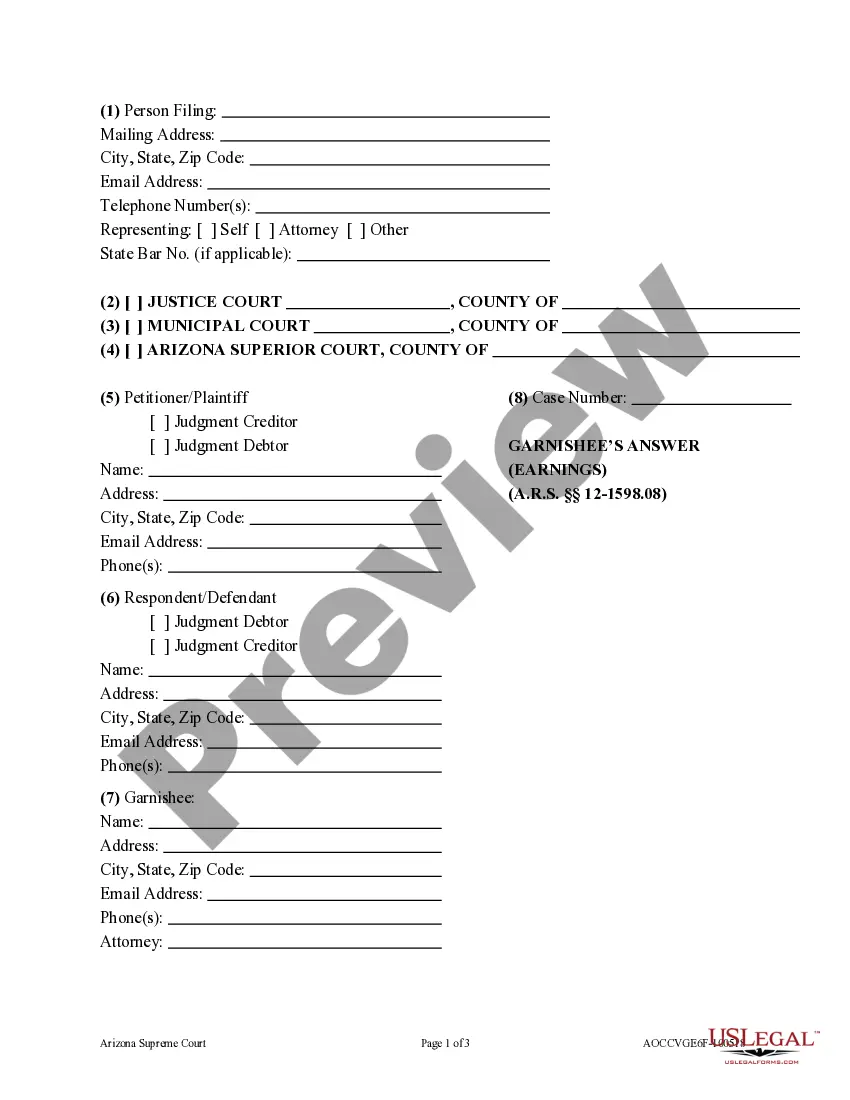

Garnishee Answer: This form is used by the Garnishee to notify the creditor when and how often the debtor is paid. It also informs the debtor of any other garnishments attached to the debtor's paycheck. This form is available in Word or Rich Text format.

Arizona Garnishee Answer

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Garnishee Answer?

If you are looking for accurate Arizona Garnishee Answer templates, US Legal Forms is exactly what you require; discover documents supplied and verified by state-certified legal professionals.

Utilizing US Legal Forms not only spares you from troubles regarding legal documents; it also saves you time, effort, and money! Downloading, printing, and completing a skilled template is much less expensive than hiring an attorney to do it for you.

And that's it. In just a few simple clicks, you will have an editable Arizona Garnishee Answer. After you create an account, all future purchases will be even easier. When you have a US Legal Forms subscription, simply Log In to your profile and then click the Download button found on the form's webpage. Then, when you wish to use this sample again, you will always be able to locate it in the My documents section. Don't waste time sifting through countless forms on multiple platforms. Obtain precise documents from a single secure service!

- To start, complete your registration process by entering your email and creating a password.

- Follow the steps below to set up an account and obtain the Arizona Garnishee Answer template to fulfill your requirements.

- Utilize the Preview feature or review the document details (if available) to ensure that the template is the correct one for your needs.

- Verify its legality in your state.

- Click on Buy Now to place your order.

- Choose a preferred pricing plan.

- Set up an account and pay with your credit card or PayPal.

- Select a suitable format and download the document.

Form popularity

FAQ

To complete a First Answer to Writ of Garnishment Form, start by obtaining the form from a reliable source, such as US Legal Forms. Fill out the necessary information, including your details and the specific garnishment case information. Ensure that you accurately state your position regarding the garnishment, and review the completed form for any errors. Finally, submit the form to the court as required, which can help clarify your role in the garnishment process, ensuring that the Arizona Garnishee Answer reflects your situation effectively.

In Arizona, when a creditor obtains a judgment against a debtor, they may initiate garnishment to collect the owed amount. The garnishment process involves notifying the garnishee, often an employer or financial institution, to withhold funds. The Arizona Garnishee Answer is a crucial document where the garnishee responds to the court about the debtor's assets or income. Using platforms like US Legal Forms can help you navigate this process more efficiently, ensuring compliance with all legal requirements.

To stop wage garnishment in Arizona, you can file a written objection with the court that issued the garnishment. Present valid reasons such as financial hardship or incorrect amounts being deducted. The Arizona Garnishee Answer can guide you through the formalities, helping you create a solid argument. Consulting with a legal professional may also enhance your chances of successfully stopping the garnishment.

In Arizona, creditors can garnish a portion of your wages, but the law protects a significant amount to ensure you can cover essential expenses. Typically, the maximum amount allowed for wage garnishment is 25% of your disposable earnings, which are your earnings after taxes. Referring to the Arizona Garnishee Answer provides clarity on these restrictions. With this knowledge, you can prepare to protect your income while addressing your obligations.

Yes, Arizona is a garnishment state, meaning creditors may legally garnish wages under specific circumstances. In Arizona, a creditor must first obtain a court judgment against you before they can begin garnishment. Knowing your rights is essential, and the Arizona Garnishee Answer can offer insights into how this process works and your options if faced with a creditor's claim. Understanding these laws can empower you to manage your financial situation better.

To quickly stop a wage garnishment, you can file a motion with the court to contest the garnishment. It is crucial to demonstrate that the garnishment is unjust or exceeds legal limits. Utilizing resources, like the Arizona Garnishee Answer, can help you understand the process and prepare your case effectively. Additionally, consulting an attorney may provide you with specific guidance tailored to your situation.

To stop a garnishment in Arizona, you can request a hearing to challenge the garnishment's validity or negotiate a settlement with the creditor. If you demonstrate that the garnishment poses an undue burden, the court may alter or terminate the garnishment. Knowing the procedures and your rights is vital in effectively managing these issues. US Legal Forms offers comprehensive resources to guide you through this process.

The new law regarding garnishment in Arizona includes stricter regulations around what can be garnished and how much. This law aims to protect consumers by providing clearer guidelines on the garnishment process. Staying informed about these changes is essential for anyone facing debt. For detailed updates on current laws and processes, US Legal Forms can be extremely helpful.

To stop wage garnishment in Arizona, you may need to file a motion with the court that issued the garnishment. This often involves showing that the garnishment creates severe financial hardship or that you are making payments towards the debt. It's vital to act swiftly to prevent further deductions from your paycheck. For assistance with the legal process, consider using US Legal Forms.

In Arizona, the maximum wage garnishment is limited to 25% of your disposable earnings after taxes. This applies to most types of debts, making it crucial for employees to understand how their wages may be affected. Additionally, there are certain exemptions that may protect a portion of your income. For more information on calculating your garnishment, US Legal Forms can be a valuable resource.