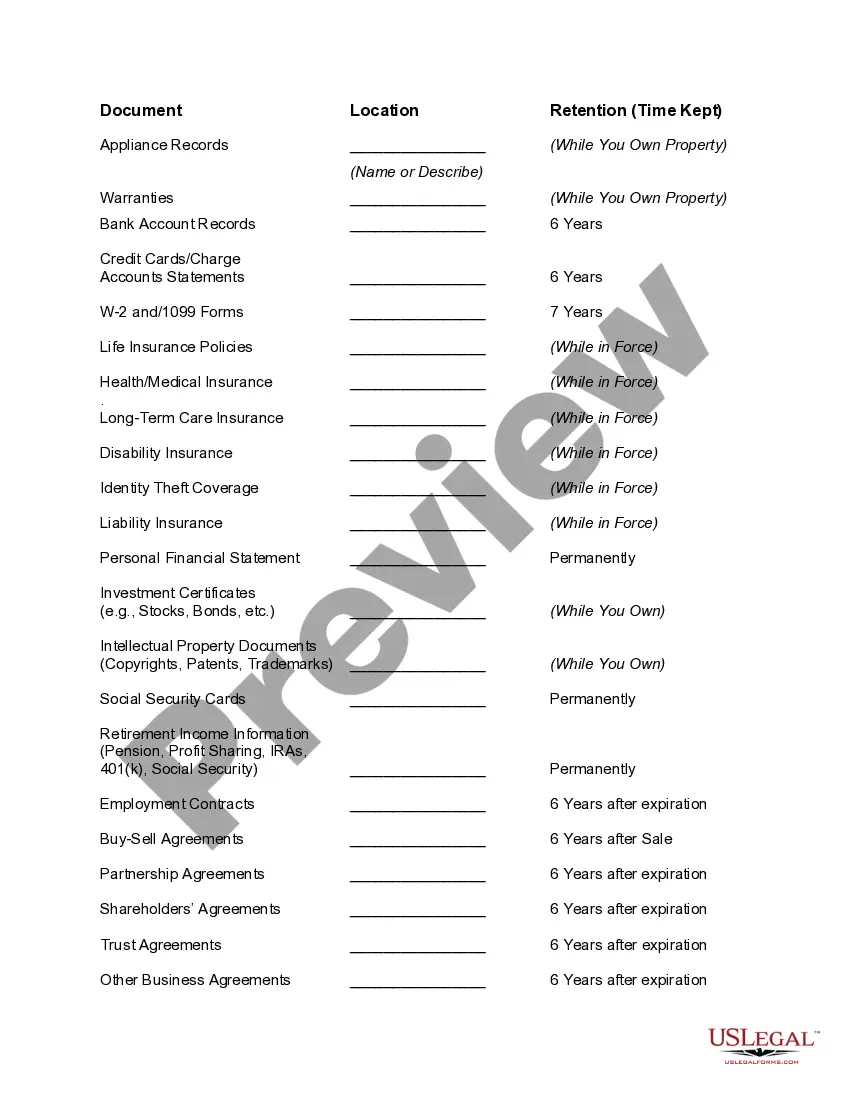

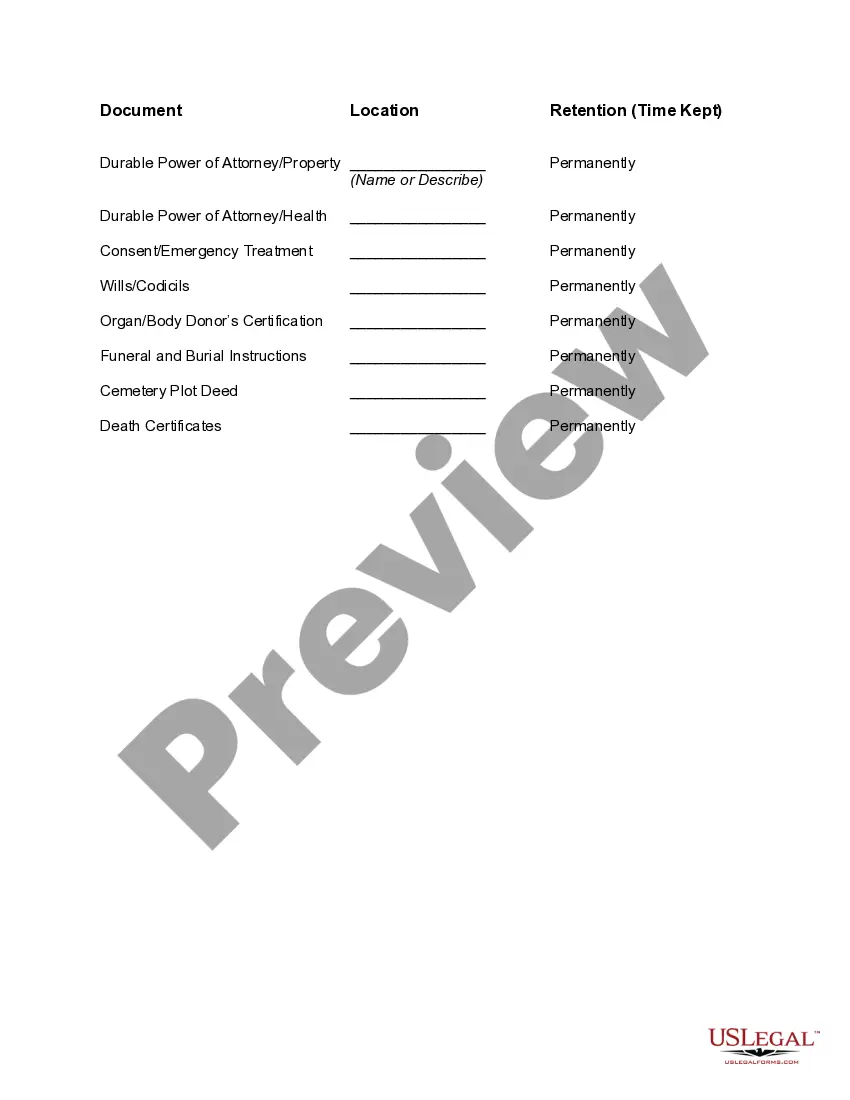

Indiana Document Organizer and Retention

Description

How to fill out Document Organizer And Retention?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides an extensive selection of legal document templates that you can purchase or create.

By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You will find the latest versions of documents such as the Indiana Document Organizer and Retention in just a few minutes.

If you have a monthly subscription, Log In to access the Indiana Document Organizer and Retention from the US Legal Forms library. The Download button will appear on each template you view. You can access all previously downloaded documents in the My documents section of your account.

Then, process the transaction. Use your credit card or PayPal account to complete the payment.

Choose the format and download the form onto your device. Make changes. Fill out, edit, print, and sign the downloaded Indiana Document Organizer and Retention. Every template added to your account has no expiration date and belongs to you indefinitely. Therefore, if you want to download or create another copy, simply go to the My documents section and click on the form you need. Access the Indiana Document Organizer and Retention with US Legal Forms, which boasts the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements and demands.

- Ensure that you have selected the correct form for your city/state.

- Click the Preview button to review the document's content.

- Check the document description to confirm you have chosen the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, select the payment plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

Knowing that, a good rule of thumb is to save any document that verifies information on your tax returnincluding Forms W-2 and 1099, bank and brokerage statements, tuition payments and charitable donation receiptsfor three to seven years.

How much should be the retention of internal audit and MRM records? The logical answer is a minimum of 3 years as that is the time frame of ISO certificate.

A DRP will identify documents that need to be maintained, contain guidelines for how long certain documents should be kept, and save your company valuable computer and physical storage space.

Records Retention Guideline #4: Keep everyday paperwork for 3 yearsMonthly financial statements.Credit card statements.Utility records.Employment applications (for businesses)Medical bills (in case of insurance disputes)

6.2 Retention times for specific records are defined in Table 1, unless otherwise specified quality records shall be retained for 10 years. In no case shall the retention time be less than seven years after final payment on the associated contract.

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained," irrespective of format (paper, electronic, or other).

The minimum retention period is the shortest amount of time that a WORM file can be retained in a SnapLock volume. If the application sets the retention period shorter than the minimum retention period, Data ONTAP adjusts the retention period of the file to the volume's minimum retention period.

As a general rule of thumb, tax returns, financial statements and accounting records should be retained for a minimum of six years.

The ADEA requires retention of employment records, such as job applications and resumes, for one year. This includes applications for permanent and temporary positions.

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.