Indiana Loan Commitment Agreement

Description

How to fill out Loan Commitment Agreement?

US Legal Forms - one of the biggest libraries of lawful types in America - offers a wide range of lawful document web templates you are able to obtain or printing. Using the web site, you may get a huge number of types for company and specific reasons, sorted by classes, suggests, or search phrases.You will discover the most recent versions of types like the Indiana Loan Commitment Agreement in seconds.

If you already have a monthly subscription, log in and obtain Indiana Loan Commitment Agreement in the US Legal Forms collection. The Download option can look on every type you see. You get access to all formerly saved types in the My Forms tab of your accounts.

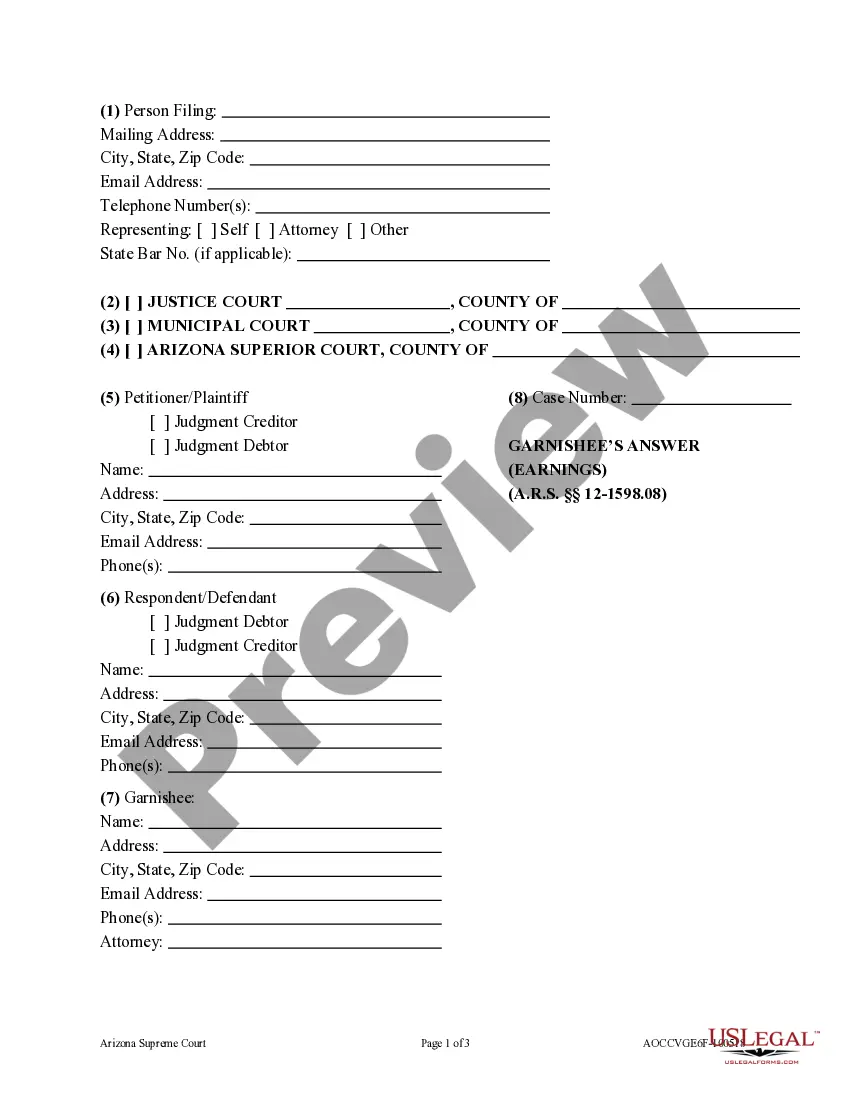

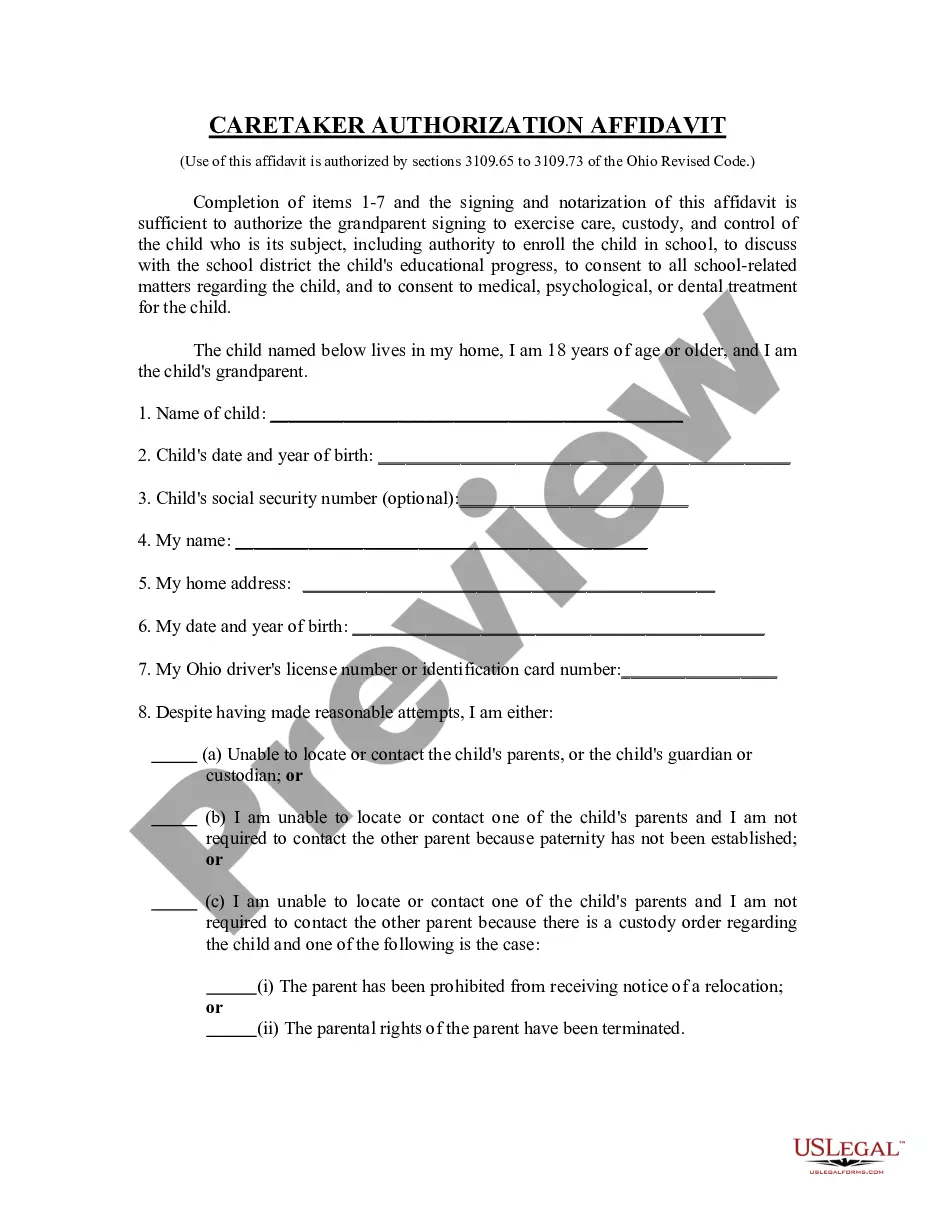

In order to use US Legal Forms for the first time, listed below are easy directions to help you get started off:

- Be sure you have picked the correct type for your city/state. Click on the Preview option to analyze the form`s content material. Look at the type outline to ensure that you have chosen the correct type.

- When the type does not fit your requirements, use the Look for area on top of the display screen to get the one who does.

- If you are satisfied with the shape, verify your decision by visiting the Get now option. Then, select the pricing prepare you want and provide your credentials to sign up for the accounts.

- Process the deal. Use your bank card or PayPal accounts to perform the deal.

- Select the file format and obtain the shape in your system.

- Make alterations. Load, change and printing and sign the saved Indiana Loan Commitment Agreement.

Every format you put into your money lacks an expiry day which is the one you have forever. So, if you wish to obtain or printing yet another version, just proceed to the My Forms segment and then click around the type you will need.

Obtain access to the Indiana Loan Commitment Agreement with US Legal Forms, one of the most considerable collection of lawful document web templates. Use a huge number of specialist and state-certain web templates that fulfill your organization or specific demands and requirements.

Form popularity

FAQ

The average time to close a mortgage ranges from 45 to 60 days, but many will close in less ? about 30 days. This is the amount of time it takes from loan application to ?loan funding,? which is when the new home or refinance loan is officially a done deal.

Once you're approved and getting ready to set a move-in date, you'll need to go through the settlement process of the purchase transaction and mortgage loan. It's important to note that just because your mortgage company created the commitment letter, doesn't mean you shouldn't be able to still back out.

You are not committed to borrowing from a specific lender until you go through the process of signing closing documents and the loan funding has been issued.

A mortgage commitment letter includes the amount being borrowed, the interest rate, and the length of the loan. There will also be conditions attached, such as the requirement to carry homeowner's insurance. A lender can still deny a loan at closing if these conditions have not been met.

The length of the commitment, also known as the rate lock or commitment expiration, will vary by lender, but it's typically 30 days.

#5 ? Title Commitment Date ? The Title Commitment Date is the period in which we need free and clear title for the closing. This could be between 5-15 days prior to closing the loan. #6 ? Closing Date ? The big day! The closing date on the mortgage is the expected day for the loan file to close.