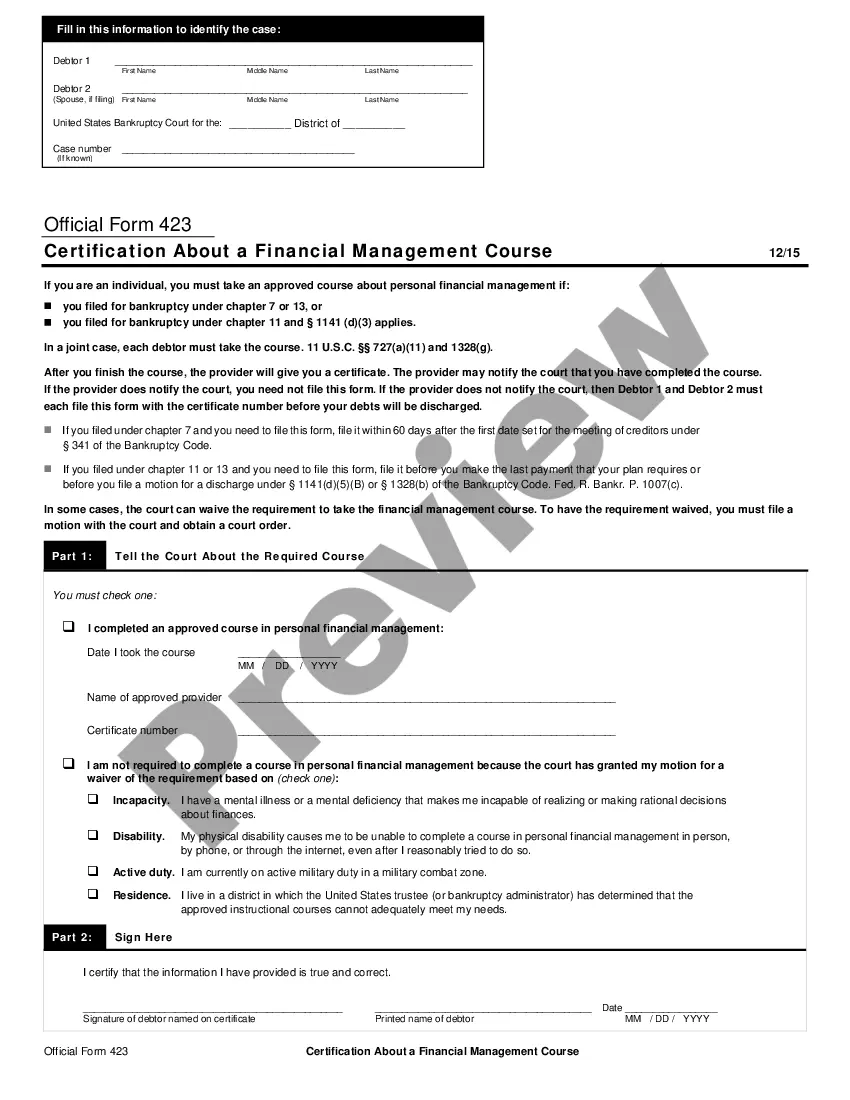

Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information. If such a request is made and is received within 60 days after the consumer learned of the adverse action, the user, within a reasonable period of time, must disclose to the consumer the nature of the information.

Indiana Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency

Description

How to fill out Notice Of Increase In Charge For Credit Based On Information Received From Person Other Than Consumer Reporting Agency?

Are you presently in the placement the place you will need documents for sometimes organization or person uses almost every time? There are tons of authorized papers layouts available online, but discovering kinds you can rely isn`t simple. US Legal Forms provides thousands of develop layouts, such as the Indiana Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency, that are published to fulfill federal and state specifications.

When you are currently informed about US Legal Forms website and have a merchant account, just log in. Following that, it is possible to obtain the Indiana Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency format.

If you do not have an accounts and want to start using US Legal Forms, abide by these steps:

- Get the develop you need and make sure it is for that correct metropolis/county.

- Utilize the Review key to analyze the form.

- See the outline to ensure that you have selected the correct develop.

- If the develop isn`t what you`re trying to find, take advantage of the Research industry to obtain the develop that meets your requirements and specifications.

- Whenever you get the correct develop, click Purchase now.

- Choose the costs program you desire, fill out the desired information to make your account, and pay money for the order making use of your PayPal or credit card.

- Pick a convenient file formatting and obtain your copy.

Discover each of the papers layouts you might have bought in the My Forms food list. You can get a additional copy of Indiana Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency at any time, if required. Just select the essential develop to obtain or print out the papers format.

Use US Legal Forms, the most extensive variety of authorized forms, in order to save some time and avoid errors. The support provides expertly made authorized papers layouts that you can use for a selection of uses. Produce a merchant account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

Risk-based pricing occurs when lenders offer different interest rates and loan terms to borrowers, based on individual creditworthiness. The Risk-Based Pricing Rule requires you to notify consumers if they are getting worse terms because of information in their credit report.

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.

Lenders sometimes send you an Adverse Action Notice when they are unable to present any offers after you share additional information with them. Lenders often standardize these documents, so it might say you applied for something even if you didn't.

Section 623(a) of the FCRA also requires a person who regularly furnishes information to CRAs to promptly notify a CRA if the person determines the previously furnished information is not complete or accurate.

A Credit Score Disclosure alerts a consumer of their FICO scores, defines what a FICO is, informs how FICO scores affect their access to consumer credit and provides contact information for the bureaus.

An adverse action notice is an explanation that issuers must give you if you're denied credit ? or if you're given less favorable financing terms ? based on your credit history. You may also get an adverse action notice if your credit is a reason an employer turns you down for a job.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them. You are entitled to a free credit report if: 1.

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.