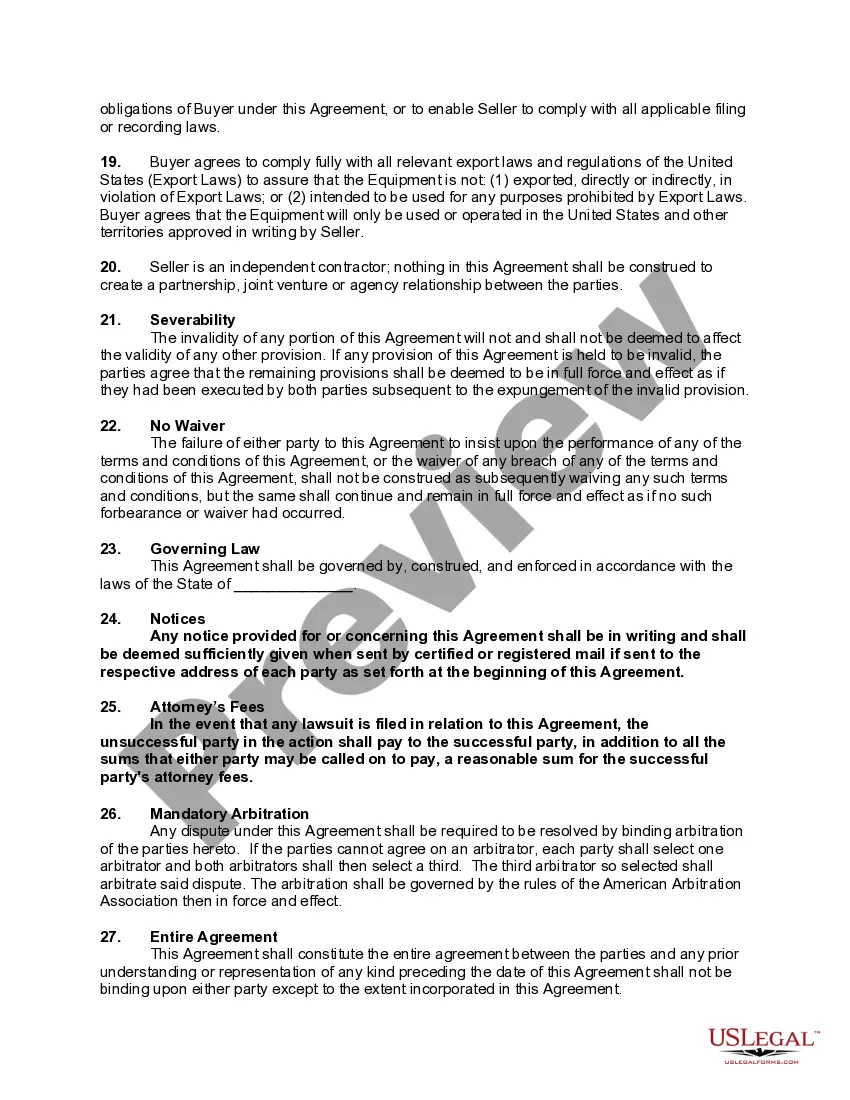

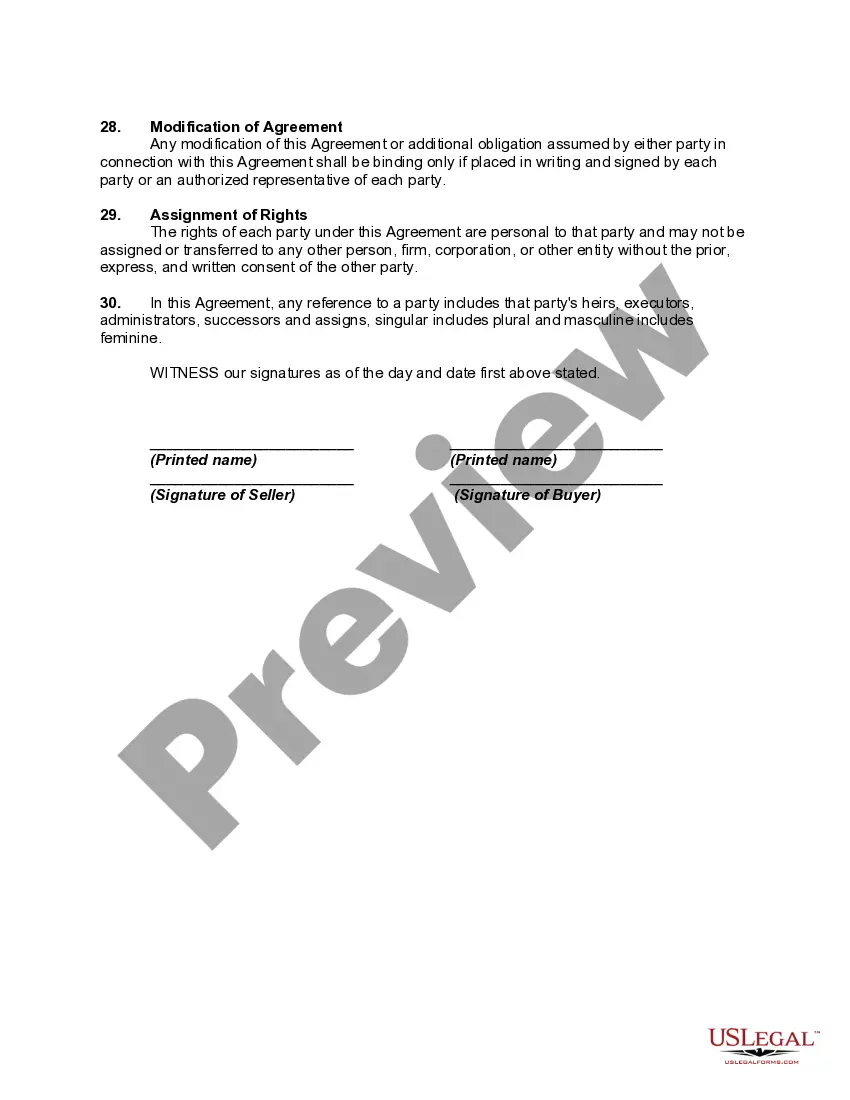

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana Agreement for Sale Equipment and Related Software

Description

How to fill out Agreement For Sale Equipment And Related Software?

Finding the appropriate legitimate document template can be challenging.

Of course, there are numerous templates available online, but how can you identify the correct form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Indiana Agreement for Sale Equipment and Related Software, which can be utilized for both business and personal needs.

You can preview the form using the Preview button and review the form summary to confirm it is suitable for you.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Indiana Agreement for Sale Equipment and Related Software.

- Use your account to review the legal forms you have previously downloaded.

- Go to the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward instructions for you to follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

Generally, a sales agreement does not need to be notarized to be valid; however, certain situations may require notarization for added legal assurance. It is wise to check local laws regarding specific agreements, particularly for significant transactions like those concerning equipment. Although notarization is not typically a requirement for the Indiana Agreement for Sale Equipment and Related Software, consulting a legal professional can provide clarity based on your unique circumstances.

To write a simple contract agreement, focus on clarity and brevity. Clearly state the parties involved, the purpose of the agreement, and the obligations of each party. It's helpful to formulate your agreement based on proven frameworks, like the Indiana Agreement for Sale Equipment and Related Software, which can guide you in crafting clear and enforceable terms.

Writing a sales agreement involves outlining the key details of the transaction clearly. Start with identifying the buyer and seller, and provide a description of the equipment or services sold. Include payment terms, delivery instructions, and any conditions for the sale. Referencing an Indiana Agreement for Sale Equipment and Related Software template can simplify this process and ensure you cover all necessary points.

Filling out a contractor agreement requires you to enter specific information about the contractor and the project. Include the scope of work, deadlines, payment details, and any liabilities. You can also reference the Indiana Agreement for Sale Equipment and Related Software for guidance on how to incorporate terms that protect both parties. This ensures clarity and mutual understanding.

Certain types of software may be exempt from Indiana personal property tax, but it largely depends on how the software is utilized. When formalizing your Indiana Agreement for Sale Equipment and Related Software, be attentive to the classification of the software in tax terms. Understanding these exemptions can lead to significant savings for your business.

Yes, software can be subject to Indiana personal property tax based on its classification and use. When drafting your Indiana Agreement for Sale Equipment and Related Software, this consideration can influence financial terms. It’s important to consult with tax professionals to navigate these complexities effectively.

In Indiana, digital products are generally subject to sales tax, just like tangible products. This rule applies especially when you engage in an Indiana Agreement for Sale Equipment and Related Software. Understanding how these regulations affect your sales can help you maintain compliance and avoid tax-related surprises.

To obtain a seller's permit in Indiana, you need to register your business with the Indiana Department of Revenue. This process is essential for anyone planning to enter into an Indiana Agreement for Sale Equipment and Related Software. An active seller’s permit allows you to legally collect sales tax on any taxable goods, including software.

Yes, in Indiana, software is typically subject to sales tax when it is delivered in a tangible format or downloaded by the end user. This is relevant when creating an Indiana Agreement for Sale Equipment and Related Software, as it ensures that all tax obligations are met. Be sure to clarify the tax implications to avoid potential issues.

Indiana personal property tax applies to tangible items, including equipment and certain types of personal property. When drafting your Indiana Agreement for Sale Equipment and Related Software, consider that both physical equipment and certain data processing software might be subject to this tax, affecting your financial planning.