Indiana Detailed and Specific Policy with Regard to Use of Company Computers

Description

How to fill out Detailed And Specific Policy With Regard To Use Of Company Computers?

Selecting the optimal legal document template can be challenging. Clearly, there are numerous templates accessible online, but how do you discover the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Indiana Detailed and Specific Policy Concerning Use of Company Computers, which can be utilized for both business and personal purposes.

All the forms are verified by professionals and comply with state and federal regulations.

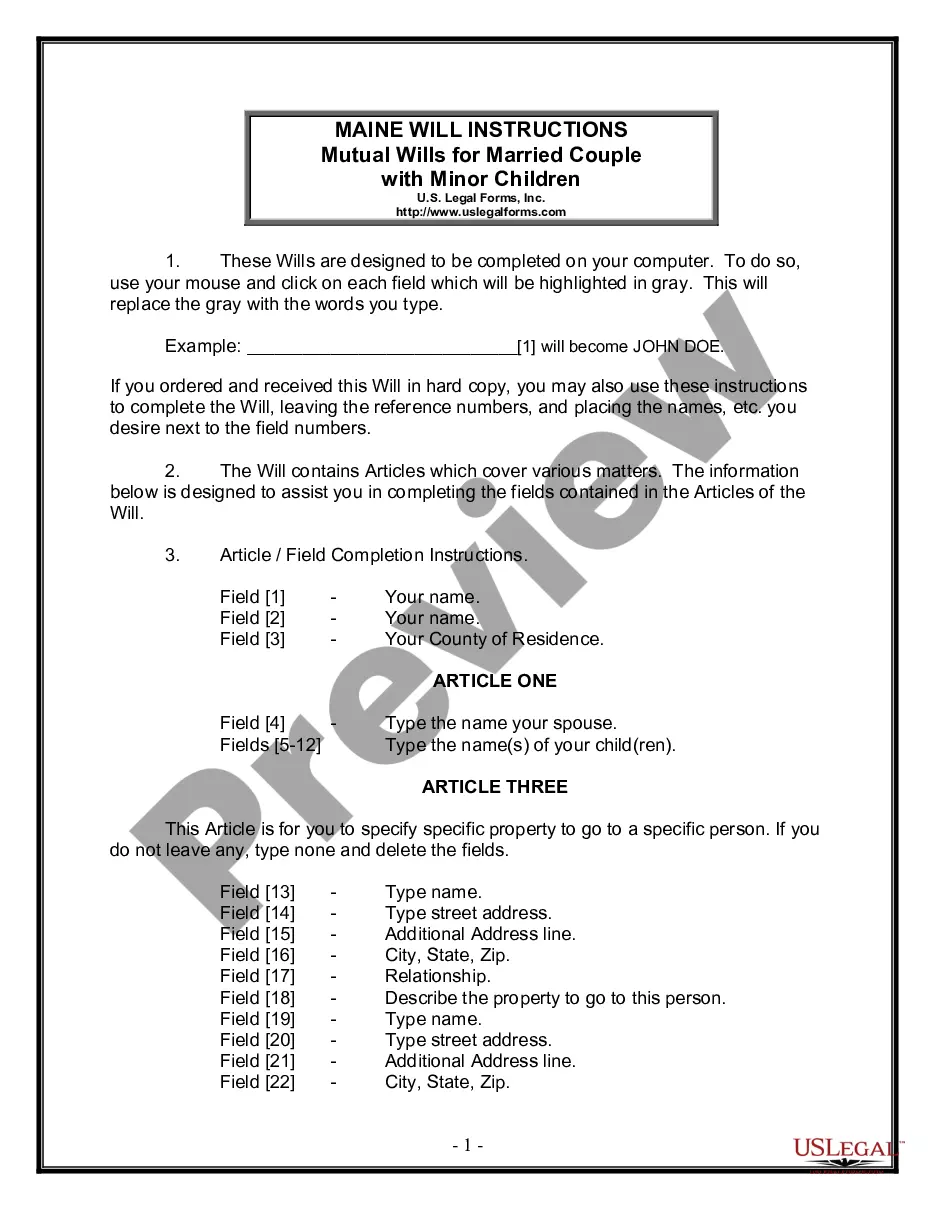

If the form does not meet your needs, utilize the Search field to find the appropriate form. Once you are confident that the form is suitable, click the Get now button to obtain the form. Select the pricing plan you wish and input the required details. Create your account and process the payment using your PayPal account or credit card. Choose the format and download the legal document template to your device. Complete, edit, and print out and sign the obtained Indiana Detailed and Specific Policy Concerning Use of Company Computers. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to download professionally-crafted documents that adhere to state requirements.

- If you are already registered, Log In to your account and then click the Download button to obtain the Indiana Detailed and Specific Policy Concerning Use of Company Computers.

- Use your account to search through the legal forms you may have acquired previously.

- Proceed to the My documents tab of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure that you have selected the correct form for your city/county.

- You can review the form using the Preview button and read the form description to confirm it is right for you.

Form popularity

FAQ

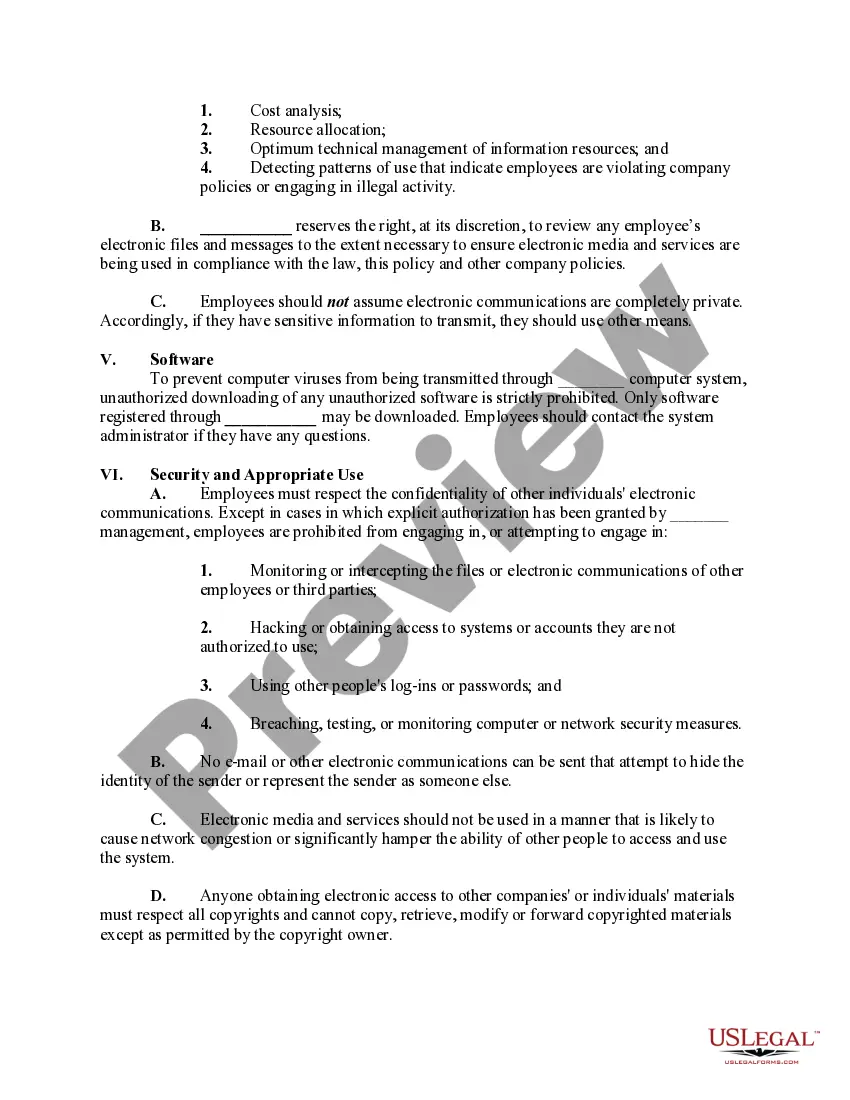

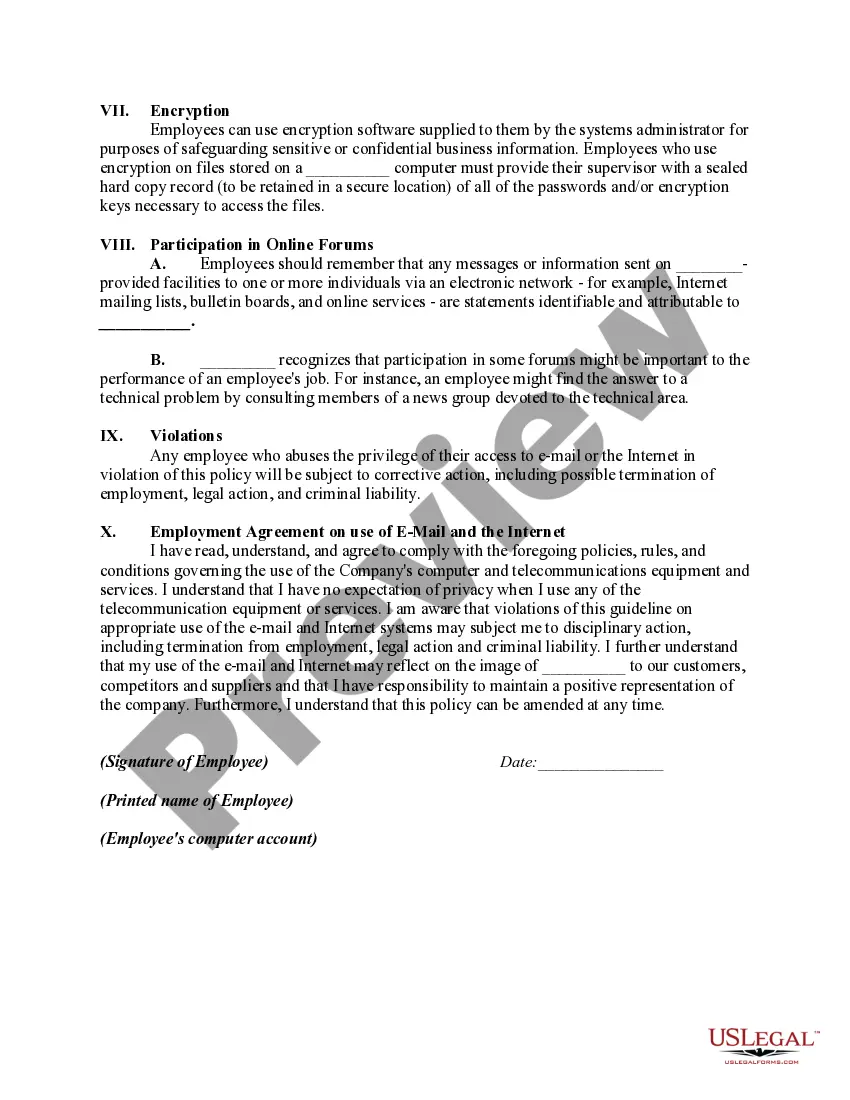

An Acceptable Use Policy for company devices sets forth the guidelines for using all company-issued technology. This Indiana Detailed and Specific Policy with Regard to Use of Company Computers emphasizes the importance of ethical behavior in the digital space. By following this policy, employees can contribute to a secure working environment that protects both company data and personal information.

The Acceptable Use Policy for computer and Internet usage specifies the permissible and non-permissible actions when using company technology. This Indiana Detailed and Specific Policy with Regard to Use of Company Computers is designed to safeguard company property and information. It helps employees understand their responsibilities and promotes compliance with workplace standards.

The computer system usage policy outlines the regulations governing the use of an organization's computer systems. This Indiana Detailed and Specific Policy with Regard to Use of Company Computers aims to protect sensitive information and maintain operational integrity. It is crucial for encouraging responsible usage while deterring unauthorized access or misconduct.

The Internet and computer use policy provides detailed instructions on how employees should utilize the Internet and computing resources at work. This Indiana Detailed and Specific Policy with Regard to Use of Company Computers sets boundaries to enhance security and productivity. By clarifying permitted activities, it helps prevent potential legal issues and promotes a positive workplace culture.

A company computer acceptable use policy defines acceptable behaviors for using company devices and networks. This Indiana Detailed and Specific Policy with Regard to Use of Company Computers serves to minimize risks such as data breaches and misuse of resources. It fosters a responsible and secure approach to technology use within the workplace.

A company computer and Internet usage policy outlines the rules and guidelines for employees regarding the use of company-provided computers and Internet resources. This Indiana Detailed and Specific Policy with Regard to Use of Company Computers is vital for protecting the company's assets and ensuring productive work environments. It establishes clear expectations on appropriate usage while also addressing security concerns.

Yes, software licenses are generally considered taxable in Indiana. However, specific conditions may apply, as highlighted in the Indiana Detailed and Specific Policy with Regard to Use of Company Computers. For businesses, understanding the tax implications is crucial for budgeting and financial planning. uslegalforms provides valuable resources to help you navigate these tax considerations effectively.

In Indiana, certain items and services are recognized as tax-exempt, including some non-profit organizations and specific types of goods. The Indiana Detailed and Specific Policy with Regard to Use of Company Computers also sheds light on tax exemptions relevant to businesses. Understanding which categories apply to your situation is vital for compliance. Explore uslegalforms to find detailed information regarding exemptions to assist your business.

Infrastructure as a Service (IaaS) is typically taxable in Indiana. The specifics are outlined in the Indiana Detailed and Specific Policy with Regard to Use of Company Computers. Companies providing or using IaaS should confirm their tax obligations, as they may vary based on individual circumstances. Utilizing resources from uslegalforms can help ensure you comply with Indiana tax laws appropriately.

In Indiana, software is generally not tax-exempt, but there are specific conditions that might change this. The Indiana Detailed and Specific Policy with Regard to Use of Company Computers outlines these exclusions in detail. Businesses purchasing software should be aware of exemptions for certain classifications or usage scenarios. Consulting uslegalforms can provide clarity and help you navigate this complex aspect.