Indiana Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

How to fill out Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can obtain or print.

By utilizing the website, you can discover thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Indiana Provision in Testamentary Trust with Bequest to Charity for a Specific Charitable Purpose in just minutes.

If you already have a subscription, Log In and obtain the Indiana Provision in Testamentary Trust with Bequest to Charity for a Specific Charitable Purpose from the US Legal Forms database. The Download button will appear on each form you view. You can access all previously acquired forms in the My documents section of your account.

Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Complete, modify, print, and sign the downloaded Indiana Provision in Testamentary Trust with Bequest to Charity for a Specific Charitable Purpose. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, just return to the My documents section and click on the form you need. Access the Indiana Provision in Testamentary Trust with Bequest to Charity for a Specific Charitable Purpose with US Legal Forms, the most extensive collection of legal document templates. Utilize numerous professional and state-specific templates that fulfill your business or personal needs and requirements.

- To use US Legal Forms for the first time, here are some basic steps to get started.

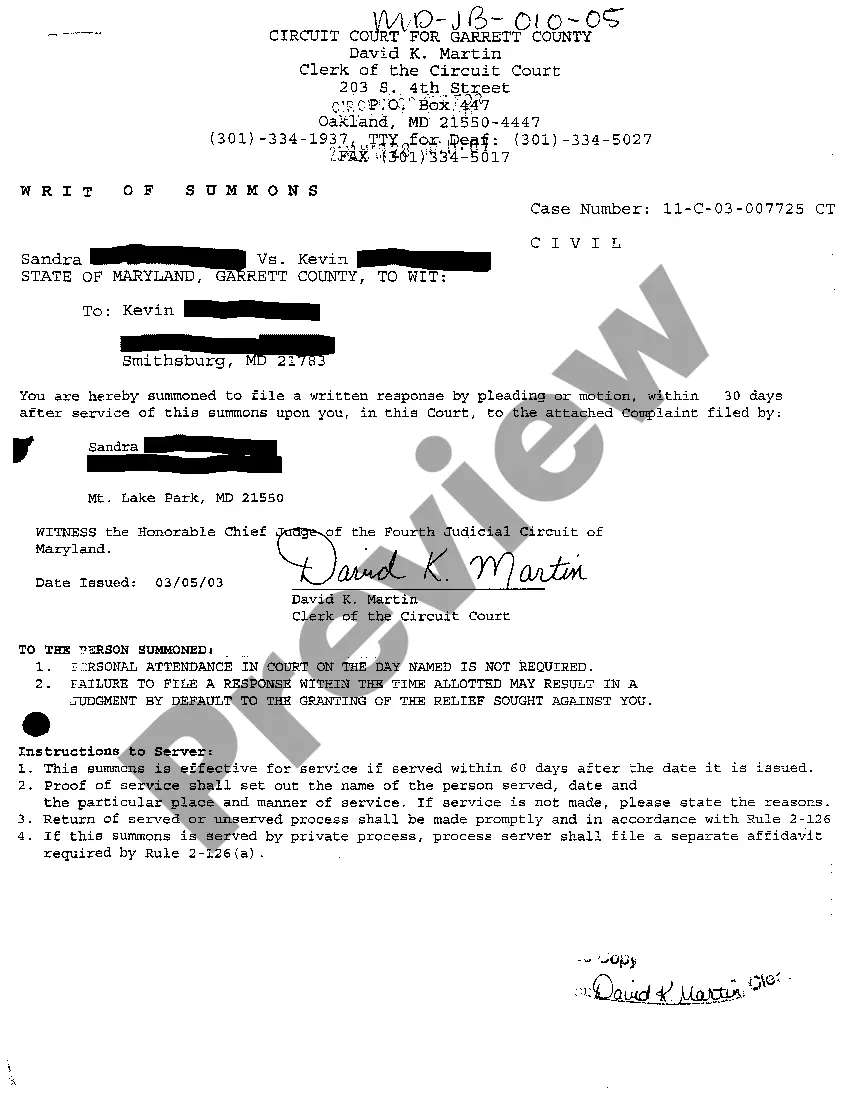

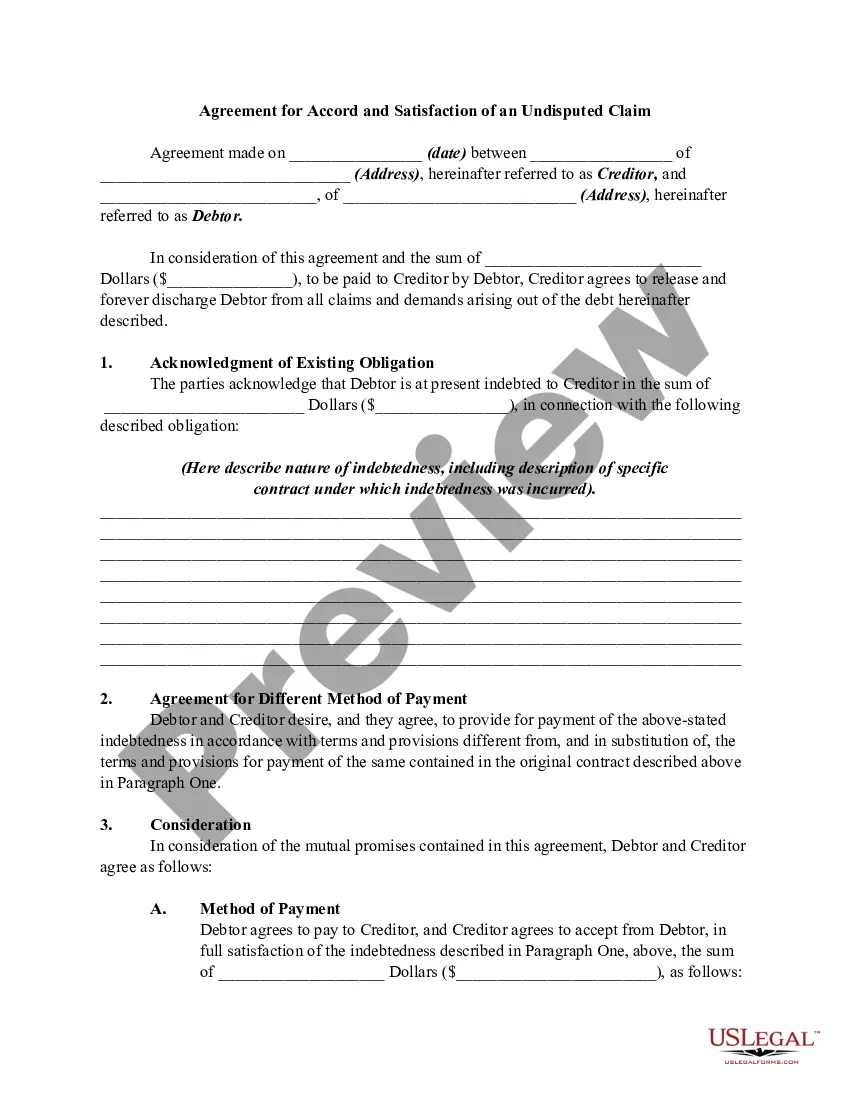

- Make sure you have selected the correct form for your area/state. Click on the Preview button to review the form's content.

- Check the form details to ensure you have picked the right form.

- If the form doesn't suit your requirements, use the Search function at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

Should You Gift Now or at Death? Instead of gifting your retirement assets to a charity during your lifetime, it can be advantageous to designate the charity as the beneficiary of your retirement account.

Distributions from a family trust to a charity Many people use family trusts to provide financial support to charities. The trust deed for a family trust may incorporate a general class of beneficiary that permits distributions to be made to charities as appointed by the trustee from time to time.

A specific bequest is a gift of a particular dollar amount or a particular piece of property. For example: I bequeath dollar amount or description of property to the Friends of the Prescott Public Library, a nonprofit corporation whose address is 215 E. Goodwin St., Prescott, Arizona, 86303.

A bequest is a gift, but a gift is not necessarily a bequest. A bequest describes the act of leaving a gift to a loved one through a Will. For example, you could simply state something like I bequest my red Corvette to my son in a Will. On the other hand, a gift can be made outside of a Will.

A bequest and an inheritance are basically two sides of the same coin. The bequest is the act of leaving something to another person through a will. On the other hand, inheritance describes the process and rights a person has to property or assets after the death of a spouse or relative.

How (and Why) to Make a Charitable BequestChoose an organization to receive your bequest.Decide what type of bequest you will give.Decide what you will give in your bequest.Add the bequest to your will and tell people about it.Pat yourself on the back while you think about the benefits of making a charitable bequest.

Charitable bequests from your will combine philanthropy and tax benefits. Bequests are gifts that are made as part of a will or trust. A bequest can be to a person, or it can be a charitable bequest to a nonprofit organization, trust or foundation. Anyone can make a bequestin any amountto an individual or charity.

Naming a charity as a life insurance beneficiary is simple: Write in the charity name and contact information when you choose or change your beneficiaries. You can name multiple beneficiaries and specify what percentage of the death benefit should go to each.