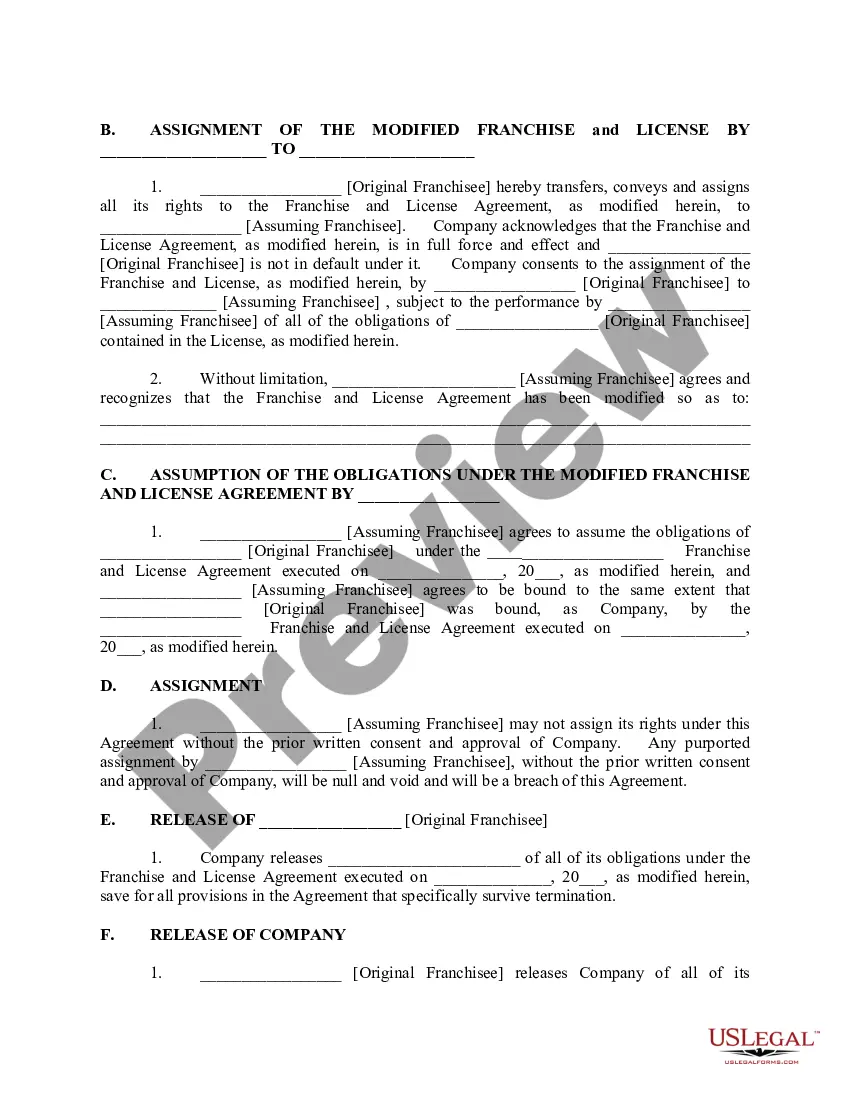

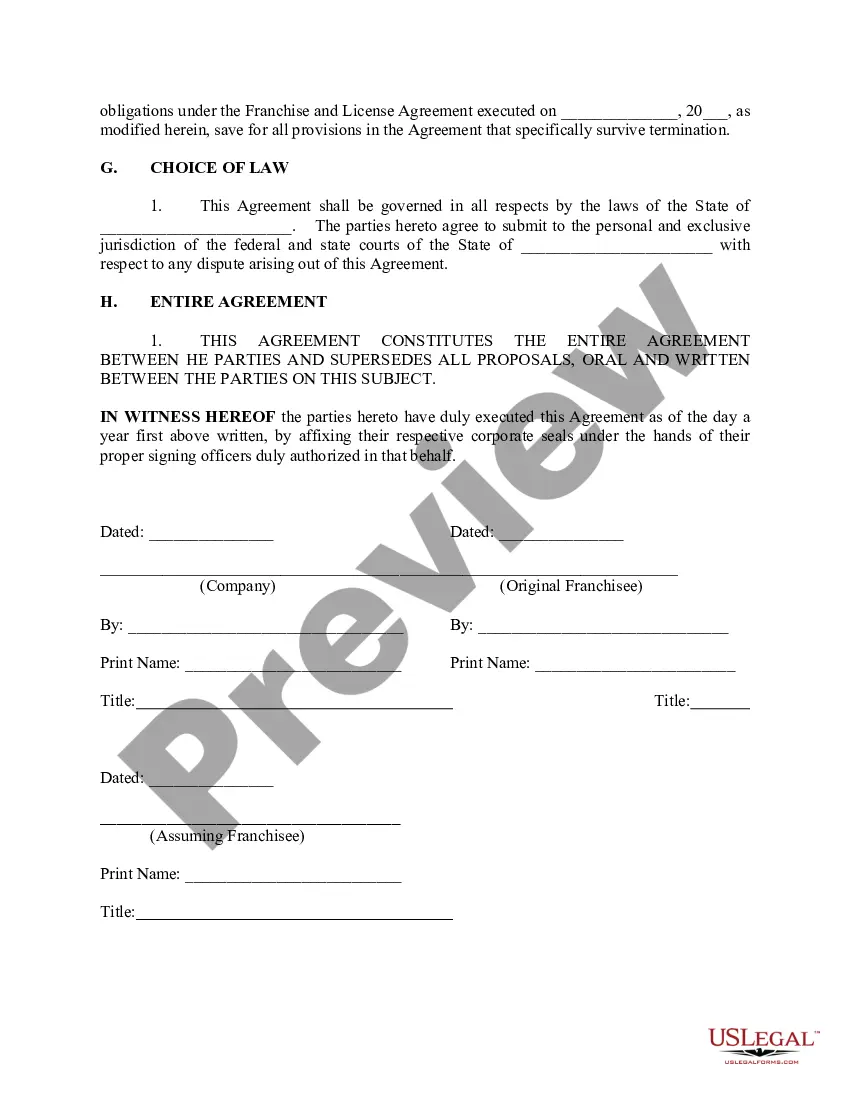

Franchise Sale Agreement - Agreement to Transfer Franchise to Third Party

Description

How to fill out Franchise Sale Agreement - Agreement To Transfer Franchise To Third Party?

When it comes to drafting a legal document, it’s easier to delegate it to the experts. However, that doesn't mean you yourself can’t get a sample to use. That doesn't mean you yourself can not find a sample to utilize, however. Download Franchise Sale Agreement - Agreement to Transfer Franchise to Third Party from the US Legal Forms website. It gives you numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. When you’re registered with an account, log in, search for a particular document template, and save it to My Forms or download it to your device.

To make things less difficult, we have included an 8-step how-to guide for finding and downloading Franchise Sale Agreement - Agreement to Transfer Franchise to Third Party quickly:

- Make sure the form meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Hit Buy Now.

- Choose the appropriate subscription for your requirements.

- Create your account.

- Pay via PayPal or by credit/bank card.

- Choose a needed format if a few options are available (e.g., PDF or Word).

- Download the document.

Once the Franchise Sale Agreement - Agreement to Transfer Franchise to Third Party is downloaded it is possible to complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Do some research on the type of franchise that best suits your needs. Call or visit the website of the company with which you are interested in opening a franchise. Write a business plan that discusses the franchise model and how you plan to penetrate a new market. Review all funding requirements.

Introduce yourself. Be clear about your intentions from the first paragraph. Introduce your company: type of business, years of operation, etc. Anything that might interest the franchisor. Explain the benefits of the franchise to the reader. Provide additional material to support your case.

The initial franchise application process is a screening mechanism by which franchisors begin to determine your interest and qualifications.Most franchise applications include many of the same requests for information, and it can get quite detailed.

An entity, other than a member of a combined group, that ceases doing business in Texas for any reason (i.e., termination, withdrawal, merger, etc.) is required to file a final franchise tax report (Forms 05-158-A and 05-158-B, 05-163 or 05-169) and pay any additional tax, if due.