Indiana Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

Have you ever found yourself in a situation where you need documentation for both business or specialized purposes almost all the time.

There are numerous legal document templates accessible online, but finding reliable versions is not straightforward.

US Legal Forms provides thousands of form templates, such as the Indiana Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, designed to comply with state and federal regulations.

Once you find the appropriate form, click on Buy now.

Choose your preferred pricing plan, complete the required details to create your account, and make the payment using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- You can then download the Indiana Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is applicable to your specific area/state.

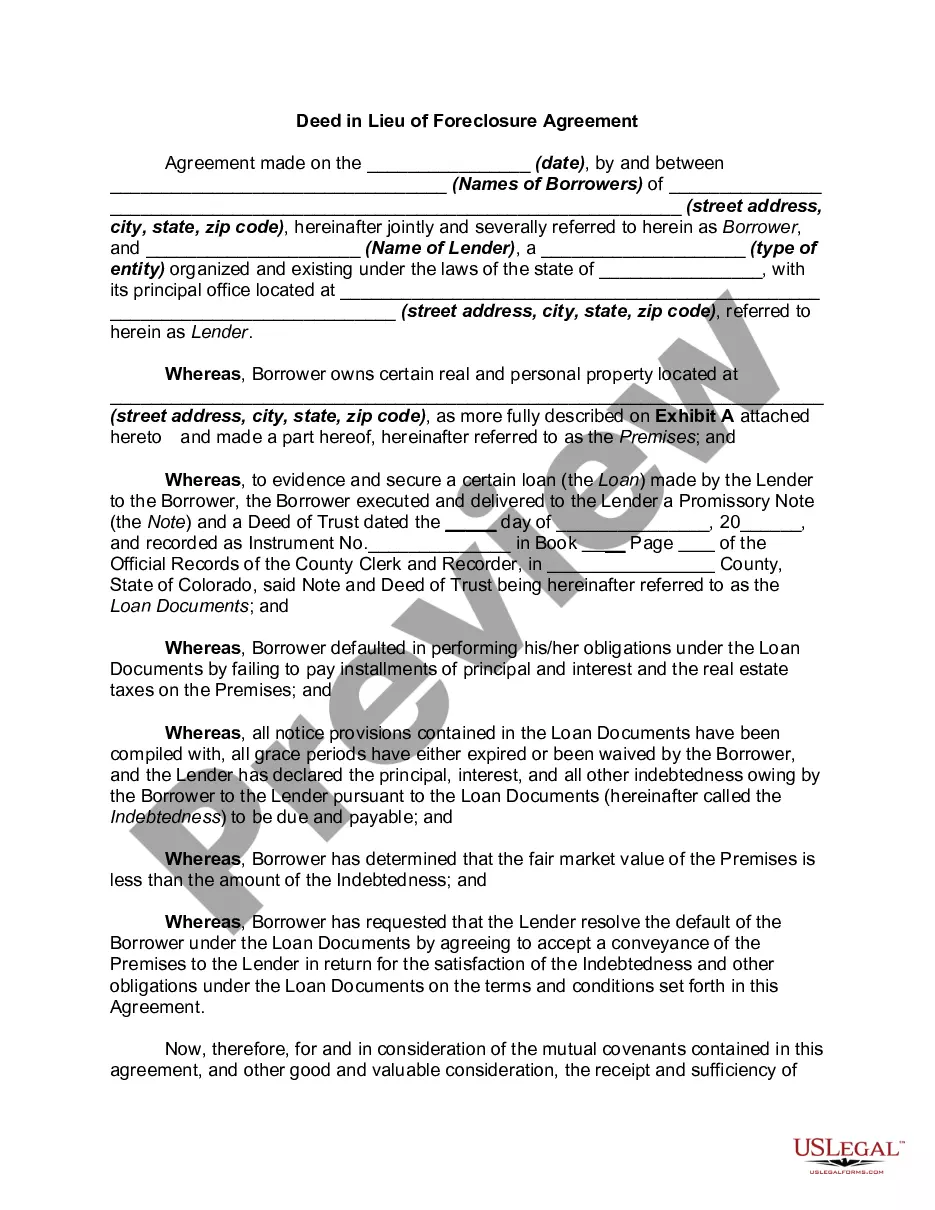

- Utilize the Review button to examine the form.

- Check the description to confirm you have selected the correct document.

- If the form does not meet your needs, use the Research field to find one that fits your requirements.

Form popularity

FAQ

To fill out a guarantee form for the Indiana Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, start by gathering all necessary information about the parties involved. You will need the details of the lease or purchase agreement, including property addresses and financial obligations. Next, provide your personal information as the guarantor and ensure to review the terms carefully. Using uslegalforms can simplify this process, offering templates that guide you through every step effectively.

Common loopholes in personal guarantees can include ambiguous language or lack of clear identification of obligations. If terms are too vague, a court may invalidate parts of the guarantee. It is essential to draft your Indiana Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate carefully, ensuring clarity and comprehensiveness to minimize these risks.

Filling out a personal guaranty involves several steps. Start by providing the necessary information about the guarantor and the party being guaranteed. Clearly outline the obligations and the duration of the guarantee. This attention to detail is essential when creating an Indiana Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, as it ensures that all parties understand their responsibilities.

Enforcing a personal guarantee typically involves first reviewing the terms outlined in the guarantee itself. If the primary party defaults on the contract, the obligee can pursue legal action against the guarantor to claim the owed amount. In the context of an Indiana Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, clear documentation is crucial, so be diligent in maintaining records for successful enforcement.

An example of a personal guarantee clause might state that the guarantor agrees to be legally responsible for all obligations outlined in the contract if the primary party defaults. This clause should specify the nature of the obligations and the consequences of default. Including a comprehensive clause is essential in your Indiana Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate to ensure clarity and enforceability.

To fill out a personal guarantee, begin by clearly identifying the parties involved, including the guarantor and the obligee. Next, outline the specific terms of the guarantee, including the obligation being guaranteed and any limitations or conditions. This process is crucial for your Indiana Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, so ensure accuracy to avoid potential legal complications.

In Indiana, a personal guarantee does not necessarily need to be notarized to be valid, but having it notarized can add an extra layer of protection. This helps in affirming the identity of the signer and can simplify the enforcement process if issues arise later. It is wise to consult legal guidance to ensure compliance with local laws when drafting your Indiana Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

Exiting a personal guaranty can be challenging, but it typically involves negotiation with the lender or landlord. You might seek to have the obligation removed by proving that the primary party can fulfill their responsibilities independently. Consulting the resources available on the US Legal Forms platform can provide you with the guidance you need for navigating this process smoothly.

A personal guarantee agreement outlines the terms under which an individual agrees to back a financial obligation. This document details the specific obligations and conditions of the personal guarantee. It's crucial for safeguarding all parties in agreements like the Indiana Personal Guaranty – Guarantee of Contract for the Lease and Purchase of Real Estate.

A guarantee generally refers to a promise made by one party to take responsibility for the debt or obligation of another. In contrast, a personal guaranty is a specific type of guarantee where an individual agrees to be liable for a debt or obligation. This distinction is particularly important in the context of an Indiana Personal Guaranty – Guarantee of Contract for the Lease and Purchase of Real Estate.