Indiana What To Do When Starting a New Business

Description

How to fill out What To Do When Starting A New Business?

Are you currently in a position where you require documents for potential business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can rely on can be challenging.

US Legal Forms provides thousands of form templates, such as the Indiana What To Do When Starting a New Business, that are designed to satisfy federal and state regulations.

Once you identify the correct form, simply click Buy now.

Select the pricing plan you want, provide the necessary information to set up your account, and complete the purchase using your PayPal or Visa or MasterCard.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Indiana What To Do When Starting a New Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

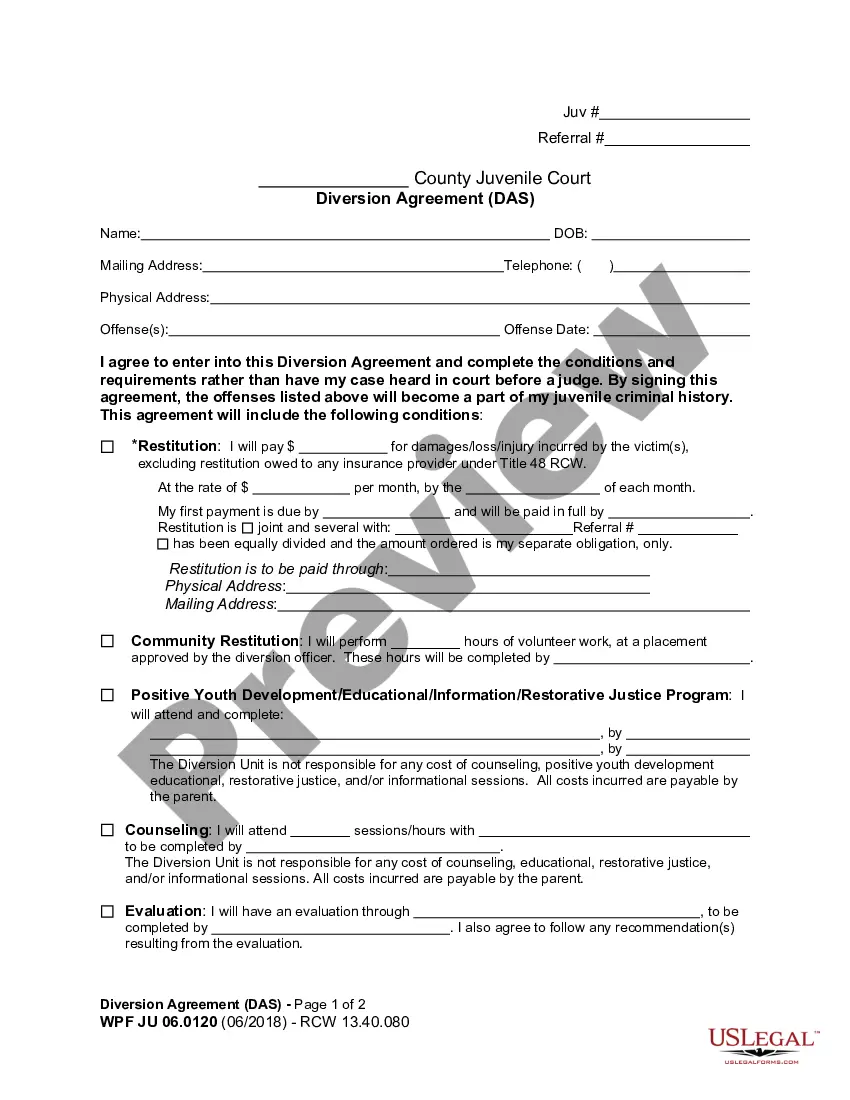

- Use the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that matches your needs.

Form popularity

FAQ

While the state of Indiana doesn't require a general business license, many municipalities require a license at the county or city level. You can check with the local government where you're running your business to see if a license is required.

If you are starting a new business in Indiana, you may need to register with the Indiana Department of Revenue.

If you don't register your business, a bank will not provide you with a business account. Additionally, if you do not register your business, the chances of getting funding from investors (unless they are friends or family) are next to none.

All limited companies must register with Companies House, who will make the company information publicly available on their website. This means companies must provide the details of who their shareholders and directors are, as well as file a copy of their annual financial accounts.

Conduct market research. Market research will tell you if there's an opportunity to turn your idea into a successful business.Write your business plan.Fund your business.Pick your business location.Choose a business structure.Choose your business name.Register your business.Get federal and state tax IDs.More items...

Quick Links. Your sole proprietorship must register with the Indiana Department of Revenue if you meet any requirements that are listed below. Each requirement has a link to the proper information needed for your business.

Most businesses don't make any profit in their first year of business, according to Forbes. In fact, most new businesses need 18 to 24 months to reach profitability.

9 common mistakes to avoid when starting a new businessNeglecting to make a business plan.Inadequate financial preparation and resources.Failing to monitor progress and adjust.Buying assets with your cash flow.Avoiding outside help.Setting the wrong price.Ignoring technology.Neglecting online marketing.More items...

To file the Articles of Incorporation for a corporation in Indiana, you must file your formation documents to the Secretary of State Business Services Division online for a $95 filing fee or by mail for a $100 filing fee.

How much does it cost to start a business in Indiana? To form an LLC in Indiana, file your Articles of Organization with the Indiana Secretary of State along with the $100 filing fee. Forming a corporation in the State of Indiana also costs $100.