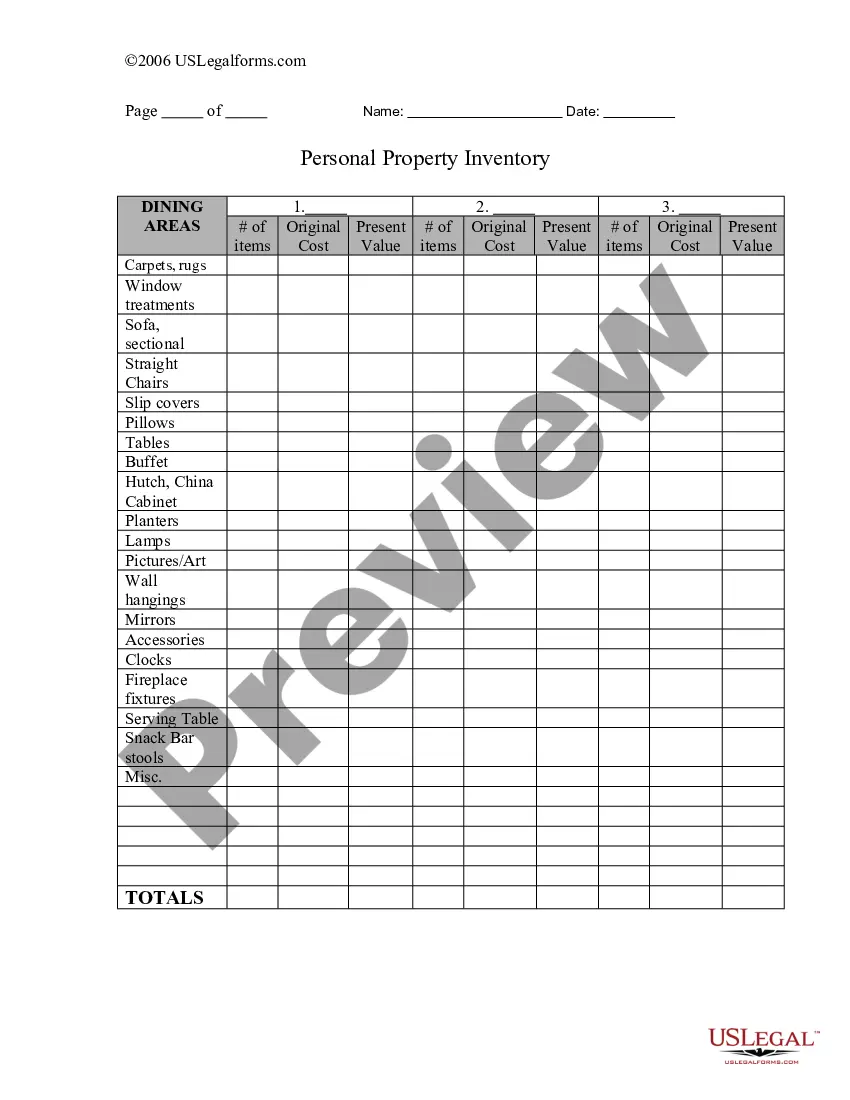

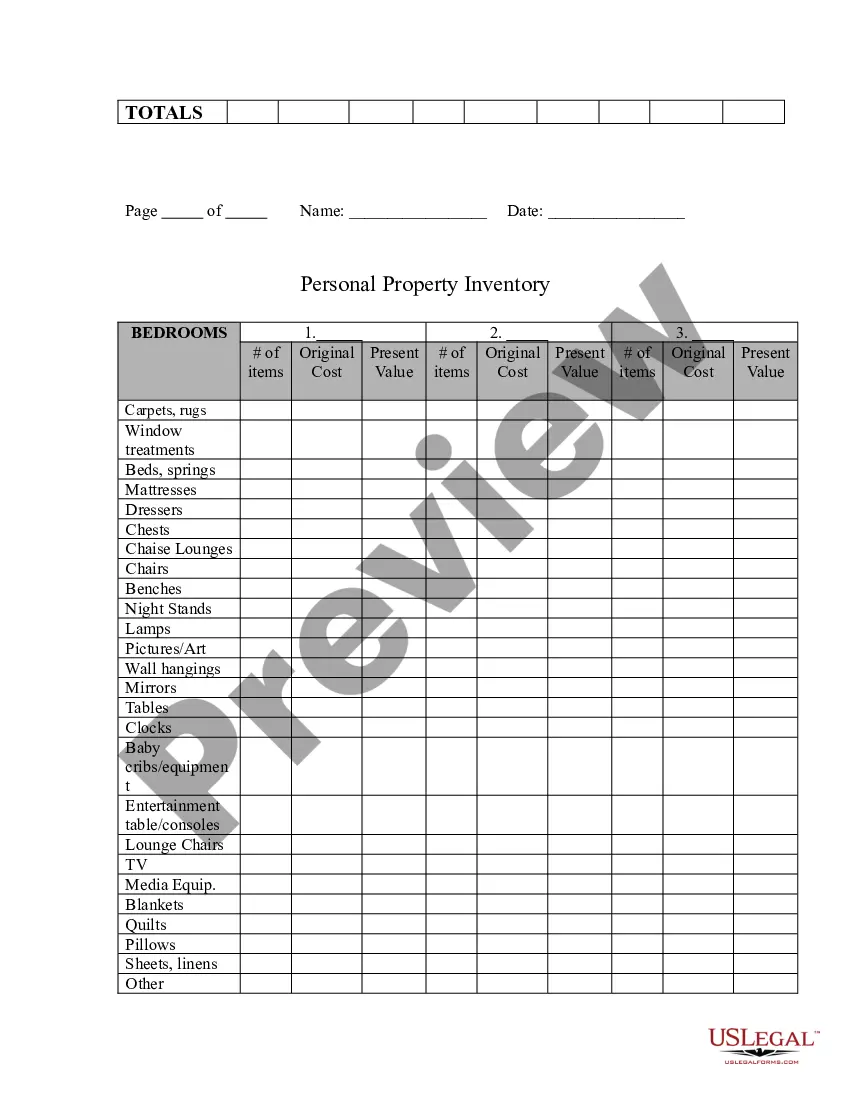

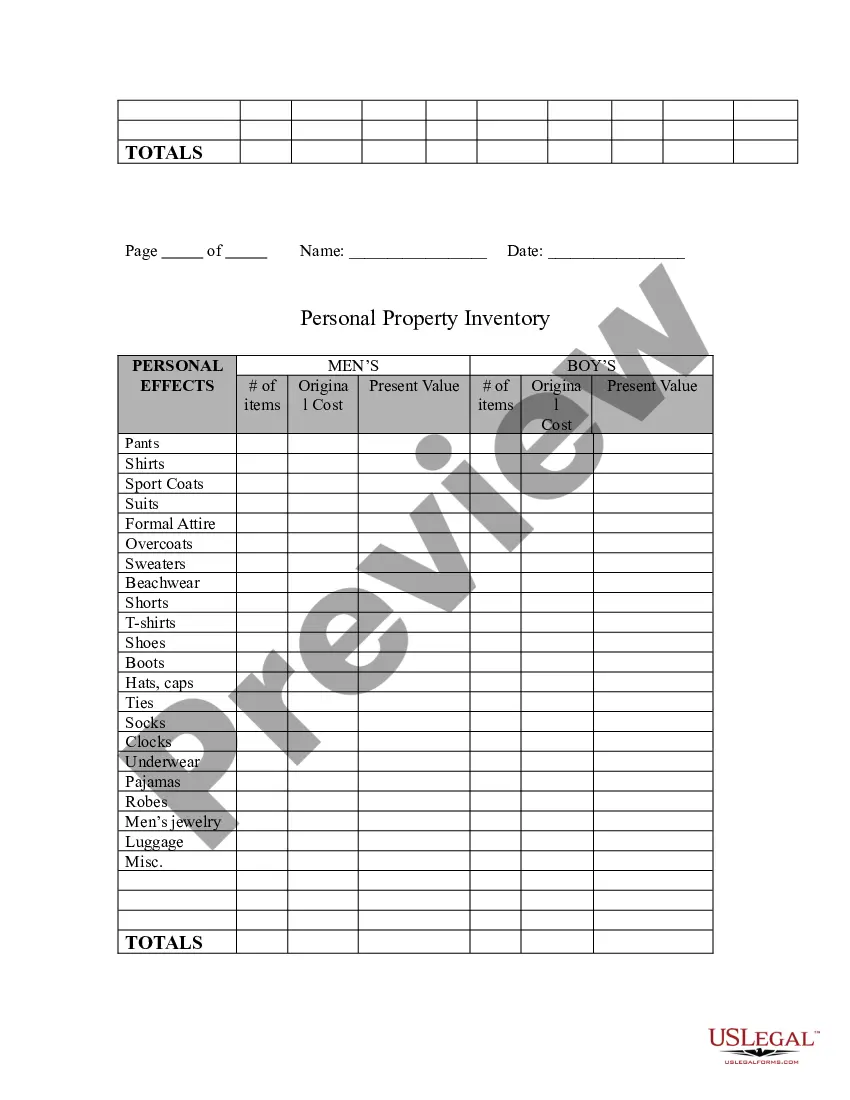

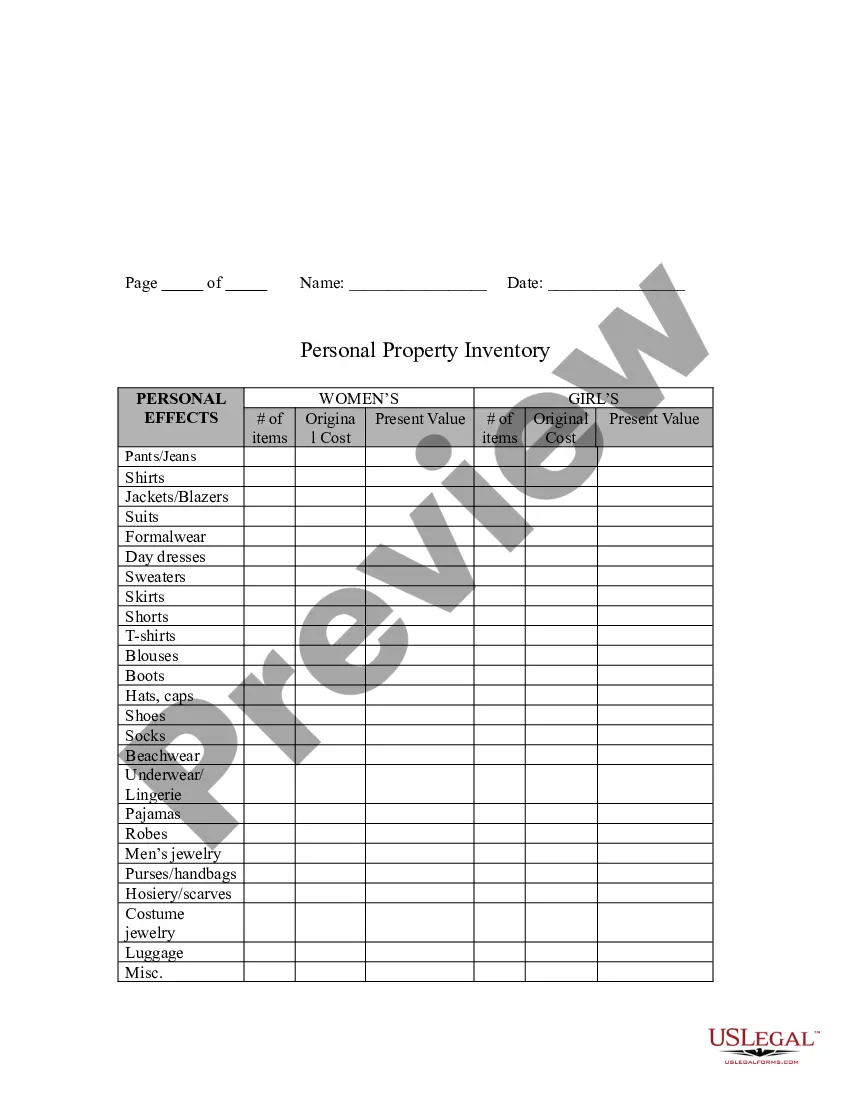

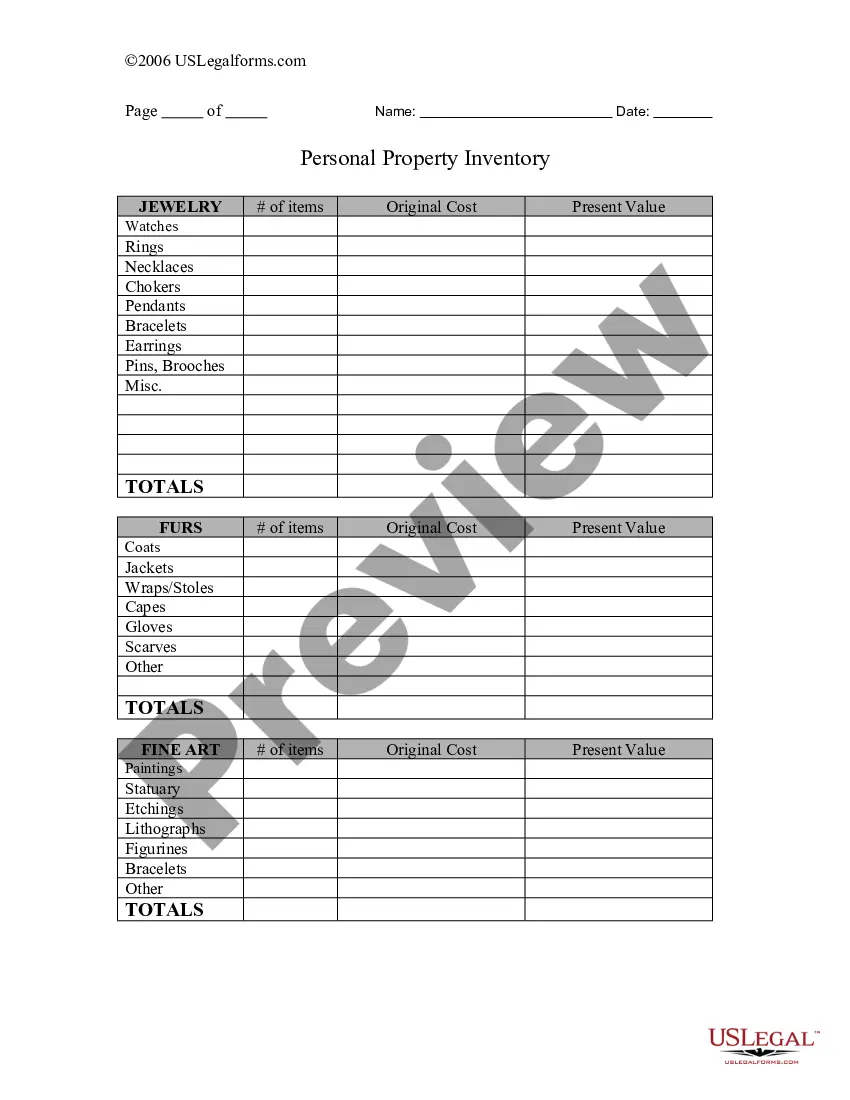

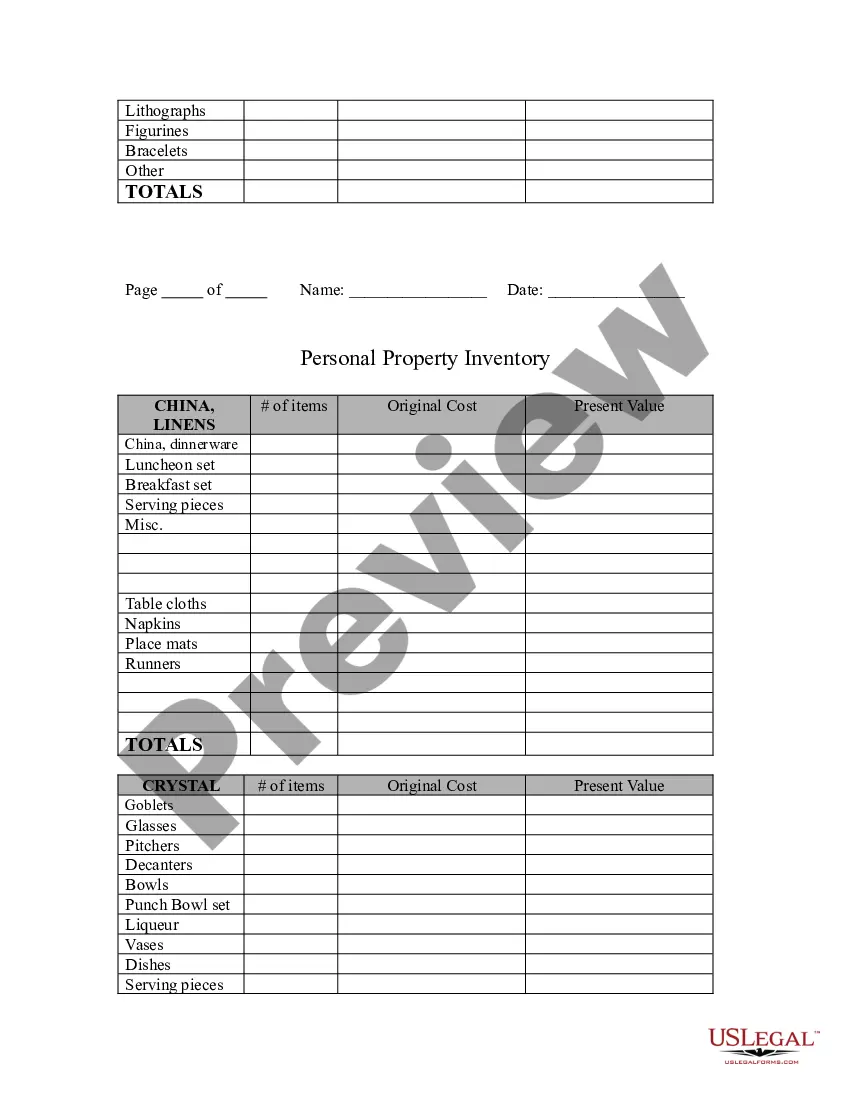

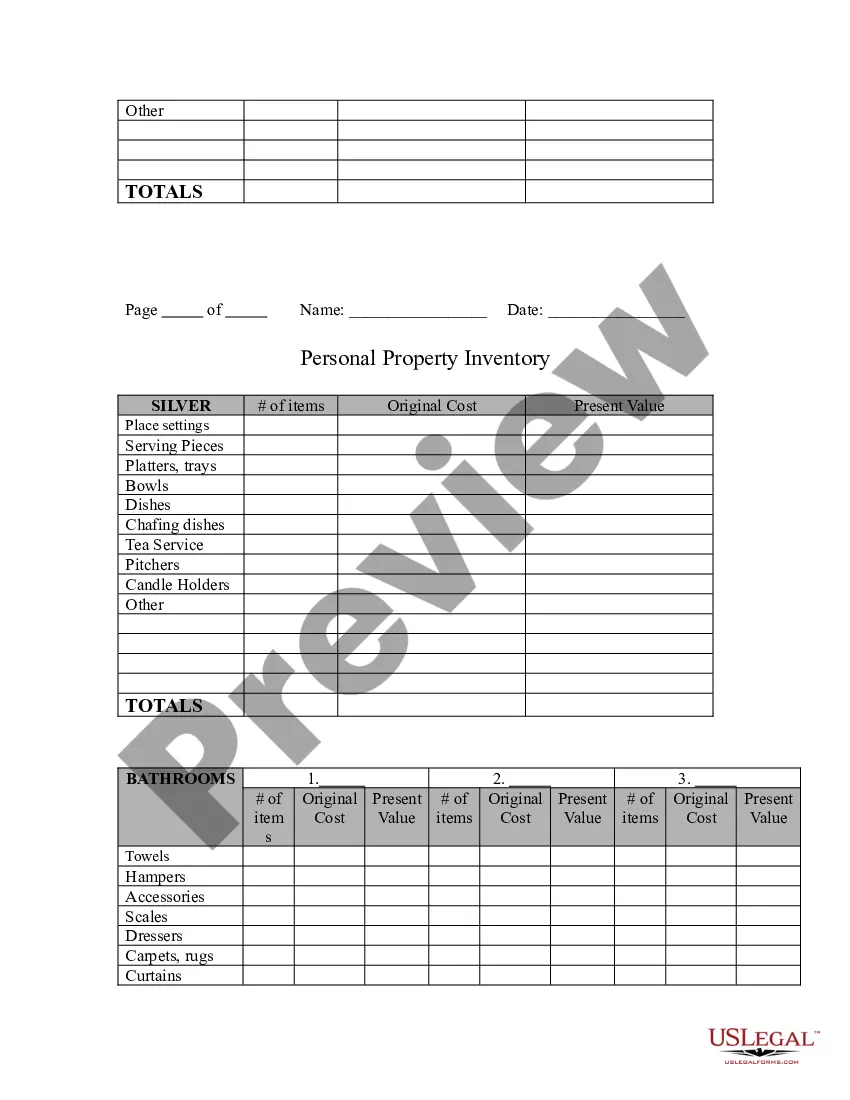

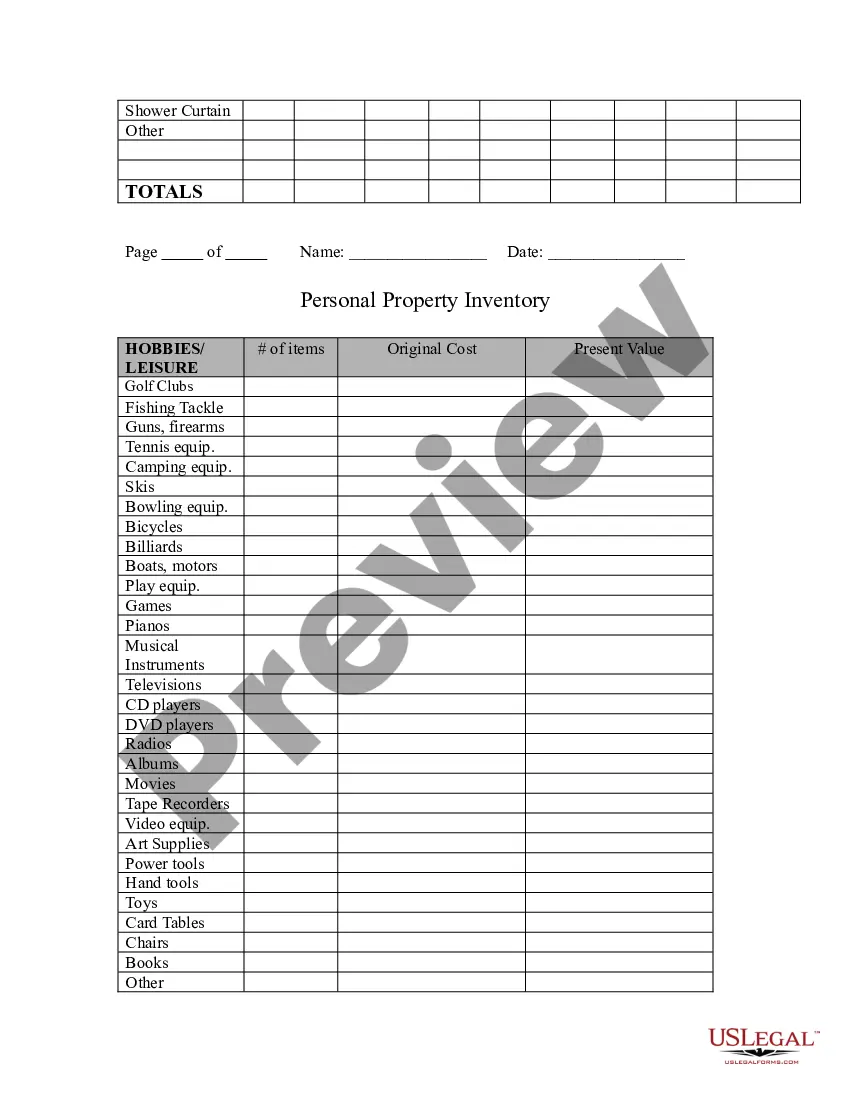

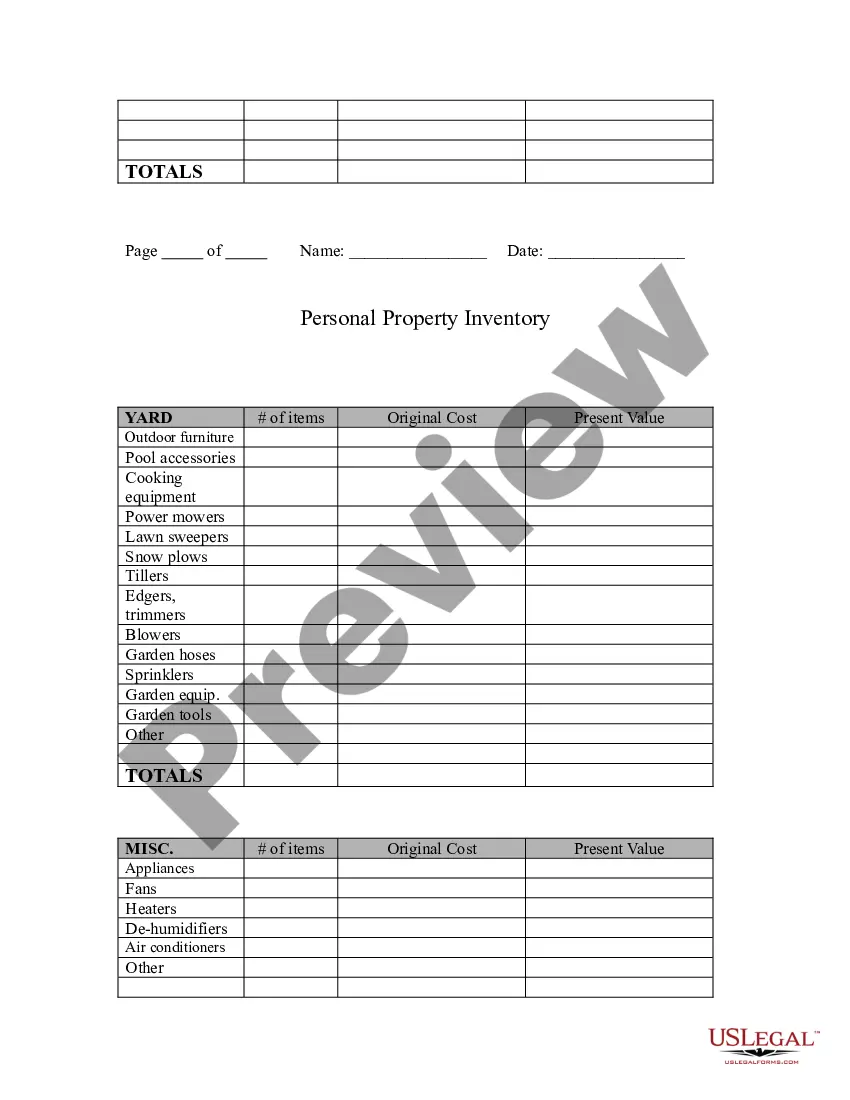

Indiana Personal Property Inventory

Description

How to fill out Personal Property Inventory?

You can spend hours on the Web looking for the valid document template that matches the federal and state requirements you need.

US Legal Forms offers a multitude of valid forms that are reviewed by experts.

It is easy to download or print the Indiana Personal Property Inventory from the service.

- If you already have a US Legal Forms account, you can Log In and click the Obtain option.

- Then, you can complete, edit, print, or sign the Indiana Personal Property Inventory.

- Every valid document template you acquire is yours indefinitely.

- To obtain another copy of the purchased form, go to the My documents tab and click the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, make sure that you have selected the correct document template for your state/town of choice.

Form popularity

FAQ

Examples of personal use property include cars, boats, artwork, jewelry, and furniture that you use for your personal enjoyment rather than for business purposes. These items typically make up a significant portion of your Indiana Personal Property Inventory. It’s helpful to distinguish between personal and business use property when considering tax implications. Understanding these differences can help you follow the right guidelines and optimize your tax situation.

To qualify for a personal property tax deduction, the property must be owned by you and used for either personal or business purposes. In Indiana, items like vehicles and certain business assets can typically qualify for these deductions. By keeping a well-organized Indiana Personal Property Inventory, you simplify the process of identifying qualified assets. This proactive approach allows you to maximize your deductions seamlessly.

You can write off various expenses on your personal taxes, including mortgage interest, property taxes, charitable contributions, and unreimbursed medical expenses. Specific to Indiana Personal Property Inventory, you can also consider writing off personal property taxes on items like vehicles. Always keep detailed records to substantiate your claims and maximize your write-offs. This practice ensures that you do not miss out on potential tax savings each year.

The IRS considers personal property as tangible items that individuals own, such as furniture, vehicles, equipment, and artwork. In terms of Indiana Personal Property Inventory, this includes anything you can physically touch and control. It is essential to understand what qualifies as personal property because it influences how you report your assets and deductions. Proper documentation helps you manage personal property effectively during tax seasons.

Yes, Indiana does impose a tax on certain types of inventory. Owners of personal property must report their Indiana Personal Property Inventory each year. This tax primarily applies to businesses that hold inventory for sale or use. It is essential to stay informed about tax obligations to avoid penalties and ensure compliance.

Currently, Indiana provides a personal property tax exemption for certain small businesses and personal property, but the $80,000 amount may vary based on specific criteria. It is vital to check with state regulations and your tax advisor regarding any exemptions applicable to your situation. Keeping an organized Indiana Personal Property Inventory will assist you in claims regarding these exemptions.

In Indiana, certain items are exempt from personal property tax, such as agricultural equipment and some types of intangible assets. Understanding these exemptions helps you optimize your Indiana Personal Property Inventory. Always verify specific exemptions with a tax professional to ensure compliance.

Inventory falls under the category of personal property for tax purposes in Indiana. This means it is subject to assessment and tax just like other personal assets. Ensuring accurate entries in your Indiana Personal Property Inventory can streamline your tax reporting process.

Yes, Indiana imposes a personal property tax on inventory. This tax applies to the value of inventory owned by businesses on January 1 each year. Properly documenting your inventory in your Indiana Personal Property Inventory can help you prepare for this tax liability.

A personal property inventory should include all physical items owned, such as furniture, electronics, and equipment. For businesses, it’s crucial to include merchandise and supplies. This comprehensive list, known as your Indiana Personal Property Inventory, helps you maintain accurate financial records and manage taxes effectively.