Indemnification is the act of making another "whole" by paying any loss another might suffer. This usually arises from a clause in a contract where a party agrees to pay for any monetary damages which arise or have arisen.

Indiana Indemnification of Purchaser of Personal Property from Estate

Description

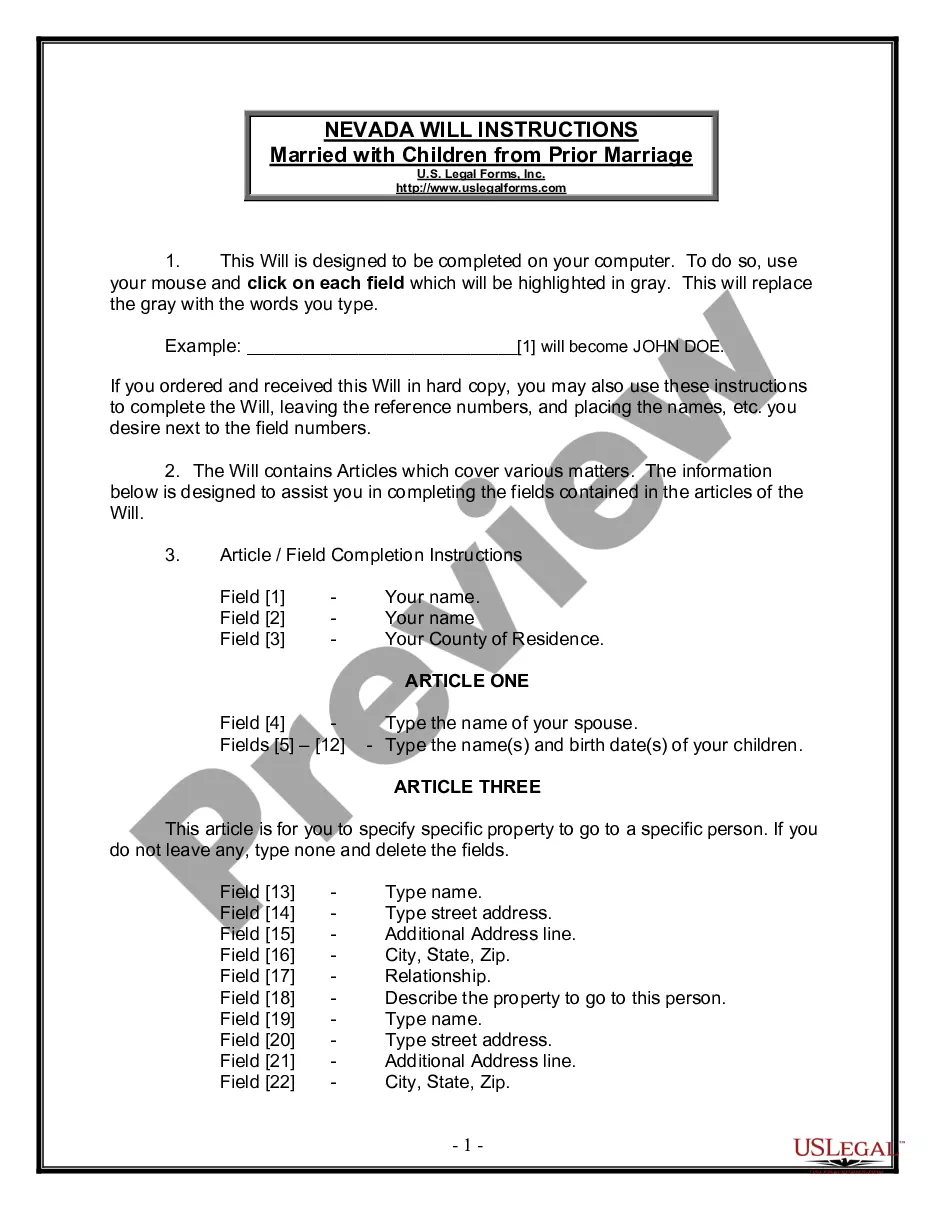

How to fill out Indemnification Of Purchaser Of Personal Property From Estate?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, suggestions, or keywords. You can find the latest versions of forms like the Indiana Indemnification of Purchaser of Personal Property from Estate within seconds.

If you already have an account, Log In to download the Indiana Indemnification of Purchaser of Personal Property from Estate from the US Legal Forms library. The Download button will be available on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Edit. Fill out, modify, and print and sign the downloaded Indiana Indemnification of Purchaser of Personal Property from Estate.

Every template you add to your account has no expiration date and is yours indefinitely. If you wish to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Indiana Indemnification of Purchaser of Personal Property from Estate with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you're using US Legal Forms for the first time, here are straightforward instructions to help you get started.

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the content of the form. Check the form description to make sure you've chosen the right one.

- If the form doesn't meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select your preferred pricing plan and provide your details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

- Select the format and download the form to your device.

Form popularity

FAQ

In Indiana, you typically have up to 18 months from the date of the decedent's death to file a claim against the estate. This timeframe is crucial for creditors and interested parties who wish to assert their rights. When dealing with claims, the Indiana Indemnification of Purchaser of Personal Property from Estate can provide valuable insights and support, ensuring you navigate the legal procedures effectively.

Certain assets in Indiana bypass probate, including life insurance policies, 401(k) accounts, and property held in trust. Additionally, assets owned jointly with rights of survivorship are directly transferred to the surviving owner. Understanding the Indiana Indemnification of Purchaser of Personal Property from Estate can enhance your estate planning and asset management strategy.

Beneficiaries can avoid probate in Indiana by utilizing strategies such as establishing joint ownership or using payable-on-death accounts. Utilizing trusts is another effective way to sidestep probate. Additionally, the Indiana Indemnification of Purchaser of Personal Property from Estate can help guide estate planning, ensuring that assets transfer smoothly without the lengthy probate process.

Not all estates in Indiana must go through probate. Some small estates can qualify for a simplified process or may not require probate at all. However, when dealing with the Indiana Indemnification of Purchaser of Personal Property from Estate, understanding probate's role is crucial. It allows for the orderly distribution of assets while protecting legal rights.

To write an indemnification clause, begin by clearly identifying the parties and the nature of the transaction. Then articulate what the purchaser agrees to indemnify the seller against. In Indiana indemnification of purchaser of personal property from estate scenarios, specificity in your terms will provide clarity and avoid potential misunderstandings.

Standard indemnity wording often includes phrases such as 'the purchaser agrees to indemnify and hold harmless' and specifies the claims covered. This language should clearly define any limitations or conditions. In the case of Indiana indemnification of purchaser of personal property from estate, using standard wording can help reduce ambiguities for both parties.

A standard letter of indemnity includes key details such as the transaction reference, parties involved, and specific claims being indemnified against. It serves as a formal agreement between the buyer and seller. When dealing with Indiana indemnification of purchaser of personal property from estate, utilizing a standard format can simplify the process and protect all parties.

A reasonable indemnity clause includes clear terms that specify what liabilities are covered and the extent of the indemnification. It should balance protecting the interests of both parties without being overly burdensome. For Indiana indemnification of purchaser of personal property from estate, a reasonable clause ensures fairness and clarity in liability.

The wording of an indemnity clause typically includes a statement that the purchaser agrees to indemnify and hold harmless the seller from any claims related to the purchased property. In Indiana indemnification of purchaser of personal property from estate, it is crucial to clearly articulate the scope and limits of the indemnification. This clarity protects both the buyer and seller.

To fill out a letter of indemnity, you should clearly state the parties involved, specify the transaction related to Indiana indemnification of purchaser of personal property from estate, and provide the details of the indemnity agreement. Ensure you outline the responsibilities and liabilities of both parties. Lastly, make sure to sign and date the letter to validate it.