Indiana Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

How to fill out Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can acquire the most recent versions of forms such as the Indiana Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor in just minutes.

If you possess a monthly subscription, sign in and download the Indiana Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously obtained forms from the My documents tab in your account.

If you are content with the form, confirm your choice by selecting the Buy now button. Then, pick the payment plan you desire and enter your details to create an account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

- To start using US Legal Forms for the first time, follow these simple steps.

- Ensure you have selected the correct form for your city/state.

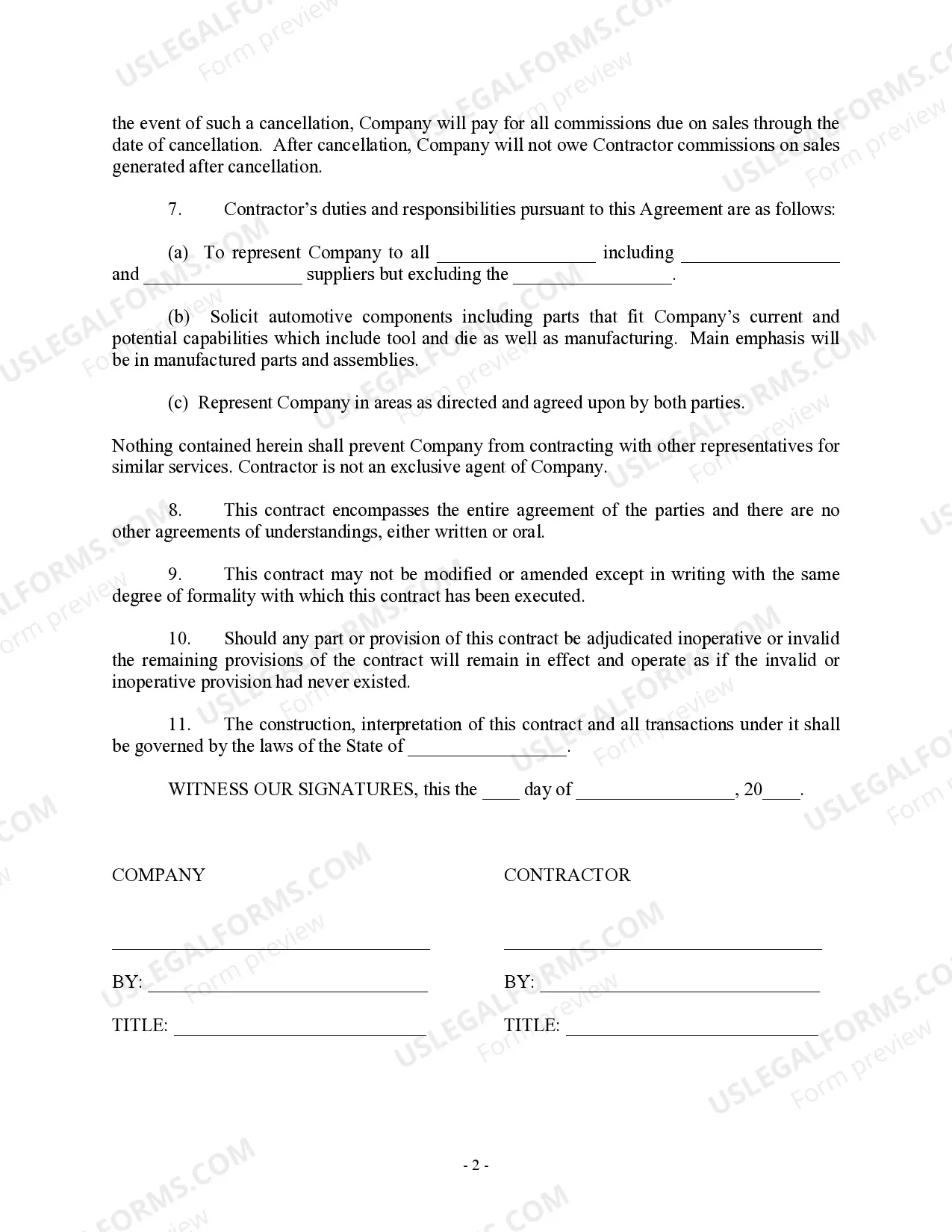

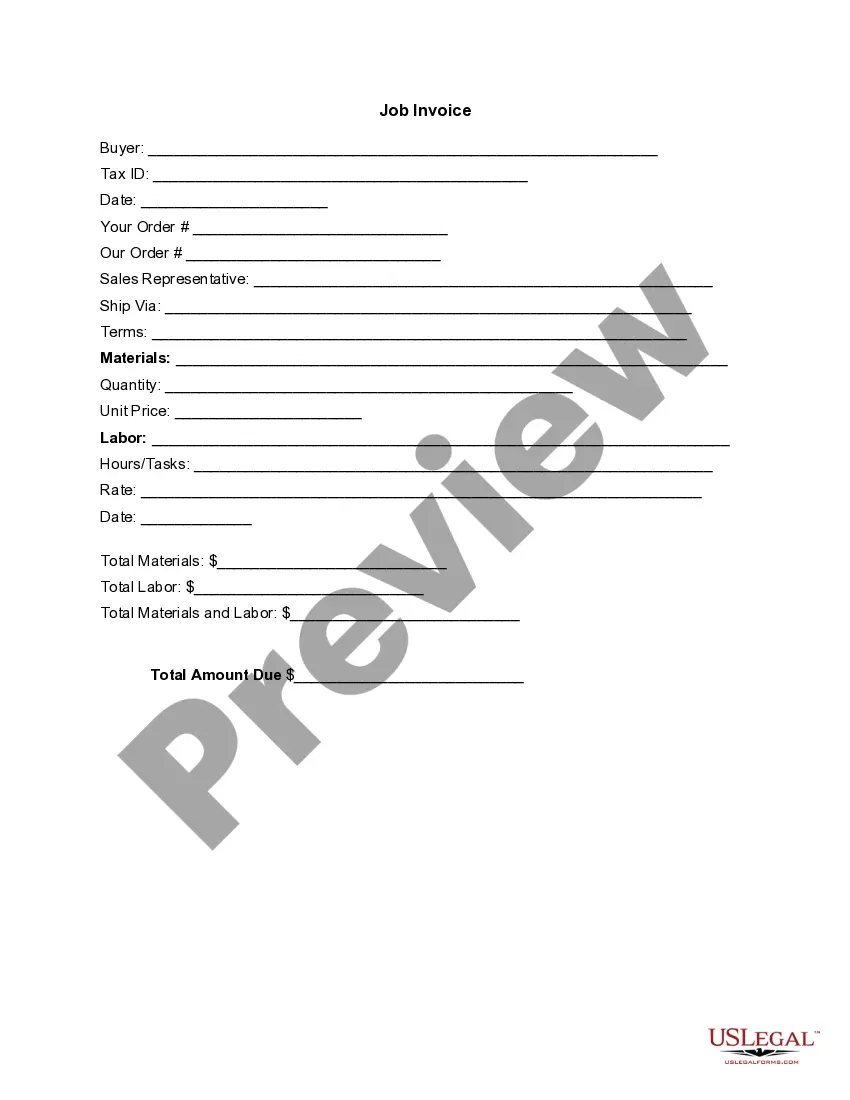

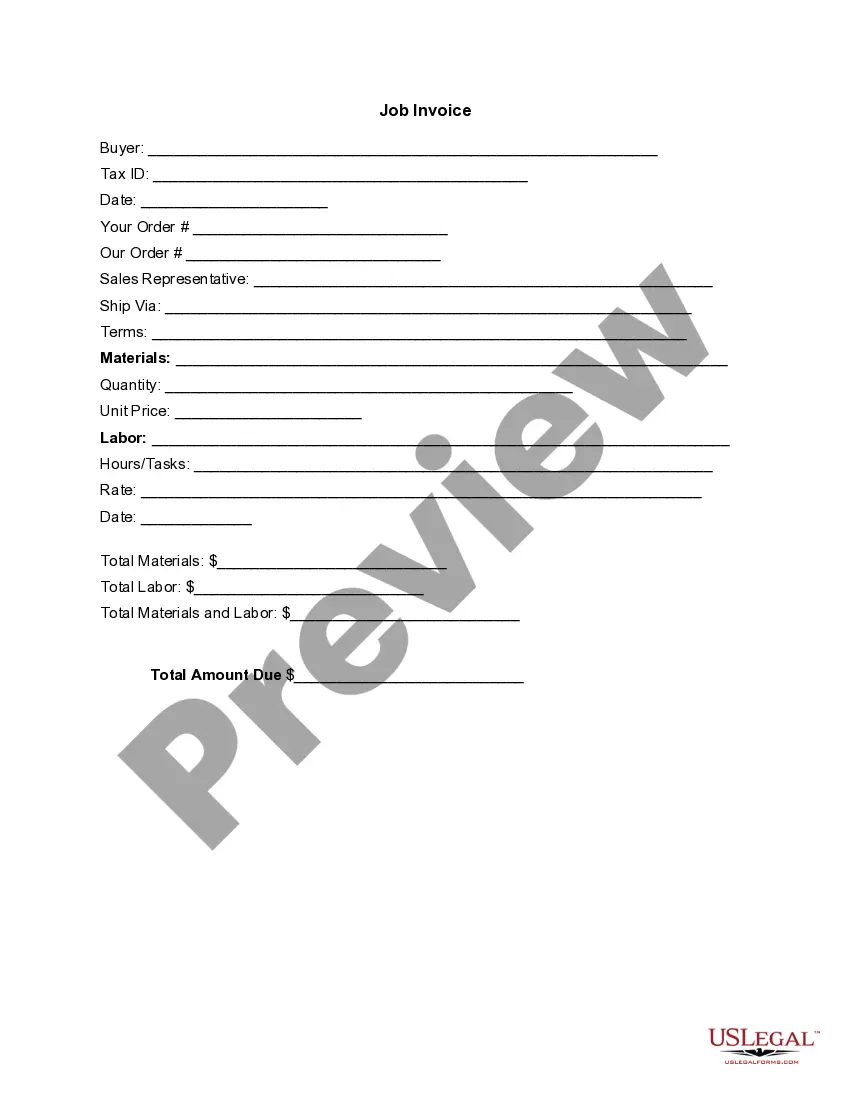

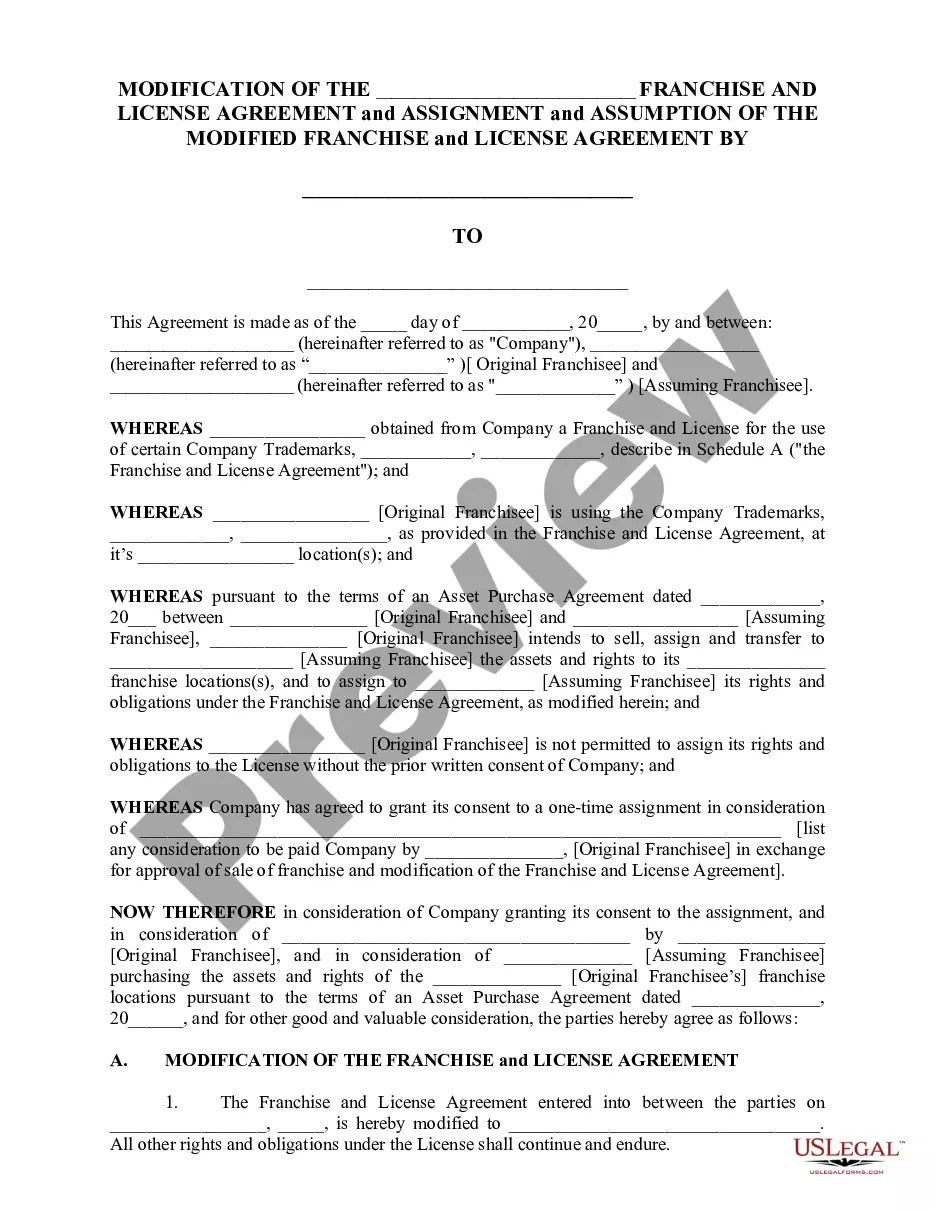

- Click the Preview button to review the form’s details.

- Check the form summary to confirm you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

Form popularity

FAQ

As a self-employed individual under an Indiana Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, a common guideline is to save around 25% to 30% of your income for taxes. This range accounts for federal, state, and self-employment taxes that apply to your earnings. By setting aside this amount regularly, you can avoid unexpected tax bills and ensure financial peace of mind during tax season. Utilizing platforms like US Legal Forms can streamline your tax preparation process.

The figure of 92.35 represents the portion of your self-employment income that is subject to self-employment tax. Under an Indiana Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, this percentage reflects the net earnings from self-employment after certain adjustments. It’s important to note that this percentage is used to calculate the tax owed, specifically Social Security and Medicare taxes. Understanding this can help you plan for your tax obligations more effectively.

Self-employment taxes can feel overwhelming, especially under an Indiana Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor situation. This higher tax is due to having to cover both the employee and employer portions of Social Security and Medicare taxes. Additionally, since you earn directly through your business, the lack of withholdings may lead to a larger tax burden. To manage these taxes better, consider working with a tax professional who understands independent contractor agreements.

Unlike regular employees, self-employed individuals receiving a 1099 do not have taxes withheld from their income. Instead, you are responsible for estimating and paying your own taxes, including income and self-employment taxes. Under an Indiana Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, understanding how to manage these tax obligations is crucial. Using tools from platforms like uslegalforms can help you maintain compliance while maximizing your earnings.

The self-employment tax rate is generally 15.3% for self-employed individuals, which covers Social Security and Medicare taxes. Specifically, 12.4% goes to Social Security on income up to a certain cap, while 2.9% is for Medicare with no income limit. This means, if you are working as a self-employed independent contractor under an Indiana Employment Agreement - Percentage of Sales, you'll need to plan for this tax. For your exact tax situation, consider consulting a tax professional.

In Indiana, businesses with employees are generally required to carry workers' compensation insurance. This includes contractors who hire employees, but independent contractors may not fall under this requirement. Understanding who must carry this insurance is essential for anyone involved in a business relationship under an Indiana Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

The percentage that an independent contractor earns can vary by industry and agreement. Typically, an independent contractor may negotiate a percentage of sales or revenue as part of their compensation. It is advisable to be clear in your Indiana Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor about these terms to avoid future disputes.

If you have individuals working for you as 1099 employees, you may not need workers' compensation insurance in Indiana, depending on their classification. However, it’s vital to understand the legal implications of employee classification and potential liabilities. Reviewing your compliance with an Indiana Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor can help clarify your responsibility in this area.

The compensation structure for independent contractors can vary widely, but it typically involves payment based on the work completed or a percentage of sales. For those under a well-defined Indiana Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, earnings might depend on the revenue generated. It’s essential to clarify these terms upfront to ensure fair compensation.

In Indiana, certain individuals are exempt from workers' compensation coverage. For instance, sole proprietors, partners, and members of limited liability companies may not be required to carry this insurance. Additionally, some independent contractors may fall into this category. Understanding these exemptions is crucial when drafting your Indiana Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.