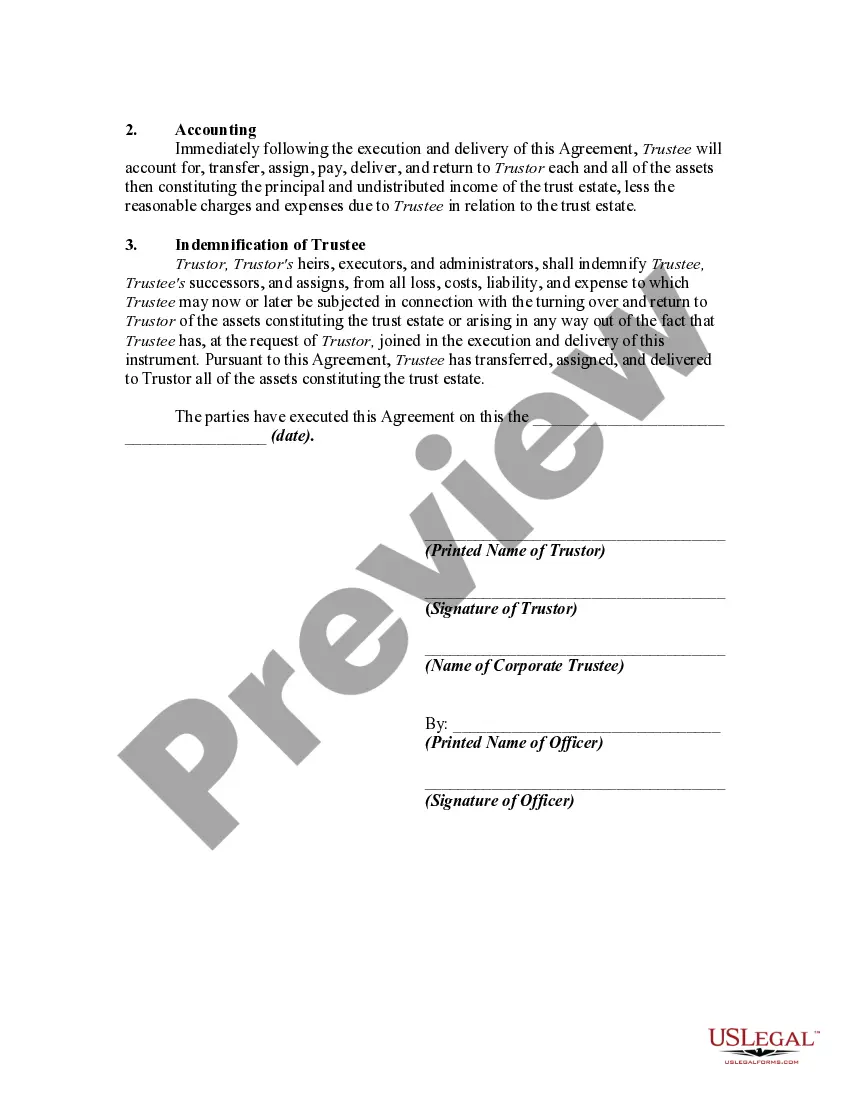

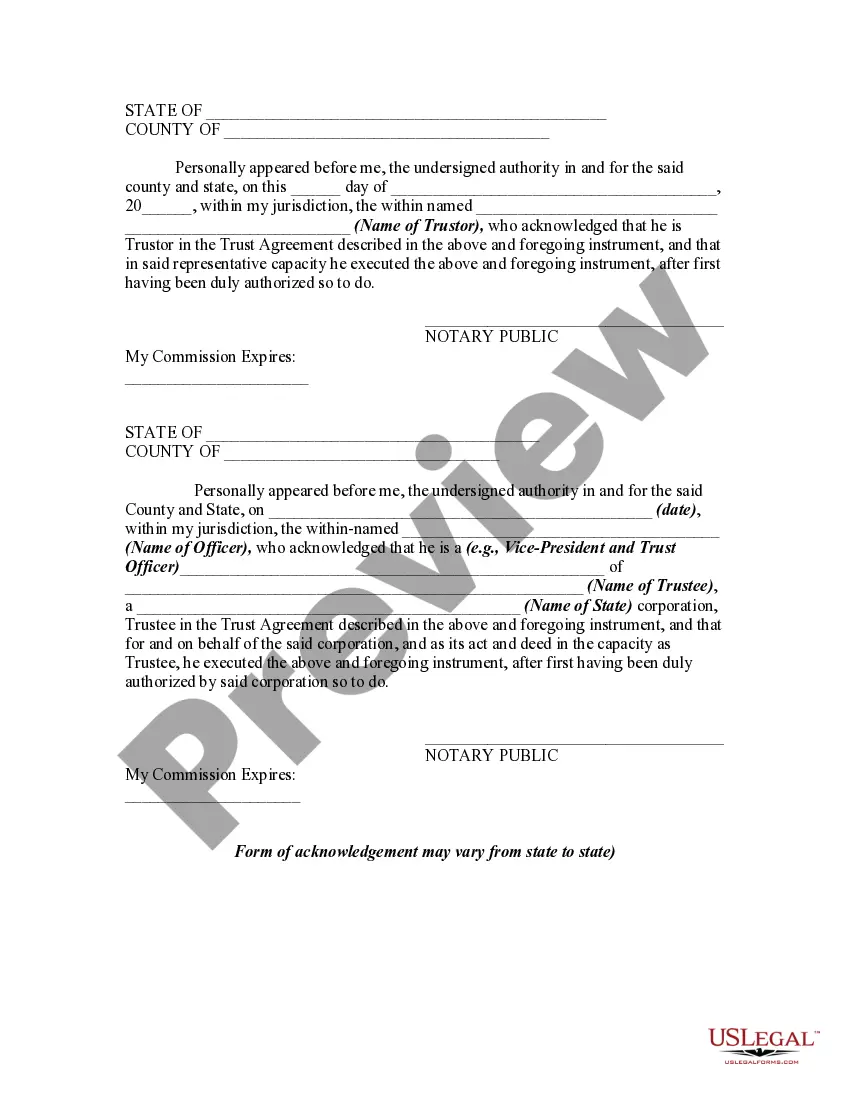

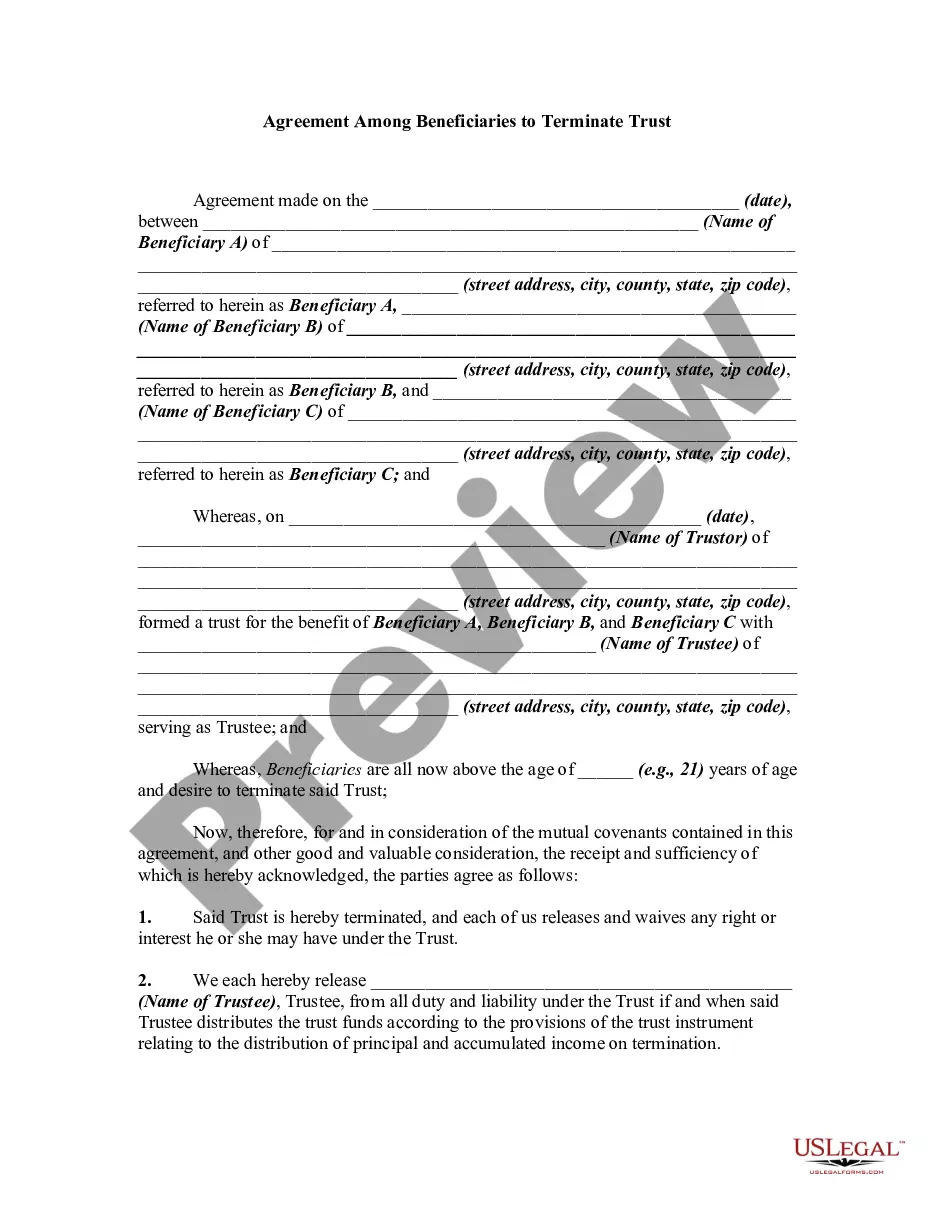

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, since the beneficiary of a trust has disclaimed any rights he has in the trust, the trustor and trustee are terminating the trust.

Indiana Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary

Description

How to fill out Agreement Between Trustor And Trustee Terminating Trust After Disclaimer By Beneficiary?

If you require to compile, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's straightforward and convenient search feature to find the documents you seek.

Various templates for business and personal purposes are organized by categories and states, or by keywords and phrases.

Step 3. If you are dissatisfied with the form, use the Search section at the top of the screen to find other versions of the legal form template.

Step 4. Once you have found the form you require, click the Acquire now button. Choose your preferred pricing plan and enter your credentials to sign up for the account.

- Use US Legal Forms to locate the Indiana Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Indiana Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's details. Be sure to read the description.

Form popularity

FAQ

Yes, a trust beneficiary can disclaim a distribution, which means they choose to refuse the benefits provided in the trust. This may be applicable in cases involving the Indiana Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, where the beneficiary’s decision can significantly impact asset distribution. It’s essential for beneficiaries to understand the implications of disclaiming and consider consulting a legal professional before making a decision.

Determining whether to put assets in a trust depends on individual financial and family circumstances. An Indiana Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary provides certain benefits, such as avoiding probate and ensuring asset protection. However, it is vital to assess if this approach aligns with your parents' goals. Consulting a legal expert can provide tailored advice based on their situation.

While putting assets in a trust offers protection, there can be downsides like loss of direct control over those assets. With an Indiana Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, managing the trust may become complex for both the trustee and the beneficiaries. This can lead to administrative burdens or unexpected tax implications. It's wise to discuss these factors with a financial advisor or legal expert before establishing a trust.

One significant mistake parents make is neglecting to clearly define their intentions and terms in the trust. Without a well-structured Indiana Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, beneficiaries can be left confused about their roles and entitlements. Additionally, lacking communication about the trust's existence or purpose can lead to conflict among family members. Open conversations about the trust can help avoid misunderstandings.

A trust fund carries various risks, including potential mismanagement or disputes among beneficiaries. When dealing with an Indiana Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, unclear terms can lead to misunderstandings about asset distribution. Furthermore, if a trustee does not act according to the trust's terms, beneficiaries may face challenges in securing their intended inheritance. Consulting with legal professionals can help mitigate these risks.

Having a trust can sometimes lead to complications regarding control and management of assets. In particular, the Indiana Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can create confusion if not managed properly. Beneficiaries may feel sidelined or excluded from decision-making. It's essential to ensure clear communication and structured guidelines to avoid potential disputes.

Shutting down a trust involves a detailed process that requires careful consideration of the trust's terms. You typically need to notify the beneficiaries and distribute the trust assets accordingly. Utilizing an Indiana Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can help clarify the termination process, making sure all legal requirements are met and the trust is properly closed.

Bringing a trust to an end requires following the legal guidelines set out in its agreement. Begin with assessing whether conditions for termination are met, such as the expiration of a term or beneficiary consent. Engaging in an Indiana Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can provide a smooth process, ensuring all procedures are correctly followed and minimizing potential disputes.

A trust can be terminated in three primary ways. First, it can end upon reaching a specified term outlined in the trust agreement. Second, mutual consent from the trustor and beneficiaries can lead to termination. Lastly, an Indiana Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary also offers a structured process for termination, ensuring all parties' agreements are documented.

Closing a trust in Indiana involves several vital steps. First, you should review the trust agreement to understand the terms specified for termination. Next, gather all necessary documentation to confirm the assets are distributed according to the Indiana Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary. Finally, formally notify beneficiaries and ensure the trust has satisfied any remaining obligations.