This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty

Description

How to fill out Continuing Guaranty Of Payment And Performance Of All Obligations And Liabilities Due To Lessor From Lessee Under Lease With Mortgage Securing Guaranty?

US Legal Forms - one of several most significant libraries of authorized varieties in the USA - delivers a variety of authorized file web templates you can obtain or produce. Making use of the web site, you can find a large number of varieties for business and specific uses, categorized by types, states, or key phrases.You can find the latest versions of varieties much like the Indiana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty within minutes.

If you already have a monthly subscription, log in and obtain Indiana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty from your US Legal Forms local library. The Download key can look on each and every develop you look at. You have access to all earlier downloaded varieties inside the My Forms tab of your respective profile.

If you wish to use US Legal Forms the first time, listed below are straightforward instructions to help you get started out:

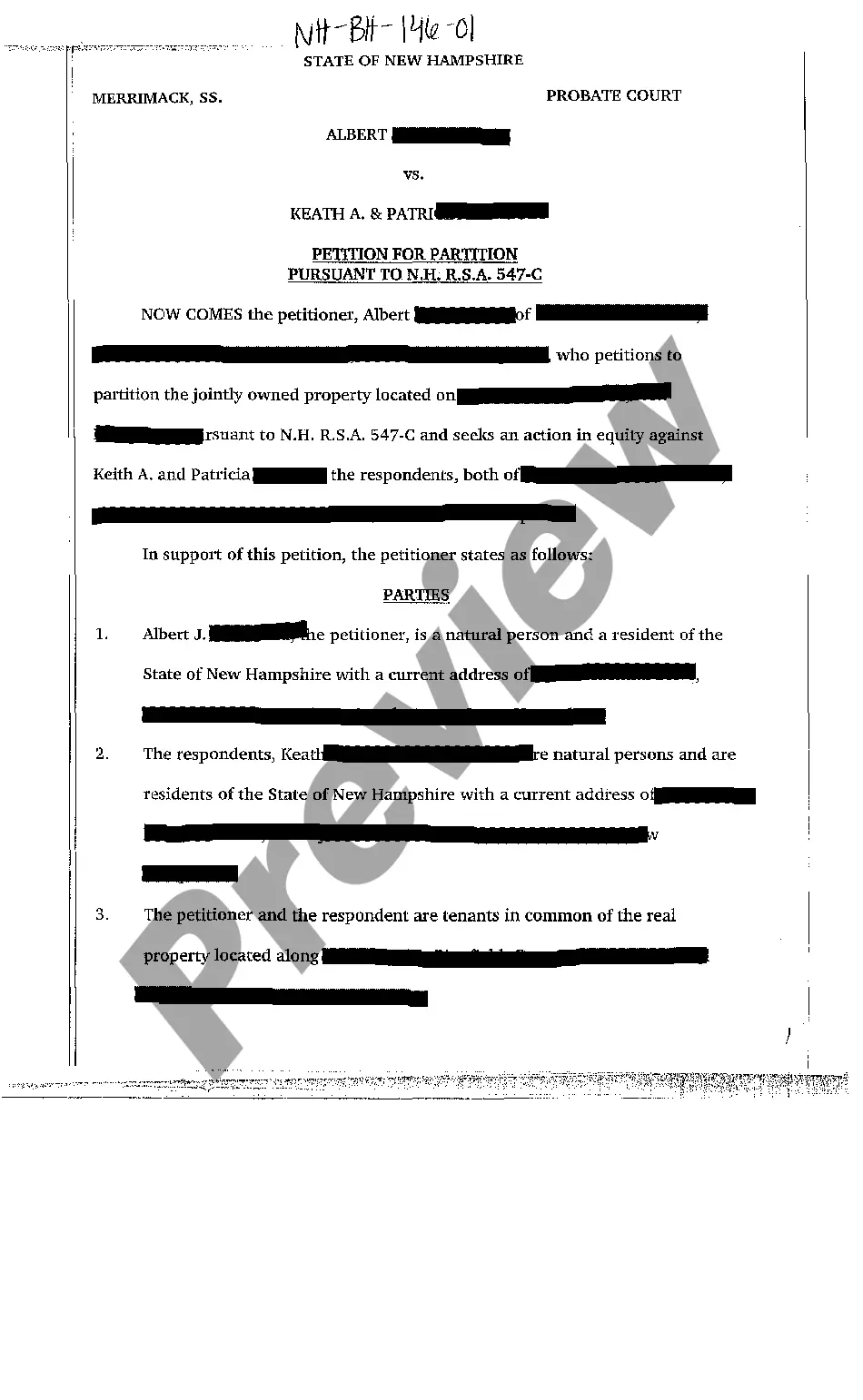

- Make sure you have selected the proper develop for your personal metropolis/state. Click the Review key to analyze the form`s information. Look at the develop outline to ensure that you have selected the proper develop.

- In case the develop does not suit your demands, utilize the Research area at the top of the display screen to get the one that does.

- In case you are pleased with the form, confirm your option by clicking on the Buy now key. Then, choose the rates plan you favor and supply your credentials to register for an profile.

- Method the financial transaction. Make use of your credit card or PayPal profile to complete the financial transaction.

- Pick the format and obtain the form on the gadget.

- Make modifications. Load, edit and produce and indication the downloaded Indiana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty.

Each and every template you included with your money lacks an expiration date and is your own property forever. So, if you wish to obtain or produce yet another version, just proceed to the My Forms segment and then click in the develop you need.

Obtain access to the Indiana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty with US Legal Forms, probably the most substantial local library of authorized file web templates. Use a large number of expert and state-particular web templates that fulfill your small business or specific requires and demands.

Form popularity

FAQ

In a lease agreement, the lessor is the person or party that issues the lease (allows the property to be rented), and the lessee is the person that the lease is granted to (the person paying rent to use the property).

Appropriate execution clauses A deed executed by an individual must clearly include the names and signatures of the signatory. A witness is also required to execute a deed signed by an individual. The elements of offer, acceptance, intention to be bound by law and consideration must be satisfied.

A personal guarantee can be enforced the same way as any debt. If the business owner does not pay, the creditor can bring a lawsuit to receive a judgment and levy the owner's personal assets to cover the debt.

A guarantee is presumed not to be enforceable unless all the named guarantors sign the guarantee (or the terms of the guarantee provide that the guarantee is enforceable on a signed party irrespective of whether other named parties sign).

A triple net lease (NNN) assigns sole responsibility to the tenant for all costs relating to the asset being leased, in addition to rent. A double net lease makes the tenant responsible for both property taxes and insurance premiums due.

The usual way that a guaranty is enforced is through a written demand (although this is not usually required in most forms) followed by the filing of a law suit. If the guarantor has pledged collateral to secure the guaranty obligation, foreclosure proceedings against that will often be commenced.

A guarantee is a binding promise of one person (the guarantor), to be answerable for the debt or obligation of another (the debtor), if that other defaults. Guarantees become enforceable by the person to whom the guarantee has been given (the creditor) when debtors have defaulted on their obligations.

Lease terms are the contract terms of a lease agreement between a lessee, usually the tenant, and a lessor, typically the landlord. The legal contract includes lease terms to establish the period of time by which the lease will last, contractual obligations, and more.