This form is an official form used in Indiana, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

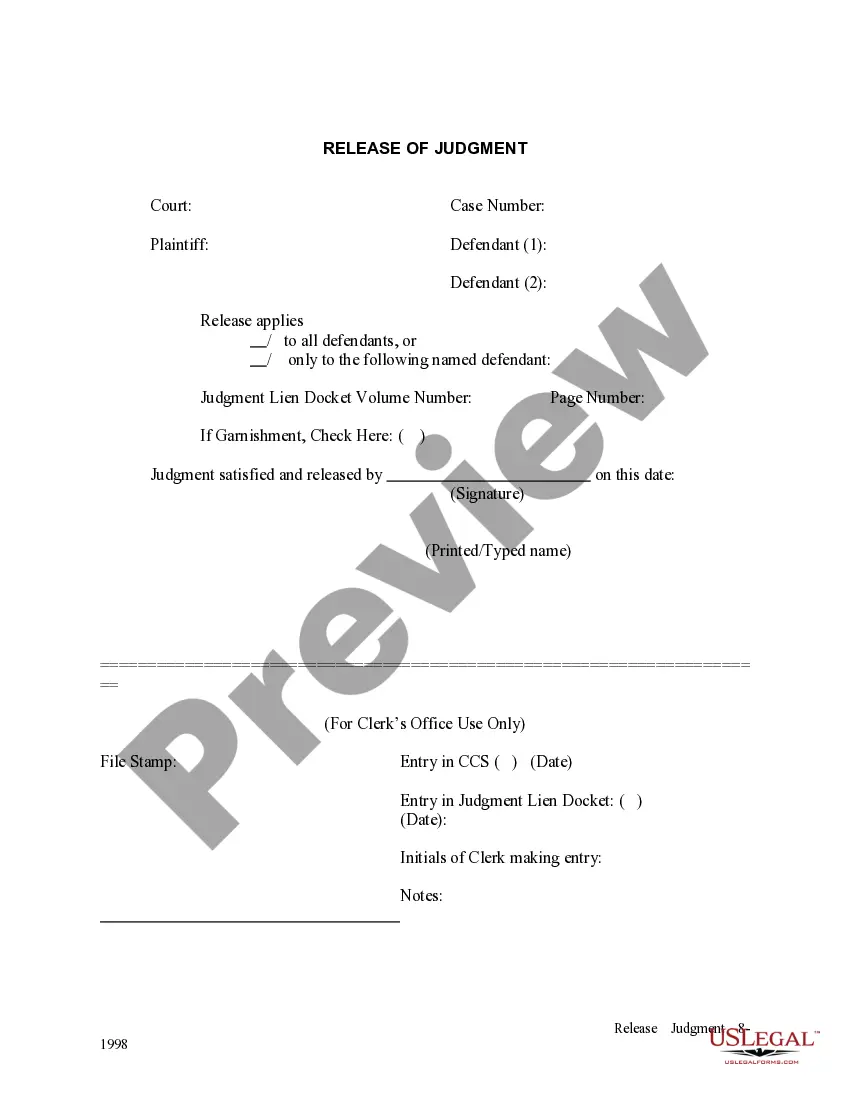

Indiana Release of Judgment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Indiana Release Of Judgment?

Looking for a sample of Indiana Release of Judgment and completing it might pose a challenge.

To conserve time, money, and effort, utilize US Legal Forms to discover the suitable template specifically for your state within minutes.

Our attorneys prepare all documents, so you only need to complete them. It's truly that straightforward.

Select your payment method, either by card or PayPal. Save the form in your preferred format. You can now print the Indiana Release of Judgment template or fill it out using any online editor. There's no need to be concerned about errors since your sample can be used, sent, and printed as many times as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to download the example.

- All your stored templates are available in My documents and can be accessed at any time for future use.

- If you haven’t signed up yet, you will need to register.

- Review our comprehensive guidelines on how to obtain your Indiana Release of Judgment form in just a few minutes.

- To acquire a legitimate form, verify its applicability for your state.

- Examine the sample using the Preview feature (if it’s available).

- If there is a description, read through it to grasp the details.

- Click the Buy Now button if you found what you are looking for.

Form popularity

FAQ

Collecting a judgment in Indiana requires you to understand various collection methods available, such as wage garnishment or bank levies. Start by filing a motion with the court that issued the judgment to initiate the collection process. The court can help enforce the judgment through various means, supporting your right to receive payment. Consider leveraging the Indiana Release of Judgment to effectively manage this process and ensure you receive what you are owed.

Once a judgment is entered against you in Indiana, it becomes part of your public record and can affect your credit. You may receive a notice explaining the judgment, and the winning party can pursue collection methods thereafter. Understanding your options, such as filing an appeal or seeking an Indiana Release of Judgment, is crucial, and USLegalForms can help illuminate these possibilities.

To set aside a default judgment in Indiana, a defendant must demonstrate a valid reason, such as lack of notice or a meritorious defense. The motion to set aside must be filed within a specific timeframe, typically within one year of the judgment. For assistance in navigating this legal process, the Indiana Release of Judgment section on USLegalForms can provide helpful guidance.

Filing a judgment lien in Indiana involves submitting the certified judgment to the appropriate county recorder's office. Along with this, any required fees and forms must be included. To ensure that your filing is accurate, the Indiana Release of Judgment section on USLegalForms can offer comprehensive support and templates.

A default judgment in Indiana occurs when the defendant fails to respond to the lawsuit within the required time frame, leading the court to rule in favor of the plaintiff. This decision allows the plaintiff to collect the owed amount without a trial. Understanding the implications of a default judgment is important, and the Indiana Release of Judgment section on USLegalForms can provide further insights.

To collect on a judgment in Indiana, the winning party can use various methods such as garnishment of wages, bank levies, or placing liens on the debtor's property. It is essential to follow proper legal procedures to ensure that the collection process is lawful. For a detailed step-by-step guide, check out the Indiana Release of Judgment resources available on USLegalForms.

After a default judgment is issued in Indiana, the winning party can take steps to enforce the judgment. This often involves filing a motion to collect, which may include garnishing wages or placing a lien on property. The plaintiff must act quickly to ensure that they take advantage of any legal rights afforded by the Indiana Release of Judgment. It's crucial to stay informed about the collection process to avoid complications down the line.