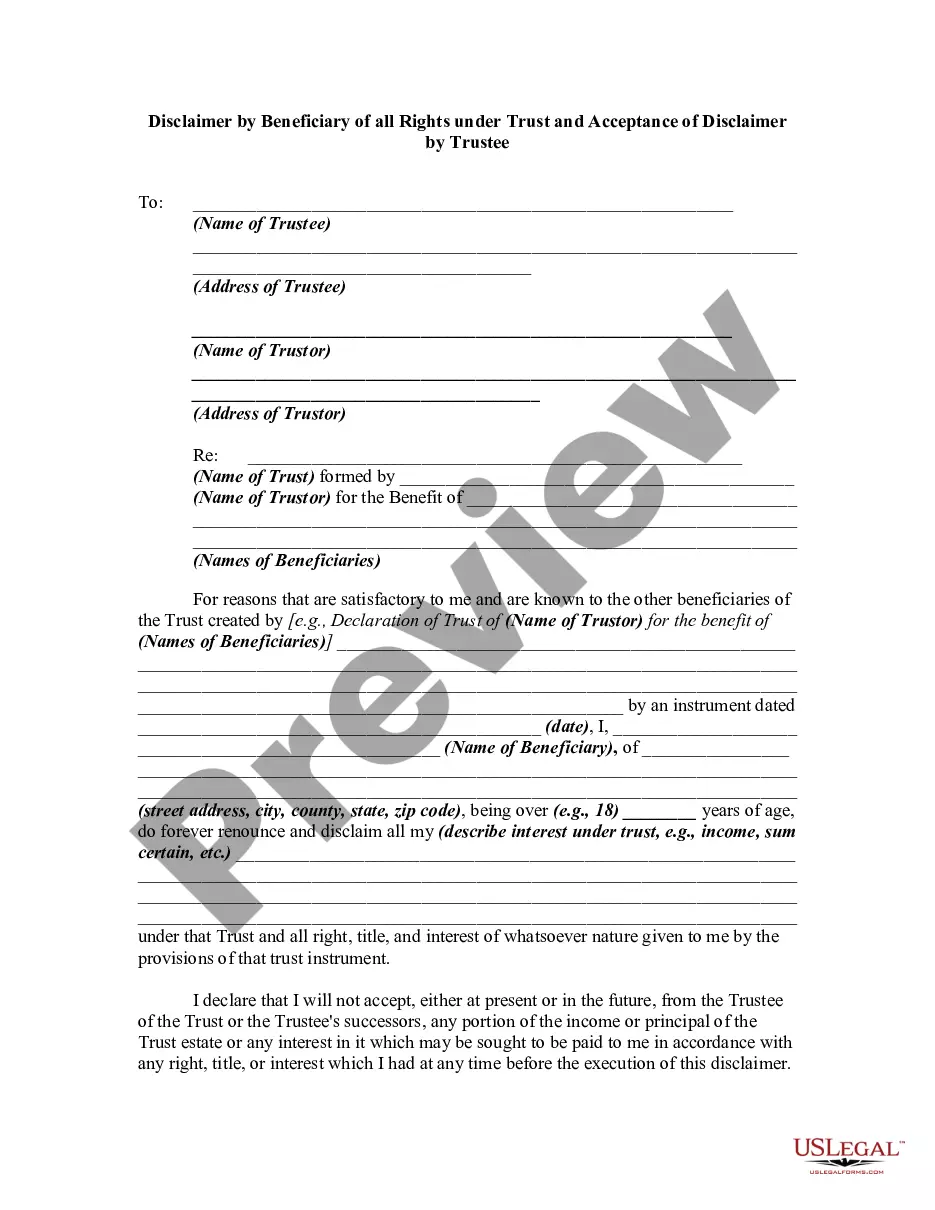

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

Indiana Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Description

How to fill out Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee?

US Legal Forms - one among the largest collections of legal documents in the United States - offers a wide array of legal templates that you can obtain or print.

By utilizing the site, you can access thousands of documents for business and personal uses, organized by categories, states, or keywords.

You can quickly access the latest versions of documents such as the Indiana Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

Check the form description to confirm that you have chosen the appropriate document.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you already possess a membership, Log In and obtain the Indiana Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee from your US Legal Forms collection.

- The Download button will appear on each form you view.

- You can find all previously downloaded forms in the My documents section of your account.

- If you are new to US Legal Forms, here are simple instructions to get you started.

- Ensure you have selected the correct form for your city/county.

- Click on the Review button to examine the contents of the form.

Form popularity

FAQ

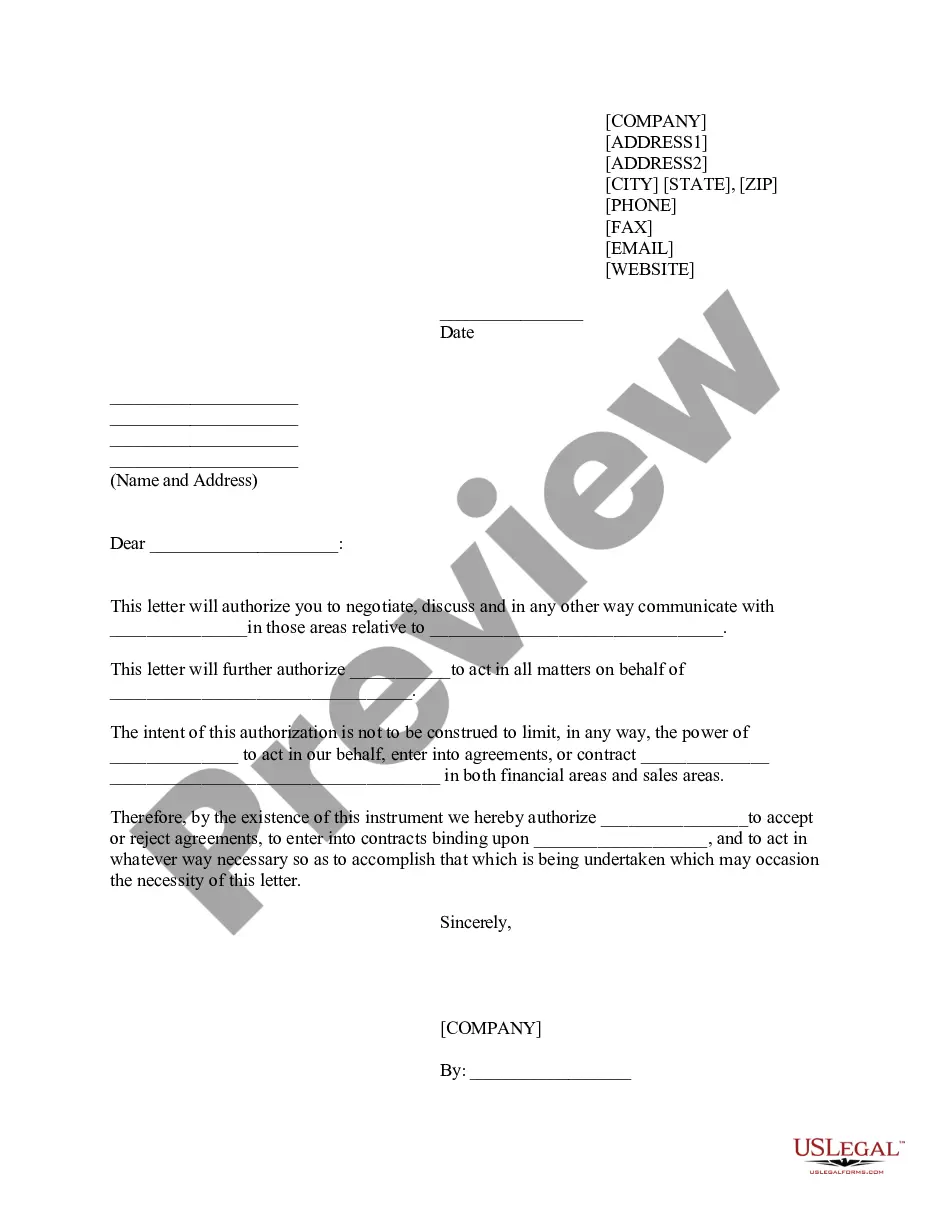

When drafting a disclaimer to avoid copyright issues, clarity is key. Clearly state that you’re abandoning any rights concerning the specific work, referencing the Indiana Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee for proper framing. This helps ensure that your intent not to enforce copyright is recognized. Utilizing platforms like uslegalforms can guide you in creating a valid disclaimer that meets legal requirements, reducing the risk of copyright infringement.

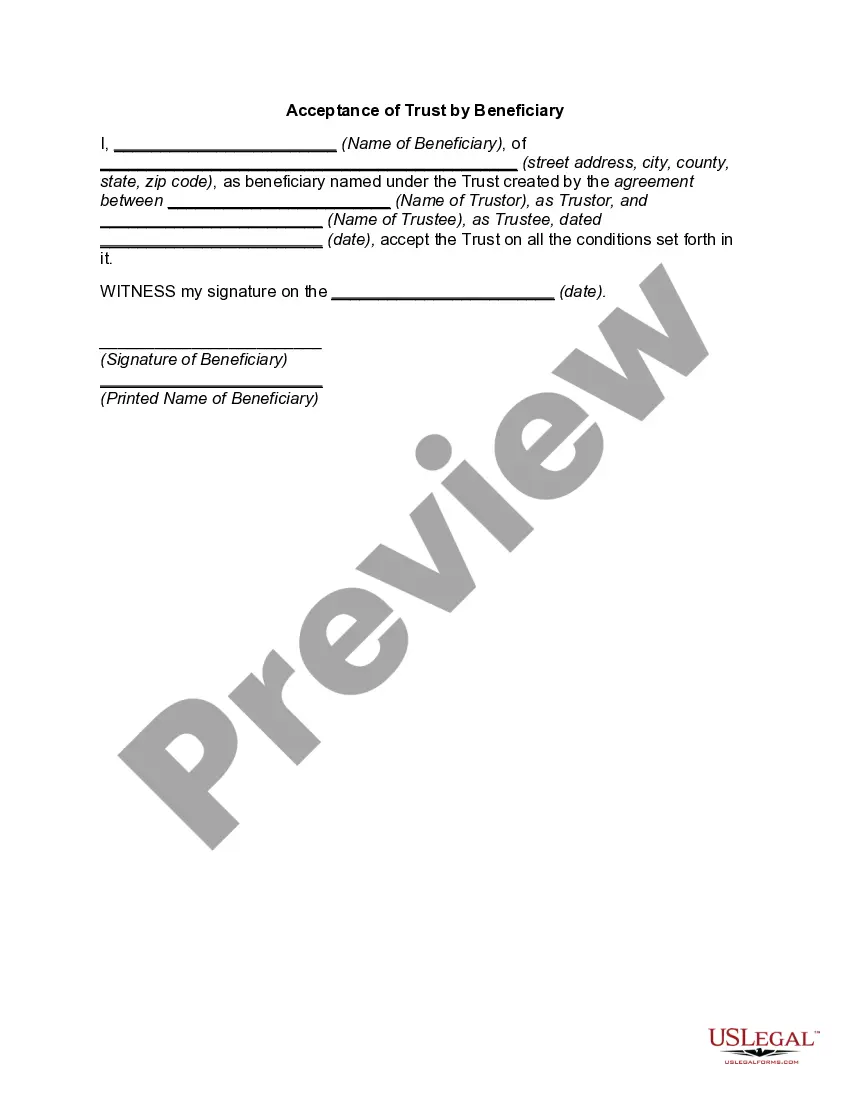

Formatting a disclaimer is crucial for its validity. Begin with a clear title, such as 'Disclaimer of Rights under Trust,' directly referencing the Indiana Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. Include the date, beneficiaries' details, and specific property or rights being disclaimed. A structured format aids in clarity and helps meet legal standards.

For a disclaimer to be qualified in Indiana, it must meet specific criteria outlined in the Indiana Code. One key requirement is that the disclaimer should be in writing and filed within a certain time frame after the transfer. Additionally, the Indiana Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee needs to be irrevocable and must not benefit the disclaiming party directly. Ensuring these conditions can provide clarity and legality.

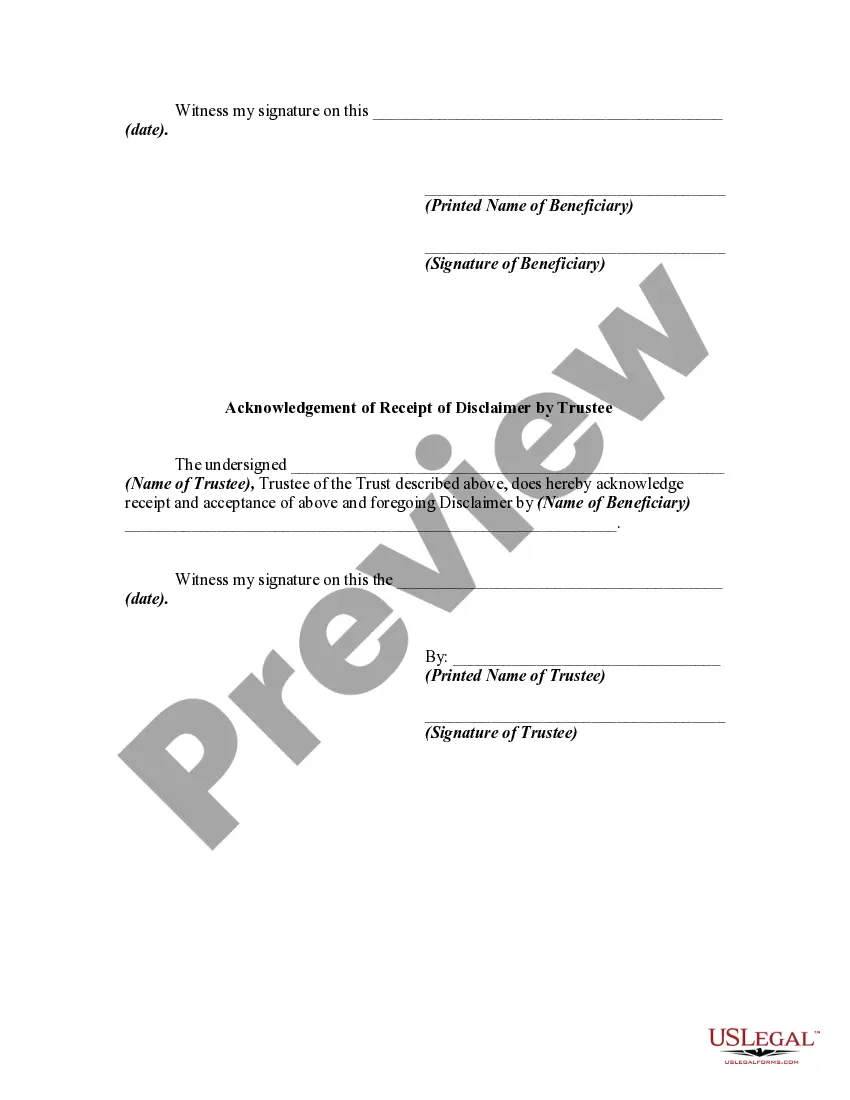

A properly executed Indiana Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is likely to hold up in court, provided it meets legal requirements. Courts generally honor disclaimers when they adhere to state laws and the intent of the individual. To ensure the disclaimer's enforceability, it’s essential to follow Indiana legal standards. Always consider consulting a legal expert when drafting to avoid potential disputes.

When a trustee breaches their duty, the beneficiary has specific rights under the Indiana Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. Beneficiaries can seek remedies such as demanding an accounting of trust assets and requesting damages for losses incurred due to the breach. Furthermore, they may have the right to remove the trustee and appoint a more reliable one. Understanding these rights ensures beneficiaries can effectively protect their interests in trust matters.

Typically, inherited assets do need to be declared for tax purposes, depending on the law and the specific circumstances surrounding the inheritance. If you are unsure what needs to be declared under the Indiana Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, it is advisable to seek legal advice. Correctly declaring your inheritance ensures compliance with the law and protects your rights.

To file a qualified disclaimer, prepare a written document stating your intent to disclaim specific assets. Submit this document to the trustee or administrator of the estate. It is essential that this follows guidelines set by the Indiana Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee to ensure your disclaimer is honored. Consulting with an attorney can facilitate a proper filing process.

A qualified disclaimer must meet specific criteria to be effective. It must be in writing, signed by the beneficiary, and occur within the stipulated time frame. Moreover, the outcome should comply with the Indiana Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. Ensuring these elements will allow the beneficiary to relinquish their rights and enable smooth transitions within the trust.

When writing a disclaimer of inheritance, start with your name, address, and any legal identification related to the inheritance. Clearly state the trust name and the specific assets you want to disclaim. Use concise language to express your intent, following the format outlined in the Indiana Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. Having a legal expert review your disclaimer can help ensure accuracy and compliance.

When disclaiming an inheritance, it is vital to meet specific legal requirements. The disclaimer must be in writing, signed, and submitted within nine months of the decedent's death. Additionally, it should align with the Indiana Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee standards to ensure it's legally recognized. Seeking assistance from professionals can prevent mistakes in this process.