Indiana Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders

Description

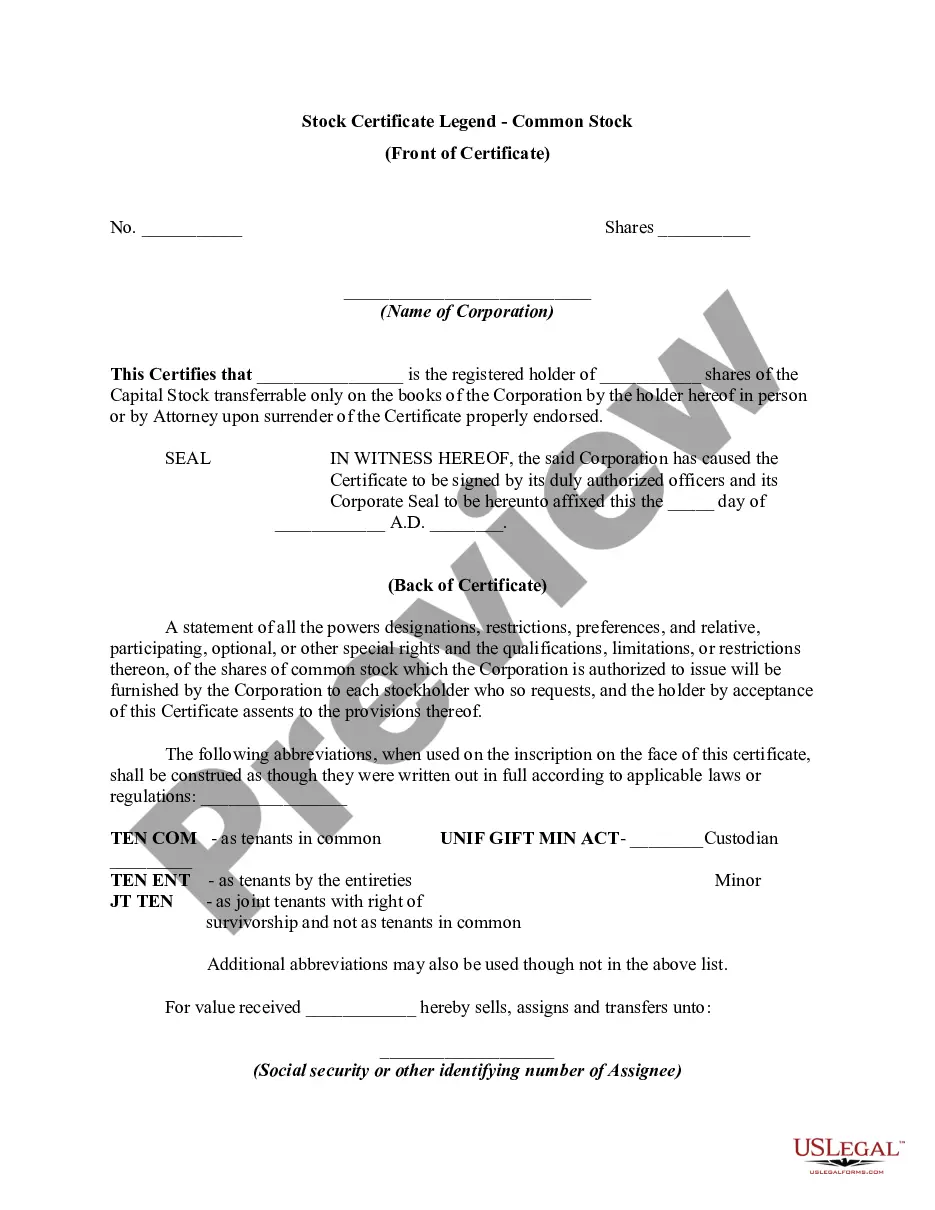

How to fill out Legend On Stock Certificate Giving Notice Of Restriction On Transfer Due To Stock Redemption Agreement Requiring First An Offer To The Corporation And Then An Offer To Other Stockholders?

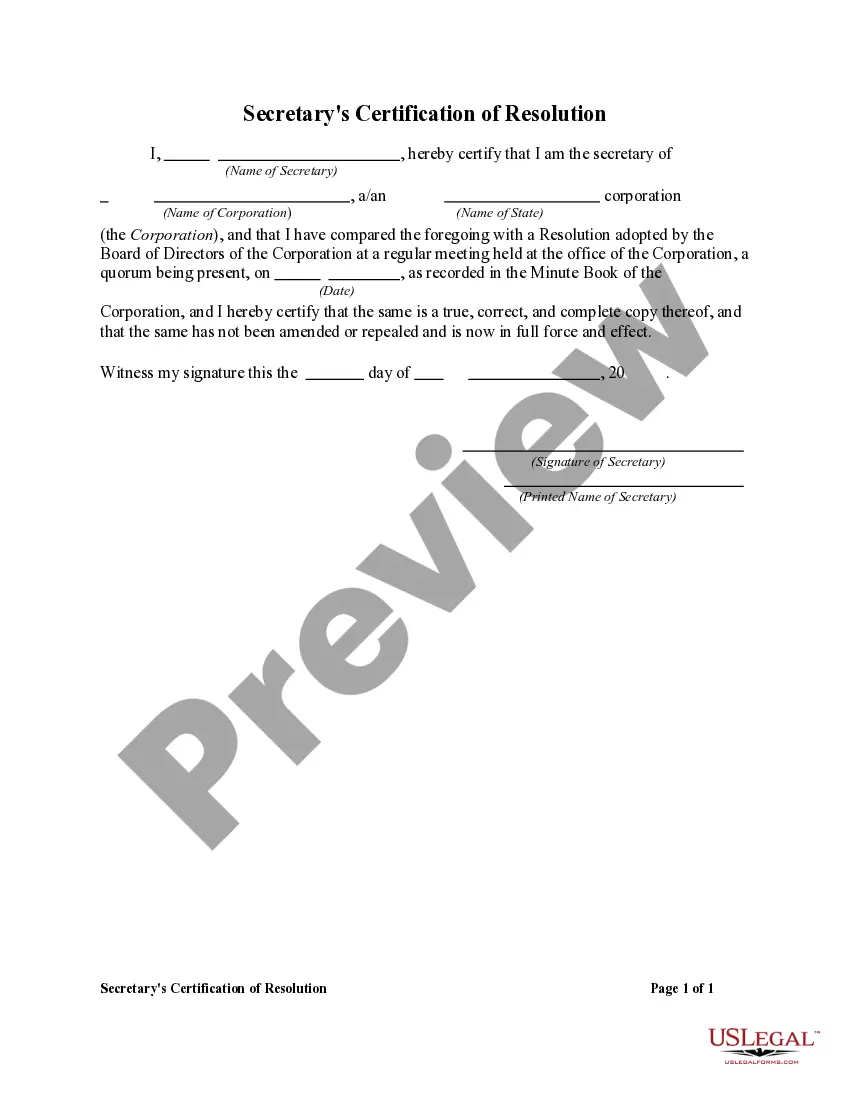

Are you currently in the placement where you require papers for sometimes business or specific uses virtually every time? There are a variety of lawful record themes available on the Internet, but getting types you can depend on isn`t simple. US Legal Forms offers a large number of kind themes, much like the Indiana Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders, that are composed to satisfy state and federal specifications.

In case you are already informed about US Legal Forms internet site and have a free account, simply log in. Following that, you can obtain the Indiana Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders format.

If you do not come with an accounts and want to start using US Legal Forms, adopt these measures:

- Get the kind you want and make sure it is for your right city/region.

- Make use of the Review switch to examine the form.

- Read the outline to actually have chosen the right kind.

- In case the kind isn`t what you`re searching for, utilize the Look for discipline to find the kind that meets your requirements and specifications.

- Once you find the right kind, click Acquire now.

- Pick the pricing prepare you need, submit the specified info to produce your bank account, and pay money for the transaction making use of your PayPal or Visa or Mastercard.

- Decide on a practical file formatting and obtain your copy.

Find all the record themes you possess purchased in the My Forms menu. You can aquire a extra copy of Indiana Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders whenever, if needed. Just click on the essential kind to obtain or print out the record format.

Use US Legal Forms, by far the most considerable collection of lawful varieties, to save time and prevent blunders. The support offers expertly produced lawful record themes which you can use for a selection of uses. Produce a free account on US Legal Forms and commence making your daily life a little easier.

Form popularity

FAQ

The Share Transfer Agreement is a standard document required for transferring shares in a company from one party to another. The agreement outlines the particulars of the transferor to the transferee. The document should also include the number of shares to be transferred and the cost or value of each share etc.

A: The most common provisions included in restricted stock purchase agreements are restrictions on when and how stock can be sold or transferred; non-compete agreements; rights of first refusal; and termination clauses which allow either party to terminate the agreement under specified conditions.

Transfer restrictions are terms that prevent the transfer of securities. They can be required by any of the following: Statute (such as the hold period restrictions required for some securities acquired pursuant to a private placement exemption).

Notes: Equity shareholders are the real owners of the company. Equity shares represent the ownership of a company and capital raised by the issue of such shares is known as ownership capital or owner's funds.

A company whose shares are restricted in transfer is called a privately held company. Restriction on transfer of shares means that shares cannot be transferred without the approval of the board of directors or the general meeting of shareholders.

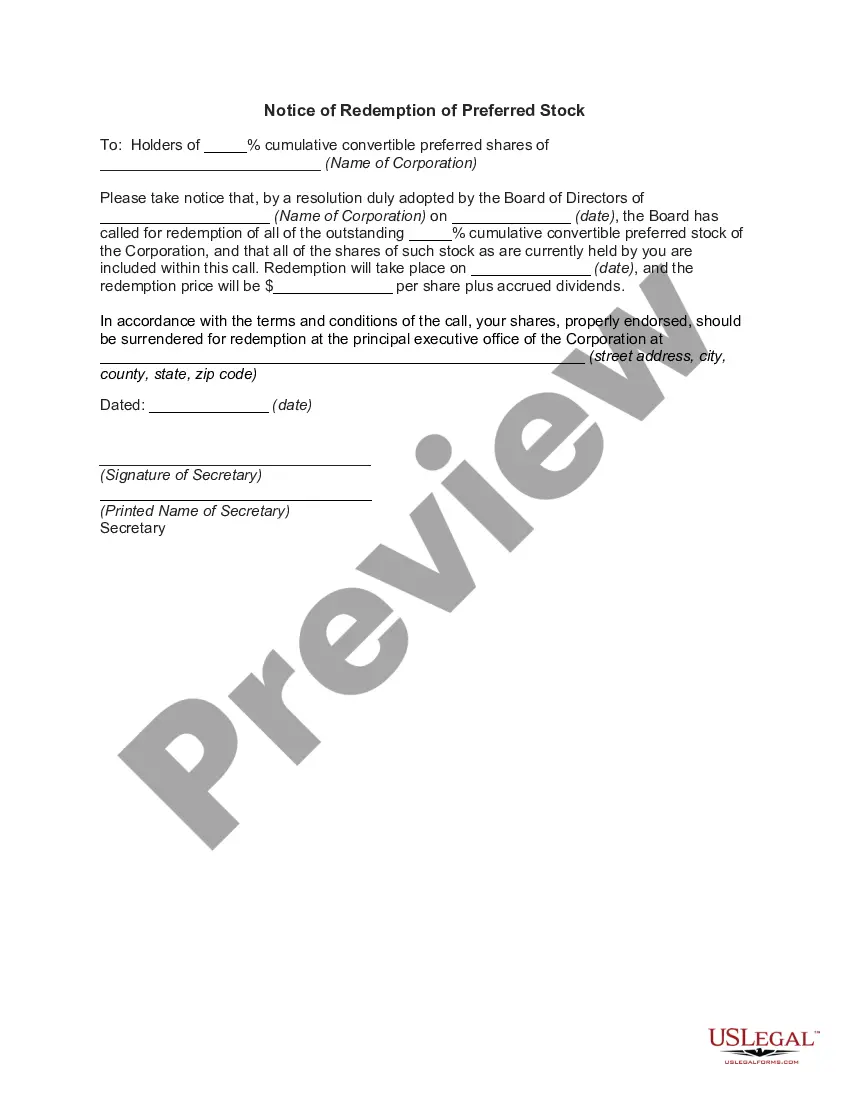

Another common type of buy-sell agreement is the ?stock redemption? agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.

A stock transfer restriction is essentially a contract between the shareholders of the corporation or members of the LLC. Therefore, the owners have the ability to be extremely creative in crafting a stock transfer restriction that meets their specific wants and needs.

A stock corporation is a type of for-profit company. Each of its shareholders receives part ownership of the corporation through their shares of stock. A stock corporation is a type of for-profit company. Each of its shareholders receives part ownership of the corporation through their shares of stock.