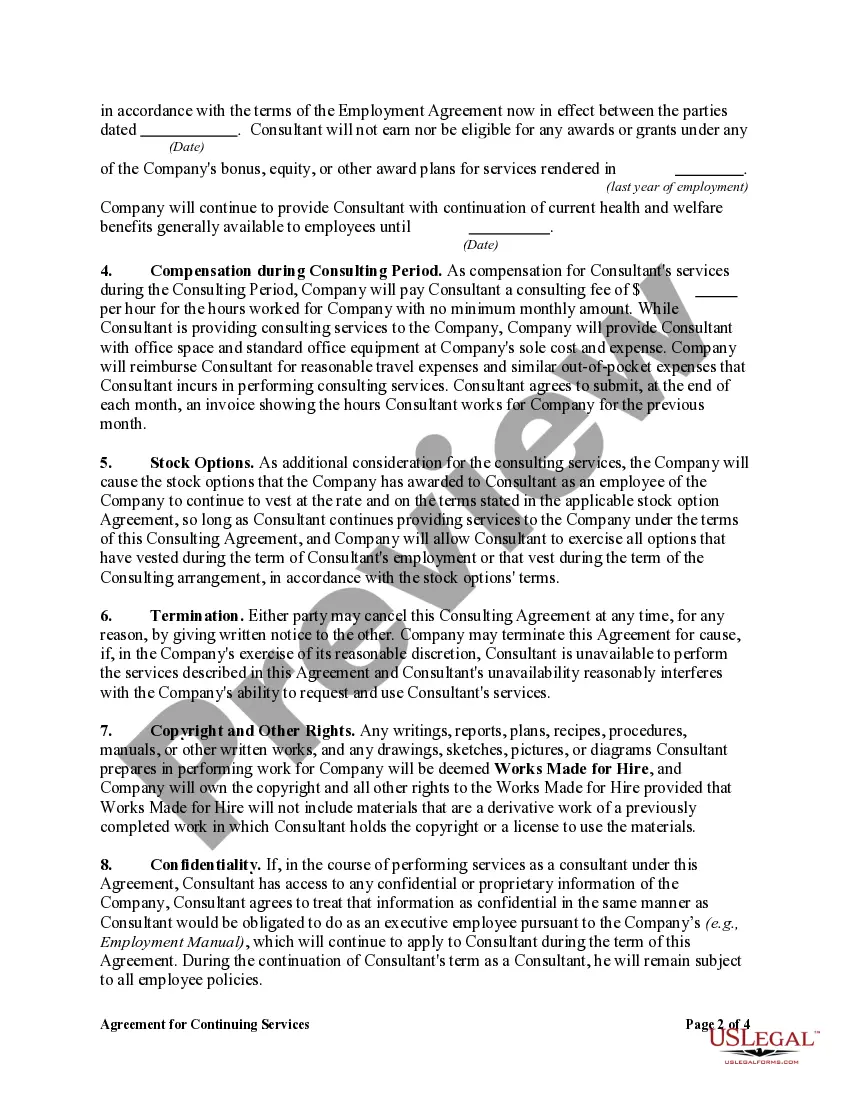

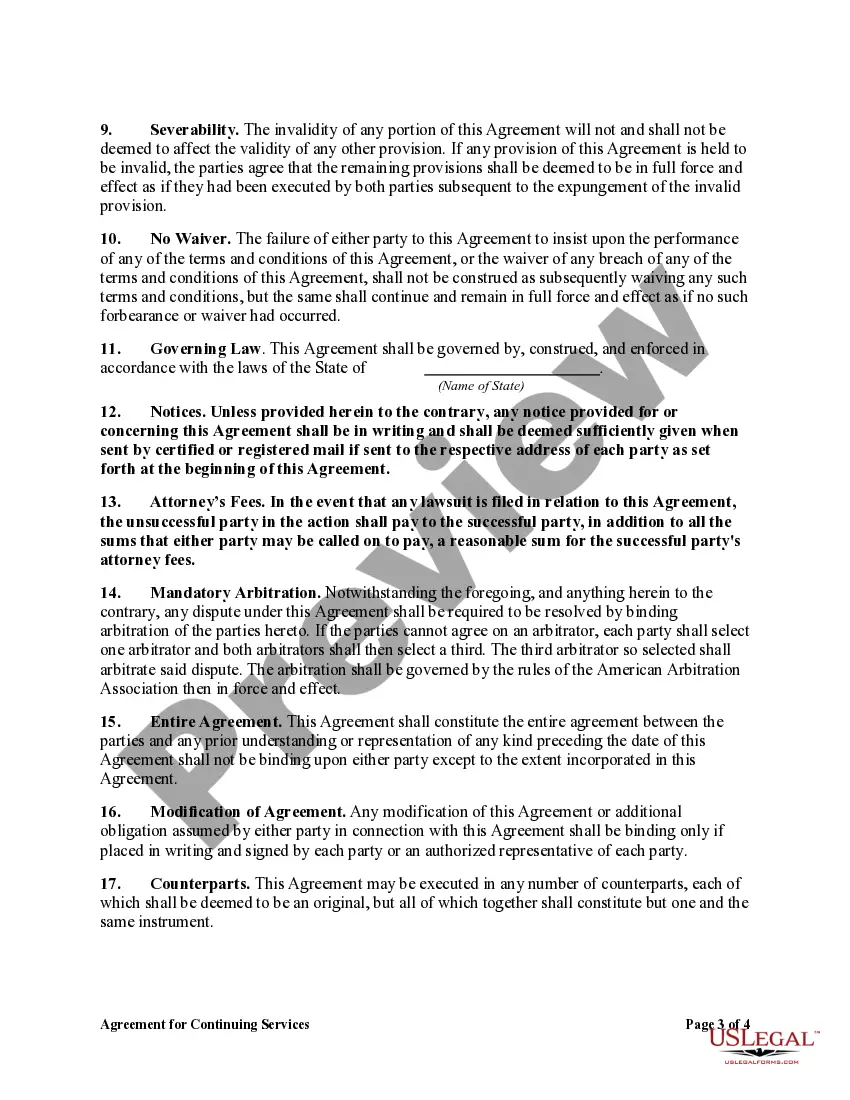

Indiana Agreement for Continuing Services of Retiring Executive Employee as a Consultant

Description

How to fill out Agreement For Continuing Services Of Retiring Executive Employee As A Consultant?

It is feasible to utilize the Internet to seek the legal document template that fulfills the state and federal requirements you require.

US Legal Forms offers a vast array of legal templates that can be evaluated by professionals.

You can easily obtain or generate the Indiana Agreement for Continuing Services of Retiring Executive Employee as a Consultant from our service.

If available, use the Review button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Download button.

- Subsequently, you can fill out, modify, print, or sign the Indiana Agreement for Continuing Services of Retiring Executive Employee as a Consultant.

- Each legal document template you purchase becomes your property indefinitely.

- To receive another copy of the acquired form, navigate to the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple directions below.

- First, make sure you have selected the correct document template for the region/area of your choice.

- Review the form description to confirm you have chosen the appropriate document.

Form popularity

FAQ

A service agreement generally focuses on the provision of specific services, while a consultancy agreement encompasses a broader range of advisory roles and expert guidance. While both agreements are essential for establishing professional relationships, consultancy agreements are typically more detailed and multifaceted. The Indiana Agreement for Continuing Services of Retiring Executive Employee as a Consultant serves as a perfect example of a consultancy agreement, detailing the executive's advisory role post-retirement.

A continuing service agreement is a type of contract that allows an entity to retain the services of an individual or organization over a specified period. This arrangement helps ensure ongoing support and service delivery. When utilizing an Indiana Agreement for Continuing Services of Retiring Executive Employee as a Consultant, it formalizes the executive's role and the support they provide following retirement.

A contract is a formal agreement between two parties that outlines specific terms and conditions, while a Master Service Agreement (MSA) serves as a foundational contract that governs future agreements between the same parties. An MSA typically provides overarching terms that streamline future contractual discussions. When dealing with the Indiana Agreement for Continuing Services of Retiring Executive Employee as a Consultant, understanding these distinctions can help clarify your legal commitments.

To write a consultancy agreement, you should identify the services being offered and outline the terms of engagement, including payment details and project timelines. Begin by introducing both parties, then clearly articulate the scope of work and any specific expectations. Uslegalforms can guide you through creating an Indiana Agreement for Continuing Services of Retiring Executive Employee as a Consultant that meets both parties' needs.

A CES agreement, or Continuing Executive Services agreement, formalizes the ongoing relationship between a retiring executive and their employer in a consulting capacity. It provides structure for work dynamics and delineates the consultant's responsibilities after retirement. This type of agreement is particularly relevant in the Indiana Agreement for Continuing Services of Retiring Executive Employee as a Consultant, offering both parties security and clarity.

A consulting services agreement is a contract between a consultant and a client detailing the scope of work, timelines, and payment terms. This type of agreement is essential for establishing the professional framework for a consultant's role. In the Indiana Agreement for Continuing Services of Retiring Executive Employee as a Consultant, such an agreement sets clear expectations for the executive's contributions during their consultancy.

The purpose of a service agreement is to outline the specifics of the services to be provided by one party to another. It defines the expectations, responsibilities, and compensation for the services rendered. In an Indiana Agreement for Continuing Services of Retiring Executive Employee as a Consultant, it ensures that both parties understand their obligations, thereby fostering a positive working relationship.

A continuing agreement refers to a legal contract that allows an executive to maintain a formal relationship with their previous employer after retirement. In the context of the Indiana Agreement for Continuing Services of Retiring Executive Employee as a Consultant, it facilitates ongoing collaboration and support. This agreement ensures clarity on the roles and responsibilities of the retiring executive in their new consultancy capacity.