Indiana Seller's Affidavit of Nonforeign Status

Description

How to fill out Seller's Affidavit Of Nonforeign Status?

Are you in a situation the place you need files for sometimes organization or personal purposes just about every working day? There are plenty of legitimate document web templates available on the Internet, but locating ones you can depend on isn`t straightforward. US Legal Forms provides a huge number of kind web templates, such as the Indiana Seller's Affidavit of Nonforeign Status, which can be written to meet federal and state needs.

In case you are currently knowledgeable about US Legal Forms website and possess a merchant account, simply log in. Afterward, it is possible to download the Indiana Seller's Affidavit of Nonforeign Status template.

Should you not provide an accounts and wish to begin using US Legal Forms, follow these steps:

- Discover the kind you need and make sure it is for your proper metropolis/county.

- Make use of the Preview switch to review the form.

- Read the outline to actually have chosen the appropriate kind.

- When the kind isn`t what you`re seeking, use the Research field to discover the kind that fits your needs and needs.

- When you obtain the proper kind, just click Acquire now.

- Opt for the costs plan you want, fill out the desired information to generate your bank account, and purchase the order with your PayPal or Visa or Mastercard.

- Decide on a practical paper structure and download your duplicate.

Locate every one of the document web templates you possess purchased in the My Forms food list. You can aquire a extra duplicate of Indiana Seller's Affidavit of Nonforeign Status anytime, if possible. Just click on the necessary kind to download or produce the document template.

Use US Legal Forms, probably the most extensive assortment of legitimate types, to save lots of some time and stay away from errors. The support provides appropriately produced legitimate document web templates that can be used for a variety of purposes. Make a merchant account on US Legal Forms and initiate generating your way of life easier.

Form popularity

FAQ

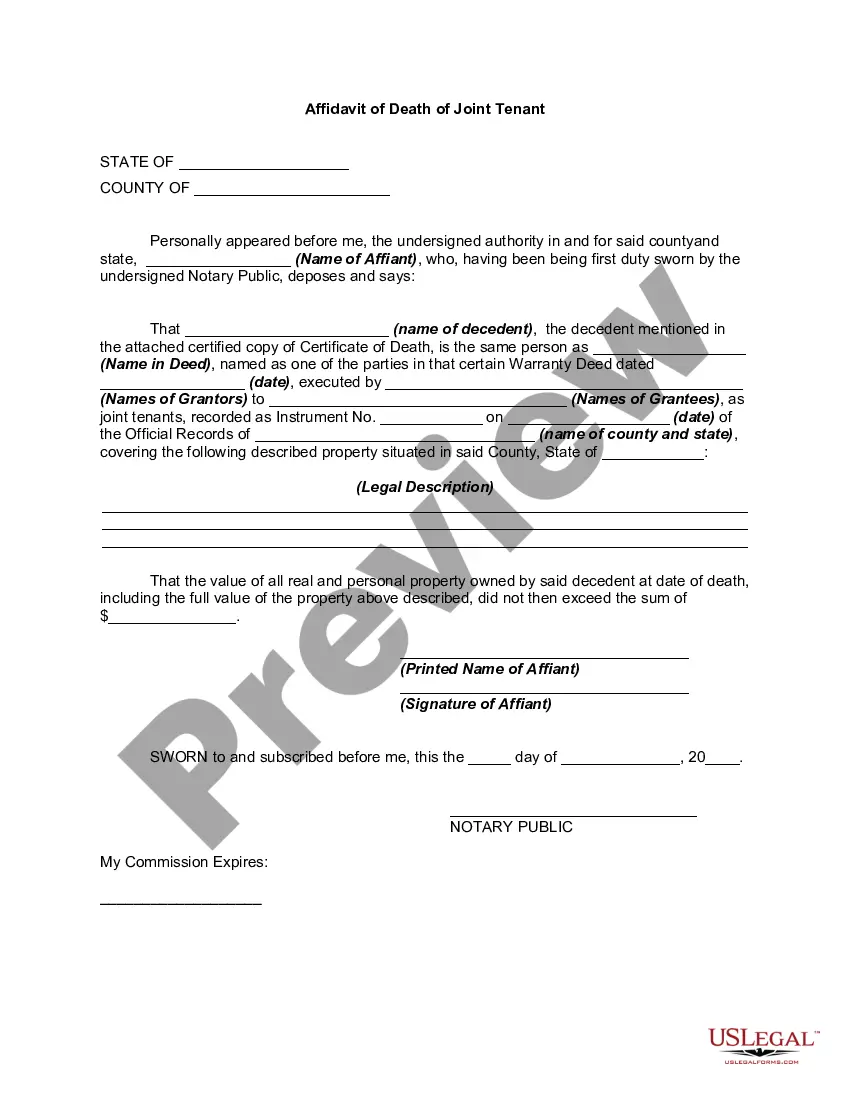

What Is a FIRPTA Affidavit? The Affidavit is the form that is used by the seller to certify under Penalty of Perjury that the seller is not a foreign seller. Generally, the escrow company or agents involved in the underlying sale will be responsible for facilitating the signatures.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

The Foreign Investment in Real Property Tax Act of 1980, also known as FIRPTA, may apply to your purchase. FIRPTA is a tax law that imposes U.S. income tax on foreign persons selling U.S. real estate.

AFFIDAVIT OF NON-FOREIGN STATUS. Exhibit 10.6. AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

A Standard Document delivered by the seller in a real property transaction to inform the purchaser, and the purchaser's lender, that the seller is not a foreign (non-US) individual or entity and therefore not subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA).

The Seller's Affidavit of Non-Foreign Status ( AS-14) is used to document the exemption if the Seller is not a NRA. This can be signed by a: US citizen; US green card holder; or. Non-citizen who meets the substantial presence test (based on the number of days actually present in the US).

Certification of Non-Foreign Status FIRPTA is the Foreign Investment in Real Property Act. If you are selling real estate in the United States, the IRS requires certain disclosures to avoid non-U.S. Persons from escape U.S. Tax on the sale of U.S. Real Estate.