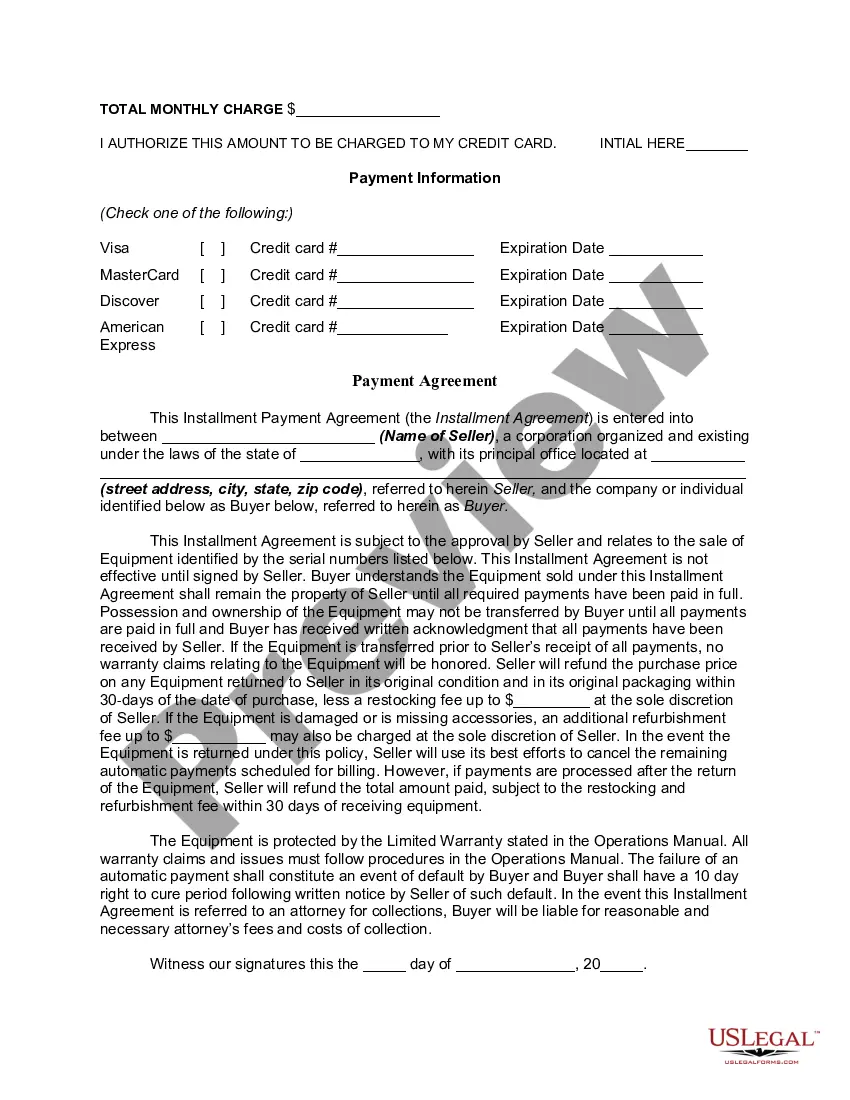

Indiana Installment Payment and Purchase Agreement

Description

How to fill out Installment Payment And Purchase Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal templates that you can download or print.

By using the website, you can discover thousands of templates for business and personal needs, organized by categories, states, or keywords. You can obtain the latest templates like the Indiana Installment Payment and Purchase Agreement in moments.

If you already have an account, Log In and download the Indiana Installment Payment and Purchase Agreement from the US Legal Forms repository. The Download option will appear on every form you access. You can review all previously downloaded templates in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form onto your device. Make edits. Fill out, modify, print, and sign the downloaded Indiana Installment Payment and Purchase Agreement. Every template you added to your account does not have an expiration date and is yours indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Gain access to the Indiana Installment Payment and Purchase Agreement with US Legal Forms, the most extensive repository of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Make sure you have selected the correct form for your city/state.

- Click the Review option to inspect the content of the form.

- Check the form description to confirm you have chosen the appropriate template.

- If the form does not meet your requirements, utilize the Search bar at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Next, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

An Installment Agreement in the United States is an Internal Revenue Service (IRS) program which allows individuals to pay tax debt in monthly payments. The total amount paid can be the full amount of what is owed, or it can be a partial amount.

How to Setup a Payment PlanStep 1 Agree to Terms. The debtor and creditor must come to terms with a payment arrangement that benefits both parties.Step 2 Create a Payment Agreement.Step 3 Begin the Payment Schedule.Step 4 Release the Debtor.

In general, installment plans must be completed within 72 months or less, depending on how much you owe. If you owe $50,000 or less, it's also possible to avoid filing Form 9465 and complete an online payment agreement application instead.

COMPOSITE WITHHOLDING PAYMENTS (FORM IT-6WTH) Amounts withheld from nonresident owners included in the composite return should be remitted. with Form IT-6WTH. Payment is due the 15th day of the 4th month following the close of the pass. through entity's tax period.

The IT-6WTH is a payment voucher that should be submitted to the Indiana Department of Revenue (DOR) only when there is a remittance with the voucher. Why do the IT-65 and IT-20S have both a Total amount of pass-through withholding line and an IT-6WTH line?

The IRS has four different types of installment agreements: guaranteed, streamlined, partial payment, and non-streamlined.

The IRS is still processing requests and installment agreements. Individuals who owe $50,000 or less in combined income tax, penalties and interest and businesses that owe $25,000 or less in payroll tax and have filed all tax returns may qualify for an Online Payment Agreement.

IRS installment agreement basics To qualify, a taxpayer must be currently compliant. A taxpayer is compliant when (1) all required tax returns have been filed, and (2) the taxpayer is up-to-date with current-year tax obligations.

When setting up your payment agreement:Review your customers history before you call.Have two or more options for payment arrangements in mind before the call.Repeat everything to the customer.Get it in writing and have your customer sign it.Follow up and follow up.

Every payment plan is individual to the customer. This means that you can work with your customers to create payment plans that work for both parties. Once the payment plan has been approved, the most efficient thing to do is set up automatic payments or automatic invoicing.