Indiana Reorganization of Partnership by Modification of Partnership Agreement

Description

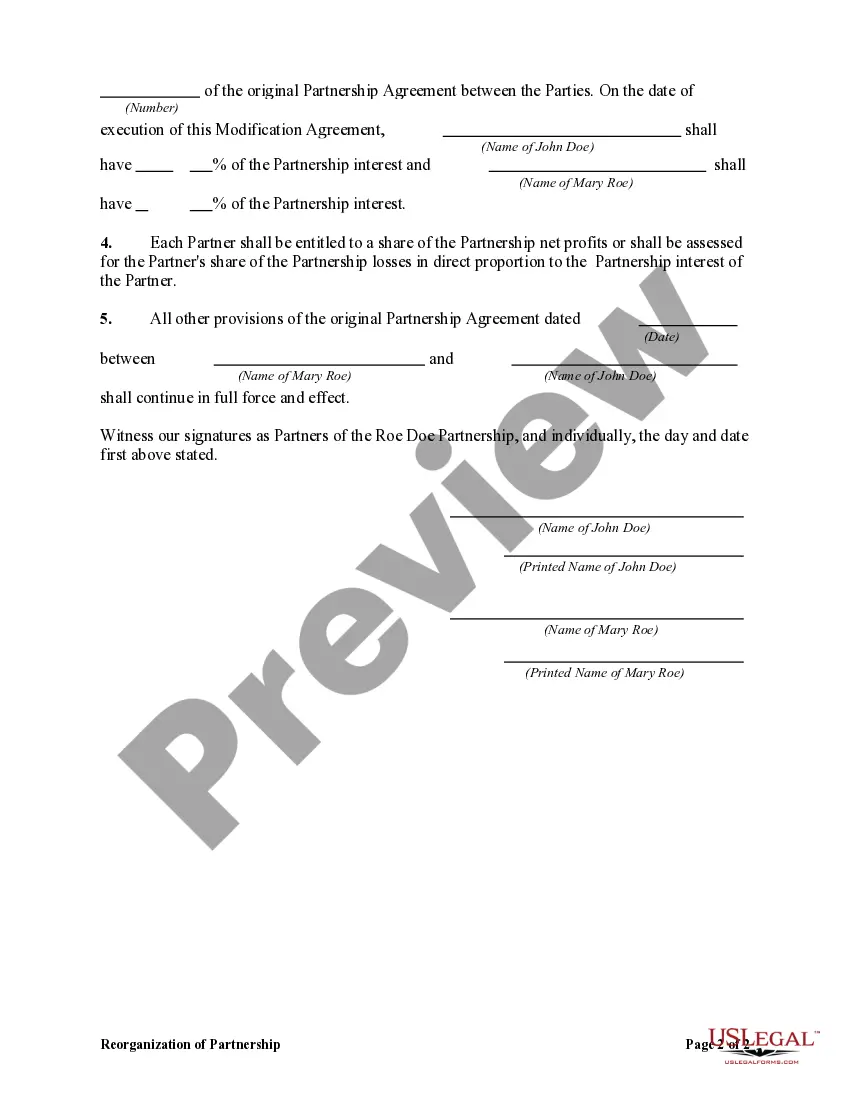

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

You are capable of dedicating several hours online searching for the legal document template that meets the federal and state requirements you will require.

US Legal Forms offers thousands of legal forms that are examined by experts.

You can obtain or create the Indiana Reorganization of Partnership by Modification of Partnership Agreement with my help.

To obtain another version of the form, use the Lookup field to find the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, edit, print, or sign the Indiana Reorganization of Partnership by Modification of Partnership Agreement.

- Every legal document template you download is yours forever.

- To get another copy of a purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for your region/city of choice.

- Review the form outline to ensure you have chosen the appropriate form.

Form popularity

FAQ

A change in a partnership agreement is commonly referred to as a modification or amendment of the partnership agreement. When partners decide to make adjustments to their original terms, this process can be categorized as an Indiana Reorganization of Partnership by Modification of Partnership Agreement. It's essential to document these changes properly to ensure all parties are on the same page and to maintain legal compliance. At US Legal Forms, we provide resources that facilitate this process, helping you navigate partnership modifications with ease.

Addback code 154 in Indiana refers to specific tax-related provisions applicable to partnerships. It primarily concerns the adjustments made to taxable income as part of partnership transactions. Understanding this code is essential for partners dealing with the Indiana Reorganization of Partnership by Modification of Partnership Agreement, as it affects financial reporting and tax implications. For detailed assistance, resources like USLegalForms can provide valuable insights.

A partnership agreement is legally binding if it meets specific criteria, such as clarity on terms, mutual consent, and adherence to state laws. This binding nature ensures that all partners are held accountable to their commitments and obligations. The validity of an agreement is vital in the context of the Indiana Reorganization of Partnership by Modification of Partnership Agreement. You can rely on USLegalForms to help ensure your partnership agreement is legally sound.

Removing a partner from a partnership agreement typically involves a process outlined in the initial agreement. It usually requires consent from all partners and possibly a formal buyout agreement. This procedure is an example of the Indiana Reorganization of Partnership by Modification of Partnership Agreement, which allows for partner transitions. Consulting legal platforms such as USLegalForms can provide the necessary documentation and guidance for this process.

Yes, a partnership agreement can be modified to reflect changes agreed upon by all partners. Successful modifications often require a written document to clearly outline the new terms and conditions. This reflects the principles of the Indiana Reorganization of Partnership by Modification of Partnership Agreement, enabling partnerships to stay relevant and functional. Platforms like USLegalForms can assist in drafting these modifications.

Several factors can void a partnership agreement, including fraud, illegality, or lack of mutual consent among partners. If the agreement violates state laws or fails to fulfill necessary legal requirements, it may not hold up in court. Understanding these risks is vital to ensuring a valid Indiana Reorganization of Partnership by Modification of Partnership Agreement. Consulting with legal resources can help clarify these issues.

Amending a partnership agreement is possible and often necessary as business needs evolve. All partners must consent to the amendments for them to be valid. This aligns with the Indiana Reorganization of Partnership by Modification of Partnership Agreement principles, which emphasize collaboration among partners. USLegalForms provides templates and guidance to make amending your agreement straightforward.

Yes, a partnership agreement can indeed be modified or changed. The process generally requires the consent of all partners involved, ensuring that everyone agrees to the new terms. This modification is an essential aspect of the Indiana Reorganization of Partnership by Modification of Partnership Agreement, allowing the partnership to adapt as needed. Utilizing a platform like USLegalForms can help guide you through this process.

To file an amended Indiana tax return, you need to complete the appropriate form, typically the IT-40 or IT-40PNR, and indicate that you are making an amendment. Ensure you include necessary documentation to support your amendments. This is particularly significant in the context of the Indiana Reorganization of Partnership by Modification of Partnership Agreement, as proper filing can help avoid penalties. You can use platforms like UsLegalForms to access the forms and guidance needed to navigate your amendment efficiently.

Yes, you can amend a partnership return to elect out of the centralized partnership audit regime. This election is made on Form 1065 and must meet specific criteria. It's important to note that executing this correctly aligns with the Indiana Reorganization of Partnership by Modification of Partnership Agreement. Seeking guidance can simplify this process, making it easier for partnerships looking to navigate these regulations.