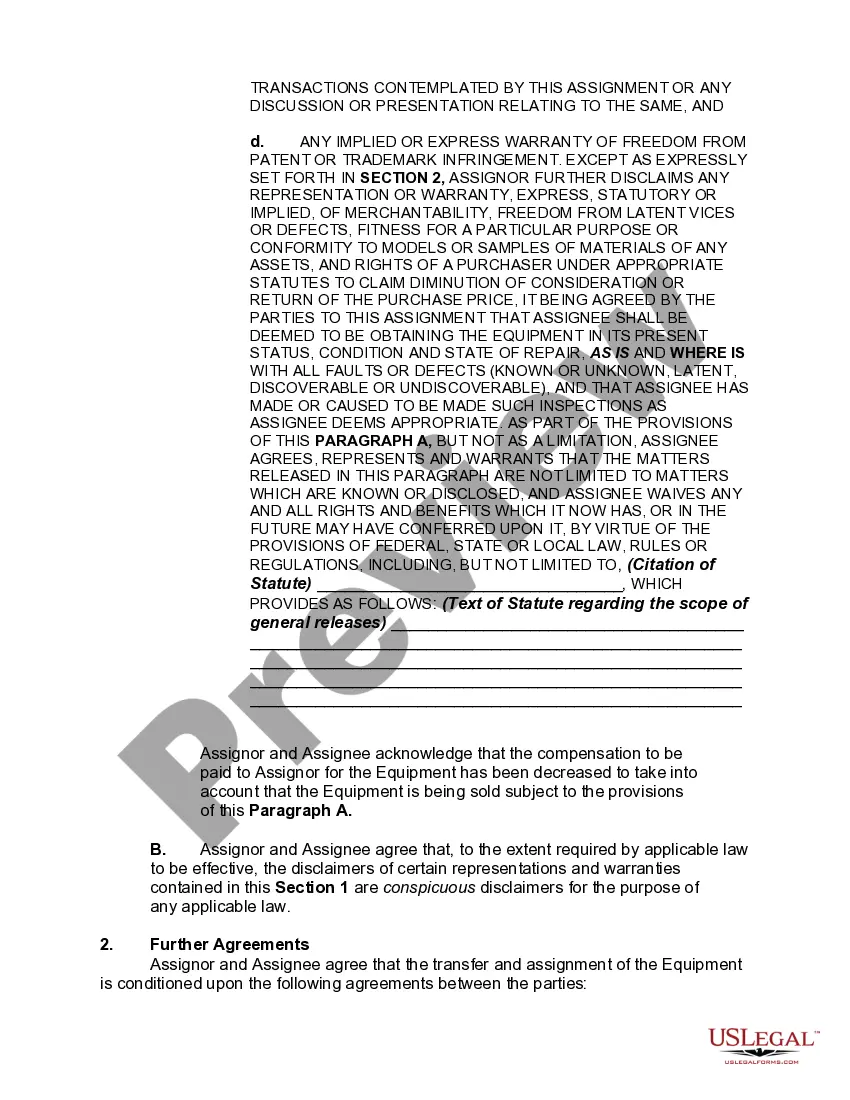

Indiana Assignment and Bill of Sale of Equipment and Machinery

Description

How to fill out Assignment And Bill Of Sale Of Equipment And Machinery?

If you need to finalize, obtain, or print valid document templates, utilize US Legal Forms, the premier collection of lawful forms available online.

Take advantage of the website's straightforward and user-friendly search function to locate the documents you need.

Various templates for commercial and personal purposes are categorized by genre and tags, or keywords.

Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other forms in the legal template format.

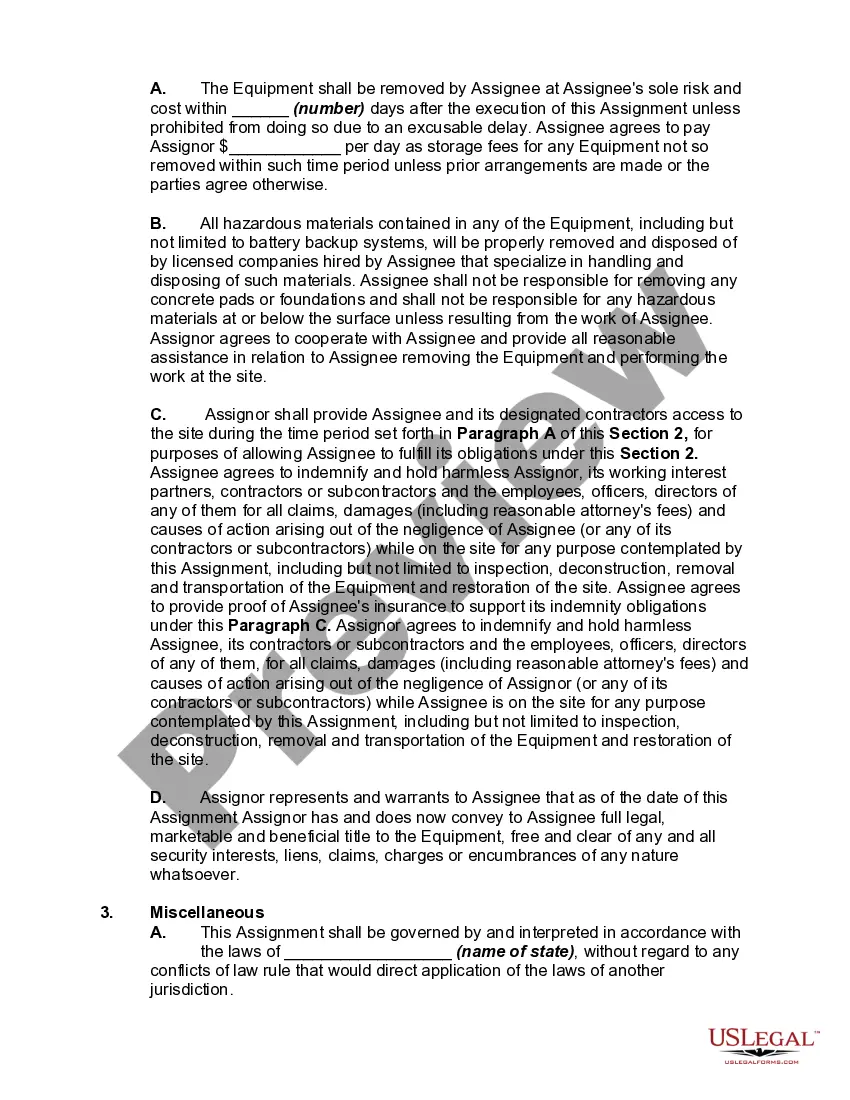

Step 4. After locating the form you need, select the Purchase now button. Choose your desired pricing plan and enter your credentials to create an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, review, and print or sign the Indiana Assignment and Bill of Sale of Equipment and Machinery.

- Leverage US Legal Forms to retrieve the Indiana Assignment and Bill of Sale of Equipment and Machinery with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and hit the Download button to access the Indiana Assignment and Bill of Sale of Equipment and Machinery.

- You can also access forms you previously acquired in the My documents section of your account.

- If you’re utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to browse through the contents of the form. Don't forget to read the details.

Form popularity

FAQ

To write an effective bill of sale, start by including the date, names, and addresses of both the buyer and seller. Clearly describe the equipment, including serial numbers, if applicable, and outline the payment terms. Utilizing templates available on platforms like US Legal Forms can make drafting your Indiana Assignment and Bill of Sale of Equipment and Machinery straightforward and compliant with state laws.

While a bill of sale confirms the transaction, it does not automatically give title to the business equipment. To legally transfer ownership, both parties may need to complete additional paperwork, such as a title transfer form. Therefore, along with the Indiana Assignment and Bill of Sale of Equipment and Machinery, ensure you review the legal requirements for title transfer in Indiana.

A bill of sale does not serve as a title; rather, it acts as a receipt or proof of the transaction. The Indiana Assignment and Bill of Sale of Equipment and Machinery is crucial in confirming the sale between parties but does not transfer ownership in the same way a title does. To assert ownership, a title transfer may still be necessary depending on the type of equipment and local regulations.

Reporting the sale of business equipment involves documenting the transaction properly for tax and legal purposes. You should retain a copy of the Indiana Assignment and Bill of Sale of Equipment and Machinery as proof of the sale. It is advisable to report the sale on your business taxes, indicating any gain or loss resulting from the sale, as this can affect your overall tax liability.

A bill of sale becomes legitimate when it contains essential elements such as the names and addresses of both the buyer and seller, a detailed description of the equipment or machinery, and the terms of the sale. In the context of the Indiana Assignment and Bill of Sale of Equipment and Machinery, it is also vital to include the signature of both parties for validation. Additionally, having the document notarized can further strengthen its legitimacy and protect both parties' interests.

In Indiana, a bill of sale is generally not required to be notarized for most transactions. However, having it notarized can provide an extra layer of protection and validation for both parties. When dealing with the Indiana Assignment and Bill of Sale of Equipment and Machinery, it may be wise to consider notarization if you seek added security. Our platform offers resources to assist you in understanding your options.

Yes, you can create a handwritten bill of sale in Indiana. A written document can suffice as long as it clearly outlines the details of the transaction, including the items sold and both parties' signatures. However, for the Indiana Assignment and Bill of Sale of Equipment and Machinery, ensure that all necessary legal aspects are covered. Using a template from our platform may simplify this process.

To fill out a bill of sale consideration in Indiana, state the amount the buyer owes for the equipment or machinery. Be clear and specific; include any other terms related to the transaction, such as payment methods or additional conditions. This clarity ensures smooth transactions and reduces misunderstandings.

An assignment is not the same as a sale; while both involve transferring rights, an assignment focuses on rights over an item, and a sale involves transferring ownership. Through an Indiana Assignment and Bill of Sale of Equipment and Machinery, you can clarify the transitions of both rights and ownership in a single transaction.

An Indiana Bill of Sale of Equipment and Machinery provides evidence that a transaction has occurred, but it does not automatically grant title. Title is usually obtained through the appropriate state registration process. Ensure both documents are in place for a complete ownership transfer.