This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Indiana Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Indiana Installments Fixed Rate Promissory Note Secured By Personal Property?

Searching for a sample of the Indiana Installments Fixed Rate Promissory Note secured by personal assets and completing them could be a hurdle.

To conserve time, expenses, and effort, utilize US Legal Forms to locate the appropriate example specifically for your state in just a few clicks.

Our legal experts prepare every document, so you merely have to complete them. It’s genuinely that straightforward.

Choose your plan on the pricing page and create your account. Decide how you would prefer to pay by credit card or PayPal. Save the form in your chosen format. You can either print the Indiana Installments Fixed Rate Promissory Note secured by personal property form or complete it with any online editor. Don’t worry about typos, as your form can be used, submitted, and published as often as needed. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and revisit the form's page to download the document.

- Your downloaded samples are stored in My documents and are accessible at any time for future use.

- If you haven’t registered yet, you ought to sign up.

- Review our comprehensive instructions on how to acquire the Indiana Installments Fixed Rate Promissory Note secured by personal property sample in mere minutes.

- To obtain a valid example, verify its relevance for your state.

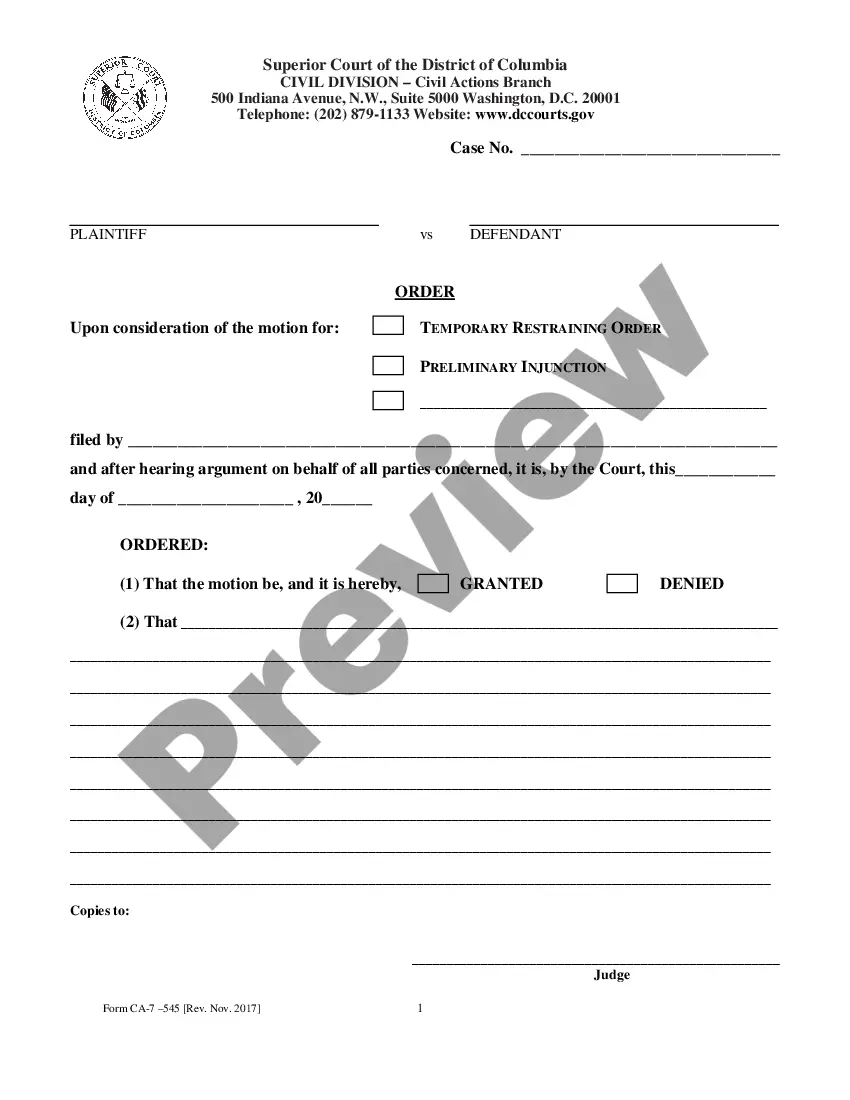

- Examine the sample using the Preview option (if available).

- If there’s a description, read it to grasp the particulars.

- Click on Buy Now if you found what you’re looking for.

Form popularity

FAQ

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Full names of parties (borrower and lender) Repayment amount (principal and interest) Payment plan. Consequences of non-payment (default and collection) Notarization (if necessary) Other common details.

Step 1 Agree to Terms. Step 2 Run a Credit Report. Step 3 Security and Co-Signer(s) Step 4 Writing the Promissory Note. Step 5 Paying Back the Borrowed Money. Calculating Total Interest Owed. Calculating the Final Payment Amount. Calculating the Monthly Payment Amount.

The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.