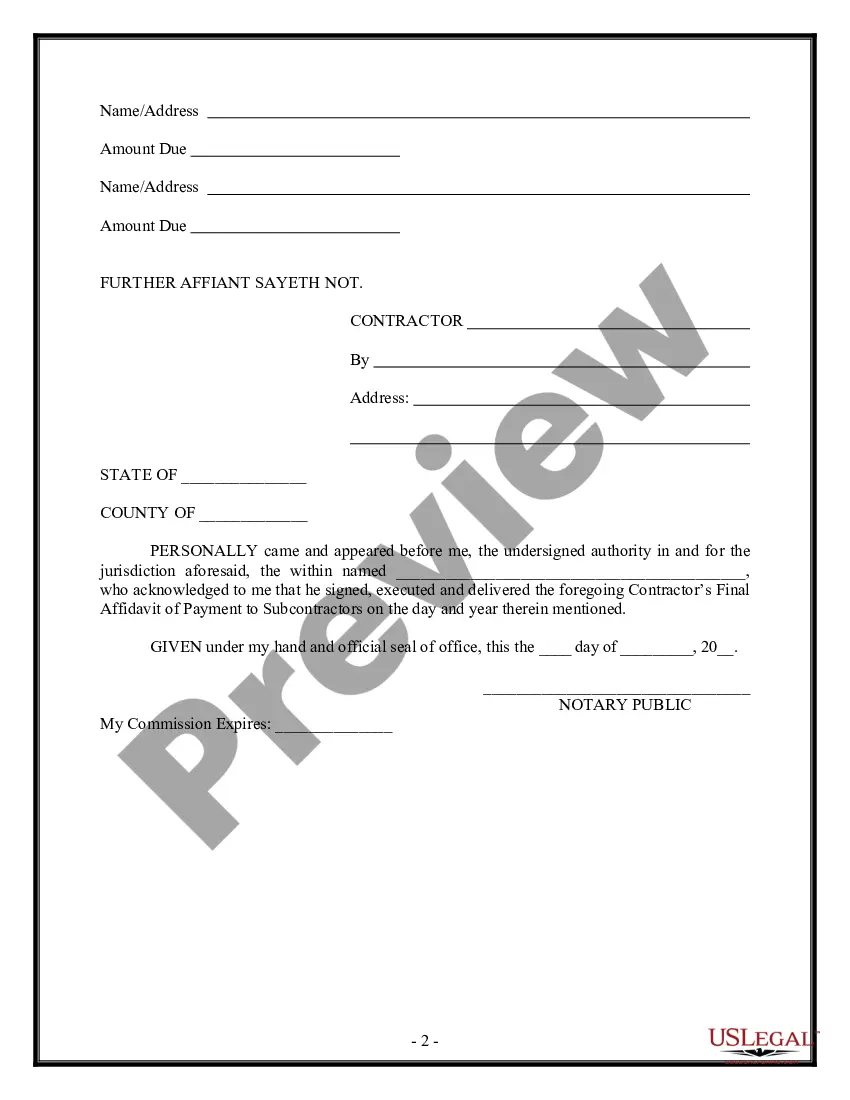

Indiana Contractor's Final Affidavit of Payment to Subcontractors

Description

How to fill out Contractor's Final Affidavit Of Payment To Subcontractors?

If you wish to obtain, purchase, or print sanctioned document templates, utilize US Legal Forms, the leading selection of legal forms, which are accessible online.

Utilize the website's straightforward and user-friendly search feature to find the documents you require.

A range of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose your preferred pricing plan and enter your details to register for the account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase. Step 6. Select the format of the legal form and download it to your device.

- Utilize US Legal Forms to locate the Indiana Contractor's Final Affidavit of Payment to Subcontractors in just a few clicks.

- If you are already a US Legal Forms client, sign in to your account and click on the Download button to access the Indiana Contractor's Final Affidavit of Payment to Subcontractors.

- You can also access forms you previously saved under the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the screen to find alternative forms of the legal template.

Form popularity

FAQ

A general rule of contributory negligence is that a main contractor is not liable for the negligence of its independent subcontractor. There are some exceptions to this rule, including: The main contractor had actual knowledge that the sub-contractor's work had been done in a foreseeably dangerous way and condoned it.

You usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

AIA Document G706A21221994 supports AIA Document G70621221994 in the event that the owner requires a sworn statement of the contractor stating that all releases or waivers of liens have been received.

When you pay subcontractors, you'll usually need to make deductions from their payments and pay the money to HMRC. Deductions count as advance payments towards the subcontractor's tax and National Insurance bill. You'll need to file monthly returns and keep full CIS records - you may get a penalty if you do not.

If the contractor defaults or otherwise doesn't take care of your wages, you can file a claim with the surety company to get at least part of your money. The surety company then takes the contractor to court to recover the amount.

In order to get paid, subcontractors need to issue invoices to the contractors they work for. Every invoice you issue needs to include some basic information, including: An invoice number: a unique code that follows a sequential order.

When Can Contractors Withhold Payment From Subcontractors? The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

How to get paid (faster) on every construction projectGet licensed.Write a credit policy.Prequalify potential customers.Get the contract in writing.Collect information about the property and other parties.Track your deadlines.Send Preliminary Notice.Submit Detailed Pay Applications or Invoices.More items...?14-Jun-2020